Navigating the world of California car insurance can feel like driving through a dense fog. Finding the right coverage at the best price requires understanding the complexities of state regulations, insurance options, and the many factors influencing your premium. This guide illuminates the path, providing a clear and concise overview of obtaining a California car insurance quote, from understanding mandatory coverages to maximizing potential savings.

We’ll explore the various types of coverage available, delve into the process of obtaining quotes both online and by phone, and examine the key factors that significantly impact your insurance costs. Learn how your driving history, age, vehicle type, and even your location can influence your premium. We’ll also uncover strategies for securing discounts and choosing a reliable insurance provider, empowering you to make informed decisions and secure the best possible California car insurance quote.

Understanding California Car Insurance

Securing the right car insurance in California is crucial for both legal compliance and financial protection. This section will clarify the various types of coverage, mandatory requirements, factors influencing premiums, and available optional add-ons. Understanding these aspects will empower you to make informed decisions about your insurance needs.

Types of Car Insurance Coverage in California

California offers several types of car insurance coverage, each designed to address specific risks. These coverages work together to provide comprehensive protection. Understanding the differences is key to selecting the appropriate level of coverage.

- Liability Coverage: This is the most basic and legally required type. It covers damages or injuries you cause to others in an accident. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: This pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This is optional but highly recommended.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, or hail. This is also optional.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle damage.

- Medical Payments Coverage (Med-Pay): This covers medical expenses for you and your passengers, regardless of fault. It can supplement health insurance.

Mandatory Insurance Requirements in California

California law mandates minimum liability coverage for all drivers. Failing to maintain this coverage can result in significant penalties, including fines, license suspension, and even vehicle impoundment.

Minimum required coverage is typically $15,000 for injuries to one person, $30,000 for injuries to multiple people in one accident, and $5,000 for property damage. These are minimums; higher limits are strongly advised.

Factors Influencing Car Insurance Premiums in California

Several factors determine the cost of your car insurance premium. Understanding these can help you find ways to potentially lower your costs.

- Driving Record: Accidents and traffic violations significantly impact premiums. A clean driving record results in lower rates.

- Vehicle Type: The make, model, and year of your car influence premiums. Sports cars and luxury vehicles often cost more to insure.

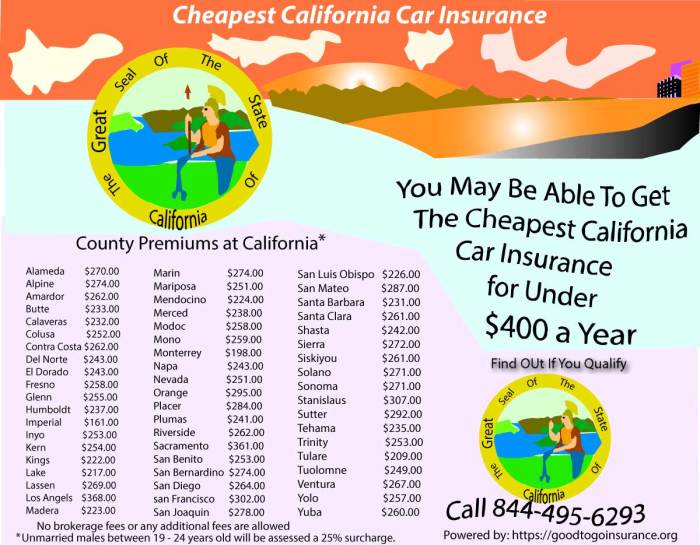

- Location: Your address affects your premium due to varying accident rates and crime statistics across different areas of California.

- Age and Gender: Younger drivers and males generally pay higher premiums due to statistically higher accident rates.

- Credit Score: In many states, including California, your credit score is a factor in determining your insurance rates.

- Coverage Level: Choosing higher coverage limits will increase your premium, but provides greater financial protection.

Common Car Insurance Add-ons or Optional Coverages

Beyond the basic coverages, several optional add-ons can enhance your protection. These are worth considering depending on your individual needs and risk tolerance.

- Rental Reimbursement: Covers the cost of a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: Provides services like towing, flat tire changes, and lockout assistance.

- Gap Insurance: Covers the difference between the actual cash value of your vehicle and the amount you still owe on your loan if your car is totaled.

- Uninsured Property Damage: Covers damage to your vehicle caused by an uninsured driver.

Obtaining a Car Insurance Quote

Securing a car insurance quote in California is a crucial step in protecting yourself and your vehicle. Understanding the process, whether online or via phone, and comparing quotes from different providers will help you find the best coverage at the most competitive price. This section details the steps involved and highlights key considerations.

Online Car Insurance Quote Process

Obtaining a car insurance quote online is generally a quick and straightforward process. Most major insurance providers offer user-friendly websites designed to guide you through the necessary steps. Typically, you’ll begin by entering basic information about yourself, your vehicle, and your driving history. The system then uses this data to generate a personalized quote.

Obtaining a Quote Over the Phone

Getting a quote by phone involves interacting directly with an insurance agent. This method can be beneficial for those who prefer personalized assistance or have more complex insurance needs. The agent will ask similar questions to those asked in the online process, but they can also provide immediate clarification and answer any questions you may have. Be prepared to provide the same information as you would online, and have your driver’s license and vehicle information readily available.

Information Required by Different Insurance Providers

While the core information requested is consistent across providers—such as your driving history, address, and vehicle details—there can be variations. Some companies might delve deeper into your driving record, asking for specific details about past accidents or violations. Others might focus on your credit score as a factor in determining your premium. Similarly, the level of detail required regarding your vehicle can differ. Some may only need the year, make, and model, while others may require the Vehicle Identification Number (VIN).

Comparing Multiple Car Insurance Quotes

Once you have several quotes, comparing them effectively is essential. Begin by ensuring you’re comparing apples to apples; ensure that the coverage levels are the same across all quotes. Then, carefully review the premium amounts, deductibles, and any additional fees or surcharges. Consider the reputation and financial stability of the insurance companies, as well as customer service ratings. A spreadsheet or a simple comparison chart can be invaluable in organizing this information and making a well-informed decision. For example, you might list the insurer’s name, the annual premium, the deductible, and the coverage details in a table to easily compare.

Choosing the Right Insurance Provider

Selecting the right car insurance provider in California is crucial for securing adequate coverage at a competitive price. A thorough understanding of different providers and their offerings will empower you to make an informed decision that best suits your individual needs and budget. This involves comparing various aspects of their services, from pricing structures to customer service responsiveness.

Comparison of California Car Insurance Providers

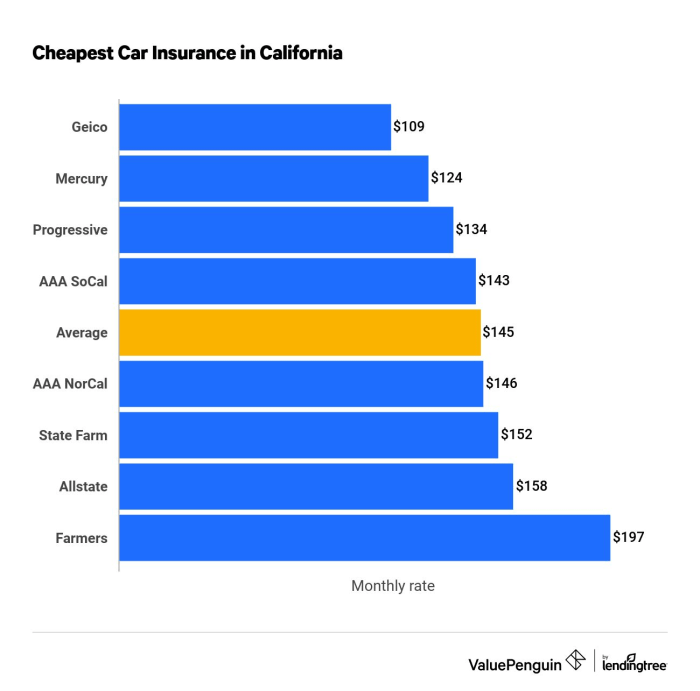

California boasts a diverse landscape of car insurance providers, ranging from large national companies to smaller, regional insurers. Major national players like State Farm, Geico, and Progressive often offer broad coverage options and extensive advertising, while regional companies may provide more personalized service and potentially more competitive rates for specific demographics. Direct-to-consumer companies like Lemonade utilize technology for streamlined processes, while traditional insurers maintain a network of local agents. The best provider for you will depend on your individual priorities and preferences. For example, a young driver might prioritize affordability, while an older driver might value comprehensive coverage and excellent customer service.

Criteria for Selecting a Reliable and Reputable Insurance Company

Choosing a reliable car insurance provider requires careful consideration of several key factors. Financial stability is paramount; you need to ensure the company can pay out claims if needed. Check the insurer’s rating from organizations like AM Best, which assesses the financial strength of insurance companies. Consider the breadth and depth of coverage offered, ensuring the policy meets your specific needs and legal requirements. A strong track record of prompt and fair claims handling is also essential. Readily available customer service channels, whether online, by phone, or in person, are crucial for addressing questions and resolving issues quickly.

Importance of Reading Customer Reviews and Ratings

Customer reviews and ratings provide valuable insights into a company’s performance and customer satisfaction. Websites like Yelp, Google Reviews, and the Better Business Bureau offer platforms for customers to share their experiences, both positive and negative. Pay attention to recurring themes in the reviews. While individual experiences can vary, consistent patterns of positive or negative feedback can indicate broader trends in customer service quality, claims handling efficiency, and overall company reliability. Reading reviews allows you to gauge the company’s responsiveness to customer concerns and its commitment to resolving issues fairly.

Advantages and Disadvantages of Various Insurance Provider Types

Different types of insurance providers offer unique advantages and disadvantages. Large national companies generally offer extensive coverage options and widespread accessibility, but may lack the personalized service of smaller insurers. Regional companies might provide more competitive rates for specific areas but may have fewer resources than larger firms. Direct-to-consumer companies often offer convenient online platforms and streamlined processes, but may lack the personal touch of an agent. Traditional insurers with local agents offer personalized guidance and support, but may have less technologically advanced systems. The optimal choice depends on your individual needs and priorities. For instance, someone comfortable managing their insurance online might prefer a direct-to-consumer model, while someone who values personal interaction might choose a traditional insurer with a local agent.

Understanding Policy Documents

Receiving your California car insurance policy can feel overwhelming, but understanding its key components is crucial for protecting yourself financially. This section will guide you through the essential parts of your policy, helping you decipher the details and ensuring you’re adequately covered.

Key Components of a Standard California Car Insurance Policy

A standard California car insurance policy typically includes several key sections. These sections work together to define your coverage, responsibilities, and the terms of your agreement with the insurance company. Understanding these components is essential for knowing what is and isn’t covered under your policy. The most important sections include the declarations page, the coverage sections (detailing liability, collision, comprehensive, etc.), and the general conditions and exclusions.

Declarations Page Information

The declarations page is the summary of your policy. It provides a snapshot of your coverage details at a glance. This page usually includes your name and address, policy number, the dates of coverage, the description of your vehicle(s), the premium amount, and the coverage limits for each type of insurance you’ve purchased (such as liability, collision, and comprehensive). It also specifies any discounts applied to your premium. For example, it might show a discount for a good driving record or for bundling your car insurance with other types of insurance. Think of the declarations page as your policy’s “table of contents” – a quick reference point for essential information.

Common Policy Exclusions and Limitations

No insurance policy covers everything. Understanding the exclusions and limitations is vital. Common exclusions might include damage caused by wear and tear, intentional acts, or driving under the influence of alcohol or drugs. Limitations often relate to the maximum amount the insurer will pay for a specific claim. For example, there might be a limit on the amount paid for rental car reimbursement after an accident, or a deductible amount you must pay before the insurance company covers the rest of the repair costs. These exclusions and limitations are clearly Artikeld in your policy documents.

Understanding Policy Terms and Conditions

The terms and conditions section Artikels the rules and responsibilities of both you and the insurance company. This section often details procedures for filing a claim, the process for resolving disputes, and the circumstances under which your policy might be canceled. It also specifies the responsibilities you have as a policyholder, such as notifying the insurer of any changes to your driving record or vehicle information. Carefully reading this section will ensure you understand your rights and obligations under the policy. For instance, it might detail the process for requesting a rate adjustment or the consequences of failing to pay your premium on time.

Filing a Claim

Filing a car insurance claim in California can seem daunting, but understanding the process can make it significantly less stressful. This section Artikels the steps involved, necessary documentation, and how to handle disputes. Remember, prompt reporting and thorough documentation are key to a smooth claims process.

The Claim Filing Process

To initiate a claim, contact your insurance provider immediately after an accident. Most companies offer 24/7 claims reporting through phone, app, or their website. Provide them with the necessary details, including the date, time, location, and circumstances of the accident. They will then guide you through the next steps, which may include providing a recorded statement and scheduling an inspection of the vehicle. The insurer will then assess the damage and determine liability.

Necessary Documentation for a Claim

It is crucial to gather comprehensive documentation following an accident. This documentation helps expedite the claims process and supports your claim.

- Police Report: If the accident involved injuries or significant property damage, obtain a copy of the police report. This report provides an objective account of the incident.

- Photos and Videos: Document the damage to all vehicles involved, including any injuries sustained. Take multiple pictures from various angles to capture the extent of the damage.

- Witness Information: If there were any witnesses, collect their names, contact information, and statements about what they observed.

- Medical Records: If injuries were sustained, gather all relevant medical records, including doctor’s notes, treatment plans, and bills.

- Vehicle Information: This includes your vehicle identification number (VIN), license plate number, and make and model.

- Insurance Information: Your insurance policy details and the contact information for all other involved parties’ insurance providers.

Resolving Claim Disputes

Disputes can arise regarding liability, the extent of damages, or the amount of compensation offered. If you disagree with your insurance company’s assessment, review your policy carefully and understand your rights. You may be able to utilize your insurer’s internal dispute resolution process. If this fails, you can consider mediation or arbitration, or even pursue legal action as a last resort. California law provides avenues for resolving such disputes, including the Department of Insurance.

Common Claim Scenarios and Resolutions

Several common scenarios illustrate how claims are typically handled.

- Minor Accident with Clear Liability: If one driver is clearly at fault for a minor fender bender, the claim process is usually straightforward. The at-fault driver’s insurance company will typically cover the repairs to the other vehicle.

- Accident with Multiple Parties and Unclear Liability: When multiple vehicles are involved and liability is contested, a more thorough investigation is required, often involving police reports and witness statements. Insurance companies may negotiate among themselves to determine liability and apportion damages.

- Accident Resulting in Injuries: Claims involving injuries are more complex and usually involve medical evaluations, treatment bills, and potentially lost wages. The insurance company will need detailed medical records and documentation of lost income to assess the claim.

- Total Loss Claim: If the damage to a vehicle exceeds its actual cash value, the insurance company will declare it a total loss and provide compensation based on the vehicle’s pre-accident value, less any deductible.

Final Thoughts

Securing the optimal California car insurance quote involves careful planning and understanding. By leveraging the information provided in this guide, you can confidently navigate the complexities of the insurance market, compare quotes effectively, and ultimately choose a policy that aligns perfectly with your needs and budget. Remember to always compare multiple quotes, read policy documents thoroughly, and don’t hesitate to ask questions. Driving in California should be enjoyable – let’s make sure your insurance coverage is too.

Essential FAQs

What is SR-22 insurance in California?

SR-22 insurance is proof of financial responsibility required by the DMV for high-risk drivers. It certifies you have the minimum liability coverage required by the state.

Can I get car insurance without a driver’s license in California?

Generally, no. Most insurers require a valid driver’s license to issue a policy. Exceptions might exist for specific situations, but it’s best to contact insurers directly.

How often can I change my car insurance provider in California?

You can switch providers at any time. Simply obtain a new policy from your desired provider and notify your current insurer of your cancellation.

What happens if I don’t have car insurance in California?

Driving without insurance in California is illegal and results in significant fines, license suspension, and potential legal consequences in case of an accident.