Navigating the world of auto insurance in Georgia can feel like driving through a maze. With numerous providers, coverage options, and factors influencing premiums, finding the best deal requires careful planning and understanding. This guide serves as your roadmap, demystifying the process of securing affordable and comprehensive auto insurance in the Peach State. We’ll explore Georgia’s regulatory landscape, key factors affecting your rates, effective quote-comparison strategies, and tips for saving money. Whether you’re a seasoned driver or a new Georgia resident, this resource will empower you to make informed decisions about your auto insurance.

From understanding the minimum coverage requirements to exploring the benefits of additional protection, we’ll delve into the specifics of various coverage types and how they apply to your unique situation. We’ll also equip you with the knowledge to effectively compare quotes from different insurers, negotiate for better rates, and ultimately secure the best possible auto insurance policy for your needs and budget.

Understanding Georgia’s Auto Insurance Market

Navigating the auto insurance landscape in Georgia requires understanding its regulatory framework and the various coverage options available. This section provides a clear overview to help you make informed decisions about your insurance needs.

Georgia’s auto insurance market is regulated by the Georgia Department of Insurance (DOI). The DOI sets minimum coverage requirements, oversees insurance companies operating within the state, and handles consumer complaints. This regulatory framework aims to protect consumers and ensure fair practices within the industry. While the DOI sets minimum standards, consumers are encouraged to consider higher coverage limits for enhanced protection.

Georgia’s Auto Insurance Coverage Options

Several types of auto insurance coverage are available in Georgia, each designed to address different potential risks. Understanding these options is crucial in selecting a policy that aligns with your individual needs and financial circumstances. Common types of coverage include liability coverage (bodily injury and property damage), collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. Liability coverage is legally mandated, while others are optional but highly recommended.

Minimum versus Recommended Coverage Levels in Georgia

Georgia mandates minimum liability coverage of $25,000 for bodily injury to one person, $50,000 for bodily injury to multiple people in a single accident, and $25,000 for property damage. These minimums, however, are often insufficient to cover the costs associated with serious accidents. Recommended coverage levels typically exceed the minimum requirements, providing greater financial protection in the event of an accident. For instance, many financial advisors recommend liability coverage of at least $100,000/$300,000/$50,000 or higher, depending on individual assets and risk tolerance. Collision and comprehensive coverage are also strongly recommended to protect your vehicle against damage from accidents and other events.

Average Auto Insurance Premiums in Major Georgia Cities

The cost of auto insurance varies significantly depending on several factors, including location, driving history, age, and the type of vehicle. The following table provides a general comparison of average premiums across some major Georgia cities. Note that these are averages and individual premiums may differ considerably. These figures are estimations based on industry data and may vary depending on the insurer and specific policy details.

| City | Average Annual Premium (Estimate) | Factors Influencing Cost | Additional Notes |

|---|---|---|---|

| Atlanta | $1,500 – $2,000 | Higher population density, increased accident rates | Costs can be higher in specific Atlanta neighborhoods. |

| Augusta | $1,200 – $1,700 | Moderate population density, relatively lower accident rates compared to Atlanta | Rates can fluctuate based on specific areas within Augusta. |

| Savannah | $1,300 – $1,800 | Tourist destination, potentially higher accident rates during peak seasons | Coastal location might influence premiums due to potential weather-related damages. |

| Columbus | $1,100 – $1,600 | Lower population density compared to Atlanta and Savannah | Generally lower premiums compared to larger metropolitan areas. |

Factors Influencing Auto Insurance Quotes

Securing affordable auto insurance in Georgia depends on a variety of factors considered by insurance companies when calculating your premium. Understanding these factors can empower you to make informed decisions and potentially lower your costs. This section details the key elements influencing your auto insurance quote.

Driving History

Your driving record significantly impacts your insurance premium. Insurance companies analyze your history to assess your risk profile. A clean driving record, free of accidents and traffic violations, typically results in lower premiums. Conversely, accidents and tickets, especially those involving significant damage or injuries, lead to higher premiums. The severity and frequency of incidents directly influence the increase. For example, a single minor fender bender might result in a modest premium increase, while a DUI conviction or multiple accidents could significantly raise your rates. Insurance companies often use a points system, where each violation adds points, increasing your premium accordingly. Maintaining a clean driving record is crucial for keeping insurance costs manageable.

Age, Gender, and Credit Score

These demographic factors play a role in determining insurance premiums, although their influence varies by insurance company and state regulations. Statistically, younger drivers, particularly those under 25, are considered higher risk due to inexperience and a higher likelihood of accidents. Therefore, they generally pay higher premiums. Similarly, gender can be a factor, although this is subject to legal challenges and varies by insurer. Credit score is increasingly used as a rating factor, with those possessing better credit scores often receiving lower rates. This is based on the correlation between responsible financial behavior and responsible driving behavior. A person with a high credit score might receive a discount of up to 40% compared to someone with a poor credit history.

Vehicle Type and Features

The type of vehicle you drive significantly impacts your insurance costs. Sports cars and luxury vehicles, often associated with higher repair costs and a greater likelihood of theft, tend to have higher insurance premiums. Conversely, smaller, less expensive vehicles usually attract lower premiums. Vehicle features also play a role. Safety features like anti-lock brakes, airbags, and anti-theft systems can lead to discounts. The vehicle’s age and its safety rating also contribute to the overall premium calculation. For example, a new, high-safety-rated SUV will generally have a different premium than an older, used sedan with fewer safety features. The cost of parts and repairs are also a major component of this calculation.

Obtaining Auto Insurance Quotes in Georgia

Securing the best auto insurance rate in Georgia involves a strategic approach to comparing quotes from various providers. Understanding the different methods for obtaining quotes and the information needed will significantly streamline the process and help you find the most suitable coverage at a competitive price.

Obtaining Auto Insurance Quotes Online

A step-by-step guide to obtaining online auto insurance quotes in Georgia typically involves visiting the insurer’s website, completing a quote request form, and reviewing the results. The process is generally straightforward and allows for quick comparisons. First, navigate to the insurer’s website and locate their quote request form, usually accessible through a prominent button or link. This form will request specific details about your vehicle, driving history, and desired coverage. Accurately filling out this form is crucial for receiving an accurate quote. Once submitted, the system will process your information and provide a quote within seconds or minutes. You can then compare quotes from multiple insurers by repeating this process. Remember to carefully review the policy details before making a decision.

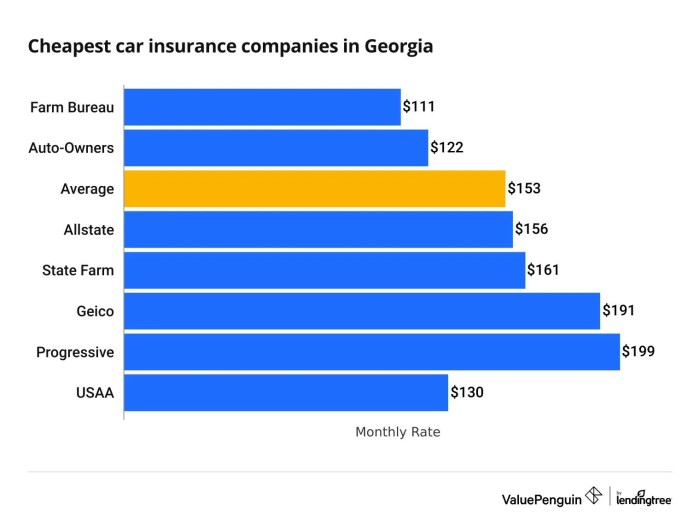

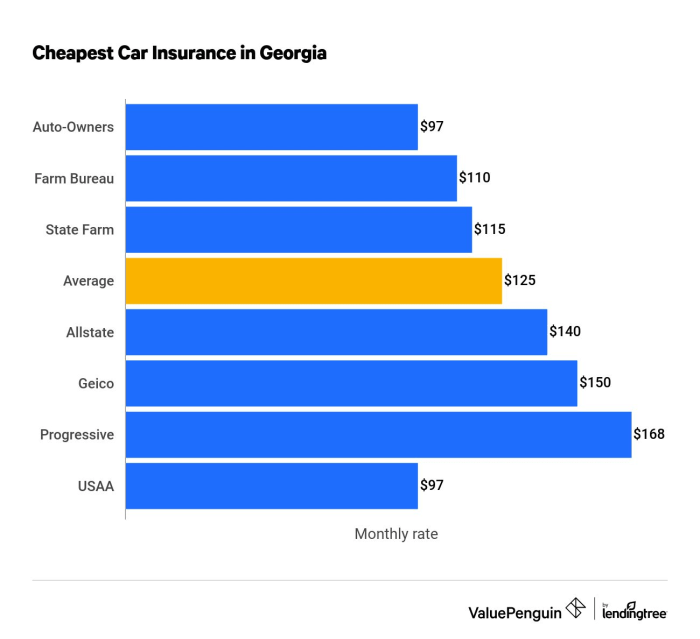

Reputable Insurance Providers in Georgia

Several reputable insurance providers operate within Georgia, offering a range of auto insurance options. These companies are known for their financial stability, customer service, and competitive pricing. While a comprehensive list is beyond the scope of this section, some examples include State Farm, Allstate, Geico, Progressive, and Nationwide. These are just a few examples, and it’s recommended to research other providers to find one that best suits your needs and budget. It’s important to check the financial strength ratings of any insurer before making a decision.

Comparison of Quote Obtaining Methods

Obtaining auto insurance quotes in Georgia can be accomplished through online platforms, phone calls, or in-person visits to an agent’s office. Online methods offer convenience and speed, allowing for quick comparisons across multiple providers. Phone calls provide a more personalized approach, allowing for direct interaction with an agent to clarify questions and discuss specific needs. In-person meetings offer the most personalized experience, enabling face-to-face discussions and detailed explanations of policy options. The best method depends on individual preferences and time constraints. Many find online methods efficient for initial comparisons, while phone calls or in-person meetings are beneficial for clarifying details or addressing complex situations.

Information Needed for Accurate Quotes

To receive accurate auto insurance quotes in Georgia, it’s crucial to have certain information readily available. This includes details about your vehicle (make, model, year), your driving history (including accidents, tickets, and prior insurance coverage), your desired coverage levels (liability, collision, comprehensive, etc.), your address, and your date of birth. Providing accurate information ensures the insurer can properly assess your risk and provide a fair and accurate quote. Omitting or misrepresenting information can lead to inaccurate or invalid quotes, potentially resulting in higher premiums or coverage gaps later. Therefore, accurate and complete information is paramount for a smooth and efficient quote process.

Analyzing and Comparing Quotes

Receiving multiple auto insurance quotes is a crucial step in securing the best coverage at the most affordable price. Effectively comparing these quotes requires a systematic approach, focusing on both the price and the specifics of the policy. This process ensures you’re not just getting the cheapest quote, but the best value for your needs.

Comparing different insurance quotes involves more than just looking at the bottom-line price. A lower premium might come with significantly less coverage, leaving you vulnerable in the event of an accident. Conversely, a higher premium could offer superior protection and peace of mind. Understanding the nuances of each policy is paramount to making an informed decision.

Effective Comparison Strategies

To effectively compare quotes, organize them in a spreadsheet or use a comparison tool. List each insurer, their premium, deductibles, coverage limits (liability, collision, comprehensive), and any additional features or discounts. This allows for a clear side-by-side comparison, highlighting key differences. For instance, comparing a $1000 deductible with a $500 deductible reveals a significant difference in your out-of-pocket expenses in case of an accident. Similarly, comparing liability limits of $25,000/$50,000 versus $100,000/$300,000 reveals substantial differences in financial protection.

Negotiating Lower Premiums

Once you’ve identified a few competitive quotes, don’t hesitate to negotiate. Explain your situation, highlight your clean driving record, and inquire about discounts for bundling policies (home and auto), safety features in your car (anti-theft devices, airbags), or completing defensive driving courses. Insurance companies often have some flexibility in their pricing, and a polite negotiation can yield savings. For example, mentioning you’re considering another insurer’s lower quote might incentivize them to match or improve their offer.

Understanding Policy Details and Exclusions

Carefully review each policy’s details, paying close attention to exclusions. These are specific situations or circumstances not covered by the insurance. Common exclusions might include damage caused by wear and tear, driving under the influence, or using the vehicle for commercial purposes. Understanding these exclusions prevents unpleasant surprises if you need to file a claim. For example, a policy might exclude coverage for damage caused by driving on unpaved roads, a detail easily overlooked.

Key Features to Consider When Comparing Policies

| Feature | Description | Example 1 | Example 2 |

|---|---|---|---|

| Premium | The total cost of the insurance policy. | $1200 per year | $1500 per year |

| Deductible | The amount you pay out-of-pocket before insurance coverage begins. | $500 | $1000 |

| Liability Coverage | Covers bodily injury or property damage you cause to others. | $25,000/$50,000 | $100,000/$300,000 |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of fault. | Included | Included |

| Comprehensive Coverage | Covers damage to your vehicle from events other than accidents (e.g., theft, vandalism). | Included | Included with higher premium |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re involved in an accident with an uninsured or underinsured driver. | $25,000/$50,000 | $50,000/$100,000 |

Saving Money on Auto Insurance in Georgia

Securing affordable auto insurance in Georgia is achievable through a combination of strategic planning and informed decision-making. By understanding the factors influencing your premiums and actively employing cost-saving strategies, you can significantly reduce your annual expenses without compromising coverage. This section Artikels several effective methods for lowering your auto insurance costs.

Strategies for Reducing Auto Insurance Costs

Several key strategies can help reduce your Georgia auto insurance premiums. These range from improving your driving record to making smart choices about your policy coverage. Implementing even a few of these can result in substantial savings over time.

- Maintain a Clean Driving Record: Accidents and traffic violations significantly increase insurance premiums. Driving safely and defensively is the most effective way to keep your rates low. A single at-fault accident can lead to a substantial premium increase for several years.

- Choose a Higher Deductible: Opting for a higher deductible—the amount you pay out-of-pocket before your insurance coverage kicks in—will lower your monthly premiums. This requires careful consideration of your financial capacity to cover a larger upfront expense in the event of a claim. A higher deductible generally translates to lower premiums.

- Shop Around and Compare Quotes: Different insurance companies use varying rating factors, resulting in diverse premiums for the same coverage. Comparing quotes from multiple insurers is crucial to find the most competitive rates. This proactive approach ensures you are not overpaying for your insurance.

- Consider Your Coverage Needs: Evaluate your coverage levels carefully. While comprehensive and collision coverage offer extensive protection, they also come with higher premiums. If your vehicle is older or has a lower value, you might consider dropping collision and comprehensive coverage, opting for liability coverage instead. This decision requires careful consideration of your risk tolerance and financial situation.

- Bundle Your Insurance Policies: Many insurers offer discounts for bundling home and auto insurance policies. This strategy leverages your loyalty and reduces administrative costs for the insurance company, leading to savings for you. For example, State Farm often provides significant discounts for bundled policies.

Benefits of Bundling Insurance Policies

Bundling your home and auto insurance policies with the same provider frequently results in significant savings. Insurers reward customer loyalty and streamline their operations by offering discounted rates for bundled policies. This is often a substantial discount, sometimes exceeding 10% off the total premium.

Impact of Safe Driving Habits on Premiums

Safe driving habits directly influence your insurance premiums. Maintaining a clean driving record, avoiding accidents and traffic violations, and participating in defensive driving courses are all effective ways to keep your rates low. Insurance companies often offer discounts for completing defensive driving courses, demonstrating a commitment to safe driving practices. For example, a driver with a clean record for five years might qualify for a “good driver” discount.

Examples of Discounts Offered by Insurance Companies

Insurance companies offer various discounts to incentivize safe driving and responsible behavior. These discounts can significantly reduce your overall premiums.

- Good Driver Discount: Awarded to drivers with a clean driving record for a specified period (e.g., three to five years without accidents or violations).

- Defensive Driving Course Discount: Offered for completing an approved defensive driving course, demonstrating a commitment to safe driving practices.

- Bundling Discount: A discount for bundling home and auto insurance policies with the same provider.

- Multi-Car Discount: A discount for insuring multiple vehicles under the same policy.

- Good Student Discount: Offered to students who maintain a certain GPA.

- Anti-theft Device Discount: A discount for installing anti-theft devices in your vehicle.

Understanding Uninsured/Underinsured Motorist Coverage

In Georgia, like many other states, a significant number of drivers operate without adequate insurance coverage. This creates a considerable risk for insured drivers involved in accidents caused by uninsured or underinsured motorists. Uninsured/Underinsured Motorist (UM/UIM) coverage is a crucial component of your auto insurance policy designed to protect you and your passengers in such situations. It bridges the gap when the at-fault driver lacks sufficient liability insurance to cover your medical bills, lost wages, and property damage.

UM/UIM coverage provides financial protection when you’re injured in an accident caused by an uninsured or underinsured driver. It compensates you for your medical expenses, lost wages, pain and suffering, and property damage, even if the at-fault driver is legally responsible but lacks the necessary insurance to cover your losses. This coverage is particularly vital in Georgia due to the potential for high medical costs and the possibility of encountering uninsured drivers on the road.

Scenarios Benefiting from UM/UIM Coverage

This coverage is invaluable in a variety of accident scenarios. Imagine a situation where you are stopped at a red light and are rear-ended by a driver who admits fault but carries only the state-mandated minimum liability insurance. The damages to your vehicle exceed their coverage, and your medical bills are substantial. UM/UIM coverage steps in to cover the remaining costs. Another example could involve a hit-and-run accident where the at-fault driver is never identified. In both cases, UM/UIM coverage ensures you are not left financially burdened. A further example is when you’re injured by a driver who is insured, but their policy limits are far lower than your actual damages. UM/UIM coverage would then cover the difference.

Factors Influencing the Cost of UM/UIM Coverage

Several factors influence the premium for UM/UIM coverage. Your driving history, including accidents and traffic violations, plays a significant role. A clean driving record typically results in lower premiums. The amount of coverage you choose also impacts the cost; higher coverage limits naturally lead to higher premiums. Your vehicle’s value is another factor; more expensive vehicles may result in higher premiums to reflect the potential cost of repairs or replacement. Your location within Georgia can also influence rates, as some areas have higher rates of uninsured drivers than others. Finally, your insurance company’s underwriting practices and risk assessment models will influence the final cost.

Questions to Ask Your Insurance Provider Regarding UM/UIM Coverage

Understanding your UM/UIM coverage requires clarifying specific details with your insurer. The coverage limits selected should accurately reflect your risk tolerance and potential liability. The process for filing a claim under this coverage should be clearly understood, including required documentation and timelines. The insurer should explain the difference between uninsured and underinsured motorist coverage and how each applies to various scenarios. The availability of additional options or endorsements, such as coverage for lost wages or pain and suffering, should be explored. Finally, you should understand how the coverage interacts with your health insurance and other sources of compensation in the event of an accident.

Illustrating Key Concepts

Visual representations can significantly aid in understanding the complex relationship between various factors and auto insurance premiums in Georgia. By visualizing this data, we can gain clearer insights into how different aspects influence the final cost. This section will describe two key visual representations without using actual images.

Driving Record and Premium Cost

Imagine a graph with two axes. The horizontal axis represents the severity of a driver’s driving record, ranging from pristine (no accidents or violations) to severely impaired (multiple accidents and serious violations). The vertical axis represents the cost of the auto insurance premium. The relationship depicted would be a positive correlation. As the severity of the driving record increases (moving rightward along the horizontal axis), the premium cost (vertical axis) would also increase, rising steadily upward. The line representing this relationship would not be perfectly straight; a driver with one minor accident might see a smaller premium increase compared to a driver with multiple serious offenses. The graph would show a clear upward trend, illustrating how a poor driving record directly translates to higher insurance premiums. This visual would effectively communicate the financial consequences of unsafe driving habits.

Distribution of Auto Insurance Premiums Across Age Groups

Consider a bar chart illustrating the distribution of average auto insurance premiums across different age groups in Georgia. The horizontal axis would represent age ranges (e.g., 16-25, 26-35, 36-45, 46-55, 56-65, 65+), and the vertical axis would represent the average premium cost for each age group. The chart would likely show a distinctive pattern. Younger drivers (16-25) would typically have the highest average premiums, represented by a tall bar. This reflects the higher risk associated with inexperienced drivers. The bars would generally decrease in height as age increases, reaching a lower point for middle-aged drivers (perhaps the 36-45 or 46-55 range). The premium might increase slightly again for the oldest age group (65+), potentially reflecting factors like increased health concerns or decreased driving ability. This visual representation would clearly show the age-related variations in auto insurance costs in Georgia, highlighting the higher premiums faced by younger drivers and the generally lower costs for middle-aged individuals. It’s important to remember that these are averages, and individual premiums will vary based on other factors.

Last Point

Securing the right auto insurance in Georgia is a crucial step in responsible driving. By understanding the factors influencing premiums, diligently comparing quotes, and employing effective cost-saving strategies, you can find a policy that provides adequate protection without breaking the bank. Remember to regularly review your coverage and adjust it as needed to reflect changes in your driving habits, vehicle, or personal circumstances. Armed with the knowledge presented in this guide, you can confidently navigate the Georgia auto insurance market and secure the best possible protection for yourself and your vehicle.

Question Bank

What is SR-22 insurance and do I need it in Georgia?

SR-22 insurance is proof of financial responsibility required by the state of Georgia for certain drivers, typically those with serious driving violations or DUI convictions. It’s not a type of insurance itself, but rather a certificate filed with the state demonstrating you maintain the minimum required liability coverage.

How often can I get my car insurance rates reviewed?

You can request a review of your car insurance rates at any time. Many insurance companies offer annual reviews, but you’re entitled to ask for a reevaluation if your circumstances change (e.g., improved driving record, new car, change in address).

Can I use my credit score to get discounts on my car insurance?

Yes, many insurance companies in Georgia consider credit scores when determining premiums. A good credit score can often qualify you for discounts. However, this practice is subject to state regulations and may vary by insurer.

What happens if I get into an accident and don’t have enough insurance coverage?

If you cause an accident and your coverage is insufficient to cover the damages, you could face significant financial liability, including lawsuits and legal fees. This is why carrying adequate coverage is crucial.