Navigating the world of Michigan car insurance can feel like driving through a blizzard – confusing and potentially costly. Michigan’s unique no-fault system significantly impacts premiums, making finding the cheapest car insurance a priority for many residents. This guide cuts through the complexity, offering practical strategies and insights to help you secure affordable coverage without sacrificing essential protection. We’ll explore the intricacies of Michigan’s auto insurance market, examining factors influencing costs, comparing various coverage options, and identifying budget-friendly insurers. Learn how your driving record, vehicle choice, and even your location can affect your premiums. We’ll provide actionable steps to Read More …

Year: 2025

Decoding the Myth: Finding the Most Cheapest Car Insurance

The quest for the “most cheapest” car insurance often leads to a tangled web of confusing jargon and misleading advertisements. While the allure of rock-bottom premiums is undeniable, prioritizing price alone can expose you to significant financial risk in the event of an accident. This exploration delves into the complexities of car insurance pricing, revealing the factors that truly determine cost and guiding you towards making informed decisions that balance affordability with adequate protection. Understanding car insurance isn’t just about finding the lowest price; it’s about understanding the coverage you need to protect yourself and your assets. This guide Read More …

Understanding Merchants Group Insurance Company: A Comprehensive Guide

Navigating the world of business insurance can be complex, especially for merchants. This guide delves into the specifics of merchants group insurance companies, exploring their structure, offerings, and benefits. We’ll unpack the advantages of group policies over individual plans, examining cost factors, claim processes, and the regulatory landscape. Understanding this type of insurance is crucial for merchants seeking comprehensive protection and financial stability. From defining what constitutes a merchants group insurance company and the types of coverage offered, to exploring the cost implications and claim procedures, we aim to provide a clear and concise overview. We will also touch Read More …

Navigating Medicare Insurance Supplemental: A Comprehensive Guide to Medigap

Medicare, while a vital safety net for healthcare costs in later life, often leaves gaps in coverage. This is where Medicare supplemental insurance, commonly known as Medigap, steps in. Understanding the nuances of Medigap plans—their varying levels of coverage, costs, and eligibility requirements—is crucial for securing comprehensive healthcare protection during retirement. This guide delves into the complexities of Medigap, providing a clear path to selecting the plan that best fits your individual needs and budget. From deciphering the alphabet soup of Medigap plans (A through N) to navigating the enrollment process and understanding the claims procedures, we aim to Read More …

Navigating Medical Insurance in Wisconsin: A Comprehensive Guide

Securing affordable and comprehensive medical insurance is a critical aspect of life in Wisconsin, yet the landscape of plans, providers, and regulations can feel overwhelming. This guide aims to demystify the process, providing a clear and concise overview of the various options available to Wisconsin residents, from understanding different plan types to navigating the state’s healthcare marketplace and government programs. We’ll explore the key factors influencing insurance costs, including age, health status, and location, and offer practical advice on finding the most suitable and affordable plan for your individual needs. Whether you’re a seasoned insurance shopper or a newcomer Read More …

Navigating Medicare: A Comprehensive Guide to Medicare Insurance Supplement Plans

Medicare, while a vital safety net for seniors, often leaves gaps in coverage. This is where Medicare Supplement Insurance, also known as Medigap, steps in. These private insurance plans help bridge those gaps, offering additional financial protection and peace of mind. Understanding the nuances of Medigap plans – their various types, costs, and benefits – is crucial for making informed decisions about your healthcare future. This guide will delve into the complexities of Medicare Supplement Insurance, empowering you to choose the plan that best suits your individual needs and budget. We will explore the different plan types (A through Read More …

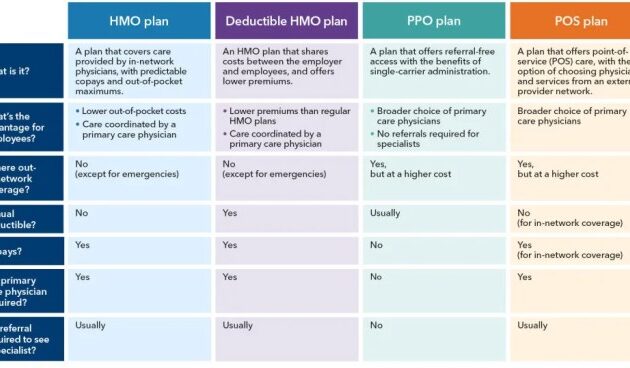

Decoding Medical Insurance PPO: A Comprehensive Guide

Navigating the world of healthcare can feel like deciphering a complex code, especially when it comes to understanding your medical insurance options. One common type of plan, the Preferred Provider Organization (PPO), offers flexibility but also presents a unique set of considerations. This guide unravels the intricacies of PPO medical insurance, empowering you to make informed decisions about your healthcare coverage. We’ll explore the core features of PPO plans, comparing them to other common options like HMOs and POS plans. Understanding terms like deductible, copay, and coinsurance is crucial for managing your healthcare costs effectively. We’ll also delve into Read More …

Understanding Mercer Insurance: A Comprehensive Guide

Mercer, a global leader in insurance solutions, has a rich history shaping the landscape of risk management and financial security. From its origins to its current standing as a major player, Mercer’s journey reflects the evolution of the insurance industry itself. This exploration delves into Mercer’s diverse offerings, examining its strengths, weaknesses, and overall impact on individuals and businesses alike. We’ll explore Mercer’s various insurance products, analyze client experiences, and consider its role in broader industry trends. This detailed overview aims to provide a comprehensive understanding of Mercer’s position within the competitive insurance market, offering valuable insights for potential Read More …

Mercury Auto Insurance Company: A Comprehensive Analysis

Mercury Auto Insurance Company has carved a significant niche in the competitive landscape of the auto insurance industry. This analysis delves into the company’s history, market position, financial performance, customer base, competitive strategies, and overall reputation. We will explore its strengths and weaknesses, examining customer feedback and marketing approaches to provide a comprehensive understanding of Mercury’s operations and its place within the broader insurance market. From its origins to its current standing, we’ll unpack the key factors contributing to Mercury’s success and challenges. We’ll also compare Mercury to its competitors, analyzing pricing models, coverage options, and customer service to Read More …

Navigating the Landscape of Mental Health Insurance

Securing adequate mental healthcare is a critical aspect of overall well-being, yet the complexities of mental health insurance can often feel overwhelming. Understanding your coverage, navigating the system, and advocating for your needs are crucial steps in accessing the support you deserve. This guide provides a comprehensive overview of mental health insurance, demystifying the process and empowering you to take control of your mental healthcare journey. From understanding different plan types and their limitations to effectively navigating the claims process and advocating for better coverage, we’ll explore the essential aspects of mental health insurance. We will also address common Read More …