Navigating the complexities of business ownership often feels like charting uncharted waters. One crucial element for ensuring smooth sailing is securing the right insurance coverage. This guide delves into the world of Business Owners Policy (BOP) insurance, exploring its multifaceted nature and providing clarity on its vital role in protecting your business investment. We’ll unpack the key components, benefits, and considerations involved in selecting a BOP that aligns perfectly with your unique business needs.

From understanding the core coverages—property damage, liability protection, and business interruption insurance—to navigating policy exclusions and limitations, we aim to equip you with the knowledge necessary to make informed decisions. We’ll compare different providers, illustrate real-world scenarios, and offer a practical step-by-step guide to acquiring and utilizing your BOP. Ultimately, this guide serves as your comprehensive roadmap to securing a robust and reliable insurance foundation for your business’s success.

What is a Business Owners Policy (BOP)?

A Business Owners Policy (BOP) is a comprehensive insurance package designed specifically for small to medium-sized businesses. It bundles several essential coverages into a single, convenient policy, simplifying insurance management and potentially reducing overall costs. Think of it as an all-in-one solution for protecting your business’s most valuable assets.

Core Components of a BOP

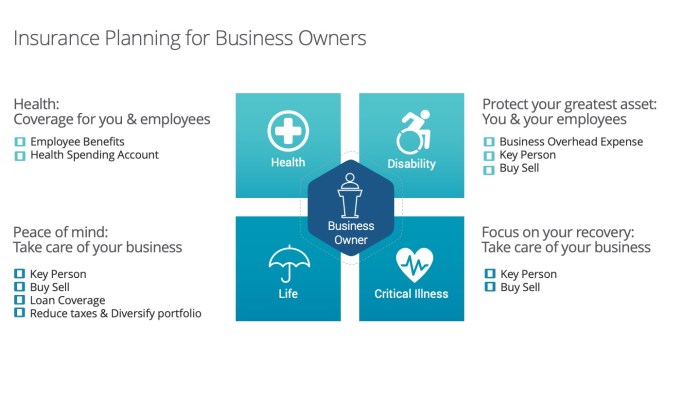

A BOP typically includes property insurance, liability insurance, and business interruption insurance. Property insurance covers physical damage to your business property, such as your building, equipment, and inventory. Liability insurance protects you from financial losses due to lawsuits arising from accidents or injuries on your property or caused by your business operations. Business interruption insurance helps cover lost income and expenses if your business is forced to close due to a covered event, like a fire or natural disaster. These three core components form the foundation of most BOP policies, though specific coverage details can vary.

Typical Coverage Included in a BOP

Beyond the core components, a BOP often includes additional coverages, depending on the insurer and the specific policy. These can include: equipment breakdown coverage (covering malfunctions of essential machinery), employee dishonesty coverage (protecting against theft or fraud by employees), and money and securities coverage (protecting cash and valuable papers). Some policies may also offer limited liability coverage for professional services, depending on the nature of the business. It’s crucial to review the specific policy details to understand exactly what is and isn’t covered.

Comparison of a BOP with Other Types of Business Insurance

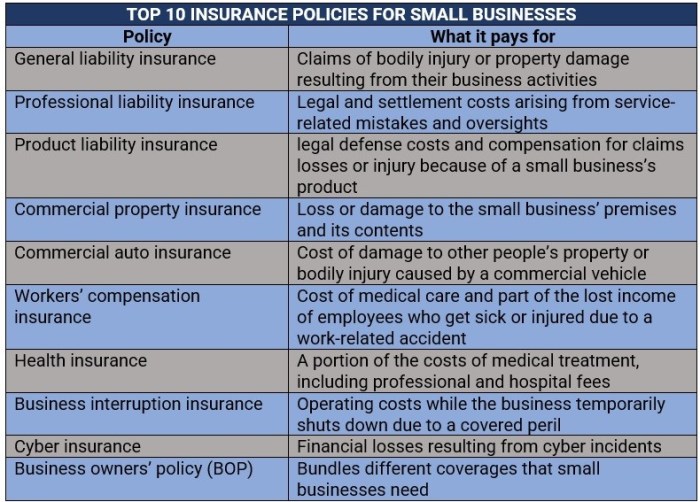

Unlike a BOP, which combines multiple coverages, other types of business insurance address specific risks individually. For example, general liability insurance only covers liability claims, while commercial property insurance solely protects physical assets. Workers’ compensation insurance is another distinct policy, focusing solely on employee injury or illness. A BOP provides a more streamlined approach, offering broader protection under one policy. This contrasts with purchasing separate policies for each type of coverage, which can be more complex and potentially more expensive.

Benefits of Bundling Insurance with a BOP

Bundling insurance with a BOP offers several key advantages. Firstly, it simplifies insurance management; dealing with one policy and one insurer is much easier than managing multiple separate policies. Secondly, it can often lead to cost savings, as bundled policies frequently offer discounts compared to purchasing individual coverages. Thirdly, it ensures comprehensive coverage, minimizing gaps in protection. Finally, it provides a more organized and efficient approach to risk management, allowing business owners to focus on their core operations rather than the complexities of insurance administration.

Comparison of BOP Coverage Options from Three Different Providers

This table provides a simplified comparison of coverage options from three hypothetical providers. Actual coverage and pricing will vary based on numerous factors, including location, business type, and risk profile. Always obtain quotes from multiple providers to find the best policy for your needs.

| Coverage Item | Provider A | Provider B | Provider C |

|---|---|---|---|

| Building Coverage | $500,000 | $750,000 | $600,000 |

| Business Personal Property | $250,000 | $300,000 | $200,000 |

| General Liability | $1,000,000 | $1,000,000 | $2,000,000 |

| Business Interruption | $100,000 | $150,000 | $125,000 |

Who Needs a BOP?

A Business Owners Policy (BOP) is a valuable tool for many businesses, offering comprehensive protection against various risks. However, not every business requires or benefits from a BOP. Understanding which businesses are best suited for this type of insurance is crucial for effective risk management.

Determining whether a BOP is right for your business involves careful consideration of several factors, including the nature of your operations, your assets, and your risk tolerance. Failing to secure adequate insurance can lead to significant financial hardship and even business closure in the event of an unforeseen incident.

Businesses That Benefit Most From a BOP

Many small to medium-sized businesses find a BOP to be an efficient and cost-effective way to manage their insurance needs. These policies typically cover property damage, liability claims, and business interruption, providing a comprehensive safety net.

- Retail stores: These businesses often face risks such as theft, property damage, and customer liability.

- Restaurants: Restaurants face similar risks as retail stores, plus additional concerns like foodborne illness liability.

- Offices: While seemingly less prone to physical damage, offices still need coverage for liability claims and data breaches.

- Small manufacturing businesses: These businesses may require coverage for equipment damage and product liability.

Businesses That May Not Need a BOP

Certain businesses may find that a BOP doesn’t fully address their specific insurance needs or that alternative insurance solutions are more cost-effective.

- Businesses with highly specialized equipment or operations: These businesses may require more tailored insurance policies to cover their unique risks, such as those in high-tech industries or construction.

- Businesses operating in high-risk areas: Businesses located in areas prone to natural disasters may require more extensive coverage than a standard BOP provides.

- Very large businesses: Larger businesses often have more complex insurance needs and may opt for separate policies to cover various aspects of their operations.

Factors to Consider When Determining Insurance Needs

Businesses should carefully assess their risk profile before selecting an insurance policy. This involves:

- Asset Value: The value of your physical assets (buildings, equipment, inventory) directly impacts the amount of coverage you need.

- Liability Exposure: Consider the potential for lawsuits due to customer injury, property damage, or professional negligence.

- Business Interruption Potential: Assess the potential financial impact of a disruption to your operations, such as due to a fire or natural disaster.

- Industry-Specific Risks: Certain industries face unique risks that require specialized coverage (e.g., cyber liability for tech companies).

Consequences of Inadequate Business Insurance

The consequences of insufficient business insurance can be severe, potentially leading to:

- Financial Ruin: A major incident without adequate insurance could wipe out a business’s savings and lead to bankruptcy.

- Legal Battles: Facing lawsuits without liability insurance can result in expensive legal fees and judgments.

- Business Closure: Severe damage or interruption without insurance can force a business to close its doors permanently.

- Reputational Damage: A lack of insurance can damage a business’s reputation and make it harder to attract customers and partners.

Categorizing Businesses Based on BOP Suitability

To simplify the assessment process, businesses can be categorized based on their suitability for a BOP:

- High Suitability: Small to medium-sized businesses with relatively standard operations and manageable risk profiles (e.g., retail stores, small offices, restaurants).

- Moderate Suitability: Businesses with some unique risk factors requiring additional considerations (e.g., businesses with specialized equipment or those in areas prone to specific hazards).

- Low Suitability: Large businesses with complex operations, high-risk profiles, or specialized needs (e.g., large manufacturing plants, high-tech companies, businesses in high-risk industries).

Understanding Policy Exclusions and Limitations

A Business Owners Policy (BOP) offers comprehensive coverage, but it’s crucial to understand its limitations. Knowing what isn’t covered can prevent costly surprises and ensure you have the right protection in place. This section details common exclusions, the implications of policy limits and deductibles, and examples of situations where claims might be denied. We’ll also briefly compare how different providers might handle these exclusions.

Common Exclusions in BOP Policies

Most BOP policies exclude certain types of losses. These exclusions are standard across many providers, though specific wording may vary. Understanding these exclusions is vital to determining the true scope of your coverage. Failure to do so could lead to significant financial burden in the event of a covered peril.

| Exclusion | Implication | Example | Provider Variations |

|---|---|---|---|

| Earth Movement (earthquakes, landslides) | Damage caused by earthquakes or landslides is typically not covered. | A building collapses due to an earthquake; the BOP will not cover the damage. | Some providers may offer earthquake coverage as an endorsement for an additional premium. |

| Flood | Damage from flooding is usually excluded. | A business experiences significant water damage due to a flood; the BOP will not cover the repairs. | Flood insurance is typically purchased separately through the National Flood Insurance Program (NFIP) or private insurers. |

| Pollution | Damage or cleanup related to pollution is generally excluded. | A chemical spill contaminates the business premises; the BOP will not cover the cleanup costs. | Some policies might offer limited pollution coverage for sudden and accidental events, but this is often subject to sub-limits. |

| Intentional Acts | Damage caused intentionally by the business owner or employees is not covered. | A business owner deliberately damages their own property; the BOP will not pay for repairs. | This exclusion is generally consistent across providers. |

Policy Limits and Deductibles

Policy limits represent the maximum amount your insurer will pay for a covered loss. Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Both significantly impact your financial responsibility in the event of a claim. Understanding these limitations allows for informed decision-making regarding coverage amounts and premium payments.

Situations Where Coverage Might Be Denied

Several scenarios can lead to a claim denial. For instance, a failure to maintain adequate security measures, leading to a burglary, might result in a claim denial, especially if the policy explicitly requires specific security measures. Similarly, if a business operates outside the scope of its permitted activities as Artikeld in the policy, coverage might be denied for losses related to those unauthorized activities. Failing to report a claim promptly or providing inaccurate information during the claims process can also lead to a denial.

Comparison of Exclusions Across BOP Providers

While core exclusions remain largely consistent across BOP providers, subtle differences exist in policy wording and the availability of endorsements to add coverage for certain exclusions. Some insurers might offer broader coverage for certain perils or more flexible options for addressing specific business needs. It is crucial to compare policies from multiple providers to identify the best fit for your specific business risks and needs. For example, one provider might offer a more comprehensive definition of “sudden and accidental” events related to pollution, whereas another might have a narrower definition. Similarly, the availability and cost of endorsements to cover flood or earthquake damage can vary significantly.

Choosing the Right BOP

Selecting the appropriate Business Owners Policy (BOP) is crucial for protecting your business assets and ensuring financial stability in the event of unforeseen circumstances. A well-chosen BOP offers comprehensive coverage tailored to your specific needs, minimizing potential financial losses and maximizing peace of mind. The process involves careful consideration of several key factors to find the best fit for your business.

Factors to Consider When Selecting a BOP Provider

Choosing a BOP provider requires careful evaluation of several factors beyond just price. Reputation, financial stability, and the provider’s claims handling process are all vital considerations. A strong track record of prompt and fair claim settlements is paramount. Consider seeking recommendations from other business owners and checking online reviews to gauge the provider’s reputation for customer service and responsiveness. Additionally, verifying the insurer’s financial strength rating from a reputable agency like A.M. Best provides assurance of their ability to meet their obligations.

Obtaining a BOP Quote: A Step-by-Step Guide

The process of obtaining a BOP quote is generally straightforward. First, gather essential information about your business, including its location, type of operations, annual revenue, and number of employees. Next, contact multiple insurance providers or utilize online comparison tools to request quotes. Be prepared to provide details about your business’s property, equipment, and liability exposures. Compare quotes carefully, paying close attention to the coverage details and policy exclusions. Finally, choose the policy that best balances coverage, price, and the provider’s reputation.

The Importance of Reviewing Policy Documents Carefully

Thoroughly reviewing your BOP policy documents is essential before finalizing your purchase. Understanding the policy’s terms, conditions, coverage limits, and exclusions is crucial to ensure it aligns with your business’s specific needs. Pay close attention to the definitions of covered perils, the limits of liability, and any exclusions that may limit your coverage. Don’t hesitate to ask your insurance provider for clarification on any unclear aspects of the policy. Misunderstandings can lead to significant problems during a claim.

Filing a Claim Under a BOP

In the unfortunate event of a covered loss, promptly reporting the incident to your insurance provider is crucial. Most providers have a dedicated claims reporting process, often accessible online or via phone. Provide accurate and detailed information about the incident, including dates, times, and any relevant documentation. Cooperate fully with the provider’s investigation, providing any necessary documentation or information they request. The claims process timeline varies depending on the complexity of the claim and the provider’s procedures.

Comparing Different BOP Options Based on Price and Coverage

Comparing BOP options requires a detailed analysis of both price and coverage. Simply choosing the cheapest option may not be the best strategy if it lacks adequate coverage for your specific risks. Create a comparison table to organize the information from different providers. Include details such as premium costs, coverage limits for property damage, liability, and business interruption, as well as any policy exclusions. This structured approach will help you identify the policy that provides the optimal balance of comprehensive coverage and affordability for your business needs. For example, one provider might offer a lower premium but have a lower liability limit, while another might offer higher coverage at a slightly higher cost. Consider the potential financial impact of an uninsured loss when making your decision.

Illustrative Scenarios

Understanding how a Business Owners Policy (BOP) works in practice is crucial. The following scenarios illustrate different types of claims and how a BOP might respond. These examples are for illustrative purposes only and specific coverage will depend on the policy’s terms and conditions.

Property Damage Covered by a BOP

A severe thunderstorm caused significant damage to “The Cozy Coffee Shop,” a small independent café. Heavy winds ripped a portion of the roof off, causing water damage to the interior and ruining expensive coffee-making equipment. The owner, Sarah, immediately contacted her insurance agent and filed a claim. The insurance adjuster visited the café, documented the damage with photographs and a detailed report, and assessed the cost of repairs and equipment replacement. After verifying the damage was covered under the BOP’s property damage section (excluding any deductible), the insurance company paid for the roof repairs, interior restoration, and replacement of the damaged equipment. The claim process took approximately four weeks, with regular communication from the insurance adjuster keeping Sarah informed of the progress.

Liability Claims Covered by a BOP

John, a customer at “Green Thumb Gardening Supplies,” slipped and fell on a wet patch of floor near the entrance, injuring his ankle. He subsequently filed a liability claim against the store, alleging negligence on the part of the business owner. Green Thumb Gardening Supplies’ BOP covered the legal costs associated with defending the claim, as well as any potential settlement or judgment. The insurance company assigned a legal team to represent the business. After investigation, it was determined that the store had not taken adequate precautions to address the wet floor. The insurance company, after negotiations with John’s lawyer, settled the claim for a sum covering John’s medical expenses and lost wages.

Business Interruption Coverage Under a BOP

A major fire broke out in the building housing “The Tech Hub,” a computer repair shop. While the building itself was insured by the landlord, The Tech Hub suffered significant business interruption due to the damage and subsequent closure for repairs. Their BOP included business interruption coverage, which compensated them for lost income during the period they were unable to operate. The insurance company assessed the business’s average monthly revenue and paid out a sum to cover the lost profits during the period of closure. Additionally, the policy covered some of the expenses incurred in relocating temporarily to a new workspace while repairs were underway. The policy also covered the cost of replacing lost data.

Closing Notes

Protecting your business requires foresight and a proactive approach to risk management. A well-structured Business Owners Policy is not merely an expense; it’s a strategic investment that safeguards your hard work, assets, and future. By carefully considering the information presented in this guide, you can confidently choose a BOP that provides the appropriate coverage and peace of mind, allowing you to focus on what truly matters: growing your business and achieving your entrepreneurial goals. Remember to regularly review your policy and adapt it as your business evolves to ensure ongoing protection.

Top FAQs

What is the difference between a BOP and a general liability policy?

A general liability policy covers third-party bodily injury or property damage claims. A BOP combines general liability with property insurance and often other coverages, offering broader protection for business owners.

How much does a BOP cost?

The cost varies significantly based on factors such as business type, location, coverage limits, and the insurer. Obtaining quotes from multiple providers is crucial for comparison.

Can I customize my BOP coverage?

Yes, many providers offer customizable options to tailor the coverage to your specific business needs. You can adjust coverage limits and add endorsements for specific risks.

What happens if I file a fraudulent claim?

Filing a fraudulent claim can result in the denial of your claim, policy cancellation, and potential legal repercussions.

How long does it take to get a BOP quote?

It typically takes a few days to receive a quote after providing the necessary information to an insurer. Some online providers offer instant quotes.