Securing the right car insurance in Wisconsin is crucial, balancing legal requirements with personal financial protection. This guide delves into the intricacies of Wisconsin’s car insurance landscape, offering clarity on mandatory coverage, factors influencing premiums, and strategies for finding affordable yet comprehensive protection. We’ll explore the various coverage options, the impact of your driving record, and the importance of understanding SR-22 requirements. Whether you’re a new driver, a seasoned motorist, or simply seeking to optimize your current policy, this comprehensive resource will empower you to make informed decisions about your car insurance in Wisconsin.

Understanding Wisconsin’s car insurance laws and the market’s nuances is key to responsible driving and financial security. This guide aims to demystify the process, providing practical advice and actionable insights to help you navigate the complexities and find the best coverage for your needs and budget. We’ll examine the interplay between your driving history, vehicle type, and location on your premiums, offering strategies to potentially lower your costs while maintaining adequate protection.

Wisconsin Car Insurance Requirements

Driving in Wisconsin requires understanding the state’s car insurance regulations to ensure legal compliance and financial protection. Failure to meet these requirements can lead to significant penalties and legal ramifications. This section details the minimum insurance coverage, potential penalties, and various insurance options available to Wisconsin drivers.

Minimum Liability Insurance Coverage

Wisconsin law mandates minimum liability insurance coverage for bodily injury and property damage. This means drivers must carry insurance that covers costs associated with injuries or damages they cause to others in an accident. The minimum required coverage is $25,000 for bodily injury to one person, $50,000 for bodily injury to multiple people in a single accident, and $10,000 for property damage. This is often referred to as 25/50/10 coverage. It’s crucial to understand that this minimum coverage might not be sufficient to cover all expenses in a serious accident.

Penalties for Driving Without Adequate Insurance

Driving in Wisconsin without the minimum required insurance is illegal. Penalties can be severe and include fines, license suspension, and even vehicle impoundment. The specific penalties can vary depending on the severity of the offense and the driver’s history. Furthermore, if involved in an accident without insurance, the uninsured driver could face significant financial liability for damages and injuries. This could include legal fees and potentially substantial compensation payments to the injured party.

Types of Car Insurance Coverage

Several types of car insurance coverage are available in Wisconsin, offering varying levels of protection. Understanding these options allows drivers to choose the coverage that best suits their needs and budget.

Liability Insurance: As discussed above, this covers injuries or damages you cause to others. It is mandatory in Wisconsin.

Collision Insurance: This covers damage to your vehicle, regardless of fault, in an accident. This is optional but highly recommended.

Comprehensive Insurance: This covers damage to your vehicle from non-accident related events such as theft, vandalism, fire, or hail. This is also optional but valuable for protecting your investment.

Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with an uninsured or underinsured driver. This coverage helps cover your medical bills and vehicle repairs even if the other driver is at fault and lacks sufficient insurance.

Medical Payments Coverage (Med-Pay): This coverage helps pay for medical expenses for you and your passengers, regardless of fault, following an accident.

Minimum vs. Recommended Coverage

The following table compares the minimum required liability coverage with recommended coverage levels. It’s important to note that recommended coverage is based on general advice and individual circumstances may necessitate higher limits.

| Coverage Type | Minimum Required | Recommended | Reasoning |

|---|---|---|---|

| Bodily Injury Liability (per person) | $25,000 | $100,000 or more | Medical costs can quickly exceed minimum limits. |

| Bodily Injury Liability (per accident) | $50,000 | $300,000 or more | Covers multiple injuries in a single accident. |

| Property Damage Liability | $10,000 | $50,000 or more | Vehicle repairs can be expensive. |

| Collision | Not Required | Recommended | Protects your vehicle in accidents, regardless of fault. |

| Comprehensive | Not Required | Recommended | Protects against non-accident related damage. |

Factors Affecting Car Insurance Premiums in Wisconsin

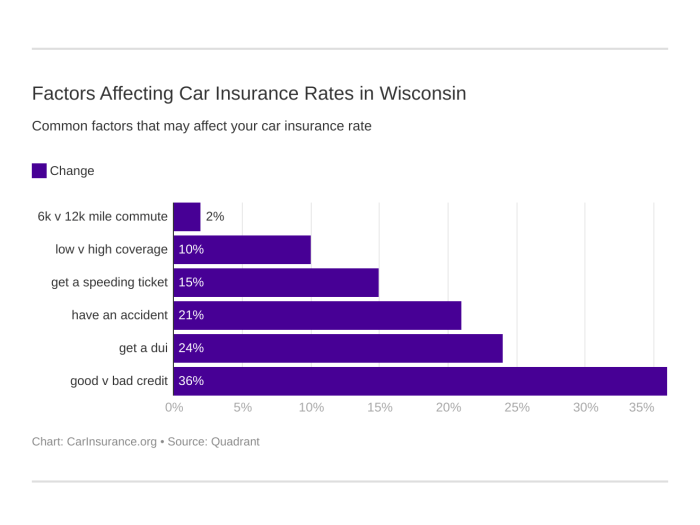

Several factors combine to determine the cost of car insurance in Wisconsin. Understanding these elements can help you make informed decisions about your coverage and potentially save money. These factors are often assessed by insurance companies using complex algorithms, resulting in a personalized premium for each driver.

Age and Driving Experience

Your age and driving history significantly influence your insurance premiums. Younger drivers, particularly those under 25, generally pay higher premiums due to statistically higher accident rates. Insurance companies view this age group as higher risk. As drivers gain experience and a clean driving record, their premiums typically decrease. Conversely, drivers with extensive, accident-free driving histories may qualify for discounts reflecting their lower risk profile.

Credit Score Impact

In Wisconsin, as in many states, your credit score can impact your car insurance premiums. Insurers often use credit-based insurance scores (CBIS) to assess risk. A higher credit score generally correlates with lower premiums, while a lower score may lead to higher premiums. This is because individuals with good credit often demonstrate responsible financial behavior, which insurers associate with responsible driving habits. However, it’s crucial to note that this is a controversial practice, and some states are working to eliminate or limit its use.

Driving Record

Your driving record is a crucial factor in determining your insurance premiums. Accidents and traffic violations significantly increase your premiums. The severity of the accident or violation directly impacts the increase. For example, a speeding ticket will likely result in a smaller premium increase compared to a DUI or an at-fault accident resulting in significant damage or injury. Maintaining a clean driving record is essential for keeping your insurance costs low.

Vehicle Type

The type of vehicle you drive also affects your insurance premiums. Generally, higher-performance vehicles, luxury cars, and vehicles with a history of theft or accidents command higher premiums due to their higher repair costs and increased risk of theft or damage. Conversely, less expensive, safer vehicles typically have lower insurance rates. Features like anti-theft devices can also influence premiums.

Location

Your location in Wisconsin plays a role in your insurance premiums. Areas with higher rates of accidents and theft generally have higher insurance costs. This reflects the increased risk that insurers face in these areas. Rural areas often have lower premiums compared to densely populated urban areas.

Average Insurance Premiums by Age Group

The following table illustrates average insurance premium variations across different age groups in Wisconsin (Note: These are illustrative averages and actual premiums can vary significantly based on other factors mentioned above. Data sourced from [Insert Reliable Source Here – e.g., a reputable insurance comparison website or state insurance department]).

| Age Group | Average Annual Premium (Estimate) | Factors Contributing to Variation | Example Scenario |

|---|---|---|---|

| 16-25 | $1800 – $2500 | Inexperience, higher accident rates | A 20-year-old with a minor accident may pay higher than average. |

| 26-35 | $1200 – $1800 | Improved driving experience, established driving record | A 30-year-old with a clean driving record may pay lower than average. |

| 36-55 | $900 – $1500 | Mature driving habits, longer driving history | A 45-year-old with a good credit score and no accidents might see a significant discount. |

| 55+ | $800 – $1200 | Lower accident rates, potential senior discounts | A 65-year-old with a long, clean driving record and a safe vehicle could enjoy the lowest premiums. |

Specific Coverage Options in Wisconsin

Choosing the right car insurance coverage in Wisconsin involves understanding the various options available and how they can protect you financially in the event of an accident. This section details several key coverage types and considerations to help you make informed decisions about your policy.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage is crucial in Wisconsin, where unfortunately, some drivers operate without insurance or with insufficient coverage. This coverage protects you and your passengers if you’re involved in an accident caused by an uninsured or underinsured driver. It compensates for medical bills, lost wages, and property damage. The importance of UM/UIM coverage lies in its ability to mitigate significant financial burdens that could arise from an accident with an at-fault driver lacking adequate insurance. Without this coverage, you would be responsible for covering your own losses, which can be devastating. Wisconsin law allows you to purchase UM/UIM coverage limits that match or exceed your bodily injury liability limits, offering a strong safety net.

Roadside Assistance Benefits

Adding roadside assistance to your car insurance policy provides valuable peace of mind. This coverage typically includes services such as towing, flat tire changes, jump starts, and lockout assistance. These services can be invaluable in emergency situations, saving you time, money, and potential stress. For example, imagine experiencing a flat tire late at night in a remote area; roadside assistance can quickly dispatch a service provider to help you get back on the road safely. The cost of roadside assistance is typically relatively low compared to the potential expenses of dealing with these situations independently.

Personal Injury Protection (PIP) Coverage Options

Wisconsin is a “no-fault” state, meaning that your own insurance policy will typically cover your medical expenses and lost wages regardless of who caused the accident. PIP coverage is a key component of this system. The amount of PIP coverage you choose impacts how much your insurance company will pay for medical bills, lost wages, and other expenses related to injuries sustained in an accident. Wisconsin law requires a minimum PIP coverage of $10,000, but you can purchase higher limits for more comprehensive protection. Choosing a higher PIP limit means greater financial protection in the event of a serious accident. Factors such as your health needs and potential lost income should be considered when selecting a PIP coverage amount.

Deductible Options and Their Impact on Premiums

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a deductible involves a trade-off between cost and out-of-pocket expense.

- Higher Deductibles: Result in lower premiums. This is because you are accepting more financial risk. If you have a higher deductible, you will pay less each month for your insurance, but you will pay more if you need to file a claim.

- Lower Deductibles: Result in higher premiums. This means you’ll pay more each month, but you’ll pay less out-of-pocket if you file a claim. This is a better option for those with limited savings or a greater risk tolerance for accidents.

For example, a $500 deductible will typically result in a lower premium than a $1000 deductible, but you would need to pay $500 before your insurance coverage begins. The optimal deductible amount depends on your personal financial situation and risk tolerance.

Understanding Wisconsin’s SR-22 Requirements

An SR-22 is a certificate of insurance that proves you carry the minimum amount of car insurance required by Wisconsin law. It’s not a separate insurance policy itself, but rather a form your insurance company files with the Wisconsin Department of Transportation (DOT) to verify your insurance coverage. Understanding when an SR-22 is required and how to obtain and maintain one is crucial for drivers in Wisconsin.

When an SR-22 is Required in Wisconsin

The state of Wisconsin mandates an SR-22 for drivers convicted of certain driving offenses. These offenses typically involve serious violations indicating a higher risk of future accidents. Examples include driving under the influence (DUI), driving without insurance, and causing accidents resulting in serious injuries or property damage. The length of time an SR-22 is required varies depending on the severity of the offense and is determined by the court. It’s important to note that the court, not the insurance company, determines the SR-22 requirement.

Obtaining an SR-22 in Wisconsin

The process begins with your insurance company. After your court-ordered requirement is established, you must contact your current insurer or find a new one willing to provide SR-22 coverage. The insurance company will then file the SR-22 with the Wisconsin DOT on your behalf. This filing electronically verifies that you maintain the minimum liability insurance required by the state. Some insurers may charge an additional fee for filing the SR-22.

Implications of Failing to Maintain an SR-22

Failing to maintain an SR-22 in Wisconsin has serious consequences. The Wisconsin DOT will be notified of the lapse in coverage, and your driver’s license will be suspended. This suspension can result in fines, further legal action, and the inability to legally drive. Maintaining continuous SR-22 coverage is critical to avoiding these penalties. The duration of the license suspension depends on the length of time the SR-22 was not maintained and can be quite lengthy. Reinstatement often requires additional fees and proof of insurance.

A Step-by-Step Guide for Obtaining and Maintaining an SR-22

- Court Order: Receive a court order mandating an SR-22 following a conviction for a qualifying offense.

- Contact Insurer: Inform your current auto insurance provider about the court order. If they don’t offer SR-22 filing, find an insurer who does.

- Obtain Coverage: Secure the minimum liability insurance coverage required by Wisconsin law.

- SR-22 Filing: Your insurer will file the SR-22 electronically with the Wisconsin DOT. You will likely receive confirmation of this filing.

- Maintain Coverage: Continuously maintain the required insurance coverage throughout the period specified by the court. Notify your insurer immediately of any changes to your policy or driving status.

- Renewal: Before the SR-22 expires, work with your insurer to renew your policy and ensure the SR-22 is refiled with the DOT. This is usually done automatically by the insurer.

Illustrative Examples of Car Insurance Scenarios in Wisconsin

Understanding the practical implications of Wisconsin’s car insurance laws is best done through real-world examples. These scenarios highlight the financial consequences of inadequate coverage and the benefits of choosing appropriate insurance plans. They also demonstrate how driving habits significantly influence premium costs.

The Financial Impact of an Accident Without Adequate Insurance

Imagine Sarah, a young Wisconsin resident, involved in a car accident. She carries only the state-mandated minimum liability coverage of $25,000 per person and $50,000 per accident. Unfortunately, the accident severely injures the other driver, resulting in $100,000 in medical bills and lost wages. Sarah’s insurance policy only covers $25,000 of the other driver’s medical expenses. The remaining $75,000 becomes Sarah’s personal responsibility. This could lead to significant financial hardship, potentially including wage garnishment, lawsuits, and the inability to pay other bills. She could face bankruptcy and severely damaged credit. The accident’s financial burden extends far beyond the immediate cost of repairs to her vehicle. This scenario underscores the critical importance of carrying higher liability limits than the minimum required.

The Benefits of Comprehensive Coverage

Consider Mark, another Wisconsin driver. He opts for comprehensive coverage in addition to liability insurance. One night, a tree falls on his parked car during a severe storm, causing extensive damage. Comprehensive coverage steps in, covering the cost of repairs, minus any applicable deductible. Without this coverage, Mark would be solely responsible for the substantial repair bill, potentially thousands of dollars. Later that year, his car is broken into, and his stereo system is stolen. Again, his comprehensive coverage helps him replace the stolen items. These examples illustrate how comprehensive coverage provides a safety net against unexpected events, protecting him from significant financial losses.

How Different Driving Habits Affect Insurance Premiums

Let’s compare two Wisconsin drivers, John and Jane. Both are the same age and drive similar vehicles. John maintains a clean driving record, drives cautiously, and completes a defensive driving course. He opts for a higher deductible to lower his premiums. Jane, on the other hand, has several speeding tickets and an at-fault accident on her record. She also frequently makes high-risk driving choices and declines the opportunity for discounts. As a result, John’s insurance premiums are considerably lower than Jane’s. This highlights how responsible driving and proactive choices can lead to substantial savings on car insurance costs. Insurance companies use a driver’s history to assess risk, and those with a history of accidents and violations are considered higher-risk and charged accordingly.

Closing Notes

Choosing the right car insurance in Wisconsin involves careful consideration of legal obligations, personal risk assessment, and financial planning. By understanding the minimum requirements, the various coverage options, and the factors influencing premiums, you can make informed decisions that protect both your finances and your future. Remember to regularly review your policy and compare quotes to ensure you maintain optimal coverage at the best possible price. Proactive management of your car insurance is an investment in your peace of mind and financial well-being.

Helpful Answers

What happens if I get into an accident without enough insurance?

You could face significant financial penalties, including hefty fines, license suspension, and legal action from the other party involved. Your ability to drive legally in Wisconsin could be severely impacted.

Can I get car insurance if I have a bad driving record?

Yes, but it will likely be more expensive. Companies assess risk, and a poor driving record indicates higher risk. You might need to shop around for insurers specializing in high-risk drivers.

How often should I review my car insurance policy?

At least annually, and especially after any significant life changes (new car, address change, marriage, etc.). Rates and your needs can change over time.

What is the difference between collision and comprehensive coverage?

Collision covers damage to your car from accidents, regardless of fault. Comprehensive covers damage from non-accident events like theft, vandalism, or weather.

How do I file a claim with my insurance company?

Contact your insurer immediately after an accident. Follow their specific claims process, providing all necessary information and documentation.