Securing the right auto insurance in New Jersey is crucial, balancing affordability with comprehensive protection. This guide navigates the complexities of NJ’s auto insurance landscape, empowering you to make informed decisions about your coverage. We’ll explore mandatory requirements, factors influencing premiums, top-rated companies, and the process of selecting a policy tailored to your individual needs. Understanding these aspects is key to securing the best possible protection while managing your budget effectively.

From deciphering complex policy details to navigating the claims process, we provide clear explanations and practical advice. Whether you’re a new driver, a seasoned motorist, or simply looking to optimize your current coverage, this guide offers valuable insights and actionable strategies to help you find the best auto insurance in NJ for your specific circumstances. We’ll equip you with the knowledge to confidently compare options, negotiate rates, and ultimately secure the most suitable and cost-effective policy.

Understanding NJ Auto Insurance Requirements

Driving in New Jersey requires adherence to specific auto insurance regulations. Understanding these requirements is crucial to avoid legal penalties and ensure you’re adequately protected in the event of an accident. This section details the mandatory coverage, potential penalties for non-compliance, and a comparison of available coverage options.

Mandatory Auto Insurance Coverage in New Jersey

New Jersey is a no-fault state, meaning that after an accident, your own insurance company will typically cover your medical bills and lost wages, regardless of who caused the accident. However, this doesn’t eliminate the need for liability coverage, which protects you if you cause an accident resulting in injuries or property damage to others. The minimum required coverage includes liability insurance, which covers bodily injury and property damage caused to others. Uninsured/underinsured motorist (UM/UIM) coverage is also mandatory, protecting you if you’re involved in an accident with an uninsured or underinsured driver.

Penalties for Driving Without Minimum Insurance Coverage

Driving in New Jersey without the minimum required auto insurance is a serious offense. Penalties can include substantial fines, suspension of your driver’s license, and even the impoundment of your vehicle. The exact penalties can vary depending on the circumstances and the number of offenses, but they can significantly impact your driving privileges and your finances. For example, a first-time offense might result in a fine of several hundred dollars and a license suspension for a specified period. Repeat offenses lead to increasingly severe penalties.

Types of Auto Insurance Coverage in New Jersey

Several types of auto insurance coverage are available in New Jersey, offering varying levels of protection. Liability coverage, as previously mentioned, is mandatory and covers injuries or damages you cause to others. Collision coverage pays for repairs to your vehicle following an accident, regardless of fault. Comprehensive coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, or natural disasters. Uninsured/underinsured motorist (UM/UIM) coverage, also mandatory, protects you if you’re involved in an accident with an uninsured or underinsured driver. Personal injury protection (PIP) coverage, a component of no-fault insurance, covers your medical expenses and lost wages after an accident, regardless of fault. Medical payments coverage (Med-Pay) supplements PIP coverage by providing additional medical expense coverage.

Comparison of Auto Insurance Coverage Options

The following table compares different levels of liability, UM/UIM, collision, and comprehensive coverage:

| Coverage Type | Minimum Requirement | Common Higher Limits | Optional Enhancements |

|---|---|---|---|

| Liability (Bodily Injury) | $15,000 per person/$30,000 per accident | $25,000/$50,000, $50,000/$100,000, $100,000/$300,000 | Umbrella liability policy for higher limits |

| Liability (Property Damage) | $5,000 per accident | $10,000, $25,000 | N/A |

| Uninsured/Underinsured Motorist (Bodily Injury) | $15,000 per person/$30,000 per accident | $25,000/$50,000, $50,000/$100,000, $100,000/$300,000 | Matching or exceeding liability limits |

| Uninsured/Underinsured Motorist (Property Damage) | $5,000 per accident | $10,000, $25,000 | N/A |

| Collision | Optional | Various Deductibles (e.g., $250, $500, $1000) | Rental car reimbursement |

| Comprehensive | Optional | Various Deductibles (e.g., $250, $500, $1000) | N/A |

Factors Affecting Auto Insurance Premiums in NJ

Several key factors influence the cost of auto insurance in New Jersey. Understanding these factors can help you make informed decisions to potentially lower your premiums. This section will explore the most significant elements impacting your insurance rates.

Driving History

Your driving record is a major determinant of your insurance premium. Insurance companies assess risk based on your past driving behavior. A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, accidents, speeding tickets, DUIs, and at-fault collisions significantly increase your rates. The severity of the incident also plays a role; a major accident causing significant damage will likely lead to a more substantial premium increase than a minor fender bender. For example, a single DUI conviction could double or even triple your insurance costs for several years. Maintaining a safe driving record is crucial for keeping your insurance premiums affordable.

Age, Gender, and Location

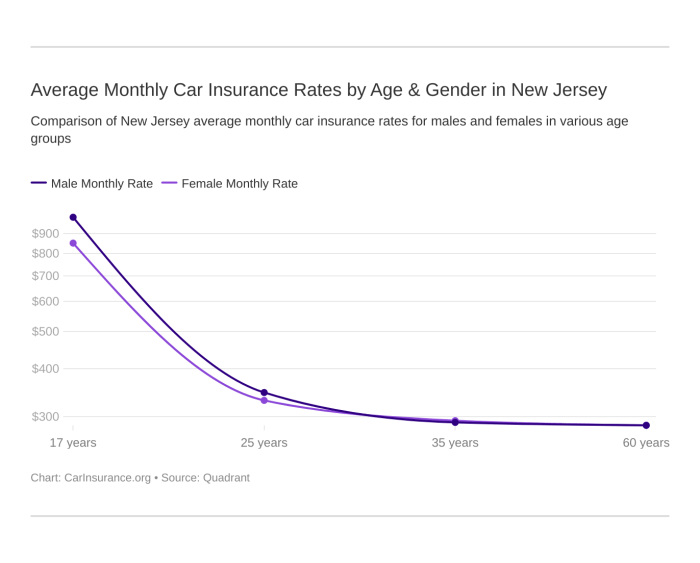

Insurance companies utilize statistical data to assess risk based on demographic factors. Younger drivers, particularly those under 25, generally pay higher premiums due to statistically higher accident rates within this age group. Similarly, gender can influence rates, although this is becoming less prevalent due to legal challenges and evolving insurance practices. Location significantly impacts premiums because accident rates and crime statistics vary across different areas of New Jersey. Living in a high-risk area with a higher frequency of accidents or theft will typically result in higher insurance premiums. For instance, drivers in densely populated urban areas often pay more than those in rural areas.

Vehicle Type and Features

The type of vehicle you drive directly impacts your insurance costs. Sports cars and high-performance vehicles are generally more expensive to insure due to their higher repair costs and increased risk of accidents. Similarly, the safety features of your vehicle influence premiums. Cars equipped with advanced safety technologies, such as anti-lock brakes, airbags, and electronic stability control, may qualify for discounts because these features reduce the likelihood and severity of accidents. For example, a new luxury SUV will typically be more expensive to insure than an older, smaller sedan.

Methods for Obtaining Discounts

Several methods exist to reduce your New Jersey auto insurance premiums. Many insurers offer discounts for various factors. These include:

- Good Student Discount: Maintaining a high GPA in school can often qualify you for a discount.

- Defensive Driving Course Completion: Successfully completing a state-approved defensive driving course demonstrates a commitment to safe driving and can lower your rates.

- Bundling Policies: Combining your auto insurance with other insurance policies, such as homeowners or renters insurance, from the same company often results in a discount.

- Multi-Car Discount: Insuring multiple vehicles under the same policy with the same company frequently leads to savings.

- Payment Plan Discounts: Paying your premiums annually or semi-annually instead of monthly can sometimes result in a lower overall cost.

- Vehicle Safety Features Discount: As previously mentioned, cars with advanced safety features can qualify for discounts.

It’s crucial to compare quotes from multiple insurance providers to find the best rates and discounts available to you. Remember to accurately represent your driving history and vehicle information when obtaining quotes to ensure accurate pricing.

Finding the Best Policy for Individual Needs

Choosing the right auto insurance policy in New Jersey requires careful consideration of your individual needs and circumstances. The best policy isn’t necessarily the cheapest; it’s the one that provides the most appropriate coverage at a price you can comfortably afford. This involves a strategic approach to comparing quotes and understanding the details of each policy.

Obtaining Quotes from Multiple Insurance Providers

Securing quotes from several insurance providers is crucial for finding the best rate and coverage. This involves contacting various companies directly, either online or via phone, and providing them with the necessary information about your vehicle, driving history, and desired coverage. Many comparison websites also exist, allowing you to input your details and receive multiple quotes simultaneously. Remember to be consistent with the information you provide to each insurer to ensure accurate comparisons. Inconsistent information may lead to vastly different quotes, hindering a fair comparison.

Effectively Comparing Insurance Quotes

Once you have several quotes, comparing them effectively is essential. Don’t solely focus on the premium amount. Carefully analyze the coverage details. Consider the deductibles, liability limits, and any additional coverage options offered, such as uninsured/underinsured motorist protection, collision, and comprehensive coverage. A lower premium might come with significantly less coverage, making it ultimately more expensive in the event of an accident. Creating a simple comparison table outlining the key features and costs of each policy can greatly simplify this process. For example, a table could include columns for insurer name, premium, liability limits, deductible amounts, and any additional coverage included.

The Importance of Reading the Fine Print in Insurance Policies

Before committing to a policy, thoroughly read the fine print. Pay close attention to exclusions, limitations, and any specific conditions that might affect your coverage. Understanding these details will prevent unexpected surprises and ensure you’re aware of what’s and isn’t covered under your policy. For instance, some policies may exclude certain types of vehicles or driving situations. It’s advisable to contact the insurance provider directly if anything is unclear.

A Step-by-Step Guide for Choosing an Auto Insurance Policy

Choosing the right auto insurance policy is a multi-step process. First, determine your coverage needs based on your personal circumstances, such as your driving history, the type of vehicle you own, and your financial situation. Next, obtain quotes from at least three different insurance providers, ensuring you provide consistent information across all applications. Then, meticulously compare the quotes, focusing not just on price but also on the scope of coverage offered. After selecting a policy that seems suitable, carefully review the policy documents, paying particular attention to the terms and conditions. Finally, confirm your understanding with the insurer before finalizing the purchase. This thorough process ensures you secure a policy that appropriately protects you while remaining within your budget.

Epilogue

Choosing the best auto insurance in New Jersey involves careful consideration of various factors, from mandatory coverage requirements to individual needs and budget constraints. By understanding the nuances of NJ’s insurance market, comparing quotes effectively, and carefully reviewing policy details, you can confidently select a policy that offers optimal protection and value. Remember, proactive planning and informed decision-making are key to securing the best possible auto insurance coverage tailored to your specific circumstances.

Helpful Answers

What happens if I’m involved in an accident and don’t have insurance?

Driving without minimum insurance in NJ results in significant penalties, including fines, license suspension, and potential legal repercussions. You’ll also be responsible for all accident-related costs.

Can I get my auto insurance premiums lowered?

Yes, several factors can influence your premiums. Maintaining a clean driving record, opting for safety features in your vehicle, bundling insurance policies, and taking defensive driving courses can all lead to discounts.

What is Uninsured/Underinsured Motorist coverage?

This coverage protects you in case you’re involved in an accident with an uninsured or underinsured driver. It helps cover your medical expenses and vehicle damage.

How long does it take to file a claim?

The claim process varies depending on the insurer and the complexity of the claim, but generally, you should report the accident to your insurer as soon as possible.