Securing affordable auto insurance can feel like navigating a maze, with numerous factors influencing premiums and a wide array of policy options available. This guide aims to demystify the process, providing you with the knowledge and tools to find the best coverage that fits your budget without compromising essential protection. We’ll explore how income, location, and driving history impact costs, examine key features of budget-friendly plans, and offer practical strategies for lowering your premiums.

From understanding liability coverage limits and identifying potential exclusions to utilizing comparison websites and leveraging discounts, we’ll equip you to make informed decisions. This guide emphasizes the importance of careful policy review and highlights potential hidden fees, empowering you to choose the most suitable and cost-effective auto insurance plan.

Finding the Best Affordable Options

Securing affordable auto insurance requires a strategic approach. By following a methodical process and utilizing available resources, drivers can significantly reduce their premiums without compromising essential coverage. This involves understanding your needs, actively comparing options, and leveraging tools designed to simplify the search.

Finding the right balance between cost and coverage is key. Many factors influence your insurance rate, including your driving history, the type of vehicle you drive, your location, and the level of coverage you choose. Understanding these factors allows you to make informed decisions to lower your premium.

Steps to Finding Affordable Auto Insurance

A systematic approach greatly increases the chances of finding the best deal. The following steps Artikel a practical method for securing affordable auto insurance.

- Assess Your Needs: Determine the minimum coverage required by your state and consider additional coverage like collision and comprehensive based on your vehicle’s value and your risk tolerance. Higher coverage typically means higher premiums.

- Gather Personal Information: Before requesting quotes, collect necessary information such as your driver’s license number, vehicle identification number (VIN), and driving history. Accurate information ensures accurate quotes.

- Use Online Comparison Tools: Several websites allow you to compare quotes from multiple insurers simultaneously. Input your information once and receive various quotes for side-by-side comparison. This saves significant time and effort.

- Contact Insurance Agents: Independent insurance agents can provide personalized advice and access to a broader range of insurers than you might find independently online. They can help navigate complex policies and find options that best fit your needs.

- Review Policy Details Carefully: Before committing to a policy, thoroughly review the terms, conditions, and coverage details. Pay close attention to deductibles, premiums, and any exclusions.

- Consider Discounts: Many insurers offer discounts for safe driving, bundling insurance policies (home and auto), or being a member of certain organizations. Actively inquire about available discounts.

Resources for Finding Affordable Auto Insurance

Numerous resources are available to assist in finding the most suitable and affordable auto insurance plan. These resources simplify the process and help ensure a comprehensive search.

- Online Comparison Websites: Sites like The Zebra, NerdWallet, and Insurify allow you to compare quotes from multiple insurers simultaneously. These sites often provide detailed policy comparisons, making it easy to identify the best value.

- Independent Insurance Agents: These agents represent multiple insurance companies, giving you access to a wider range of options and potentially more competitive rates than dealing with individual insurers directly. They act as your advocate throughout the process.

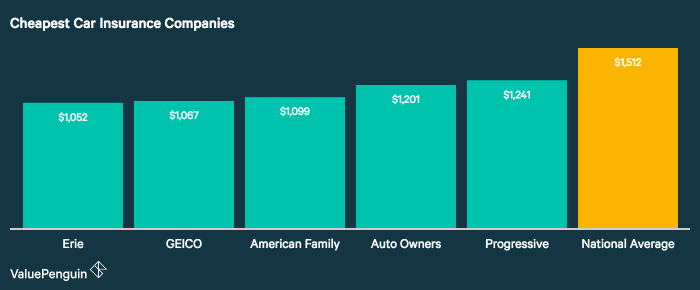

- Direct Insurers: Companies like Geico, Progressive, and State Farm offer policies directly to consumers. While convenient, it’s crucial to compare their rates with those offered by other insurers and agents.

The Importance of Comparing Quotes

Comparing quotes from multiple insurers is paramount to securing affordable auto insurance. Failing to do so could result in paying significantly more than necessary for the same level of coverage.

Obtaining at least three to five quotes from different insurers is recommended to ensure a comprehensive comparison. This allows you to identify the best value based on your specific needs and risk profile.

Factors Affecting Auto Insurance Premiums

Several key factors influence the cost of your auto insurance premiums. Understanding these factors can help you make informed decisions to potentially lower your expenses. This section will explore how your driving record, age, and the type of car you drive affect your insurance costs, and illustrate how discounts can significantly reduce your premium.

Driving Record Impact on Premiums

Your driving history is a significant determinant of your insurance premium. Insurance companies assess risk based on your past driving behavior. A clean driving record, free of accidents and traffic violations, will typically result in lower premiums. Conversely, accidents, speeding tickets, and other moving violations increase your risk profile, leading to higher premiums. The severity of the offense also plays a role; a serious accident will likely have a more substantial impact on your rates than a minor fender bender. Many insurers use a points system to track driving infractions, with more points leading to higher premiums. For example, a driver with multiple speeding tickets might face a premium increase of 20-30% or more compared to a driver with a clean record.

Age and Insurance Premiums

Age is another crucial factor affecting auto insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, resulting in higher premiums. Insurance companies perceive this increased risk and adjust premiums accordingly. As drivers age and gain more experience, their premiums generally decrease, reaching their lowest point in middle age (typically between 30 and 60). After this point, premiums may gradually increase again, although the increase may be less pronounced than in early adulthood. This is partially due to factors like potential eyesight changes and slower reaction times that are associated with aging.

Car Type and Insurance Costs

The type of vehicle you drive significantly impacts your insurance premiums. Factors considered include the car’s make, model, year, safety features, and repair costs. Generally, newer cars with advanced safety technology tend to have lower premiums than older vehicles with fewer safety features. Sports cars and luxury vehicles often command higher premiums due to their higher repair costs and increased likelihood of theft. Conversely, smaller, less expensive vehicles typically result in lower premiums. For example, insuring a high-performance sports car will be considerably more expensive than insuring a compact economy car.

Premium Comparison Based on Driver Profiles

The following table illustrates how different driver profiles can lead to varying insurance premiums. These are estimated premiums and actual costs can vary based on specific insurer, location, and policy details.

| Driver Profile | Age | Driving Record | Estimated Premium |

|---|---|---|---|

| Experienced Driver | 45 | Clean (no accidents or tickets in 5 years) | $800/year |

| Young Driver | 18 | Clean (no accidents or tickets) | $1500/year |

| Driver with Accidents | 30 | 2 accidents in past 3 years | $1200/year |

| Senior Driver | 70 | Clean (no accidents or tickets in 10 years) | $950/year |

Discounts that Reduce Premiums

Several discounts can help reduce your auto insurance premiums. These discounts incentivize safe driving habits and bundled services. Common discounts include:

Safe Driver Discount: Maintaining a clean driving record for a specified period often qualifies you for a significant discount.

Bundling Discount: Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, from the same company frequently results in a discount.

Other potential discounts might include: good student discounts, anti-theft device discounts, and multi-car discounts. Contacting your insurer to inquire about available discounts is advisable.

Understanding Policy Details and Fine Print

Securing the best affordable auto insurance involves more than just comparing prices; it requires a thorough understanding of the policy’s details and fine print. Failing to do so could lead to unexpected costs and inadequate coverage when you need it most. Carefully reviewing your policy is crucial to ensure you’re getting the protection you expect and are paying a fair price.

Policy documents can often seem dense and overwhelming, but taking the time to understand them is an investment in your financial well-being. Many consumers overlook crucial details, leading to unpleasant surprises later. Understanding the terms and conditions protects you from hidden fees and ensures you’re adequately covered in case of an accident or other unforeseen events.

Hidden Fees and Charges

Several hidden fees can significantly increase your final cost. These charges are often buried within the policy documents and might not be readily apparent during the initial quote process. Examples include administrative fees, processing fees, or even fees associated with specific payment methods. Some insurers might also charge extra for optional add-ons, such as roadside assistance or rental car reimbursement, which are not always clearly advertised. Another potential hidden cost is the difference between the stated deductible and the actual out-of-pocket expenses after an accident, which might include additional fees for assessments or repairs. It is essential to scrutinize the policy for any such hidden charges to avoid unexpected financial burdens.

Understanding Policy Terms and Conditions

Understanding the policy’s terms and conditions is paramount. This includes comprehending the definitions of coverage, exclusions, and limitations. For example, a policy might exclude certain types of damage or accidents, or it might have specific limitations on the amount of coverage provided. Understanding these limitations helps you make informed decisions about your coverage needs. Additionally, carefully review the cancellation policy, which Artikels the process and potential fees associated with canceling or modifying your insurance. Pay close attention to the definition of “at-fault” accidents, as this significantly impacts claims processing. Finally, familiarize yourself with the claims process, including the necessary documentation and procedures to follow in case of an accident. This preparedness can streamline the claims process and ensure a smoother experience during a stressful time.

Illustrative Example

Let’s visualize how implementing various cost-saving strategies can significantly reduce your auto insurance premiums. A clear visual representation, such as a bar chart, can effectively demonstrate the potential savings.

This example uses a hypothetical scenario to illustrate the impact of different discounts and choices. The chart will compare the total premium cost under different circumstances, allowing for a straightforward comparison of potential savings.

Premium Comparison with and without Discounts

Imagine a bar chart with two main groups of bars: “Premium without Discounts” and “Premium with Discounts.” Within each group, individual bars represent different scenarios. For instance, “Premium without Discounts” might have bars representing the base premium, a premium with only liability coverage, and a premium with liability and collision but no additional discounts. Conversely, “Premium with Discounts” could show the same scenarios but with the application of discounts like safe driver, multi-car, and good student discounts. The height of each bar represents the dollar amount of the premium.

For example, let’s assume a base premium of $1,200 annually. A bar representing this would be the tallest in the “Premium without Discounts” group. Next to it, a slightly shorter bar might represent a premium of $1,000 with liability-only coverage. A shorter bar still might show $800 for liability and collision coverage. Now, in the “Premium with Discounts” section, we’d see the same coverage options, but with reductions applied. The $1,200 base premium might drop to $900 with a safe driver discount and multi-car discount. The liability-only premium could fall to $750, and the liability and collision premium to $600. The difference in height between the bars in each group visually represents the amount saved by implementing each discount. This clear visual representation makes it easy to understand the financial benefits of securing various discounts. The chart would clearly show that accumulating discounts leads to substantial savings. The difference in height between the corresponding bars for each coverage type would highlight the financial advantage of taking advantage of available discounts.

Closure

Finding the best affordable auto insurance requires careful consideration of your individual needs and a proactive approach to comparison and negotiation. By understanding the factors influencing premiums, diligently comparing quotes, and employing cost-saving strategies, you can secure reliable coverage without overspending. Remember to thoroughly review policy documents and ask clarifying questions to ensure complete comprehension before committing to a plan. Taking these steps will empower you to find the best balance between affordability and essential protection for your vehicle.

FAQ Compilation

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others’ property or injuries you inflict on others in an accident. Collision coverage pays for damage to your own vehicle, regardless of fault.

How often should I review my auto insurance policy?

It’s advisable to review your policy annually, or whenever there’s a significant life change (e.g., new car, address change, improved driving record).

Can I get auto insurance if I have a poor driving record?

Yes, but you’ll likely pay higher premiums. Consider working with a specialist insurance agent to find options.

What is an SR-22 form?

An SR-22 is a certificate of insurance that proves you maintain the minimum liability coverage required by your state after a serious driving offense.