Securing the right auto insurance in Connecticut is crucial for responsible drivers. This guide delves into the complexities of Connecticut’s auto insurance landscape, providing a clear understanding of requirements, cost factors, and the claims process. Whether you’re a seasoned driver or a new resident, understanding your options and responsibilities is key to financial protection and peace of mind on the road.

From understanding minimum liability coverage and penalties for driving uninsured to navigating the intricacies of different policy types and finding affordable options, we’ll equip you with the knowledge to make informed decisions about your auto insurance needs. We’ll explore how factors like driving history, age, vehicle type, and location influence your premiums, and provide practical tips for securing the best possible coverage at a competitive price.

Connecticut Auto Insurance Requirements

Driving in Connecticut requires understanding the state’s auto insurance regulations to ensure compliance and avoid penalties. This section details the minimum coverage requirements, penalties for non-compliance, and a breakdown of different insurance coverage types available.

Minimum Liability Coverage Requirements in Connecticut

Connecticut mandates minimum liability insurance coverage for bodily injury and property damage. This means drivers must carry insurance that covers injuries or damages they cause to others in an accident. The minimum required coverage is $25,000 for bodily injury to one person, $50,000 for bodily injury to two or more people in a single accident, and $25,000 for property damage. This is often expressed as 25/50/25 liability coverage. It’s crucial to understand that this coverage protects others, not the policyholder’s vehicle or injuries.

Penalties for Driving Without Insurance in Connecticut

Driving without the minimum required auto insurance in Connecticut carries significant consequences. Penalties include fines, license suspension, and vehicle registration suspension. The fines can be substantial, varying depending on the offense and the driver’s history. Furthermore, driving without insurance can lead to difficulty in obtaining insurance in the future, resulting in higher premiums. In some cases, the penalties can be so severe that they impact the driver’s ability to maintain employment or secure loans.

Types of Auto Insurance Coverage Available in Connecticut

Beyond the mandatory liability coverage, several other types of auto insurance are available in Connecticut to provide more comprehensive protection.

Liability Coverage: As previously explained, this covers injuries and damages to others caused by the insured driver.

Collision Coverage: This covers damage to the insured vehicle resulting from a collision, regardless of fault. For example, if you hit a tree or another car, collision coverage would help pay for repairs or replacement.

Comprehensive Coverage: This covers damage to the insured vehicle from events other than collisions, such as theft, vandalism, fire, hail, or animal damage. It provides broader protection than collision coverage.

Uninsured/Underinsured Motorist Coverage: This protects the insured if they are involved in an accident with an uninsured or underinsured driver. It covers medical expenses and property damage.

Medical Payments Coverage (Med-Pay): This coverage helps pay for medical expenses for the insured and passengers in their vehicle, regardless of fault.

Personal Injury Protection (PIP): In some states, this covers medical expenses and lost wages for the insured and passengers, regardless of fault. Connecticut does not mandate PIP coverage.

Average Costs of Auto Insurance in Connecticut Cities

The cost of auto insurance varies significantly depending on several factors, including location, driving record, age, and the type of coverage. The following table provides estimated average costs for minimum and comprehensive coverage in several Connecticut cities. These are averages and individual costs may differ. Note that these figures are estimates and can change based on the insurance provider and specific circumstances.

| City | Minimum Coverage (Annual) | Comprehensive Coverage (Annual) | Difference |

|---|---|---|---|

| Hartford | $800 | $1800 | $1000 |

| New Haven | $750 | $1700 | $950 |

| Bridgeport | $900 | $1900 | $1000 |

| Stamford | $850 | $1850 | $1000 |

Factors Affecting Auto Insurance Rates in Connecticut

Securing affordable auto insurance in Connecticut depends on several interconnected factors. Understanding these factors can help drivers make informed decisions to potentially lower their premiums. This section details the key elements influencing insurance costs, allowing for a more comprehensive understanding of your personal rate.

Driving History’s Impact on Premiums

Your driving record significantly impacts your insurance premiums. Insurance companies assess risk based on past driving behavior. Accidents, speeding tickets, and driving under the influence (DUI) convictions all lead to higher premiums. The severity of the offense and the frequency of incidents directly correlate with increased costs. For example, a single speeding ticket might result in a modest increase, while a DUI conviction could lead to a substantial premium surge or even policy cancellation. Maintaining a clean driving record is the most effective way to keep your insurance costs low. Many insurance companies offer discounts for drivers with accident-free periods of several years.

Age and Gender Influence on Rates

Age and gender are statistical factors considered by insurance companies in Connecticut, reflecting historical claims data. Younger drivers, particularly those under 25, generally pay higher premiums due to statistically higher accident rates within this demographic. This is because younger drivers often have less experience and are more prone to risky driving behaviors. Similarly, gender can influence rates, though this factor’s impact is less significant than age. Historically, some studies have shown a slight difference in accident rates between genders, resulting in varying premiums. However, this disparity is becoming less pronounced as driving habits evolve.

Other Factors Affecting Insurance Costs

Beyond driving history and demographics, several other factors contribute to auto insurance costs in Connecticut. The type of vehicle you drive is a major determinant. Sports cars and high-performance vehicles often carry higher premiums due to their increased risk of accidents and higher repair costs. Your location also plays a crucial role, as areas with higher accident rates and theft rates generally command higher premiums. Finally, your credit score can surprisingly impact your insurance rate. Insurance companies often use credit scores as an indicator of risk, with individuals possessing lower credit scores typically paying more.

Prioritized List of Factors Influencing Premium Costs

Considering the relative impact on premiums, the following list prioritizes the factors discussed above:

- Driving History: This is arguably the most significant factor. Accidents and violations directly increase risk and therefore premiums.

- Vehicle Type: The type of car you drive significantly influences repair costs and potential accident severity.

- Location: Your address reflects the risk associated with your area, including accident and theft rates.

- Age: Younger drivers, statistically, pose a higher risk to insurers.

- Credit Score: While less impactful than the preceding factors, a poor credit score can still lead to increased premiums.

- Gender: This factor’s influence is relatively minor compared to others on this list.

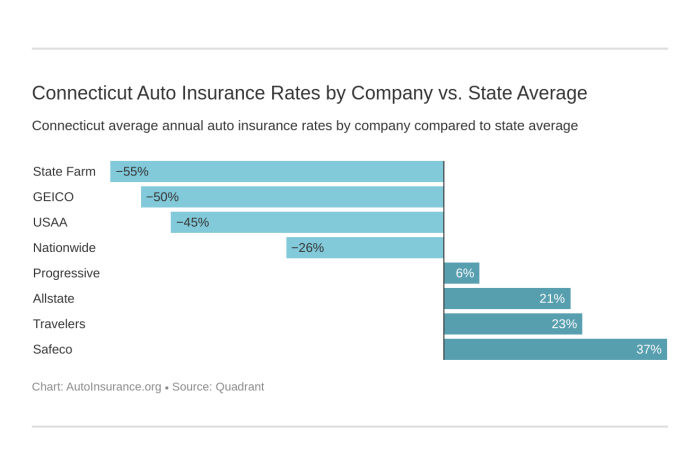

Finding Affordable Auto Insurance in Connecticut

Securing affordable auto insurance in Connecticut requires a proactive approach. By understanding the market, comparing quotes effectively, and negotiating strategically, drivers can significantly reduce their premiums. This section Artikels practical strategies to achieve this goal.

Comparing Auto Insurance Quotes

Comparing quotes from multiple providers is crucial for finding the best rates. Begin by obtaining at least three to five quotes from a mix of large national companies and smaller regional insurers. Be sure to provide consistent information across all applications to ensure accurate comparisons. Pay close attention not only to the overall premium but also to the coverage details, deductibles, and any additional fees or surcharges. Online comparison tools can streamline this process, allowing you to input your information once and receive multiple quotes simultaneously. However, remember to verify the information provided by these tools with the insurance companies directly.

Negotiating Lower Insurance Premiums

Once you have several quotes, don’t hesitate to negotiate. Insurance companies often have some flexibility in their pricing. Highlight any positive driving history, such as a clean driving record or completion of a defensive driving course. Inquire about discounts for bundling policies (home and auto insurance), paying premiums annually instead of monthly, or installing anti-theft devices. Be polite but firm in your negotiations, and be prepared to switch providers if you don’t receive a satisfactory offer. Consider mentioning competing quotes to leverage better terms.

Types of Auto Insurance Policies

Connecticut requires minimum liability coverage, but drivers can opt for more comprehensive policies. Liability insurance covers damages to others’ property or injuries sustained by others in an accident you cause. Collision coverage repairs your vehicle after an accident regardless of fault. Comprehensive coverage protects against damage from non-collision events like theft, vandalism, or hail. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. The optimal policy depends on individual circumstances and risk tolerance. A higher deductible generally lowers your premium, but increases your out-of-pocket expense in the event of a claim. Weigh the cost-benefit carefully.

Obtaining Car Insurance in Connecticut: A Step-by-Step Guide

- Gather Necessary Information: Compile your driver’s license, vehicle identification number (VIN), and driving history. Also, have information ready about your address, employment, and any prior insurance claims.

- Compare Quotes: Use online comparison tools and contact insurance companies directly to obtain at least three to five quotes.

- Review Policy Details: Carefully compare coverage levels, deductibles, and premiums for each quote. Understand what each coverage option entails.

- Negotiate Premiums: Contact the insurers and try to negotiate lower rates based on your driving history and other factors.

- Choose a Policy: Select the policy that best meets your needs and budget.

- Make Payment: Pay your first premium to activate your coverage. Confirm the effective date of your policy.

- Maintain Proof of Insurance: Keep a copy of your insurance card in your vehicle and ensure your coverage remains active.

Connecticut’s Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage is a crucial component of auto insurance in Connecticut, offering vital protection in the event of an accident caused by a driver who lacks sufficient insurance or is uninsured altogether. Many drivers on the road are either underinsured or completely without coverage, making this protection especially important for safeguarding yourself and your passengers.

This coverage protects you and your passengers from financial losses incurred due to injuries or property damage caused by an at-fault driver who is uninsured or whose insurance limits are insufficient to cover your losses. It essentially acts as a secondary insurance policy, stepping in to cover the gap when the at-fault driver’s insurance is inadequate. The policy covers medical expenses, lost wages, pain and suffering, and property damage.

Scenarios Benefiting from UM/UIM Coverage

Several scenarios highlight the value of UM/UIM coverage. Imagine you’re involved in a serious accident caused by a hit-and-run driver. Their insurance company won’t pay because they can’t be identified. Your UM/UIM coverage will help cover your medical bills and vehicle repair costs. Another example involves a collision with an underinsured driver. Their policy might only cover $25,000 in damages, but your medical bills exceed that amount. Your UM/UIM coverage would then pay the difference. Finally, consider a scenario where you are a passenger in a vehicle and the at-fault driver has minimal insurance coverage. Your UM/UIM coverage could help cover your medical expenses and lost wages.

Cost and Benefits of Different UM/UIM Coverage Levels

The cost of UM/UIM coverage varies based on several factors, including your driving record, the type of vehicle you drive, and the coverage limits you choose. Higher coverage limits naturally lead to higher premiums. However, the benefits of higher limits significantly outweigh the increased cost, particularly in cases of severe injuries or significant property damage. Choosing a lower limit might seem cost-effective initially, but could leave you financially vulnerable in the event of a serious accident. It’s essential to carefully weigh the potential costs of insufficient coverage against the increased premium for higher limits. A conversation with your insurance agent can help determine the appropriate level of coverage based on your individual needs and risk tolerance. Consider the potential costs of medical bills, lost wages, and vehicle repairs in the event of a serious accident when deciding on your UM/UIM coverage.

Illustrative Example: A Connecticut Driver’s Insurance Costs

Let’s examine a hypothetical scenario to illustrate how various factors influence auto insurance costs in Connecticut. We’ll consider a 30-year-old driver, Sarah, living in Hartford, with a clean driving record and driving a 2020 Honda Civic.

Sarah’s Insurance Costs

Sarah’s insurance costs will vary depending on the coverage she chooses and the insurer. We’ll estimate costs based on average premiums in Connecticut for similar profiles, acknowledging that actual costs can differ significantly.

Breakdown of Coverage Costs

The following table provides an estimated breakdown of Sarah’s annual insurance costs for different coverage levels. These figures are illustrative and should not be considered a precise quote. Actual premiums depend on the specific insurer, policy details, and individual risk assessment.

| Coverage Type | Estimated Annual Cost (USD) | Factors Influencing Cost |

|---|---|---|

| Liability (100/300/50) | $500 | State minimum requirements, driver’s history, location. Higher limits would increase cost. |

| Collision | $300 | Vehicle type, age, and value. Newer, more expensive vehicles cost more to insure. |

| Comprehensive | $200 | Vehicle type, age, and value. Similar factors to collision coverage. |

| Uninsured/Underinsured Motorist | $150 | State requirements and chosen coverage limits. Higher limits result in higher premiums. |

| Personal Injury Protection (PIP) | $250 | State requirements and chosen coverage limits. Higher limits increase costs. |

| Total Estimated Annual Cost | $1400 | This is a composite cost based on the individual coverage estimates above. |

Impact of Different Factors

Several factors could significantly impact Sarah’s insurance costs. For example, if Sarah had a speeding ticket or an at-fault accident in the past three years, her premiums would likely increase substantially. Choosing a higher deductible on her collision and comprehensive coverage would lower her premiums but increase her out-of-pocket expenses in the event of a claim. Conversely, opting for lower coverage limits would reduce her premium but increase her personal financial risk in the event of an accident. Living in a higher-risk area, such as a city with a high rate of accidents, would also increase her premiums. Finally, switching to a less expensive vehicle could potentially lower her insurance costs.

Ultimate Conclusion

Successfully navigating the world of Connecticut auto insurance requires careful consideration of various factors and a proactive approach to securing the right coverage. By understanding the state’s requirements, influencing factors on premiums, and the claims process, drivers can ensure they have the necessary protection while managing their costs effectively. This guide serves as a starting point for your journey towards informed and responsible auto insurance choices in Connecticut.

Detailed FAQs

What happens if I’m in an accident and the other driver is uninsured?

Uninsured/Underinsured Motorist (UM/UIM) coverage protects you in such situations. It covers your medical bills and vehicle damage if the at-fault driver lacks sufficient insurance.

How often can I get my auto insurance rates reviewed?

You can request a review of your rates at any time, particularly if your circumstances have changed (e.g., improved driving record, new vehicle, change of address). Many insurers offer annual reviews as well.

Can I pay my auto insurance premiums monthly?

Most insurers offer various payment options, including monthly installments. However, paying annually often results in lower overall costs due to reduced administrative fees.

What documents do I need to provide when filing a claim?

Typically, you’ll need police reports (if applicable), photos of the damage, contact information of all parties involved, and details of the incident.

How do I cancel my auto insurance policy?

Contact your insurance provider directly to initiate the cancellation process. Be aware of any cancellation fees or penalties that may apply.