Securing the right auto insurance in Pennsylvania can feel like navigating a complex maze. Understanding the state’s unique requirements, the factors influencing premiums, and the diverse options available is crucial for every driver. This guide cuts through the confusion, offering a clear and concise overview of Pennsylvania’s auto insurance landscape, empowering you to make informed decisions and find the best coverage for your needs.

From understanding the minimum coverage requirements and exploring different policy types to finding affordable options and navigating the complexities of SR-22 filings, we’ll delve into the essential aspects of Pennsylvania auto insurance. We’ll also examine strategies for lowering premiums, the importance of uninsured/underinsured motorist coverage, and the specific challenges faced by high-risk drivers. By the end, you’ll be better equipped to protect yourself and your finances on Pennsylvania roads.

Pennsylvania Auto Insurance Requirements

Pennsylvania law mandates that all drivers carry a minimum level of auto insurance coverage to protect themselves and others involved in accidents. Understanding these requirements is crucial to ensure compliance and avoid potential penalties. Failure to maintain the legally required insurance can result in significant fines and license suspension.

Minimum Coverage Requirements

Pennsylvania’s minimum auto insurance requirements are designed to provide a basic level of financial protection in the event of an accident. These requirements focus primarily on liability coverage, which protects you against financial losses if you cause an accident that injures someone or damages their property. It’s important to note that these minimums might not be sufficient to cover all potential costs associated with a serious accident.

Types of Auto Insurance Coverage

Several types of auto insurance coverage are available in Pennsylvania, each offering different levels of protection. Understanding the implications of each type is key to making an informed decision about your insurance needs.

| Coverage Type | Minimum Requirement | Recommended Coverage | Implications |

|---|---|---|---|

| Bodily Injury Liability | $15,000 per person/$30,000 per accident | $100,000 per person/$300,000 per accident | Covers medical bills, lost wages, and pain and suffering for those injured in an accident you caused. Minimum coverage is often insufficient. |

| Property Damage Liability | $5,000 | $100,000 | Covers the cost of repairing or replacing damaged property, such as another vehicle or a fence, in an accident you caused. Minimum coverage may not cover extensive damage. |

| Uninsured/Underinsured Motorist | Not Required (but highly recommended) | $100,000/$300,000 | Covers your injuries and damages if you’re hit by an uninsured or underinsured driver. Essential protection given the prevalence of uninsured drivers. |

| Collision | Not Required | Comprehensive coverage with a deductible appropriate to your budget. | Covers damage to your vehicle caused by a collision, regardless of fault. |

| Comprehensive | Not Required | Comprehensive coverage with a deductible appropriate to your budget. | Covers damage to your vehicle from non-collision events, such as theft, vandalism, or weather damage. |

Minimum vs. Recommended Coverage

The minimum coverage requirements in Pennsylvania offer only basic protection. Considerably higher coverage levels are recommended to safeguard against significant financial losses resulting from accidents. The table above illustrates the difference between the minimum and recommended coverage amounts. For example, a $15,000/$30,000 bodily injury liability policy might not cover the medical expenses associated with serious injuries, leaving you personally liable for the difference.

Factors Affecting Auto Insurance Premiums in PA

Understanding the factors that influence your auto insurance premiums in Pennsylvania is crucial for managing your budget and securing the best possible coverage. Several key elements contribute to the final cost, and being aware of these can help you make informed decisions. This section will explore these factors and offer strategies for potentially reducing your premiums.

Several interconnected factors determine the cost of auto insurance in Pennsylvania. These factors are carefully assessed by insurance companies to calculate risk and, consequently, your premium. A higher perceived risk translates to a higher premium, while a lower risk profile typically results in lower costs.

Age of the Driver

Younger drivers, particularly those under 25, generally face higher insurance premiums than older drivers. This is because statistically, younger drivers are involved in more accidents. Insurance companies view them as higher-risk individuals, leading to increased premiums to offset the potential for higher claims. As drivers gain experience and a clean driving record, their premiums typically decrease. For example, a 17-year-old driver with a learner’s permit will pay significantly more than a 45-year-old with a long history of safe driving.

Driving History

Your driving record significantly impacts your insurance premiums. Accidents, speeding tickets, and DUI convictions all increase your perceived risk. Each incident adds to your insurance score, leading to higher premiums. Conversely, a clean driving record with no accidents or violations over several years can result in significant premium discounts. For instance, a driver with multiple speeding tickets within a year will likely pay substantially more than a driver with a spotless record.

Type of Vehicle

The type of vehicle you drive also affects your insurance premiums. Sports cars and high-performance vehicles are generally more expensive to insure than sedans or smaller cars due to their higher repair costs and greater potential for accidents. The vehicle’s safety features, such as anti-lock brakes and airbags, also influence the premium. A vehicle with advanced safety features might receive a discount. For example, a new luxury SUV will typically cost more to insure than a used compact car.

Location

Your location plays a role in determining your insurance premium. Areas with higher rates of accidents and theft tend to have higher insurance premiums. This is because insurance companies face a greater risk of paying out claims in these areas. Urban areas, for example, often have higher premiums than rural areas due to increased traffic congestion and higher crime rates. A driver living in a high-crime city will likely pay more than a driver in a quiet, rural town.

Strategies to Lower Auto Insurance Premiums

Understanding the factors that influence your premiums is only half the battle; knowing how to mitigate these factors is equally important. Here are several strategies you can employ to potentially lower your auto insurance costs:

- Maintain a clean driving record: Avoid accidents and traffic violations.

- Choose a safe vehicle: Opt for vehicles with good safety ratings and lower repair costs.

- Consider increasing your deductible: A higher deductible typically translates to lower premiums.

- Bundle your insurance: Combine your auto insurance with other types of insurance, such as homeowners or renters insurance, for potential discounts.

- Shop around for insurance: Compare quotes from multiple insurance providers to find the best rates.

- Take a defensive driving course: Completing a defensive driving course can demonstrate your commitment to safe driving and may result in discounts.

- Maintain good credit: In some states, including Pennsylvania, credit history can influence insurance rates.

Finding Affordable Auto Insurance in PA

Securing affordable auto insurance in Pennsylvania requires a strategic approach. Understanding the various factors influencing your premium and actively comparing options are crucial steps in finding the best coverage at the most competitive price. This section will Artikel effective methods for achieving this goal.

Finding the right balance between comprehensive coverage and affordability is a key challenge for many Pennsylvania drivers. Several strategies can help reduce your insurance costs without compromising necessary protection. By understanding these strategies and actively engaging in the comparison process, you can significantly improve your chances of finding a policy that fits both your budget and your needs.

Comparison Shopping Across Multiple Providers

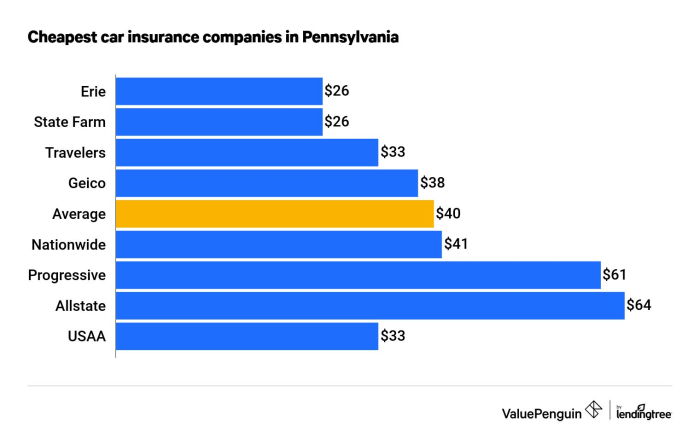

Effective comparison shopping is paramount to finding affordable auto insurance. Pennsylvania’s diverse insurance market offers a wide range of providers, each with varying pricing structures and coverage options. Failing to compare quotes from multiple insurers can result in paying significantly more than necessary. It’s important to note that rates can vary substantially, even for similar coverage levels, depending on the insurer. For instance, a driver with a clean driving record might find a significantly lower rate with one company compared to another. Consider exploring both large national insurers and smaller, regional companies to broaden your search and increase your chances of finding a favorable rate.

Utilizing Online Comparison Tools

Numerous online comparison websites streamline the process of obtaining multiple quotes simultaneously. These platforms allow you to input your information once and receive quotes from several insurers, facilitating a quick and efficient comparison. While convenient, it’s crucial to verify the accuracy of the information provided by these websites, as they may not always reflect the most up-to-date pricing. Always double-check the details with the individual insurance providers before making a decision. For example, a website might list a lower rate than what is ultimately offered by the insurance company directly due to a recent rate adjustment or a specific promotional offer that is not reflected on the comparison site.

Negotiating with Insurance Providers

Don’t hesitate to negotiate your insurance premiums. Insurers are often willing to work with customers to find a mutually agreeable rate, particularly if you have a strong driving record and have been with a previous insurer for a significant period. Highlighting your positive driving history and any discounts you’re eligible for (such as bundling home and auto insurance) can strengthen your negotiating position. For example, you might negotiate a lower rate by agreeing to a higher deductible or opting for a less comprehensive coverage plan. However, always carefully weigh the potential savings against the increased financial risk associated with a higher deductible or reduced coverage.

Exploring Discounts and Bundling Options

Many insurance providers offer discounts for various factors, such as good driving records, completing defensive driving courses, installing anti-theft devices, or bundling multiple insurance policies (homeowners, renters, auto). Actively investigating and utilizing these discounts can significantly lower your premium. For example, bundling your auto and homeowners insurance with the same provider often results in a substantial discount compared to purchasing each policy separately. Similarly, completing a defensive driving course can demonstrate your commitment to safe driving, leading to a reduction in your insurance premiums.

Step-by-Step Guide to Obtaining and Comparing Quotes

- Gather necessary information: Compile your driver’s license information, vehicle details (year, make, model), address, and driving history.

- Utilize online comparison tools: Enter your information on several comparison websites to obtain multiple quotes simultaneously.

- Contact insurance providers directly: Verify the quotes received from the comparison websites by contacting the insurers directly.

- Compare coverage details: Carefully examine the coverage details offered by each insurer, ensuring they meet your needs.

- Analyze pricing and discounts: Compare the total premiums, factoring in any applicable discounts.

- Select the best option: Choose the policy that offers the best balance of coverage and affordability.

Pennsylvania’s Auto Insurance Laws and Regulations

Pennsylvania’s auto insurance laws are designed to protect drivers and victims of accidents. Understanding these regulations is crucial for all drivers in the state, ensuring compliance and knowing your rights in the event of a claim. This section summarizes key aspects of Pennsylvania’s auto insurance laws and the process for filing a claim.

Pennsylvania mandates minimum liability coverage for bodily injury and property damage. This means drivers must carry insurance to cover the costs if they cause an accident resulting in injuries or property damage to others. The specific amounts required are subject to change, so it’s important to check the Pennsylvania Department of Insurance website for the most up-to-date information. Beyond the minimum requirements, drivers may opt for higher coverage limits to provide greater protection.

Minimum Liability Coverage Requirements

Pennsylvania requires drivers to carry a minimum amount of liability insurance. This insurance covers the costs of injuries or damages you cause to others in an accident. Failure to maintain the minimum required coverage can result in significant penalties, including fines and license suspension. It’s vital to ensure your policy meets these minimum requirements. Specific amounts for bodily injury and property damage are defined by state law and should be verified with the Pennsylvania Department of Insurance.

Filing an Auto Insurance Claim in Pennsylvania

The process for filing an auto insurance claim in Pennsylvania involves several key steps. Prompt reporting and accurate documentation are essential for a smooth and efficient claims process. Failing to follow these steps may delay or even jeopardize your claim.

- Report the Accident: Immediately report the accident to your insurance company, regardless of fault. Provide as much detail as possible, including the date, time, location, and involved parties.

- Gather Information: Collect information from all involved parties, including names, addresses, phone numbers, driver’s license numbers, insurance information, and vehicle information. If possible, take photos of the damage to all vehicles involved.

- Obtain Police Report: If the accident involved injuries or significant property damage, obtain a copy of the police report. This report can be a crucial piece of evidence in your claim.

- File a Claim: Contact your insurance company to file a formal claim. You will likely need to provide the information you gathered at the accident scene and the police report (if applicable).

- Cooperate with the Insurance Company: Fully cooperate with your insurance company’s investigation. This includes providing any requested documentation and answering their questions honestly and completely.

Additional Important Considerations

Beyond the minimum liability coverage, drivers may consider purchasing additional coverage options, such as Uninsured/Underinsured Motorist (UM/UIM) coverage, Collision coverage, and Comprehensive coverage, to protect themselves and their vehicles in various situations. Understanding these options and their implications is crucial for making informed decisions about your auto insurance policy. Consult with an insurance professional to determine the best coverage for your individual needs and circumstances.

Uninsured/Underinsured Motorist Coverage in PA

Pennsylvania drivers face a significant risk of accidents involving uninsured or underinsured motorists. This coverage is crucial for protecting yourself and your passengers from financial ruin in the event of a collision caused by a driver lacking sufficient insurance. Understanding the benefits and limitations of uninsured/underinsured motorist (UM/UIM) coverage is vital for responsible driving in the state.

Uninsured/Underinsured Motorist Coverage Benefits and Limitations in Pennsylvania

Benefits of UM/UIM Coverage

UM/UIM coverage compensates you for injuries and property damage caused by a hit-and-run driver or a driver with insufficient insurance to cover your losses. This protection extends to medical bills, lost wages, pain and suffering, and vehicle repair or replacement costs. The policy limits you choose determine the maximum amount your insurer will pay. Choosing higher limits offers greater financial security in the event of a serious accident.

Limitations of UM/UIM Coverage

While UM/UIM coverage is invaluable, it does have limitations. The amount of compensation is typically capped by the limits of your chosen policy. If your injuries or damages exceed your coverage limits, you may be responsible for the remaining costs. Furthermore, some policies may exclude certain types of claims, or may require you to pursue legal action against the at-fault driver before receiving compensation from your own insurer. It’s crucial to carefully review your policy to understand its specific terms and conditions.

Scenario Illustrating the Value of UM/UIM Coverage

Imagine you’re driving in Philadelphia when another car runs a red light and strikes your vehicle. The other driver is uninsured. Your injuries require extensive medical treatment, resulting in significant medical bills and lost wages due to your inability to work. Repairing your vehicle also incurs substantial costs. Without UM/UIM coverage, you would be solely responsible for all these expenses. However, with UM/UIM coverage, your own insurance company would step in to cover your medical bills, lost wages, and vehicle repair costs, up to your policy’s limits, relieving you of a potentially crippling financial burden. The peace of mind provided by this coverage is invaluable.

Pennsylvania’s High-Risk Auto Insurance Market

Securing affordable auto insurance in Pennsylvania can be challenging for drivers with less-than-perfect driving records. The state’s high-risk auto insurance market caters to individuals who have been deemed higher risks by insurance companies due to various factors, resulting in significantly higher premiums than those paid by drivers with clean records. This often creates a considerable financial burden and limits access to necessary coverage.

High-risk drivers in Pennsylvania face difficulties obtaining insurance due to their increased likelihood of filing claims. Insurance companies assess risk based on several factors, and a history of accidents, traffic violations, or DUI convictions significantly increases the perceived risk. This leads to insurers either refusing coverage altogether or offering policies with substantially higher premiums to compensate for the elevated risk. The resulting higher premiums can make maintaining auto insurance financially unsustainable for some individuals.

Options Available to High-Risk Drivers in Pennsylvania

Finding affordable auto insurance as a high-risk driver requires exploring various options. These options aren’t always ideal, but they provide avenues for obtaining necessary coverage.

One primary avenue is the Pennsylvania Assigned Risk Plan (also known as the FAIR Plan). This plan provides a safety net for drivers who have been rejected by multiple insurers. While the premiums through the FAIR Plan are typically higher than standard rates, it ensures that high-risk drivers can still obtain the minimum legally required coverage. It is important to note that the coverage offered might be more basic than what’s available through private insurers.

Another approach involves improving one’s driving record. By completing defensive driving courses, maintaining a clean driving record for several years, and demonstrating responsible driving habits, drivers can potentially improve their insurability and qualify for lower premiums from standard insurers in the future. This requires patience and a commitment to safe driving practices.

Finally, comparing quotes from multiple insurers is crucial. While many insurers might initially reject an application, some might offer policies with varying premiums depending on their individual risk assessment models. This requires diligent research and comparison shopping across different providers. It’s important to be transparent about one’s driving history when obtaining quotes.

Factors Contributing to High-Risk Insurance Premiums

The following infographic visually represents the key factors influencing high-risk auto insurance premiums in Pennsylvania.

Infographic Description: The infographic is a circular chart, divided into segments of varying sizes, representing the weight of each factor. The largest segment, labeled “Driving Record,” dominates the chart, illustrating its significant influence. This segment is further subdivided into smaller sections representing specific violations like accidents (largest subsection), speeding tickets, and DUI convictions (smaller subsections). The next largest segment is “Age and Gender,” reflecting the statistical differences in accident rates among various demographic groups. A smaller segment is dedicated to “Vehicle Type,” showing that higher-performance or more expensive vehicles often carry higher premiums. The remaining smaller segments represent “Location,” (reflecting higher accident rates in certain areas), and “Credit Score,” highlighting the growing use of credit scores in risk assessment. Each segment is clearly labeled and uses contrasting colors for visual clarity. The title of the infographic is “Factors Affecting Pennsylvania High-Risk Auto Insurance Premiums”. A key is included to explain the meaning of each color used to represent the segments.

Ultimate Conclusion

Obtaining adequate auto insurance in Pennsylvania is not just a legal requirement; it’s a crucial step in safeguarding your financial well-being. By understanding the intricacies of the state’s insurance regulations, actively comparing options, and employing smart strategies to manage your premiums, you can navigate the system effectively and secure the right coverage at a reasonable price. Remember to regularly review your policy to ensure it continues to meet your evolving needs. Driving safely and maintaining a clean driving record are also key factors in keeping your insurance costs manageable.

FAQs

What happens if I get into an accident and I don’t have insurance?

Driving without insurance in Pennsylvania is illegal and can result in significant fines, license suspension, and even vehicle impoundment. You’ll also be responsible for all accident-related costs, which can be substantial.

Can I get my auto insurance through my employer?

Some employers offer group auto insurance plans to their employees, often at discounted rates. Check with your HR department to see if this is an option for you.

How often can I change my auto insurance policy?

You can typically change your auto insurance policy whenever you wish, although there might be a waiting period depending on your provider and the type of change.

What is the difference between liability and collision coverage?

Liability coverage pays for damages to other people’s property or injuries to others in an accident you caused. Collision coverage pays for repairs to your vehicle, regardless of who is at fault.