Driving in Indiana requires understanding the state’s auto insurance landscape. This guide delves into the intricacies of Indiana auto insurance, from mandatory coverage levels and the penalties for non-compliance to strategies for securing affordable rates and navigating the claims process. We’ll explore various coverage options, factors influencing premiums, and the crucial role of an SR-22 certificate, all presented in a clear and accessible manner.

Understanding Indiana’s auto insurance regulations is paramount for responsible drivers. This guide aims to equip you with the knowledge needed to make informed decisions about your coverage, ensuring you’re adequately protected while staying within budget. We will cover everything from the minimum required coverage to optional protections, providing you with the tools to navigate the complexities of Indiana’s insurance market confidently.

Indiana Auto Insurance Requirements

Driving in Indiana requires adhering to the state’s minimum auto insurance requirements. Failure to do so can result in significant penalties, impacting your driving privileges and potentially your finances. Understanding these requirements is crucial for all Indiana drivers.

Minimum Auto Insurance Coverage in Indiana

Indiana mandates that all drivers carry a minimum level of liability insurance. This means you must be financially responsible for damages or injuries you cause to others in an accident. The minimum coverage required is $25,000 bodily injury liability for one person, $50,000 bodily injury liability for all people injured in a single accident, and $25,000 property damage liability. This means that if you cause an accident resulting in injuries, your insurance company will pay a maximum of $25,000 for one person’s medical bills and a maximum of $50,000 for all injured parties combined. For property damage, the maximum payout from your insurance is $25,000.

Penalties for Driving Without Insurance

Driving in Indiana without the minimum required auto insurance is a serious offense. Penalties can include significant fines, suspension of your driver’s license, and even the impoundment of your vehicle. The specific penalties can vary depending on the circumstances and the number of offenses. Furthermore, if you’re involved in an accident without insurance, you could be held personally liable for all damages and medical expenses, potentially leading to substantial financial hardship. These penalties serve as a strong deterrent to uninsured driving.

Types of Mandatory Coverage

Indiana’s minimum insurance requirements cover specific types of liability. Liability insurance protects you financially if you are at fault in an accident. It covers the costs associated with injuries and property damage to others. While not mandated at the minimum level, Uninsured/Underinsured Motorist coverage is highly recommended. This protects you in the event you are involved in an accident with a driver who is uninsured or underinsured. It will cover your medical bills and property damage if the other driver’s insurance is insufficient.

Minimum vs. Optional Coverage

The following table compares Indiana’s minimum required auto insurance coverage with some commonly chosen optional coverage options. Choosing higher coverage limits or adding optional coverage provides greater financial protection.

| Coverage Type | Minimum Required | Optional Coverage Options | Description |

|---|---|---|---|

| Bodily Injury Liability (per person) | $25,000 | $50,000, $100,000, or higher | Covers medical bills and other expenses for injuries you cause to others. |

| Bodily Injury Liability (per accident) | $50,000 | $100,000, $250,000, or higher | Covers medical bills and other expenses for all injuries you cause in a single accident. |

| Property Damage Liability | $25,000 | $50,000, $100,000, or higher | Covers damage to another person’s vehicle or property that you cause. |

| Uninsured/Underinsured Motorist | Not Required | Various limits available | Protects you if you are involved in an accident with an uninsured or underinsured driver. |

| Collision | Not Required | Various limits available | Covers damage to your vehicle regardless of fault. |

| Comprehensive | Not Required | Various limits available | Covers damage to your vehicle from events other than collisions, such as theft or hail damage. |

Types of Auto Insurance in Indiana

Choosing the right auto insurance coverage in Indiana is crucial for protecting yourself financially in the event of an accident. Understanding the different types of coverage available and how they impact your premiums is key to making an informed decision. This section details the main types of auto insurance, factors influencing their cost, and how they benefit different driver profiles.

Liability Coverage

Liability insurance covers damages you cause to others in an accident. It’s typically divided into bodily injury liability and property damage liability. Bodily injury liability covers medical bills and other expenses for injured individuals, while property damage liability covers repairs or replacement of damaged vehicles or property. The cost of liability coverage is primarily influenced by your driving record (accidents, tickets), the amount of coverage you choose (higher limits cost more), and your location (higher-risk areas have higher premiums). New drivers often pay more for liability insurance due to their lack of driving experience, while experienced drivers with clean records typically enjoy lower premiums. High-risk drivers, with multiple accidents or serious violations, will face significantly higher costs.

- Bodily Injury Liability: Pays for medical expenses, lost wages, and pain and suffering of others injured in an accident you caused.

- Property Damage Liability: Pays for repairs or replacement of property damaged in an accident you caused.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle regardless of fault. This means that even if you cause the accident, your insurance will cover the damage to your car. The cost of collision coverage is influenced by the make, model, and year of your vehicle (newer, more expensive cars cost more to insure), your deductible (higher deductibles mean lower premiums), and your driving record. New drivers often find collision coverage expensive due to their higher risk profile, while experienced drivers with clean records may secure more affordable rates. High-risk drivers will invariably face higher premiums.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, fire, hail, or animal strikes. Factors influencing its cost are similar to collision coverage: the vehicle’s value, your deductible, and your driving record. The age and condition of your vehicle also play a role. New drivers may find comprehensive coverage more expensive, while experienced drivers with a clean record may benefit from lower premiums. High-risk drivers will again pay more.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical expenses, lost wages, and property damage. The cost of UM/UIM coverage is relatively less impacted by your driving record compared to other coverages, but your location and the amount of coverage you choose will still influence the price. All driver profiles benefit from this coverage, as it provides crucial protection against drivers who lack adequate insurance.

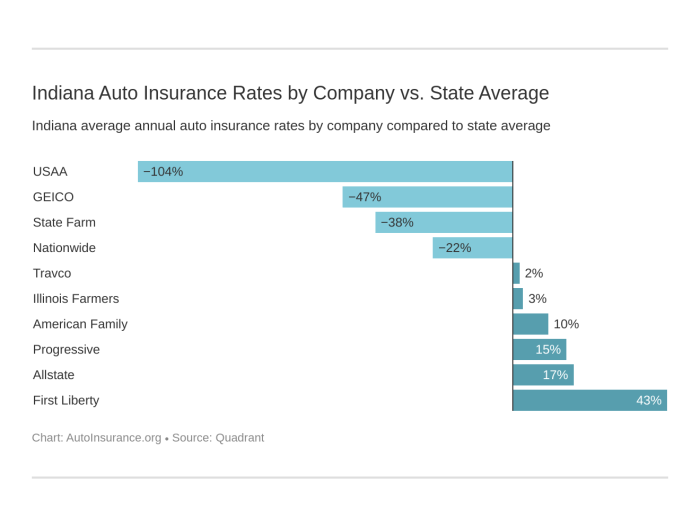

Finding Affordable Auto Insurance in Indiana

Securing affordable auto insurance in Indiana requires a strategic approach. Understanding the factors influencing your premium and actively comparing quotes are key to finding the best value. This section will guide you through the process of obtaining competitive rates and navigating the complexities of Indiana’s auto insurance market.

Finding the best auto insurance rate involves understanding what factors insurance companies weigh. These factors directly impact the premium you’ll pay.

Factors Influencing Auto Insurance Premiums

Insurance companies use a complex algorithm to determine your premium, considering several key factors. Your driving record plays a significant role; accidents and traffic violations increase your risk profile and thus your premium. Age is another crucial factor; younger drivers, statistically, are involved in more accidents, leading to higher premiums. Your location also matters; areas with higher crime rates or a greater frequency of accidents generally have higher insurance costs. The type of vehicle you drive impacts your premium as well; sports cars and luxury vehicles are often more expensive to insure due to higher repair costs and a greater likelihood of theft. Finally, your credit history can be a factor in some cases, although this is subject to state regulations. A good credit score can sometimes translate to lower premiums.

Comparing Auto Insurance Quotes

A systematic approach to comparing quotes from different insurance providers is essential to finding the best deal.

- Gather Information: Begin by compiling your personal information, including your driving history, vehicle details, and address.

- Use Online Comparison Tools: Many websites allow you to input your information and receive quotes from multiple insurers simultaneously. This streamlines the comparison process.

- Contact Insurers Directly: While online tools are convenient, contacting insurers directly can provide a more personalized experience and allow you to ask specific questions.

- Analyze Quotes Carefully: Compare not only the price but also the coverage offered by each insurer. A cheaper policy with inadequate coverage might be more costly in the long run.

- Read the Fine Print: Before committing to a policy, carefully review the policy documents to fully understand the terms and conditions.

Questions to Ask Insurance Companies

Before purchasing a policy, it is crucial to ask pertinent questions to ensure you understand the coverage and terms.

- What specific coverages are included in your policy, and what are the limits for each?

- What are the deductibles for different types of claims (e.g., collision, comprehensive)?

- What is the process for filing a claim, and what documentation is required?

- Are there any discounts available (e.g., good driver, multi-car, bundling)?

- What is the insurer’s customer service reputation, and how can I contact them if I have questions or need assistance?

Indiana’s SR-22 Requirement

An SR-22 certificate is a form filed with the Indiana Bureau of Motor Vehicles (BMV) by your insurance company, verifying that you maintain the minimum required auto insurance coverage. It’s not a separate type of insurance itself, but rather proof of insurance compliance mandated under specific circumstances. Think of it as an extra layer of assurance for the state that you’re meeting your insurance obligations.

The SR-22 requirement in Indiana is triggered by certain driving infractions or legal situations that demonstrate a higher risk to the public. It serves as a way for the state to ensure drivers with a history of risky behavior maintain the necessary insurance coverage to protect others on the road.

Circumstances Requiring an SR-22 in Indiana

An SR-22 is typically required in Indiana after a driver is convicted of a serious driving offense. These offenses often include driving under the influence (DUI), driving while suspended, reckless driving, or accumulating a significant number of moving violations within a specific timeframe. The specific offenses and the duration of the SR-22 requirement are determined by the court and the severity of the infraction. For example, a first-time DUI conviction might require an SR-22 for three years, while a subsequent offense could extend the requirement for a longer period. The BMV will clearly Artikel the length of the requirement as part of the driver’s penalty.

Obtaining an SR-22 Certificate

The process of obtaining an SR-22 begins with securing auto insurance coverage that meets or exceeds Indiana’s minimum liability requirements. Once you have insurance, you’ll need to contact your insurance provider and request that they file an SR-22 certificate with the Indiana BMV on your behalf. Most insurance companies will handle this process for you; however, it’s crucial to confirm with your insurer that the certificate has been successfully filed and received by the BMV. This typically involves providing your insurance company with the necessary documentation related to your court case or driving violation. You may also need to pay an additional fee for the filing of the SR-22.

Implications of Failing to Maintain an SR-22 Certificate

Failing to maintain a valid SR-22 certificate in Indiana can have serious consequences. The BMV will be notified if your insurance lapses or your SR-22 is not renewed. This can result in the suspension or revocation of your driver’s license, impacting your ability to legally drive. Furthermore, you may face additional fines or penalties imposed by the state. Maintaining continuous insurance coverage and a valid SR-22 is critical to avoiding these repercussions. The length of the license suspension varies depending on the specific circumstances and the length of the initial SR-22 requirement. For example, if the initial requirement was for three years and the driver allowed the SR-22 to lapse, the license suspension could be for a period equal to the remaining time on the SR-22 requirement, or even longer.

Resources for More Information

Drivers seeking more information about Indiana’s SR-22 requirements can consult the official website of the Indiana Bureau of Motor Vehicles (BMV). The BMV website provides detailed information on the types of offenses that trigger an SR-22 requirement, the process for obtaining and maintaining an SR-22, and the penalties for non-compliance. Contacting your insurance provider directly is another valuable resource; they can provide guidance on the SR-22 process and ensure you meet all the necessary requirements. Additionally, consulting with a legal professional familiar with Indiana traffic laws can be beneficial, particularly if you have questions regarding the specific implications of your situation.

Filing an Auto Insurance Claim in Indiana

Filing an auto insurance claim in Indiana can seem daunting, but understanding the process can make it significantly less stressful. This guide Artikels the steps involved, necessary documentation, and strategies for navigating interactions with insurance adjusters. Remember, prompt and accurate reporting is key to a successful claim.

Steps to File an Auto Insurance Claim

After a car accident in Indiana, promptly reporting the incident to your insurance company is crucial. Failing to do so could jeopardize your claim. The following steps provide a clear path to filing your claim.

- Report the Accident: Immediately contact your insurance company’s claims department, usually via phone. Provide them with the accident details, including date, time, location, and any injuries involved.

- Gather Information: Collect information from all parties involved, including names, contact details, driver’s license numbers, insurance information, and vehicle details (make, model, license plate). Obtain contact information for any witnesses. If possible, take photographs of the damage to all vehicles and the accident scene itself.

- File a Police Report: If the accident involves injuries or significant property damage, file a police report. This report serves as crucial evidence in your claim.

- Submit Your Claim: Your insurance company will likely provide you with a claim form. Complete this form accurately and thoroughly, attaching all supporting documentation. This often involves an online portal or a mailed submission.

- Cooperate with the Adjuster: Your insurance company will assign a claims adjuster to investigate your claim. Cooperate fully with the adjuster, providing any requested information or documentation promptly.

Necessary Documentation for a Successful Claim

Comprehensive documentation significantly increases the likelihood of a successful claim. The following items are generally required.

- Police report (if applicable)

- Photographs of the accident scene and vehicle damage

- Contact information of all parties involved

- Medical records and bills (if injuries are involved)

- Repair estimates from reputable auto body shops

- Your insurance policy information

- Witness statements (if available)

Dealing with Insurance Adjusters

Insurance adjusters are responsible for investigating claims and determining liability and compensation. Maintaining open and professional communication is vital.

Be prepared to answer questions thoroughly and honestly. Keep detailed records of all communication with the adjuster, including dates, times, and summaries of conversations. If you disagree with the adjuster’s assessment, politely express your concerns and provide supporting evidence. Remember to always remain calm and respectful throughout the process. If you’re having difficulty reaching a resolution, consider seeking legal advice.

Common Reasons for Claim Denials and Addressing Them

Claims are sometimes denied for various reasons. Understanding these reasons can help you prevent denials or effectively appeal them.

- Lack of sufficient evidence: Ensure you provide comprehensive documentation, including police reports, photographs, and witness statements.

- Policy violations: Review your policy carefully to ensure you haven’t violated any terms or conditions that could affect your coverage.

- Failure to cooperate: Promptly respond to all requests from your adjuster and provide all necessary information.

- Pre-existing damage: If the damage was pre-existing, provide documentation to support this claim.

- Fraudulent claims: Accuracy and honesty are paramount. Any attempt to deceive your insurer will result in claim denial.

If your claim is denied, carefully review the denial letter and understand the reasons provided. Gather any additional evidence that might support your claim and submit a formal appeal following your insurance company’s procedures. Consider seeking legal counsel if you believe the denial is unwarranted.

Outcome Summary

Securing the right auto insurance in Indiana involves careful consideration of your individual needs and risk profile. By understanding the state’s requirements, comparing quotes from different providers, and proactively addressing potential issues like SR-22 requirements, you can protect yourself financially and legally. Remember, the information provided here serves as a guide; consulting with an insurance professional is always recommended for personalized advice.

FAQ Corner

What happens if I’m involved in an accident and I don’t have insurance?

Driving without the minimum required insurance in Indiana can lead to significant penalties, including fines, license suspension, and even vehicle impoundment. You would also be responsible for all accident-related costs yourself.

How often should I review my auto insurance policy?

It’s advisable to review your auto insurance policy at least annually, or whenever there’s a significant life change (new car, change in driving habits, etc.). This ensures your coverage remains appropriate for your current circumstances.

Can I get my auto insurance canceled?

Yes, your auto insurance can be canceled for various reasons, including non-payment of premiums, fraudulent claims, or serious driving violations. It’s crucial to maintain consistent payments and adhere to the terms of your policy.

What is the difference between liability and collision coverage?

Liability coverage protects you if you cause an accident that injures someone or damages their property. Collision coverage pays for repairs to your vehicle regardless of who is at fault.