Securing your business against unforeseen circumstances is paramount. This guide delves into the multifaceted world of business insurances, providing a clear understanding of the various types available, the factors influencing costs, and the crucial steps in selecting the right policy. We’ll explore how to navigate policy intricacies, file claims effectively, and understand the legal implications of insurance coverage, ultimately empowering you to make informed decisions to protect your business.

From understanding the nuances of liability insurance to mitigating risks through comprehensive coverage, we aim to demystify the process of choosing and managing business insurance. This guide offers practical advice and insights, helping you navigate the complexities and build a robust risk management strategy tailored to your specific needs.

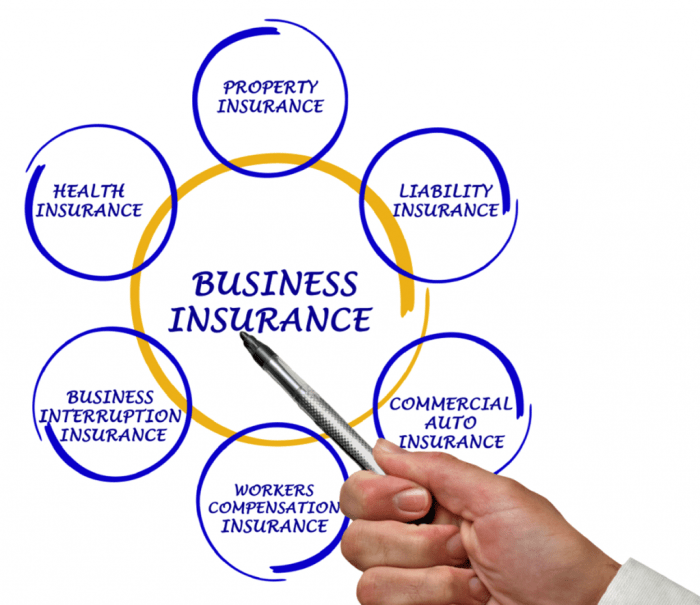

Types of Business Insurance

Protecting your business from unforeseen events is crucial for its long-term success. Business insurance provides a financial safety net, mitigating potential losses and ensuring operational continuity. Understanding the different types of insurance available is vital for selecting the right coverage to meet your specific needs and risk profile.

Common Types of Business Insurance

A variety of insurance policies cater to the diverse risks faced by businesses. Choosing the appropriate coverage depends on factors like industry, size, and location. The following Artikels some key types.

- General Liability Insurance: This covers bodily injury or property damage caused by your business operations to third parties. For example, if a customer slips and falls on your premises, general liability insurance would cover their medical expenses and potential legal costs.

- Professional Liability Insurance (Errors and Omissions): This protects professionals from claims of negligence or mistakes in their services. A lawyer wrongly advising a client, for example, could be covered under this policy.

- Commercial Property Insurance: This covers damage to or loss of your business property, including buildings, equipment, and inventory, due to events like fire, theft, or vandalism. A fire destroying your office building would be covered under this type of insurance.

- Workers’ Compensation Insurance: This covers medical expenses and lost wages for employees injured on the job. This is often mandated by law. A worker suffering a workplace injury would have their medical bills and lost wages covered.

- Commercial Auto Insurance: This covers damages or injuries caused by company vehicles. An accident involving a company delivery truck would fall under this category.

- Business Interruption Insurance: This covers lost income if your business is forced to shut down due to a covered event, such as a fire or natural disaster. This helps maintain financial stability during downtime.

- Cyber Liability Insurance: This protects businesses from financial losses resulting from data breaches or cyberattacks. This is increasingly important in today’s digital world, covering costs associated with data recovery, legal fees, and notification of affected individuals.

Comparison of Business Insurance Types

Three common types – General Liability, Commercial Property, and Business Interruption – offer a good illustration of the differences and similarities in business insurance.

General Liability and Commercial Property insurance both protect against physical damage, but to different targets. General liability covers damage *caused* by your business to others, while Commercial Property covers damage *to* your business’s own property. Business Interruption insurance, on the other hand, focuses on the financial consequences of a covered event, regardless of whether it involves physical damage. All three are crucial for comprehensive business protection, though the specific needs will vary greatly depending on the business’s operations and risk profile.

Business Insurance Comparison Table

| Insurance Type | Coverage | Cost Factors | Suitability for Business Size |

|---|---|---|---|

| General Liability | Bodily injury, property damage caused by business operations to third parties | Business revenue, industry risk, location | Suitable for all business sizes |

| Commercial Property | Damage to or loss of business property | Value of property, location, building type | Suitable for all business sizes owning property |

| Workers’ Compensation | Medical expenses and lost wages for injured employees | Number of employees, industry risk, payroll | Mandatory for businesses with employees in most jurisdictions |

| Business Interruption | Lost income due to business disruption | Business revenue, potential downtime, industry risk | Suitable for all business sizes, particularly those with significant operating expenses |

Factors Affecting Business Insurance Costs

Understanding the factors that influence your business insurance premiums is crucial for effective financial planning. Several key elements interact to determine the cost, and knowing these allows for better budgeting and potential cost-saving strategies. This section will explore the major factors that impact your insurance premiums.

Industry Impact on Insurance Pricing

The type of industry your business operates in significantly affects insurance costs. High-risk industries, such as construction or manufacturing, typically face higher premiums due to the increased likelihood of accidents, injuries, and property damage. Conversely, businesses in lower-risk sectors, like administrative services, may enjoy lower premiums. For example, a construction company handling heavy machinery will pay substantially more for liability insurance than a software development firm. This difference reflects the inherent risks associated with each industry. The insurer assesses the historical claims data for similar businesses within each industry sector to establish a baseline risk profile.

Geographic Location and Insurance Costs

Location plays a considerable role in determining insurance premiums. Areas with higher crime rates, natural disaster risks (earthquakes, hurricanes, floods), or a greater frequency of accidents will generally lead to higher insurance costs. A business operating in a high-crime area might face higher premiums for property and liability insurance compared to a similar business in a safer location. Similarly, businesses located in areas prone to natural disasters will need to factor in higher premiums for appropriate coverage. Insurance companies use actuarial data and geographic risk models to assess these location-specific risks.

Business Size and Insurance Premiums

The size of your business directly impacts insurance costs. Larger businesses typically have higher premiums due to their greater exposure to risk. They might employ more people, own more assets, and generate higher revenue, all of which increase potential liability and losses. A small bakery will have different insurance needs and costs compared to a large multinational corporation. Insurers consider factors like the number of employees, the value of assets, and annual revenue when calculating premiums for businesses of varying sizes.

Claims History and Risk Assessment

A business’s claims history is a significant factor in determining future premiums. A history of frequent or large claims will lead to higher premiums as insurers perceive a greater risk. Conversely, a clean claims history can result in lower premiums and even discounts. Risk assessment involves a thorough evaluation of the business’s operations, safety procedures, and potential hazards. Insurers use this assessment to identify areas of potential risk and adjust premiums accordingly. A business with robust safety protocols and a proactive approach to risk management might qualify for lower premiums.

Strategies for Reducing Business Insurance Costs

Businesses can implement several strategies to potentially lower their insurance costs. These strategies focus on mitigating risks and demonstrating a commitment to safety and responsible operations.

- Implement comprehensive safety programs to reduce workplace accidents and injuries.

- Invest in security measures to protect property from theft and damage.

- Maintain accurate and detailed records of all business operations and assets.

- Shop around and compare quotes from multiple insurance providers.

- Negotiate with your insurer to secure favorable rates and coverage options.

- Consider bundling insurance policies to potentially receive discounts.

- Explore loss control measures to mitigate risks and demonstrate a commitment to safety.

Understanding Policy Exclusions and Limitations

Business insurance policies, while designed to protect your business from various risks, aren’t all-encompassing. Understanding the exclusions and limitations within your policy is crucial for ensuring you have the appropriate level of coverage. Failing to do so can lead to significant financial losses in the event of a claim.

Policy exclusions and limitations specify circumstances or events that are not covered by the insurance policy. These are typically detailed in the policy’s exclusions section and are often expressed in precise legal language. Carefully reviewing this section is paramount to understanding the scope of your protection.

Common Exclusions and Limitations

Insurance policies often exclude coverage for certain types of losses or damages. These exclusions are designed to manage risk and prevent the insurer from covering events that are difficult to predict, control, or are considered inherently high-risk. Common exclusions can include acts of war, intentional acts, wear and tear, and gradual deterioration. Limitations might include specific dollar amounts or timeframes for coverage. For example, a policy might exclude coverage for damage caused by flooding in specific high-risk zones, or it may limit liability coverage for a specific incident to a certain monetary amount. Specific exclusions will vary widely depending on the type of insurance and the insurer.

Significance of Reviewing Policy Documents

Thoroughly reviewing your business insurance policy documents is not merely a formality; it’s a critical step in risk management. The policy wording, while often complex, dictates exactly what is and is not covered. Overlooking key exclusions or misinterpreting limitations can have severe consequences. Taking the time to understand the policy’s nuances can prevent costly surprises during a claim. If you find the language difficult to understand, seeking clarification from your insurance broker or agent is advisable.

Consequences of Insufficient Coverage or Overlooked Exclusions

Insufficient coverage or overlooked exclusions can leave your business vulnerable to significant financial losses. Imagine a scenario where your business experiences a fire, but the policy excludes coverage for damage caused by faulty electrical wiring, the actual cause of the fire. This could result in substantial out-of-pocket expenses for repairs and business interruption. Similarly, if your liability coverage is insufficient, you could face personal financial ruin if sued for a significant amount exceeding your policy limits. Understanding the implications of gaps in coverage is vital for proactive risk mitigation.

Interpreting Policy Wording to Identify Potential Gaps

Interpreting policy wording requires careful attention to detail. Look for phrases like “except as otherwise provided,” “notwithstanding anything to the contrary,” and similar qualifiers. These phrases often indicate exceptions or limitations to the general coverage. Pay close attention to defined terms and specific exclusions listed within the policy. If you are unsure about the meaning of any particular clause, seeking professional advice from an insurance professional is highly recommended. Understanding the specific language used in your policy is key to identifying potential gaps in your coverage and ensuring your business is adequately protected.

Filing a Business Insurance Claim

Filing a business insurance claim can seem daunting, but understanding the process can significantly ease the stress and improve your chances of a successful outcome. A well-prepared and promptly filed claim is crucial for minimizing financial losses and ensuring a swift recovery after an insured event. This section details the steps involved, offers advice on communication, and Artikels the typical claim timeline.

Required Documentation for a Business Insurance Claim

Gathering the necessary documentation is the first crucial step. The specific documents required will vary depending on the type of claim and your insurance policy, but generally include a completed claim form, detailed descriptions of the incident, dates, times, and locations. You’ll also need proof of loss, such as repair bills, police reports (if applicable), and any relevant contracts or agreements. Photographs and video evidence of the damage are extremely helpful, providing visual support for your claim. Maintaining meticulous records of your business operations will greatly simplify this process. Consider keeping a detailed inventory of your assets with photos for future reference.

Communicating Effectively with Your Insurance Provider

Clear and concise communication is vital throughout the claims process. Be prompt in reporting the incident, providing all requested information accurately and completely. Maintain a professional and courteous tone in all communications, both written and verbal. Keep detailed records of all correspondence, including dates, times, and the names of individuals you speak with. If you have questions or concerns, don’t hesitate to ask for clarification; understanding the process is key to a smoother experience. For complex claims, consider seeking advice from a business consultant or insurance professional.

Typical Claim Processing Timeline and Potential Challenges

The claim processing timeline varies significantly depending on the complexity of the claim and the insurance provider. Simple claims may be processed within a few weeks, while more complex claims involving significant losses or disputes can take several months. Potential challenges include insufficient documentation, discrepancies in information, or disputes over the extent of coverage. Delays can also arise from internal processing issues within the insurance company. Proactive communication and thorough documentation can help mitigate these challenges and ensure a faster resolution. For example, a small business experiencing a fire might see their claim processed within 2-3 months if documentation is complete and cooperation with the adjuster is prompt, whereas a larger business with complex inventory and significant damage could face a 6-12 month timeline.

Step-by-Step Guide to Filing a Business Insurance Claim

- Report the incident to your insurance provider as soon as possible, noting the date, time, and location.

- Complete the claim form provided by your insurer, ensuring all information is accurate and complete.

- Gather all necessary documentation, including photos, repair bills, police reports, and any other relevant materials.

- Submit your claim form and supporting documentation to your insurance provider via the designated method (mail, email, or online portal).

- Cooperate fully with your insurance adjuster’s investigation, providing any additional information or documentation requested.

- Review the claim settlement offer carefully and negotiate if necessary.

- Maintain detailed records of all communication and transactions throughout the process.

Business Insurance and Legal Compliance

Operating a business often involves navigating a complex web of legal obligations, and securing the appropriate insurance coverage is frequently a crucial element of this. Failure to comply with insurance regulations can lead to significant financial penalties and legal repercussions, impacting the business’s stability and reputation. Understanding the interplay between business insurance and legal compliance is therefore essential for responsible business ownership.

Legal requirements related to business insurance vary significantly depending on the jurisdiction, industry, and specific business activities. These requirements often dictate minimum coverage levels for certain types of insurance, and non-compliance can result in substantial fines, suspension of operations, or even criminal charges in some cases. Businesses must proactively research and understand the specific insurance mandates applicable to their operations in their location.

Insurance Requirements by Jurisdiction

The specific types of insurance legally required for businesses differ widely across jurisdictions. For instance, workers’ compensation insurance is typically mandatory in most developed countries to protect employees injured on the job. Similarly, many jurisdictions mandate liability insurance for certain businesses, such as those operating motor vehicles or handling hazardous materials. Businesses operating in multiple jurisdictions must ensure compliance with all applicable regulations in each location. Ignoring these regulations can result in significant legal penalties, including hefty fines and potential lawsuits. Furthermore, consistent non-compliance can severely damage a business’s reputation and erode public trust.

Consequences of Non-Compliance

Non-compliance with insurance regulations carries substantial risks. Financial penalties can range from relatively minor fines to substantial monetary sanctions, depending on the severity and duration of the non-compliance. Beyond financial repercussions, non-compliance can lead to the suspension or revocation of business licenses, effectively shutting down operations. In cases involving serious negligence or willful disregard for safety regulations, criminal charges might be filed, resulting in even more severe consequences. For example, a construction company failing to maintain adequate workers’ compensation insurance could face substantial fines and legal action if an employee is injured on the job.

Mandated Insurance by Industry

Several industries face specific legal mandates regarding insurance coverage. For example, transportation companies often require extensive liability insurance to cover potential damages caused by accidents involving their vehicles. Healthcare providers typically need professional liability insurance (malpractice insurance) to protect against claims of medical negligence. Similarly, contractors often require various types of liability insurance to protect against claims related to property damage or injuries sustained on a worksite. Failure to secure these legally mandated policies can expose businesses to crippling financial losses and legal battles.

Mitigating Legal Risks with Insurance

Business insurance plays a vital role in mitigating legal risks. Liability insurance, for example, can protect a business from financial losses associated with third-party claims of bodily injury or property damage. Product liability insurance covers claims arising from defects in products sold by the business. Professional liability insurance safeguards professionals against claims of negligence or malpractice. By proactively securing appropriate insurance coverage, businesses can significantly reduce their exposure to financial ruin and legal battles, allowing them to focus on their core operations. A comprehensive insurance strategy acts as a buffer against unexpected events, helping to maintain the business’s financial stability and reputation.

Concluding Remarks

Protecting your business investment requires a proactive approach to risk management. By carefully considering the various types of business insurance, understanding the factors influencing costs, and diligently reviewing policy details, you can build a comprehensive safety net. Remember, consulting with an insurance professional is crucial to ensure you have the right coverage to safeguard your business’s future and navigate potential challenges with confidence. Proactive planning and informed decision-making are key to minimizing risk and maximizing your business’s long-term success.

FAQ Insights

What is the difference between general liability and professional liability insurance?

General liability covers bodily injury or property damage caused by your business operations. Professional liability (errors and omissions insurance) protects against claims of negligence or mistakes in professional services.

How often should I review my business insurance policies?

At least annually, or whenever your business experiences significant changes (e.g., expansion, new products/services, location change).

Can I get business insurance if my business is home-based?

Yes, but your coverage needs might differ from a traditional office setting. You’ll need to disclose your home-based status to your insurer.

What happens if I don’t have the right business insurance and an incident occurs?

You could face significant financial losses, lawsuits, and damage to your business reputation. Insufficient coverage can leave you personally liable for damages.

What is a deductible, and how does it affect my insurance premiums?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums, but you bear more risk.