Navigating the world of vehicle insurance can feel like deciphering a complex code. Premiums vary wildly, influenced by a multitude of factors, leaving many drivers wondering: what is a realistic average vehicle insurance cost? This guide delves into the key elements affecting your insurance bill, providing clarity and empowering you to make informed decisions about your coverage.

From understanding the impact of your driving record and vehicle type to exploring various coverage options and available discounts, we’ll unpack the intricacies of vehicle insurance pricing. We’ll also compare different insurance providers, helping you find the best balance between cost and comprehensive protection.

Factors Influencing Average Vehicle Insurance Cost

Several key factors interact to determine the final cost of your vehicle insurance. Understanding these factors can help you make informed decisions and potentially save money. These factors range from personal characteristics like your age and driving record to the type of vehicle you drive and where you live.

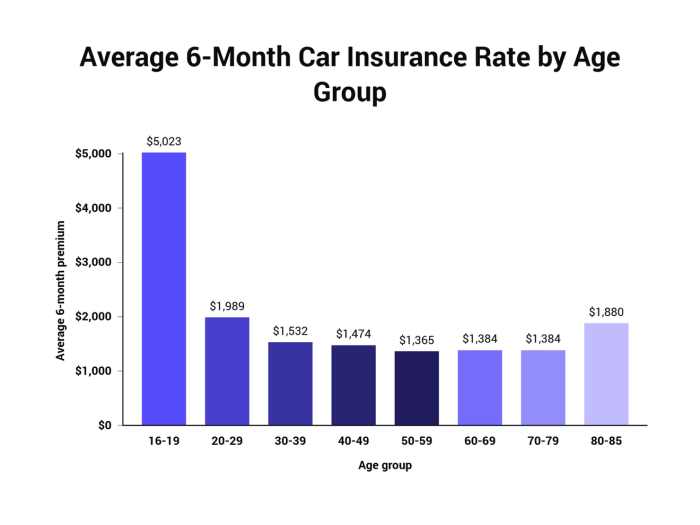

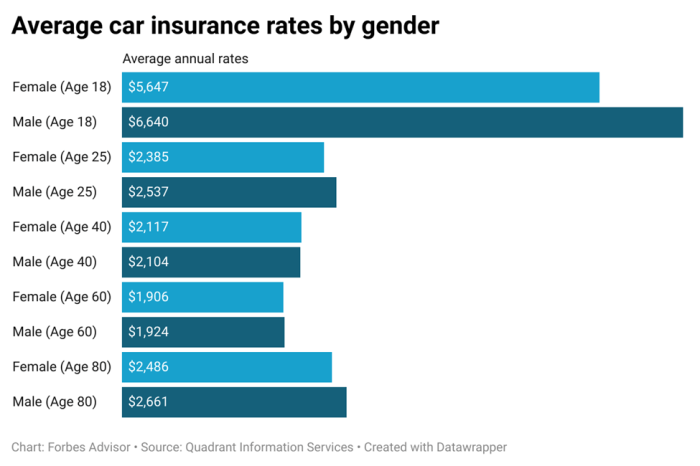

Driver Age and Insurance Premiums

Younger drivers typically pay significantly higher insurance premiums than older drivers. This is because statistically, younger drivers are involved in more accidents. Insurance companies assess a higher risk associated with less experienced drivers. As drivers gain experience and reach their mid-twenties and beyond, their premiums generally decrease, reflecting a lower perceived risk. This reduction continues until a certain age, after which premiums may stabilize or slightly increase due to factors like potential health concerns affecting driving ability.

Driving History’s Impact on Insurance Costs

Your driving history significantly influences your insurance rates. Accidents and traffic violations, such as speeding tickets or DUIs, increase your premiums. Each incident demonstrates a higher risk profile to the insurance company. The severity of the accident or violation also matters; a major accident will typically lead to a more substantial premium increase than a minor fender bender. Maintaining a clean driving record is crucial for keeping insurance costs low. Many insurance companies offer discounts for drivers who have remained accident-free for a specific period.

Insurance Rates for Different Vehicle Types

The type of vehicle you drive directly impacts your insurance premiums. Generally, sports cars and high-performance vehicles are more expensive to insure than sedans or smaller vehicles. This is because they are more likely to be involved in accidents and are often more costly to repair. SUVs and trucks, while sometimes less expensive to insure than sports cars, tend to have higher premiums than sedans due to their size and potential for greater damage in accidents. The cost of parts and repairs for larger vehicles is typically higher.

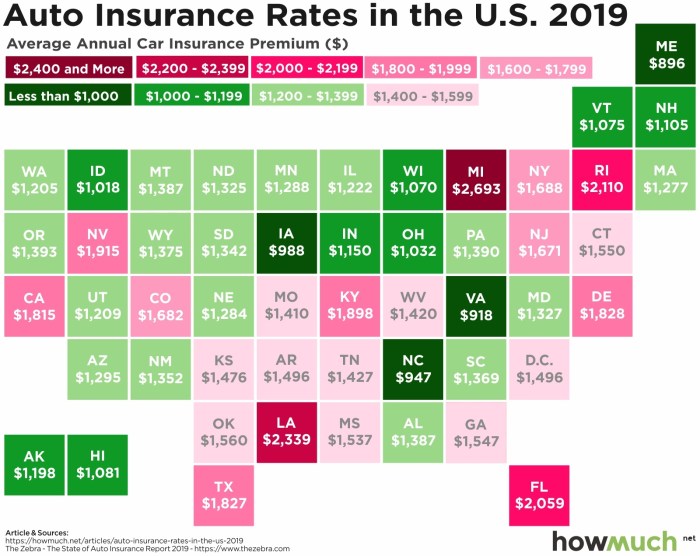

Location’s Influence on Insurance Premiums

Your location plays a significant role in determining your insurance rates. Urban areas tend to have higher premiums than rural areas due to increased traffic congestion, higher accident rates, and a greater likelihood of theft. The higher risk associated with urban driving leads to higher insurance costs. Conversely, rural areas generally have lower accident rates and therefore lower premiums. Specific zip codes within a city can also influence rates, reflecting local crime statistics and accident frequency.

Credit Score’s Impact on Insurance Costs

Your credit score can surprisingly influence your car insurance premiums. Many insurance companies use credit-based insurance scores to assess risk. A higher credit score generally correlates with lower insurance premiums, while a lower score indicates a higher risk and therefore higher premiums. This is because a good credit history suggests responsible financial behavior, which insurance companies often associate with responsible driving habits.

| Credit Score Range | Approximate Premium Increase/Decrease Compared to Average |

|---|---|

| 750-850 (Excellent) | 10-15% Decrease |

| 660-749 (Good) | 5-10% Decrease |

| 620-659 (Fair) | 0-5% Change |

| Below 620 (Poor) | 15-30% Increase |

Types of Vehicle Insurance Coverage and Their Costs

Understanding the different types of vehicle insurance coverage and their associated costs is crucial for making informed decisions about your policy. The price you pay will depend on several factors, including your driving record, location, the type of vehicle you drive, and the coverage levels you choose. This section will break down the costs associated with various common coverages.

Liability Coverage Costs

Liability coverage pays for damages and injuries you cause to others in an accident. It’s typically broken down into bodily injury liability and property damage liability. Bodily injury liability covers medical expenses and lost wages for injured parties, while property damage liability covers repairs or replacement of damaged property. The cost of liability coverage varies significantly based on the limits of coverage you select. Higher limits, offering greater protection, naturally lead to higher premiums. For example, a policy with $100,000/$300,000 bodily injury liability limits (meaning $100,000 per person and $300,000 per accident) will generally be more expensive than a policy with $25,000/$50,000 limits. State minimum requirements also heavily influence the base cost, with some states mandating higher minimums than others.

Collision and Comprehensive Coverage Costs

Collision coverage pays for damage to your vehicle caused by an accident, regardless of fault. Comprehensive coverage protects against damage caused by events other than collisions, such as theft, vandalism, fire, or hail. The average cost of these coverages varies greatly depending on the vehicle’s make, model, year, and value. A newer, more expensive vehicle will generally have higher premiums for both collision and comprehensive coverage than an older, less expensive vehicle. For example, a luxury SUV will likely cost significantly more to insure comprehensively than a used compact car. Deductibles also play a significant role; higher deductibles (the amount you pay out-of-pocket before insurance kicks in) lead to lower premiums.

Uninsured/Underinsured Motorist Coverage Costs

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured. The cost of UM/UIM coverage varies depending on the limits of coverage you choose. Higher limits mean higher premiums but provide greater financial protection if you are seriously injured by an uninsured driver. Many states require minimum UM/UIM coverage, but it’s advisable to consider higher limits for enhanced protection. The difference in cost between minimum coverage and higher limits can be substantial, yet the increased protection can be invaluable in the event of a serious accident.

Medical Payments Coverage Costs

Medical payments (Med-Pay) coverage pays for medical expenses for you and your passengers, regardless of fault, following an accident. The cost of Med-Pay coverage is influenced by the coverage limit you select. Higher limits result in higher premiums. This coverage is often less expensive than other types of coverage but can provide crucial financial assistance for medical bills following an accident. The amount of coverage selected, therefore, directly impacts the premium. For example, a $1,000 Med-Pay limit will be less expensive than a $5,000 limit.

Cost-Effectiveness of Different Coverage Levels

Choosing the right coverage levels involves balancing cost and protection. Consider the following comparison:

- Minimum Liability: Lowest cost, but minimal protection in the event of a serious accident.

- Higher Liability Limits: More expensive than minimum, but offers significantly greater financial protection.

- Collision & Comprehensive with High Deductible: Moderate cost, provides good protection for your vehicle, but requires a larger out-of-pocket expense in the event of a claim.

- Collision & Comprehensive with Low Deductible: Higher cost, but provides more comprehensive coverage with a smaller out-of-pocket expense.

- UM/UIM Coverage at State Minimum: Relatively inexpensive, but offers limited protection if involved in an accident with an uninsured/underinsured driver.

- High UM/UIM Limits: More expensive, but provides substantial protection in the event of an accident with an uninsured/underinsured driver.

Discounts and Ways to Reduce Vehicle Insurance Costs

Reducing your vehicle insurance costs is achievable through various strategies, primarily focusing on risk mitigation and leveraging available discounts. By understanding these strategies, you can significantly lower your premiums and save money over time. This section will explore several effective methods for achieving these savings.

Safe Driving Discounts

Safe driving discounts are a common way insurers reward responsible drivers. These discounts are typically based on your driving record, specifically the absence of accidents and traffic violations. Insurance companies often use a points system; fewer points generally translate to larger discounts. For example, a driver with a clean driving record for three years might receive a 10-20% discount, while someone with multiple accidents or speeding tickets may see their premiums increase significantly or be ineligible for any discounts. The impact on premiums can be substantial, potentially saving hundreds of dollars annually. The exact discount percentage varies by insurer and the specific terms of their safe driver program.

Bundling Home and Auto Insurance

Many insurance companies offer discounts for bundling home and auto insurance policies. This strategy leverages the insurer’s efficiency in managing multiple policies for a single customer. By insuring both your home and vehicle with the same company, you often qualify for a significant discount, typically ranging from 10% to 25% or more depending on the insurer and the specifics of your policies. This discount is a direct result of the reduced administrative costs and increased customer loyalty associated with bundling. For instance, a customer paying $1000 annually for auto and $800 annually for home insurance might save $200 by bundling, reducing the total annual cost by 10%.

Good Student Discounts

Good student discounts are designed to incentivize academic achievement. Insurers recognize that good students tend to be more responsible and less likely to be involved in accidents. The specific requirements for eligibility vary by insurer, but generally involve maintaining a certain grade point average (GPA). For example, a student maintaining a GPA of 3.0 or higher might qualify for a discount of 10-25%, depending on the company. Some insurers might also offer discounts for students enrolled in advanced placement courses or attending college. This discount can be particularly beneficial for families with multiple students.

Anti-theft Device Discounts

Installing anti-theft devices in your vehicle can significantly reduce your insurance premiums. Insurers view these devices as a deterrent to theft, reducing their risk. The savings associated with these devices can vary depending on the type of device and the insurer’s specific discount program. For example, a vehicle equipped with a GPS tracking system and an immobilizer might qualify for a 5-15% discount. The more sophisticated and effective the anti-theft device, the greater the potential savings. This reflects the reduced likelihood of a claim due to theft.

Discounts and Potential Savings

| Discount Type | Potential Savings | Eligibility Requirements | Example |

|---|---|---|---|

| Safe Driving | 10-25% | Clean driving record (no accidents or tickets) | $1000 premium reduced to $750-$875 |

| Bundling (Home & Auto) | 10-25%+ | Insuring both home and auto with same company | $1800 total premium reduced to $1350-$1530 |

| Good Student | 10-25% | High GPA (varies by insurer) | $1000 premium reduced to $750-$875 |

| Anti-theft Device | 5-15% | Installation of approved anti-theft device | $1000 premium reduced to $850-$950 |

Final Review

Securing affordable yet comprehensive vehicle insurance requires careful consideration of numerous factors. By understanding how your age, driving history, vehicle type, location, and credit score influence premiums, you can proactively manage your insurance costs. Remember to leverage available discounts, compare insurer offerings, and carefully select your coverage and deductible to find the optimal balance between cost and protection. Armed with this knowledge, you can confidently navigate the insurance landscape and secure the best possible coverage for your needs.

FAQ Resource

What is the average cost of liability insurance?

The average cost of liability insurance varies significantly based on location and coverage limits, but it typically ranges from a few hundred to over a thousand dollars annually.

How does my marital status affect my insurance rates?

Many insurers consider marital status, often offering lower rates to married individuals, as they are statistically associated with safer driving habits.

Can I get insurance with a poor driving record?

Yes, but it will likely be more expensive. Insurers assess risk based on your driving history, and a poor record will lead to higher premiums. Consider seeking quotes from multiple insurers specializing in high-risk drivers.

What is the difference between a collision and comprehensive claim?

A collision claim covers damage to your vehicle in an accident, regardless of fault. A comprehensive claim covers damage from events outside of collisions, such as theft, vandalism, or weather-related damage.