Securing the right car insurance in Louisiana can feel like navigating a complex maze. This guide unravels the intricacies of Louisiana’s car insurance landscape, offering clarity on mandatory coverage, factors influencing premiums, and strategies for finding affordable yet comprehensive protection. We’ll explore the state’s unique regulations, compare insurance providers, and equip you with the knowledge to make informed decisions about your auto insurance needs.

From understanding Louisiana’s minimum liability requirements to navigating the process of filing a claim, we’ll cover all the essential aspects. Whether you’re a seasoned driver or a new resident, this comprehensive resource will empower you to confidently manage your car insurance in the Pelican State.

Factors Affecting Car Insurance Premiums in Louisiana

Several key factors influence the cost of car insurance in Louisiana. Understanding these factors can help you make informed decisions and potentially lower your premiums. These factors are interconnected, and a change in one can significantly affect your overall rate.

Driving History’s Impact on Premiums

Your driving history is a major determinant of your insurance premiums. A clean driving record, free of accidents and traffic violations, will typically result in lower rates. Conversely, accidents and tickets, particularly those involving significant damage or injury, will substantially increase your premiums. The severity and frequency of incidents directly correlate with higher costs. For example, a single at-fault accident causing significant property damage could lead to a premium increase of 20-40% or more, depending on your insurer and policy. Multiple incidents within a short period will result in even steeper increases, potentially making insurance unaffordable. Conversely, maintaining a spotless record for several years can earn you discounts.

Vehicle Type and Insurance Rates

The type of vehicle you drive significantly impacts your insurance costs. Generally, higher-value vehicles, such as luxury cars or high-performance sports cars, command higher premiums due to increased repair costs and a higher risk of theft. Trucks and SUVs often fall somewhere in between cars and motorcycles in terms of premium costs, depending on size and features. Motorcycles, due to their inherent higher risk of accidents and injuries, typically have the highest insurance rates. For example, insuring a high-performance sports car might cost twice as much as insuring a smaller, economical sedan. A large pickup truck may have a premium slightly higher than a comparable sedan.

Geographic Location and Insurance Costs

Your location in Louisiana plays a role in determining your insurance premiums. Areas with higher rates of accidents and theft will generally have higher insurance costs. This is due to increased claims frequency in these areas, leading insurance companies to charge more to cover their risk. Urban areas tend to have higher rates than rural areas. For example, drivers in densely populated cities like New Orleans or Baton Rouge might pay significantly more than those in smaller, more rural towns. This difference can be substantial, sometimes amounting to hundreds of dollars annually.

Age and Insurance Premiums

Your age is another crucial factor. Younger drivers, particularly those under 25, typically pay higher premiums due to statistically higher accident rates in this demographic. As drivers gain experience and age, their premiums usually decrease, reflecting a lower risk profile. Mature drivers, particularly those over 55, may qualify for senior discounts, further reducing their premiums. This reflects the statistical trend of reduced accident involvement among older drivers.

Table Illustrating Factors Affecting Premium Costs

| Factor | Low Risk | Medium Risk | High Risk |

|---|---|---|---|

| Driving History | Clean record, no accidents or tickets | One minor accident or speeding ticket | Multiple accidents, DUI, serious violations |

| Vehicle Type | Small, economical car | Mid-size sedan or SUV | Luxury car, high-performance sports car, motorcycle |

| Location | Rural area with low accident rates | Suburban area | Urban area with high accident rates |

| Age | Over 55 | 25-55 | Under 25 |

Finding Affordable Car Insurance in Louisiana

Securing affordable car insurance in Louisiana requires a proactive approach and a thorough understanding of the market. Several strategies can significantly reduce your premiums, allowing you to find a policy that fits your budget without compromising necessary coverage. By carefully comparing quotes, understanding available discounts, and navigating the quote-gathering process efficiently, you can achieve significant savings.

Strategies for Finding Affordable Car Insurance in Louisiana

Finding the best car insurance rate requires more than just searching online. Consider these key strategies to lower your premiums while maintaining adequate coverage.

- Shop Around and Compare: Don’t settle for the first quote you receive. Obtain quotes from multiple insurers to compare prices and coverage options. Different companies weigh factors differently, leading to varying premiums.

- Bundle Your Insurance: Many insurers offer discounts for bundling your car insurance with other types of insurance, such as homeowners or renters insurance. This can lead to substantial savings.

- Improve Your Credit Score: Your credit score is a significant factor in determining your insurance premiums. Improving your credit score can lead to lower rates.

- Maintain a Safe Driving Record: A clean driving record with no accidents or traffic violations is crucial for obtaining lower premiums. Defensive driving courses can also help reduce your rates.

- Choose a Higher Deductible: Opting for a higher deductible can lower your monthly premiums. However, be sure you can comfortably afford the higher out-of-pocket expense in case of an accident.

- Consider Your Coverage Needs: Evaluate your actual needs. While comprehensive and collision coverage are beneficial, they also increase premiums. If your car is older, you might consider dropping collision coverage to save money.

- Explore Low-Cost Insurers: Some insurers specialize in providing affordable coverage. Researching these companies can uncover competitive rates.

Comparing Quotes from Different Insurance Providers

Effectively comparing quotes involves more than just looking at the bottom-line price. A systematic approach is crucial.

Begin by creating a spreadsheet to compare key factors. Include the insurer’s name, the quoted premium, the deductible amount, the coverage limits (liability, uninsured/underinsured motorist, etc.), and any included discounts. This allows for a side-by-side comparison of apples-to-apples quotes. Remember to ensure that the coverage levels are consistent across all quotes before making a decision. Avoid comparing a policy with minimal liability coverage to one with higher limits, as the difference in price may not accurately reflect the true cost difference.

Insurance Discounts in Louisiana

Numerous discounts are available to Louisiana drivers. Understanding these discounts and their eligibility requirements is vital for securing the lowest possible premium.

- Good Student Discount: This discount is typically offered to students with good grades and a clean driving record.

- Safe Driver Discount: Insurers reward drivers with a history of safe driving and accident-free years.

- Multi-Car Discount: Insuring multiple vehicles with the same company often results in a discount on each policy.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can lower your premiums.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can often result in a discount.

- Bundling Discount: As mentioned previously, bundling your car insurance with other insurance policies often leads to significant savings.

It’s important to note that the availability and amount of each discount vary depending on the insurance company and your specific circumstances. Always inquire about available discounts when obtaining quotes.

Obtaining Multiple Quotes and Selecting the Best Option

The process of obtaining multiple quotes is straightforward. Utilize online comparison tools or contact insurance companies directly. Provide consistent information to ensure accurate comparisons.

Once you have gathered several quotes, meticulously review each one. Don’t solely focus on the price; carefully compare the coverage offered. Select the policy that provides the best balance of coverage and affordability for your individual needs. Remember, the cheapest policy isn’t always the best if it lacks sufficient coverage to protect you in the event of an accident.

Louisiana’s Insurance Companies and Their Services

Choosing the right car insurance provider in Louisiana can significantly impact your financial well-being and peace of mind. A variety of companies operate within the state, each offering a unique blend of coverage options, services, and customer support. Understanding the differences between these providers is crucial for making an informed decision.

Many factors influence the selection of a car insurance company, including price, coverage options, customer service reputation, and the range of additional services offered. This section will explore some of Louisiana’s major car insurance providers, highlighting their key features and customer experiences.

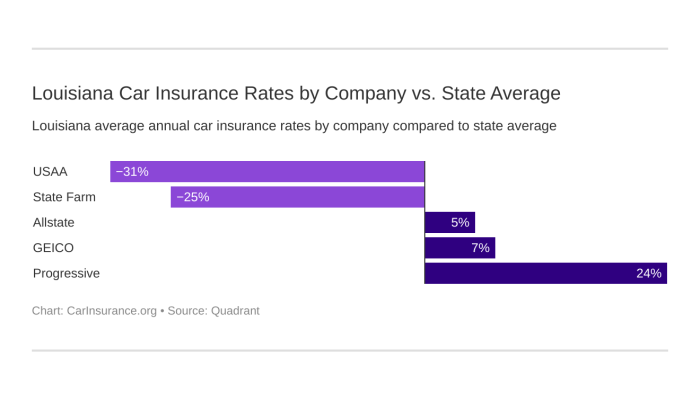

Major Car Insurance Companies in Louisiana

Several large national and regional insurers have a substantial presence in Louisiana’s car insurance market. These companies offer a range of coverage options and additional services to cater to diverse customer needs. Examples include State Farm, Geico, Progressive, Allstate, and Louisiana Farm Bureau Insurance. These are not exhaustive, but they represent some of the most commonly chosen insurers in the state.

Services Offered by Louisiana Car Insurance Companies

Louisiana car insurance companies typically offer a standard range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Beyond these core coverages, many insurers provide additional services to enhance customer value. These often include roadside assistance (such as towing, flat tire changes, and jump starts), accident forgiveness programs (which can prevent premium increases after an at-fault accident), and various discounts based on factors like safe driving records, bundling policies, and vehicle safety features. Some companies may also offer rental car reimbursement after an accident.

Customer Service Ratings and Reviews

Assessing customer service is vital when choosing a car insurance provider. Reviews and ratings from sources like J.D. Power, the Better Business Bureau (BBB), and independent review sites offer insights into customer experiences with different companies. These sources provide valuable data points regarding claims processing speed, ease of communication, and overall customer satisfaction. While ratings can fluctuate, consistently high ratings generally indicate a positive customer experience. It’s important to remember that individual experiences can vary.

Comparison of Key Features and Benefits

The following table summarizes key features and benefits of some major car insurance providers in Louisiana. Note that specific offerings and pricing can change, so it’s always best to check directly with the insurer for the most up-to-date information.

| Company | Roadside Assistance | Accident Forgiveness | Discounts | Customer Service Rating (Example – Not Actual Rating) |

|---|---|---|---|---|

| State Farm | Yes | Yes | Multiple (safe driver, bundling, etc.) | 4.5/5 |

| Geico | Yes | Yes | Multiple (good student, defensive driving, etc.) | 4.2/5 |

| Progressive | Yes | Yes | Multiple (homeowner, multi-car, etc.) | 4.0/5 |

| Allstate | Yes | Yes | Multiple (good driver, anti-theft devices, etc.) | 4.3/5 |

Understanding Louisiana’s Uninsured/Underinsured Motorist Coverage

Driving in Louisiana, like anywhere, carries inherent risks. One significant risk is the potential for an accident with an uninsured or underinsured driver. This is where uninsured/underinsured motorist (UM/UIM) coverage becomes crucial, providing a safety net to protect you and your passengers from substantial financial burdens in the aftermath of such an accident.

Understanding the importance of UM/UIM coverage is paramount for all Louisiana drivers. This coverage acts as a secondary insurance policy, stepping in when the at-fault driver lacks sufficient insurance or has no insurance at all to cover your medical bills, lost wages, and vehicle repairs. Without UM/UIM coverage, you would be solely responsible for these expenses, potentially leading to significant financial hardship.

Benefits of Uninsured/Underinsured Motorist Coverage

UM/UIM coverage offers several key benefits in the event of an accident with an uninsured or underinsured driver. It compensates you for medical expenses, lost wages due to injuries, and property damage to your vehicle. The policy can also cover pain and suffering, and other related expenses. The exact amount of coverage depends on the limits you select when purchasing your policy.

Coverage Options Available

Louisiana law requires that all drivers carry a minimum amount of liability insurance, but this minimum may not be sufficient to cover your losses in a serious accident. UM/UIM coverage options are available in various amounts, allowing you to customize your protection. You can choose to match your bodily injury liability limits, or opt for higher limits to ensure more comprehensive protection. It’s important to carefully consider your needs and risk tolerance when choosing your coverage limits. Many insurance companies offer different levels of UM/UIM coverage, such as $25,000, $50,000, $100,000, or even higher limits per person or per accident. The higher the limit, the greater the protection, but also the higher the premium.

Scenarios Where UM/UIM Coverage is Beneficial

Consider these scenarios to understand the practical benefits of UM/UIM coverage:

Scenario 1: A driver without insurance runs a red light and causes a collision, resulting in significant injuries and vehicle damage to you. Your medical bills alone exceed $50,000, and your vehicle requires extensive repairs. Without UM/UIM coverage, you would be responsible for all these costs. With UM/UIM coverage, your insurance company would step in to cover your expenses up to your policy limits.

Scenario 2: You are involved in a collision with an underinsured driver. Their liability coverage of $25,000 is insufficient to cover your $40,000 in medical bills. Your UM/UIM coverage would cover the remaining $15,000.

Scenario 3: A hit-and-run accident leaves you injured and your vehicle damaged. Because the at-fault driver cannot be identified, you have no recourse through their insurance. Your UM/UIM coverage provides the necessary protection in this situation.

Filing a Car Insurance Claim in Louisiana

Filing a car insurance claim in Louisiana after an accident can be a complex process, but understanding the steps involved can help ensure a smoother experience. This section Artikels the necessary procedures, documentation, and strategies for navigating the claim process effectively.

Steps to File a Car Insurance Claim

Prompt action is crucial after an accident. Begin by ensuring everyone’s safety and then immediately contact the police to file an accident report. This report serves as vital documentation for your insurance claim. Next, contact your insurance company as soon as possible to report the accident. Provide them with the necessary information, including the date, time, location, and details of the accident. Finally, gather all relevant documentation and information (detailed below) to support your claim. Failure to report the accident promptly may affect your claim’s processing and potential payout.

Necessary Documentation and Information

Comprehensive documentation is essential for a successful claim. This includes the police accident report (if applicable), photographs of the damage to all vehicles involved, contact information for all parties involved (including witnesses), a copy of your driver’s license and vehicle registration, and any medical records related to injuries sustained in the accident. Detailed descriptions of the accident, including the sequence of events and contributing factors, should also be provided. The more complete and accurate the information, the more efficient and effective the claims process will be.

Dealing with Insurance Adjusters

Insurance adjusters investigate claims to determine liability and assess damages. Be prepared to cooperate fully with the adjuster, providing all requested documentation and answering their questions honestly and completely. Keep detailed records of all communications with the adjuster, including dates, times, and summaries of conversations. Remember, you are not obligated to give a recorded statement without consulting an attorney. Understanding your rights and the adjuster’s role is critical to ensuring a fair assessment.

Negotiating a Fair Settlement

Negotiating a fair settlement often requires careful consideration of several factors. The adjuster’s initial offer may not reflect the full extent of your damages, including vehicle repairs, medical expenses, lost wages, and pain and suffering. Gathering thorough documentation, such as repair estimates from multiple sources and medical bills, strengthens your negotiation position. Consider consulting with an attorney if you believe the offered settlement is inadequate or if you are having difficulty reaching an agreement with the insurance adjuster. They can help you navigate the complexities of the legal process and advocate for your rights.

Louisiana’s Laws Regarding Car Accidents

Navigating the aftermath of a car accident in Louisiana requires understanding the state’s specific legal framework. This includes knowing your responsibilities regarding reporting, the process of obtaining crucial documentation, and the implications of different accident scenarios on liability. This section Artikels the key legal aspects to help you understand your rights and obligations.

Reporting Car Accidents in Louisiana

Louisiana law mandates reporting car accidents under specific circumstances. Generally, accidents involving injuries or property damage exceeding $500 must be reported to the local law enforcement agency. Failure to report can result in penalties. The report should include details such as the date, time, location, parties involved, and a description of the accident. It is crucial to gather contact information from all involved parties, including witnesses. Accurate and complete reporting is vital for insurance claims and potential legal proceedings.

Obtaining a Police Report

To obtain a police report, you should contact the law enforcement agency that responded to the accident. You might need to provide identifying information, such as the date, time, and location of the accident, as well as the names of those involved. There might be a fee associated with obtaining a copy of the report, and processing times can vary depending on the agency’s workload. The police report serves as a critical piece of evidence in insurance claims and any subsequent legal actions.

At-Fault vs. No-Fault Accident Scenarios

Louisiana operates under a “fault” system, meaning the at-fault driver is financially responsible for the damages caused. Determining fault often involves investigating the circumstances of the accident, considering witness statements, and analyzing police reports. In a no-fault scenario, which is less common in Louisiana compared to some other states with no-fault insurance laws, the insurance company of the at-fault driver would be responsible for covering the damages of the injured party. However, Louisiana’s fault-based system means that the injured party typically files a claim with the at-fault driver’s insurance company. This process can be complex, and legal representation might be necessary.

Liability in Louisiana Car Accidents

Louisiana’s laws regarding liability in car accidents are based on negligence. To establish liability, it must be shown that a driver acted negligently, breaching a duty of care owed to others, and that this negligence directly caused the accident and resulting damages. Comparative negligence is applied in Louisiana, meaning the injured party’s own negligence can reduce the amount of compensation they receive. For example, if a driver is found 70% at fault and the other driver 30% at fault, the injured party’s compensation would be reduced by 30%. This means a thorough investigation of all contributing factors is essential to determine the appropriate apportionment of fault. Evidence such as witness testimonies, police reports, and accident reconstruction reports plays a significant role in determining liability.

Illustrative Example: A High-Risk Driver in Louisiana

Let’s consider the case of Mark, a 25-year-old resident of Baton Rouge, Louisiana. Over the past three years, Mark has accumulated a less-than-stellar driving record. He’s received three speeding tickets, one for reckless driving, and was at fault in two minor accidents. This history significantly impacts his ability to secure affordable car insurance.

Mark’s challenges in obtaining affordable insurance stem directly from his high-risk profile. Insurance companies assess risk based on driving history, and Mark’s record indicates a higher probability of future accidents and claims. This translates to significantly higher premiums compared to a driver with a clean record. He might find many insurers unwilling to offer him coverage at all, forcing him to seek out specialized high-risk insurance providers, which typically come with substantially increased costs. The cost of his insurance could be several times higher than that of a driver with a clean record.

Strategies for Improving Driving Record and Lowering Premiums

Improving his driving record is crucial for Mark to lower his insurance premiums. He can achieve this through several proactive steps. First, he needs to consistently abide by traffic laws, avoiding any further violations. Second, he should enroll in a defensive driving course. Many insurers offer discounts for completing such courses, demonstrating a commitment to safer driving practices. Third, maintaining a clean driving record for an extended period will gradually improve his risk profile and allow him to potentially qualify for lower premiums with different insurers over time. Finally, he should explore options like installing a telematics device in his vehicle. These devices track driving habits and can reward safe driving with discounts.

Potential Insurance Options for High-Risk Drivers

Given his driving history, Mark’s options are limited, but not nonexistent. He might need to explore specialized high-risk insurance providers who cater to drivers with poor driving records. These companies typically charge higher premiums to compensate for the increased risk. Another option is to maintain a high deductible, which reduces the premium cost but requires a larger out-of-pocket expense in case of an accident. Comparing quotes from multiple high-risk insurers is essential to find the most competitive rates. He should also be prepared to demonstrate significant improvements in his driving behavior before seeking lower premiums from standard insurers. Lastly, he could consider increasing his coverage limits for liability insurance. While this will raise the premium, it could protect him from significant financial consequences in the event of a serious accident.

Final Thoughts

Ultimately, securing adequate car insurance in Louisiana is not just a legal requirement; it’s a crucial step in protecting yourself, your passengers, and your financial well-being. By understanding the factors that influence premiums, comparing quotes diligently, and selecting coverage that aligns with your individual needs, you can confidently navigate the complexities of Louisiana’s insurance market and drive with peace of mind. Remember to regularly review your policy and adjust it as your circumstances change.

Quick FAQs

What happens if I’m in an accident and the other driver is uninsured?

Uninsured/Underinsured Motorist (UM/UIM) coverage is crucial. It protects you in accidents involving uninsured or underinsured drivers, covering your medical bills and vehicle damage.

How often should I review my car insurance policy?

It’s advisable to review your policy annually, or whenever there’s a significant life change (new car, change in driving record, etc.), to ensure it still meets your needs.

Can I get my car insurance canceled?

Yes, your insurance can be canceled for various reasons, including non-payment of premiums, fraudulent claims, or serious driving violations. Review your policy for specific cancellation clauses.

What documents do I need to file a car insurance claim?

Typically, you’ll need police reports (if applicable), photos of the accident scene and vehicle damage, contact information of all involved parties, and details of the incident.