Navigating the California auto insurance market can feel like driving through a dense fog, especially when searching for affordable coverage. This guide illuminates the path, offering insights into the factors influencing insurance costs, strategies for finding low-cost options, and crucial details about policy coverage. We’ll explore various insurance providers, the impact of your driving history and credit score, and ways to maximize discounts and savings. Ultimately, this guide aims to empower you to make informed decisions and secure the best possible auto insurance protection without breaking the bank.

From understanding minimum coverage requirements to comparing quotes from multiple providers, we’ll cover everything you need to know to find California low cost auto insurance that meets your needs and budget. We’ll delve into the nuances of different policy types, explain how various factors influence premiums, and provide actionable tips for securing significant savings. This is your roadmap to affordable and effective auto insurance in California.

Understanding California’s Auto Insurance Market

California’s auto insurance market is complex, influenced by a variety of factors that ultimately determine the cost of coverage for drivers. Understanding these factors and the available coverage options is crucial for securing the right policy at a price that fits your budget. This section will explore the key elements influencing insurance costs, the different types of coverage, and a comparison of minimum versus recommended coverage levels.

Factors Influencing Auto Insurance Costs in California

Several key factors contribute to the variability of auto insurance premiums in California. These include the driver’s driving record (accidents and violations), age and driving experience (younger and less experienced drivers typically pay more), vehicle type and value (sports cars and luxury vehicles are generally more expensive to insure), location (higher crime rates and accident frequencies in certain areas lead to higher premiums), credit history (in many cases, a good credit score can result in lower premiums), and the level of coverage selected (higher coverage limits naturally increase costs). Insurance companies also use sophisticated algorithms to assess risk, taking into account a wide range of data points.

Types of Auto Insurance Coverage

California offers several types of auto insurance coverage. Liability coverage is mandatory and protects you financially if you cause an accident resulting in injuries or property damage to others. Uninsured/Underinsured Motorist (UM/UIM) coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage covers damage to your vehicle from events other than collisions, such as theft, vandalism, or weather-related incidents. Medical payments coverage helps pay for medical expenses for you and your passengers, regardless of fault. Personal injury protection (PIP) coverage, though not mandatory, can cover medical bills and lost wages for you and your passengers.

Minimum Coverage Requirements vs. Recommended Coverage

California’s minimum liability coverage requirements are $15,000 for injuries or death to one person, $30,000 for injuries or death to multiple people in a single accident, and $5,000 for property damage. While meeting these minimums is legally sufficient, they may not be adequate to cover significant damages in a serious accident. Recommended coverage often significantly exceeds these minimums, providing greater financial protection. For example, many experts suggest carrying liability coverage of $100,000/$300,000 or even higher, depending on individual circumstances and assets. Similarly, while collision and comprehensive coverage are optional, they are highly recommended to protect your financial investment in your vehicle.

Average Auto Insurance Costs Across Major California Cities

The following table provides an estimated comparison of average auto insurance costs across several major California cities. Note that these are averages and actual costs can vary widely based on the factors discussed above. Data is based on industry reports and may not reflect current market conditions precisely.

| City | Average Cost (Annual) | Minimum Coverage Cost (Annual) | Factors Influencing Cost |

|---|---|---|---|

| Los Angeles | $2,000 | $700 | High population density, traffic congestion, higher accident rates |

| San Francisco | $1,800 | $650 | High cost of living, higher vehicle values, congested roads |

| San Diego | $1,600 | $600 | Moderate traffic, relatively lower accident rates compared to LA and SF |

| Sacramento | $1,400 | $550 | Lower population density, generally lower cost of living |

Identifying Low-Cost Insurance Options

Finding affordable auto insurance in California can feel like navigating a maze, but with a strategic approach, you can significantly reduce your premiums. This section will Artikel key strategies and factors influencing your insurance costs, empowering you to make informed decisions.

Strategies for Finding Affordable Auto Insurance

Securing low-cost auto insurance involves a multi-pronged approach. Careful comparison shopping is paramount, but equally important are steps you can take to improve your insurability. This includes maintaining a clean driving record, exploring different coverage options, and bundling insurance policies.

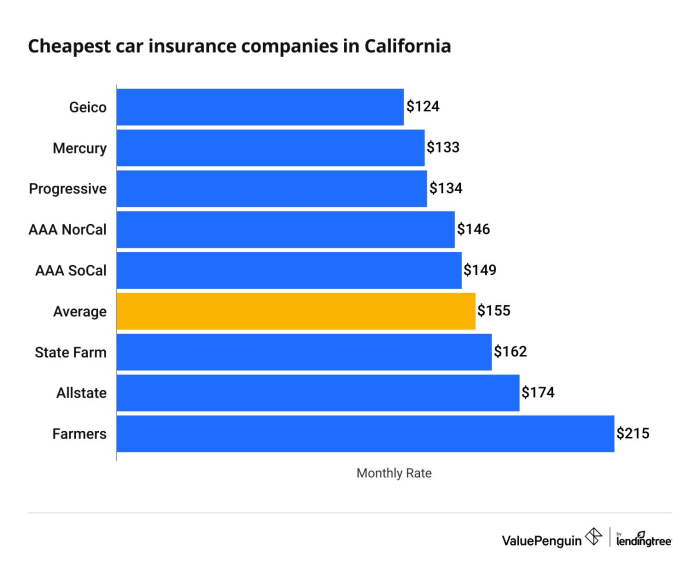

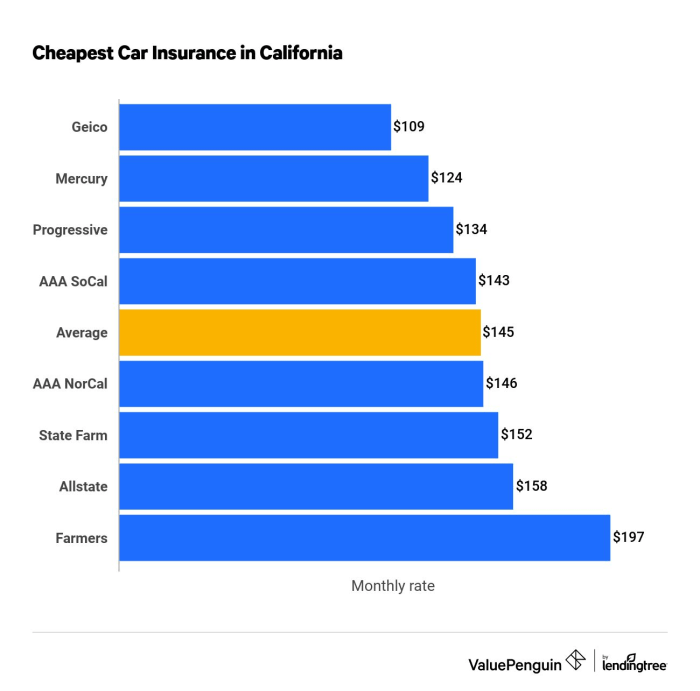

Benefits and Drawbacks of Different Insurance Providers

The California auto insurance market is diverse, offering a range of providers with varying strengths and weaknesses. Larger, national companies often provide extensive coverage options and convenient online services, but may have higher premiums. Smaller, regional providers might offer more personalized service and potentially lower rates, but may have fewer locations or less robust online tools. Direct-to-consumer insurers utilize technology to streamline the process and offer competitive rates, while independent agents can compare policies from multiple providers, providing a broader range of choices. The ideal provider depends on individual needs and priorities.

Impact of Driving History and Credit Score on Insurance Premiums

Your driving history is a significant factor influencing your insurance premiums. Accidents, traffic violations, and even the number of years you’ve held a license directly impact your rates. A clean driving record translates to lower premiums. Similarly, your credit score plays a surprisingly large role. Insurers often use credit-based insurance scores to assess risk, and a higher credit score generally results in lower premiums. This is due to the statistical correlation between creditworthiness and responsible behavior, including driving habits. For example, an individual with a history of multiple accidents and a low credit score will likely face significantly higher premiums than someone with a clean driving record and a high credit score.

Comparing Insurance Quotes Effectively

Effectively comparing insurance quotes requires a systematic approach. The following flowchart Artikels the steps involved:

Factors Affecting Insurance Premiums

Understanding what influences your California auto insurance premium is crucial for securing the best possible rate. Several interconnected factors determine the cost, broadly categorized as driver-related, vehicle-related, and location-related. These factors work together to create a personalized risk assessment for each driver.

Driver-Related Factors

Your driving history and personal characteristics significantly impact your premium. Insurance companies assess risk based on your likelihood of filing a claim.

- Age: Younger drivers, particularly those under 25, generally pay higher premiums due to statistically higher accident rates. Insurance companies consider them higher risk. As drivers gain experience and reach their mid-twenties and beyond, premiums typically decrease.

- Driving Experience: A clean driving record with several years of accident-free driving significantly reduces premiums. Consistent safe driving demonstrates lower risk to insurers.

- Driving Record: Traffic violations and accidents significantly increase premiums. A speeding ticket, for example, can raise your rates for several years. At-fault accidents drastically increase premiums, reflecting the higher risk you pose.

- Credit History: In many states, including California, your credit history can influence your insurance rates. A good credit score often correlates with responsible behavior, which insurers consider a positive factor.

Vehicle-Related Factors

The type of vehicle you drive plays a substantial role in determining your insurance cost.

- Vehicle Type: Sports cars and high-performance vehicles generally have higher insurance premiums due to their higher repair costs and increased risk of theft. Conversely, smaller, less expensive cars often have lower premiums.

- Vehicle Value: The value of your car directly impacts your collision and comprehensive coverage costs. More expensive vehicles cost more to repair or replace, leading to higher premiums.

- Vehicle Safety Features: Cars equipped with advanced safety features, such as anti-lock brakes (ABS), electronic stability control (ESC), and airbags, may qualify for discounts. These features reduce the severity of accidents and thus lower the insurer’s risk.

Location-Related Factors

Where you live influences your insurance rates.

- Geographic Location: Insurance rates vary significantly by location due to differences in accident rates, theft rates, and the cost of repairs. Areas with high crime rates or frequent accidents tend to have higher premiums.

- Garaging Address: Where you park your car overnight can also influence your rates. Garaging your car in a secure location, such as a garage, can result in lower premiums compared to parking on the street.

Understanding Policy Details and Coverage

Choosing the right auto insurance policy in California involves understanding the details of the coverage you’re purchasing. This section will clarify the various types of coverage and help you decipher your policy documents to ensure you have the protection you need. Knowing what your policy covers is crucial for managing risk and avoiding unexpected financial burdens in the event of an accident.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It typically includes bodily injury liability and property damage liability. Bodily injury liability covers medical bills, lost wages, and pain and suffering for those injured in an accident you caused. Property damage liability covers the cost of repairing or replacing damaged property, such as another person’s vehicle. The limits of your liability coverage are expressed as numbers, such as 25/50/25, which means $25,000 per person for bodily injury, $50,000 total for bodily injury per accident, and $25,000 for property damage. Higher limits offer greater protection but typically result in higher premiums.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident caused by an uninsured or underinsured driver. In California, many drivers operate without adequate insurance. Uninsured motorist bodily injury coverage protects you and your passengers for medical expenses, lost wages, and pain and suffering if the at-fault driver lacks insurance. Underinsured motorist bodily injury coverage steps in if the other driver’s insurance limits are insufficient to cover your losses. This coverage is essential given the prevalence of uninsured drivers on California roads. For example, if you are seriously injured by an uninsured driver, this coverage would help pay for your medical bills, even if they are substantial.

Collision and Comprehensive Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, fire, hail, or even damage from animals. While not legally required in California, these coverages are highly recommended as they can prevent significant out-of-pocket expenses. For instance, if a tree falls on your car during a storm, comprehensive coverage would cover the repairs. If you’re involved in a fender bender, collision coverage will take care of the damage to your car, even if you were at fault.

Understanding Policy Documents and Key Information

Your insurance policy is a legal contract. Carefully reviewing it is crucial. Key information to locate includes your coverage limits (as discussed above), your deductible (the amount you pay out-of-pocket before your insurance kicks in), your premium amount, and the effective dates of your coverage. The policy will also detail the conditions and exclusions of your coverage, outlining situations where your insurance may not provide compensation. Look for sections outlining how to file a claim and contact information for your insurance company. If any part of your policy is unclear, contact your insurance provider for clarification.

Summary

Finding affordable auto insurance in California doesn’t have to be an overwhelming task. By understanding the factors that influence premiums, leveraging available discounts, and carefully comparing quotes from multiple insurers, you can secure the coverage you need without compromising your financial well-being. Remember to thoroughly review policy details and don’t hesitate to utilize available resources and consumer protection agencies to ensure you’re making the best choice for your individual circumstances. Driving safely and maintaining a clean driving record remain key factors in keeping your premiums low over the long term. Armed with the information in this guide, you are well-equipped to navigate the California auto insurance landscape and find the best deal.

Question Bank

What is SR-22 insurance and do I need it?

SR-22 insurance is proof of financial responsibility required by the DMV in certain situations, such as after a DUI or serious accident. It’s not a type of insurance itself, but a certificate verifying you have the required minimum liability coverage.

Can I get auto insurance without a car?

Yes, some insurers offer non-owner car insurance which protects you if you’re driving someone else’s car. This is useful if you don’t own a vehicle but drive regularly.

How often can I change my car insurance provider?

You can typically switch providers at any time, though there may be penalties depending on your current policy terms. It’s generally best to switch at the end of your policy term to avoid early cancellation fees.

What is the difference between liability and collision coverage?

Liability coverage protects you if you cause an accident that injures someone or damages their property. Collision coverage pays for repairs to your vehicle regardless of who is at fault.