Securing the right car insurance in Georgia is crucial for responsible drivers. This guide delves into the complexities of Georgia’s insurance landscape, clarifying minimum coverage requirements, exploring various coverage options, and offering practical strategies for finding affordable yet comprehensive protection. Understanding your insurance needs is paramount, and this resource aims to empower you with the knowledge to make informed decisions.

From understanding Georgia’s mandated minimum liability coverage to navigating the nuances of SR-22 requirements and filing claims, we’ll cover essential aspects of car insurance in the Peach State. We’ll also explore factors influencing premium costs, providing tips to help you secure the best possible rates while ensuring adequate coverage for your needs.

Georgia’s Minimum Car Insurance Requirements

Driving in Georgia requires adhering to the state’s minimum car insurance requirements. Failure to do so can result in significant penalties, impacting your driving privileges and potentially leading to financial hardship. Understanding these requirements and their implications is crucial for all Georgia drivers.

Minimum Liability Coverage Amounts

Georgia law mandates that all drivers carry a minimum amount of liability insurance. This coverage protects others in the event you cause an accident. The minimum requirements are $25,000 for bodily injury to one person, $50,000 for bodily injury to two or more people, and $25,000 for property damage. This means that your insurance company will pay a maximum of $25,000 for injuries to a single person, up to $50,000 for injuries to multiple people in a single accident, and up to $25,000 for damage to another person’s property. It’s important to note that this is the *minimum* required; higher coverage limits are strongly recommended to adequately protect yourself and others.

Penalties for Driving Without Minimum Insurance

Driving in Georgia without the minimum required liability insurance is a serious offense. Penalties can include significant fines, suspension of your driver’s license, and even the impoundment of your vehicle. The specific penalties may vary depending on the circumstances and the number of offenses. Furthermore, being uninsured can lead to financial ruin if you are involved in an accident, as you would be personally liable for all damages and medical bills. This could easily exceed your personal assets.

Comparison to Neighboring States

Georgia’s minimum liability insurance requirements are relatively low compared to some neighboring states. For example, South Carolina has similar minimums, while states like Florida and North Carolina may have higher minimum coverage limits. Direct comparison requires researching each state’s individual requirements, as these can change. It is advisable to check the Department of Insurance website for the most up-to-date information on each state’s requirements.

Summary of Georgia’s Minimum Insurance Requirements

| Coverage Type | Minimum Amount | Penalty for Non-Compliance | Description |

|---|---|---|---|

| Bodily Injury Liability (per person) | $25,000 | Fines, license suspension, vehicle impoundment | Covers injuries to one person in an accident you caused. |

| Bodily Injury Liability (per accident) | $50,000 | Fines, license suspension, vehicle impoundment | Covers injuries to multiple people in an accident you caused. |

| Property Damage Liability | $25,000 | Fines, license suspension, vehicle impoundment | Covers damage to another person’s property in an accident you caused. |

Finding Affordable Car Insurance in Georgia

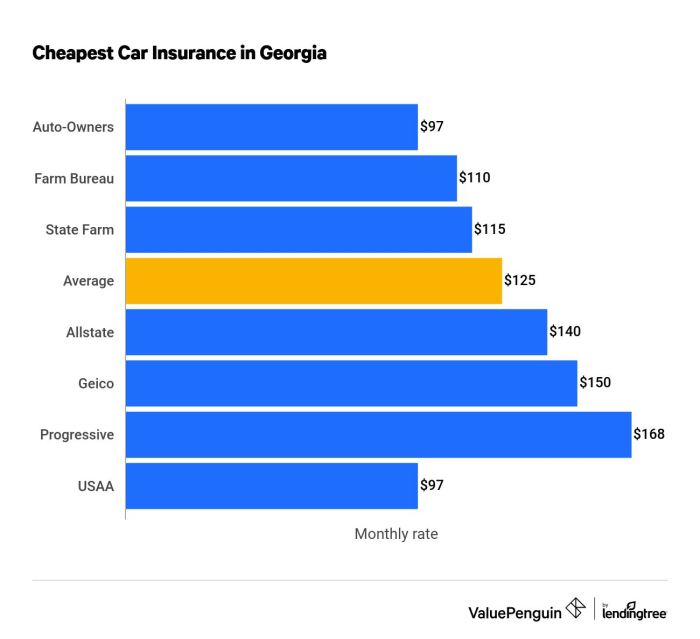

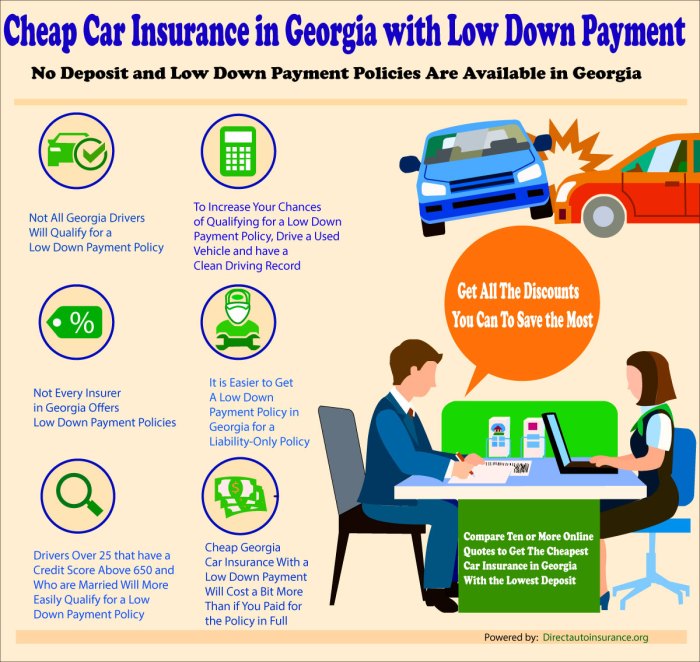

Securing affordable car insurance in Georgia is achievable with a strategic approach. By understanding your options and employing effective negotiation techniques, you can significantly reduce your premiums without compromising necessary coverage. This section will Artikel several methods for finding and securing the best possible rates.

Strategies for Finding Affordable Car Insurance

Finding the most affordable car insurance involves careful comparison and strategic choices. Consider factors like your driving history, the type of vehicle you drive, and the coverage you need. Bundle your insurance policies (home and auto) with the same provider to potentially unlock discounts. Maintaining a clean driving record is crucial; even minor infractions can impact your premiums. Exploring different insurance companies is essential as rates vary significantly. Consider increasing your deductible; a higher deductible typically translates to lower premiums, though this requires a larger upfront payment in the event of a claim. Finally, consider your coverage needs carefully; you may find that dropping unnecessary add-ons could save you money.

Negotiating Lower Premiums

Negotiating lower premiums often involves showcasing your responsible driving history and exploring potential discounts. Contact your insurance provider directly to discuss your options. Inquire about discounts for bundling policies, safe driving courses, or anti-theft devices. Highlight any relevant factors, such as a good driving record or years of insurance without claims. Be prepared to compare quotes from other insurers to leverage competitive pricing. Remember to be polite and professional throughout the negotiation process. Document any agreements reached in writing.

Comparing Car Insurance Shopping Methods

Online comparison tools and independent agents offer distinct advantages and disadvantages in your search for affordable car insurance. Online comparison tools provide a convenient way to quickly compare quotes from multiple insurers simultaneously. However, they may not present the complete picture, and the information provided might not be completely up-to-date. Independent agents, on the other hand, can offer personalized advice and access to a broader range of insurers, potentially including those not listed on comparison websites. However, this personalized service might not always translate into the lowest premiums. The choice depends on your personal preferences and comfort level with technology and personal interaction.

Step-by-Step Guide to Comparing Car Insurance Quotes

Comparing car insurance quotes involves a methodical approach to ensure you’re making an informed decision.

- Gather Information: Compile details such as your driving history, vehicle information, and desired coverage levels.

- Use Online Comparison Tools: Utilize several reputable online comparison websites to obtain quotes from multiple insurers.

- Contact Insurance Companies Directly: Reach out to insurers whose quotes interest you to clarify details and discuss potential discounts.

- Review Policy Details: Carefully examine the coverage details, deductibles, and premiums of each quote.

- Compare Prices and Coverage: Create a comparison chart to easily visualize the differences between quotes.

- Choose the Best Option: Select the policy that offers the best balance of price and coverage for your needs.

Georgia’s SR-22 Insurance Requirements

An SR-22 is not a type of insurance policy itself, but rather a certificate of insurance that verifies you maintain the minimum required liability coverage mandated by the state of Georgia. It serves as proof to the Georgia Department of Driver Services (DDS) that you’re complying with the state’s financial responsibility laws. This certificate is typically required after a driver has been involved in a serious accident, received multiple traffic violations, or driven without insurance.

Obtaining an SR-22 in Georgia

The process of obtaining an SR-22 begins with finding an insurance provider licensed in Georgia that offers SR-22 filing. Once you’ve secured coverage that meets or exceeds Georgia’s minimum liability requirements, the insurance company will file the SR-22 electronically with the DDS on your behalf. This electronic filing confirms your compliance. You will then receive a copy of the certificate, which you should retain for your records. The process is relatively straightforward but requires proactive engagement with an insurance provider capable of handling SR-22 filings.

Consequences of Not Maintaining an SR-22

Failure to maintain an active SR-22 in Georgia after it’s been mandated can have serious consequences. The DDS may suspend or revoke your driver’s license. This suspension remains in effect until proof of continuous SR-22 coverage is provided. Furthermore, driving with a suspended license due to non-compliance with SR-22 requirements can lead to fines, further license suspensions, and even jail time depending on the circumstances. The implications extend beyond driving privileges and can affect employment, loan applications, and other aspects of daily life.

Finding Insurance Providers Offering SR-22 Filing in Georgia

Several insurance companies operating in Georgia offer SR-22 filing services. To find these providers, you can begin by contacting your current insurance company if you have one. Many major insurance providers offer this service as part of their standard offerings. Alternatively, you can conduct an online search using s such as “SR-22 insurance Georgia” or “high-risk auto insurance Georgia.” Online insurance comparison websites can also be helpful tools in identifying insurers who cater to drivers requiring SR-22 filings. It’s crucial to compare quotes from multiple providers to ensure you secure the most affordable and suitable coverage. Remember to verify that the company is licensed to operate in Georgia and has a proven track record of successfully filing SR-22 certificates with the DDS.

Epilogue

Successfully navigating the world of car insurance in Georgia requires a blend of understanding and proactive planning. By familiarizing yourself with the state’s minimum requirements, exploring various coverage options, and employing effective cost-saving strategies, you can secure the appropriate level of protection while managing your budget effectively. Remember to regularly review your policy and don’t hesitate to seek professional advice when needed. Driving safely and responsibly remains the best way to minimize your risk and keep your premiums down.

Helpful Answers

What happens if I’m in an accident and don’t have insurance?

Driving without insurance in Georgia is illegal and can result in significant fines, license suspension, and even jail time. You’ll also be responsible for all accident-related costs yourself.

Can I get car insurance if I have a DUI on my record?

Yes, but it will likely be more expensive. Insurance companies consider DUI convictions high-risk factors, leading to increased premiums. You may need to seek specialized high-risk insurance providers.

How often can I change my car insurance policy?

You can typically change your car insurance policy whenever you like, although there may be penalties for canceling a policy early, depending on your contract.

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others in an accident. Collision coverage pays for damage to your own vehicle, regardless of fault.

How do I file a claim for damage to my car caused by a pothole?

This depends on whether you have comprehensive coverage. Comprehensive coverage often covers damage from events like potholes. You’ll need to report the incident to your insurance company and follow their claims process.