The automotive insurance industry is a dynamic landscape shaped by technological innovation, evolving consumer expectations, and a complex regulatory environment. This guide delves into the intricacies of this sector, examining the diverse types of policies available, the factors influencing premium costs, and the impact of technological advancements on both insurers and consumers. We will explore the competitive dynamics among major players, the importance of customer experience, and the future trajectory of this crucial market.

From understanding the nuances of liability and collision coverage to navigating the complexities of telematics and AI-driven risk assessment, this exploration aims to provide a clear and comprehensive overview of the automotive insurance world, empowering readers with the knowledge to make informed decisions.

Market Overview of Automotive Insurance Companies

The automotive insurance market is a dynamic and complex landscape, constantly evolving in response to technological advancements, economic shifts, and changing consumer behavior. This overview examines the current state of the market, highlighting key trends and competitive dynamics among major players.

The global automotive insurance market is characterized by a high degree of competition, with a mix of large multinational corporations and smaller regional insurers. Profitability varies significantly depending on factors such as claims frequency, operating costs, and investment returns. Economic downturns often lead to increased claims due to reduced vehicle maintenance and more risky driving behaviors, impacting profitability. Conversely, periods of economic growth can see increased premiums and a rise in new vehicle sales, boosting the market overall.

Technological Advancements Shaping the Industry

Technological advancements are profoundly impacting the automotive insurance sector. Telematics, the use of technology to monitor driving behavior, is becoming increasingly prevalent. This allows insurers to offer usage-based insurance (UBI) programs, which adjust premiums based on individual driving habits. Data analytics plays a crucial role in risk assessment, fraud detection, and claims processing, leading to greater efficiency and potentially lower premiums for safe drivers. The rise of autonomous vehicles presents both opportunities and challenges, potentially leading to lower accident rates but also requiring new insurance models to account for liability in the event of accidents involving self-driving cars. Artificial intelligence (AI) is also being implemented for tasks such as customer service, claims processing, and risk assessment, streamlining operations and improving customer experience.

Economic Factors Influencing the Market

Economic conditions significantly influence the automotive insurance market. During economic recessions, consumers may delay purchasing new vehicles or opt for less expensive insurance coverage, impacting insurers’ revenue. Inflationary pressures increase the cost of vehicle repairs and replacement parts, leading to higher claims payouts for insurers. Interest rates also play a role, impacting investment returns and the cost of capital for insurance companies. Government regulations, such as mandatory insurance requirements and minimum coverage levels, also shape the market landscape, influencing both consumer behavior and insurer strategies. Fuel price fluctuations can indirectly affect the market by influencing the frequency and severity of accidents, as well as impacting consumer spending habits.

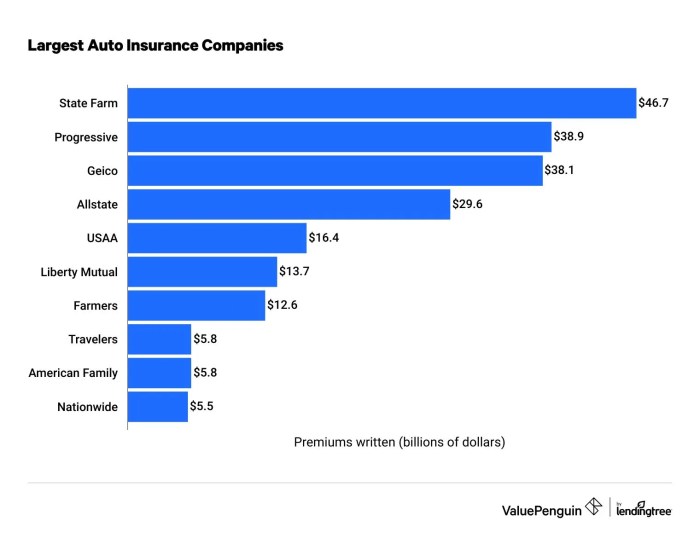

Competitive Dynamics Among Major Players

The competitive landscape of the automotive insurance market is characterized by intense rivalry among established players and the emergence of new entrants, particularly in the digital insurance space. Large, multinational insurers often leverage their extensive networks and brand recognition to maintain market share. Smaller, more agile companies are increasingly competing by offering specialized products, focusing on niche markets, or utilizing technology to enhance efficiency and customer experience. Mergers and acquisitions are common, as larger companies seek to expand their market reach and diversify their product offerings. Price competition is a significant factor, with insurers constantly striving to balance profitability with the need to attract and retain customers. Differentiation strategies, such as offering personalized services, bundled products, or innovative insurance solutions, are becoming increasingly important in this competitive environment.

Market Share of Top Automotive Insurance Companies

| Company | Market Share (%) | Geographic Focus | Key Strengths |

|---|---|---|---|

| Company A | 15 | Global | Strong brand recognition, extensive distribution network |

| Company B | 12 | North America | Technological innovation, strong customer service |

| Company C | 10 | Europe | Competitive pricing, niche market focus |

| Company D | 8 | Global | Diversified product offerings, strong financial stability |

Types of Automotive Insurance Policies

Choosing the right automotive insurance policy can feel overwhelming, given the variety of options available. Understanding the different types of coverage and their associated costs is crucial to securing adequate protection while managing your budget effectively. This section will detail the key features of common automotive insurance policies, enabling you to make an informed decision.

Liability Coverage

Liability insurance protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, lost wages, and property repairs for the other party involved. Liability coverage typically consists of two parts: bodily injury liability and property damage liability. The limits are expressed as numbers, such as 100/300/100, representing $100,000 per person for bodily injury, $300,000 total for bodily injury per accident, and $100,000 for property damage. Higher limits provide greater protection but also come with a higher premium.

- Key Features: Covers bodily injury and property damage to others caused by you.

- Exclusions: Does not cover damage to your own vehicle or injuries to you or your passengers.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This is crucial if you have a loan or lease on your car, as the lender will likely require it. The payout will usually cover the cost of repairs or the actual cash value of your vehicle, minus your deductible.

- Key Features: Pays for damage to your vehicle in an accident, regardless of fault.

- Exclusions: Typically excludes damage caused by wear and tear, vandalism (unless you have comprehensive coverage), or acts of God (unless you have comprehensive coverage).

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. It’s a valuable addition to your policy, providing broader protection against unforeseen circumstances. Like collision coverage, it will typically pay for repairs or the actual cash value of your vehicle, minus your deductible.

- Key Features: Covers damage to your vehicle from non-collision events, such as theft, fire, or hail.

- Exclusions: Generally excludes damage from wear and tear or mechanical breakdowns.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It will help cover your medical bills and vehicle repairs if the other driver’s insurance is insufficient to cover your losses. This is particularly important in areas with a high percentage of uninsured drivers.

- Key Features: Covers injuries and damages caused by an uninsured or underinsured driver.

- Exclusions: Does not apply if you are at fault and the other driver is insured adequately.

Personal Injury Protection (PIP)

PIP coverage pays for your medical expenses and lost wages, regardless of fault, after an accident. It also covers medical expenses for your passengers. Some states require PIP coverage, while others offer it as an option. The availability and requirements for PIP coverage vary significantly by state.

- Key Features: Covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Exclusions: May have limitations on the amount of coverage provided.

Cost and Benefits Comparison

The cost of each type of coverage varies based on several factors, including your driving record, location, vehicle type, and the coverage limits you choose. Generally, liability insurance is the most affordable, while comprehensive and collision coverage add to the premium. However, the benefits of having these additional coverages can significantly outweigh the increased cost in the event of an accident. For example, collision coverage could save you thousands of dollars in repair costs after a fender bender, while comprehensive coverage might protect you from financial loss due to theft or a natural disaster. It’s important to weigh the potential costs and benefits carefully when choosing your policy.

Factors Affecting Automotive Insurance Premiums

Several key factors influence the cost of your automotive insurance premium. Understanding these factors can help you make informed decisions about your coverage and potentially lower your costs. These factors are assessed by insurance companies through sophisticated risk assessment models to determine the likelihood of you filing a claim.

Driving History

Your driving record is a significant determinant of your insurance premium. A clean driving record, free of accidents and traffic violations, will typically result in lower premiums. Conversely, accidents, especially those deemed your fault, and traffic violations like speeding tickets or DUIs, will substantially increase your premiums. The severity and frequency of incidents directly impact the assessment of risk. For example, a single minor fender bender might result in a moderate premium increase, while a DUI conviction could lead to a significant surge, or even policy cancellation in some cases. Insurance companies use points systems to quantify the severity of driving infractions, which are then factored into the premium calculation.

Age and Driving Experience

Age and driving experience are strongly correlated with accident risk. Younger drivers, particularly those under 25, statistically have higher accident rates, leading to higher premiums. This is because they generally have less driving experience and may be more prone to risky driving behaviors. As drivers age and gain experience, their premiums generally decrease, reflecting a lower perceived risk. Insurance companies often offer discounts for experienced drivers, particularly those with accident-free driving histories for many years.

Location

Where you live significantly impacts your insurance premium. Areas with higher crime rates, more traffic congestion, and a greater frequency of accidents generally have higher insurance rates. Insurance companies analyze claims data geographically to identify high-risk areas. Factors like the density of the population, the prevalence of theft, and the quality of roads all contribute to the risk assessment for a given location. Living in a rural area with low traffic volume typically results in lower premiums compared to a densely populated urban center with high accident rates.

Vehicle Type

The type of vehicle you drive is another crucial factor. Sports cars and high-performance vehicles are often associated with higher insurance premiums due to their higher repair costs and increased risk of accidents. Factors like the vehicle’s safety features, its theft rate, and its repair costs all play a role in determining the premium. Conversely, smaller, less expensive vehicles typically command lower premiums. The make, model, and year of the vehicle are all considered in the risk assessment.

Credit Score

In many jurisdictions, your credit score can influence your insurance premium. The rationale behind this is that individuals with poor credit scores may be considered higher risk. While the exact correlation is debated, insurance companies often use credit scores as one factor among many in their risk assessment models. This practice is subject to regulation and varies by state or country. Maintaining a good credit score can potentially lead to lower insurance premiums.

Claims History

Your claims history significantly impacts future premiums. Filing a claim, regardless of fault, usually results in a premium increase. The frequency and severity of claims are key factors. Multiple claims in a short period suggest a higher risk profile, leading to a more substantial premium increase. Conversely, maintaining a clean claims history can lead to discounts and lower premiums over time. Insurance companies track claims data meticulously to assess the risk associated with each policyholder.

Technological Advancements in Automotive Insurance

The automotive insurance industry is undergoing a significant transformation driven by rapid technological advancements. These innovations are impacting every aspect of the business, from risk assessment and claims processing to customer service and product development. The integration of technology is leading to greater efficiency, improved accuracy, and a more personalized customer experience.

Telematics and Usage-Based Insurance (UBI)

Telematics, the use of technology to collect and analyze data from vehicles, is revolutionizing how insurance risk is assessed. Usage-based insurance (UBI) leverages this data to offer personalized premiums based on individual driving behavior. Telematics devices, often integrated into smartphones or dedicated onboard systems, track various driving metrics such as speed, acceleration, braking, mileage, and even time of day. This granular data allows insurers to accurately identify safer drivers and reward them with lower premiums, while higher-risk drivers may see their premiums increase. For example, a driver who consistently maintains a moderate speed and avoids harsh braking maneuvers might receive a significant discount compared to a driver with a more aggressive driving style. This system fosters safer driving habits and creates a fairer pricing model.

Data Analytics and AI in Risk Assessment and Claims Processing

Data analytics and artificial intelligence (AI) are transforming how insurers assess risk and process claims. Insurers utilize vast datasets encompassing driving records, demographics, vehicle information, and telematics data to create sophisticated risk models. AI algorithms analyze these datasets to identify patterns and predict the likelihood of accidents or claims. This allows for more accurate pricing and helps to identify high-risk individuals more effectively. Furthermore, AI is streamlining claims processing. Automated systems can analyze photos and other evidence submitted by policyholders to assess damage and expedite the settlement process, significantly reducing processing time and costs. For instance, AI-powered image recognition can automatically assess the extent of damage to a vehicle after an accident, eliminating the need for manual inspection in many cases.

The Impact of Autonomous Vehicles on the Future of Automotive Insurance

The rise of autonomous vehicles (AVs) presents both challenges and opportunities for the automotive insurance industry. While AVs promise to significantly reduce accidents due to human error, the liability in the event of an accident involving an AV becomes complex. Determining responsibility between the vehicle manufacturer, software provider, and owner requires new insurance models and legal frameworks. The frequency and severity of accidents are expected to change, leading to adjustments in premium calculations. For example, insurers might develop specialized policies for AVs, factoring in the vehicle’s safety features and autonomous driving capabilities. Furthermore, the potential for increased vehicle downtime due to software glitches or maintenance needs may also influence insurance coverage.

Innovative Technologies Enhancing Efficiency and Customer Experience

Many automotive insurance companies are employing innovative technologies to improve efficiency and customer satisfaction. Chatbots and virtual assistants provide 24/7 customer support, answering frequently asked questions and resolving simple issues. Personalized mobile apps offer convenient access to policy information, claims management, and roadside assistance. Blockchain technology has the potential to enhance data security and transparency in claims processing. For instance, a company might use a mobile app to allow customers to report an accident, upload photos, and receive immediate updates on the claim’s progress, all through a user-friendly interface. This streamlines the process and reduces customer frustration.

Last Recap

The automotive insurance industry stands at a pivotal point, poised for transformation through technological advancements and evolving consumer needs. Understanding the competitive landscape, the intricacies of policy options, and the impact of regulatory changes is paramount for both insurers and consumers. By embracing innovation and prioritizing customer experience, automotive insurance companies can navigate the challenges and opportunities that lie ahead, ensuring a secure and efficient future for the industry.

FAQ Insights

What is the difference between liability and collision coverage?

Liability insurance covers damages you cause to others, while collision coverage protects your own vehicle in an accident, regardless of fault.

How does my driving record affect my premiums?

A clean driving record generally leads to lower premiums, while accidents and traffic violations can significantly increase them.

Can I get discounts on my auto insurance?

Yes, many companies offer discounts for things like safe driving, bundling policies, and having security features on your vehicle.

What is usage-based insurance (UBI)?

UBI uses telematics devices or smartphone apps to track your driving habits, potentially leading to lower premiums if you demonstrate safe driving behavior.

What should I do if I have a dispute with my insurance company?

Review your policy carefully, contact your insurer’s customer service department, and consider filing a complaint with your state’s insurance department if necessary.