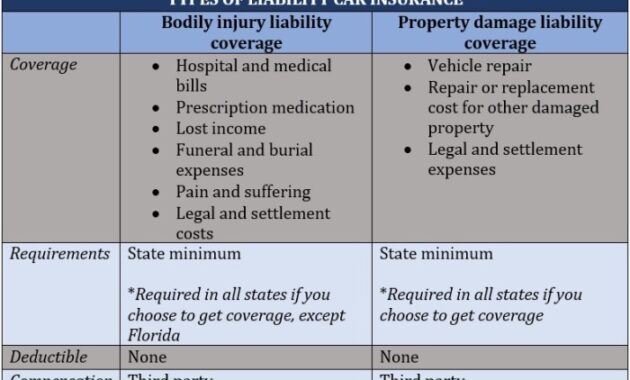

Understanding car insurance can feel like navigating a maze, but one crucial element is liability coverage. This vital component of your policy protects you financially if you’re at fault in an accident causing injury or damage to others. This guide unravels the complexities of liability coverage, explaining its nuances and ensuring you’re equipped to make informed decisions about your auto insurance. We’ll explore the different types of liability coverage, the significance of policy limits, and who is covered under your policy. We’ll also delve into common exclusions, the claims process, and the crucial role of liability in accident determination. Read More …

Month: April 2025

Who Gets the Insurance Check When a Car is Totaled?

Determining who receives the insurance check after a car is totaled can be surprisingly complex. It’s not always as simple as handing it over to the registered owner. Factors like liens, loans, multiple ownership, and the specifics of the insurance policy all play a crucial role in determining the rightful recipient. This guide will unravel the intricacies of this process, providing clarity and understanding in a situation that can often be fraught with confusion and potential disputes. Understanding the interplay between legal ownership, insurance coverage, and the insurance company’s procedures is key to navigating this process smoothly. We’ll explore Read More …

Why Is Insurance So Expensive? Unpacking the Rising Costs of Coverage

The seemingly ever-increasing cost of insurance is a pervasive concern, affecting individuals and businesses alike. From health insurance premiums to car insurance rates, the upward trend prompts many to question the underlying factors driving these expenses. This exploration delves into the multifaceted reasons behind the escalating costs, examining a range of contributing elements, from healthcare inflation and insurance company practices to economic fluctuations and the legal landscape. Understanding these complex dynamics is crucial for navigating the insurance market effectively and making informed decisions about coverage. By analyzing various factors, we aim to provide a clearer picture of why insurance Read More …

Navigating WI Auto Insurance: A Comprehensive Guide

Securing the right auto insurance in Wisconsin is crucial for responsible drivers. This guide unravels the complexities of WI auto insurance, providing a clear understanding of mandatory coverages, premium factors, and available options. We’ll explore strategies for finding affordable coverage, navigating insurance claims, and understanding Wisconsin’s specific laws and regulations concerning auto insurance. From liability and collision coverage to the impact of driving history and at-fault accidents, we delve into the essential aspects of protecting yourself and your vehicle on Wisconsin roads. We aim to empower you with the knowledge to make informed decisions about your auto insurance needs, Read More …

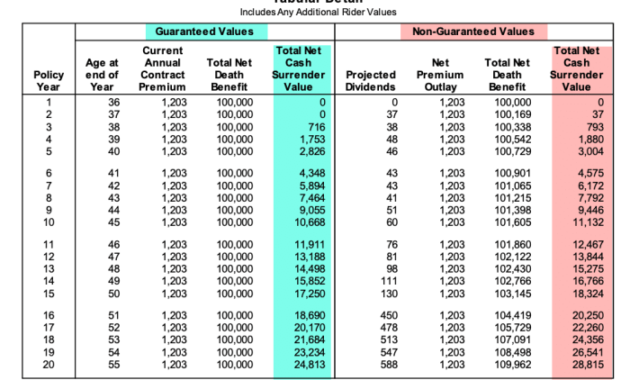

Mastering Your Financial Future: A Comprehensive Guide to the Whole Life Insurance Policy Calculator

Securing your family’s financial well-being is a paramount concern, and understanding whole life insurance is a crucial step in that process. A whole life insurance policy calculator can demystify this complex financial instrument, providing a clear picture of potential costs and benefits. This guide will explore the functionality of these calculators, the factors influencing premium calculations, and how to interpret the results to make informed decisions about your future. We’ll delve into the intricacies of different policy types, the impact of age and health, and the various payment options available. Understanding these factors empowers you to navigate the world Read More …

Unlocking Financial Security: A Comprehensive Guide to Whole Policy Life Insurance

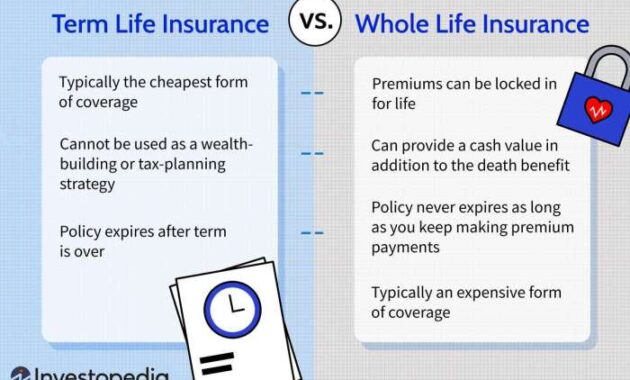

Whole life insurance often evokes images of complex financial instruments, but its core purpose is remarkably simple: providing lifelong financial protection for your loved ones while simultaneously offering potential long-term growth. This guide unravels the intricacies of whole policy life insurance, demystifying its features, benefits, and potential drawbacks to empower you with the knowledge needed to make informed decisions about your financial future. We’ll explore the fundamental differences between whole life and term life insurance, delve into the mechanics of cash value accumulation, and examine how whole life policies can serve as powerful tools in estate planning and wealth Read More …

What is Considered Full Coverage Insurance: A Comprehensive Guide

The term “full coverage insurance” is often bandied about, but its true meaning remains surprisingly elusive. Many believe a simple “full coverage” policy offers complete protection against all possible scenarios, a misconception that can lead to significant financial hardship. This guide delves into the complexities of auto insurance, clarifying what truly constitutes full coverage and highlighting the crucial distinctions between different policy levels. Understanding the nuances of auto insurance is vital for responsible financial planning. This guide will explore the core components of full coverage, examining collision and comprehensive coverage in detail, and comparing them to liability insurance. We’ll Read More …

Decoding Whole Life Insurance Policy Rates: A Comprehensive Guide

Securing your financial future often involves navigating the complex world of life insurance. Understanding whole life insurance policy rates is crucial for making informed decisions that align with your long-term goals and financial capacity. This guide delves into the multifaceted factors influencing these rates, providing clarity and empowering you to make the best choice for your needs. From the impact of age and health to the nuances of policy features and provider comparisons, we’ll unravel the intricacies of whole life insurance pricing. We’ll explore different policy types, offer strategies for managing costs, and provide illustrative examples to illuminate the Read More …