Securing the right car insurance in Utah is more than just fulfilling a legal requirement; it’s about safeguarding your financial future. Understanding Utah’s unique insurance landscape, from minimum coverage stipulations to the factors influencing premium costs, is crucial for every driver. This guide unravels the complexities of Utah car insurance, empowering you to make informed decisions and protect yourself on the road.

This comprehensive resource delves into the specifics of Utah’s car insurance requirements, offering insights into various coverage types, the impact of driving history on premiums, and strategies for finding affordable yet comprehensive insurance. We’ll explore the state’s specific laws and regulations, addressing common concerns and providing practical advice to help you navigate the process with confidence.

Understanding Utah Car Insurance Requirements

Driving in Utah requires understanding the state’s car insurance laws to ensure you’re legally protected and avoid potential penalties. This information Artikels the minimum coverage requirements, penalties for non-compliance, available coverage types, and how Utah’s points system affects insurance premiums.

Minimum Liability Insurance Coverage in Utah

Utah mandates minimum liability insurance coverage to protect others involved in accidents you may cause. This minimum coverage includes $25,000 for bodily injury to one person, $50,000 for bodily injury to multiple people in a single accident, and $15,000 for property damage. This means that if you cause an accident resulting in injuries or property damage exceeding these amounts, you are personally liable for the difference. It is strongly recommended to carry higher liability limits to adequately protect yourself from significant financial losses.

Penalties for Driving Without Insurance in Utah

Driving without the minimum required insurance in Utah carries serious consequences. These penalties can include fines, license suspension, and even vehicle impoundment. The fines can be substantial, varying depending on the circumstances and whether it’s a first or subsequent offense. A driver’s license suspension will prevent you from legally operating a vehicle, and vehicle impoundment means your car will be towed and held until insurance is provided. These penalties can significantly impact your driving record and financial stability.

Types of Car Insurance Coverage Available in Utah

Beyond the mandatory liability coverage, several other types of insurance are available to provide more comprehensive protection.

Collision Coverage: This covers damage to your vehicle caused by accidents, regardless of fault. For example, if you hit a tree or another car, collision coverage will pay for repairs or replacement, minus your deductible.

Comprehensive Coverage: This covers damage to your vehicle from non-accident events, such as theft, vandalism, fire, or hail. If your car is stolen or damaged by a hailstorm, comprehensive coverage will help with the repair or replacement costs.

Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical expenses and vehicle damage if the other driver’s insurance is insufficient to cover your losses. This is particularly important in Utah, where some drivers may not carry adequate insurance.

Medical Payments Coverage: This coverage helps pay for medical expenses for you and your passengers, regardless of fault, following an accident. It’s a valuable addition to your policy, providing quicker access to funds for necessary medical care.

Utah’s Points System and Its Impact on Insurance Rates

Utah utilizes a points system to track driving infractions. Points are assigned for various violations, such as speeding tickets, accidents, and driving under the influence (DUI). Accumulating points can lead to increased insurance premiums. Insurance companies consider your driving record when determining your rates, and a higher number of points typically results in higher premiums. For example, a DUI conviction will significantly increase your insurance costs due to the high risk associated with this offense. Maintaining a clean driving record is crucial for keeping your insurance rates affordable.

Finding and Comparing Car Insurance in Utah

Finding the right car insurance in Utah can feel overwhelming with so many providers and policy options. This section will guide you through comparing providers, utilizing available resources, and obtaining quotes to secure the best coverage at a competitive price. Understanding your needs and comparing options is key to finding the best fit for your budget and driving profile.

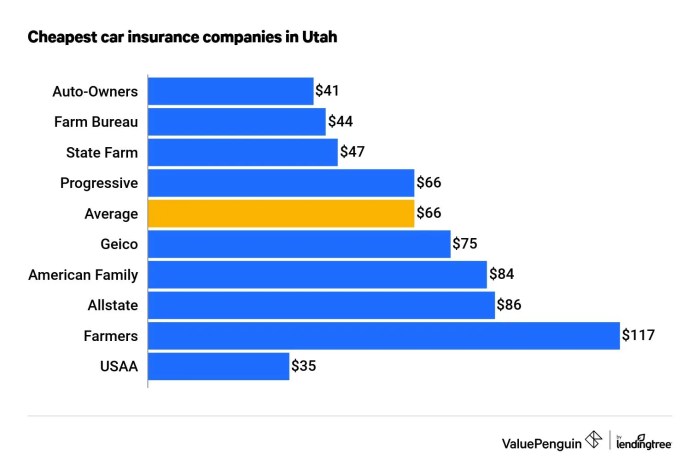

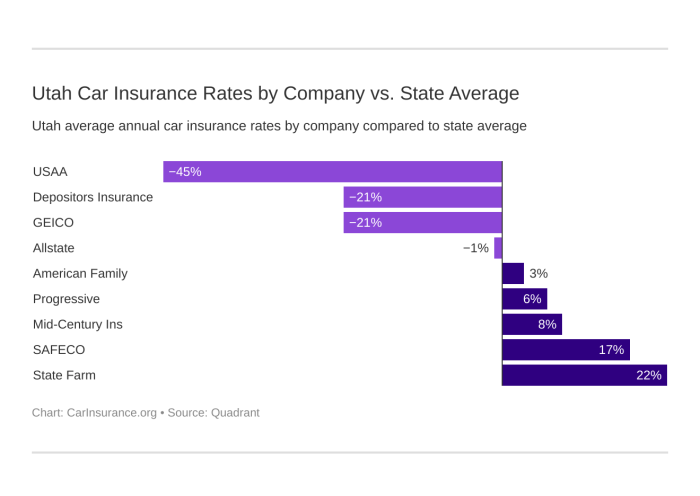

Comparison of Major Car Insurance Providers in Utah

Choosing a car insurance provider involves careful consideration of factors beyond just price. Coverage limits, deductibles, and additional features significantly impact the overall value of a policy. The following table provides a comparison of three major providers in Utah, though specific pricing will vary based on individual circumstances. Remember to always get personalized quotes from each company.

| Provider | Average Annual Premium (Estimate) | Key Features | Customer Service Rating (Example) |

|---|---|---|---|

| Progressive | $1200 – $1800 | Name Your Price® Tool, accident forgiveness, roadside assistance | 4.5/5 stars (based on independent surveys) |

| Geico | $1100 – $1700 | Easy online quote process, 24/7 claims service, various discounts | 4.2/5 stars (based on independent surveys) |

| State Farm | $1300 – $1900 | Wide range of coverage options, strong local agent network, Drive Safe & Save® program | 4.4/5 stars (based on independent surveys) |

*Note: These are estimated average annual premiums and may vary significantly based on factors such as age, driving history, vehicle type, location, and coverage level. Contact each provider directly for an accurate quote.*

Resources for Finding Car Insurance Quotes in Utah

Several resources can assist in finding car insurance quotes. Utilizing these tools allows for efficient comparison shopping and helps ensure you’re getting the best possible rate.

Finding competitive car insurance quotes in Utah is simplified through various online platforms and local agents. These resources streamline the comparison process and empower consumers to make informed decisions.

- Online Comparison Tools: Websites like The Zebra, Insurify, and Policygenius allow you to compare quotes from multiple insurers simultaneously.

- Independent Insurance Agents: These agents represent multiple insurance companies, providing access to a wider range of options and personalized advice.

- Direct from Insurance Companies: Obtain quotes directly from individual insurance company websites (e.g., Progressive, Geico, State Farm).

Steps to Obtain Car Insurance Quotes in Utah

The process of obtaining car insurance quotes involves gathering necessary information and utilizing available resources. Following these steps will ensure a smoother and more efficient experience.

- Gather Information: Collect details such as your driver’s license information, vehicle information (year, make, model, VIN), and your desired coverage levels.

- Use Online Comparison Tools: Enter your information into online comparison websites to receive multiple quotes simultaneously.

- Contact Insurance Companies Directly: Reach out to individual insurance providers to get personalized quotes.

- Compare Quotes: Carefully review each quote, paying close attention to coverage levels, premiums, and deductibles.

- Choose a Policy: Select the policy that best meets your needs and budget.

- Purchase Policy: Complete the purchase process with your chosen provider.

Tips for Negotiating Lower Car Insurance Premiums in Utah

Several strategies can help you negotiate lower car insurance premiums. Proactive steps can lead to significant savings over the policy’s lifespan.

Negotiating lower premiums requires a strategic approach, combining research with effective communication. By leveraging these tips, you can potentially secure more affordable car insurance.

- Shop Around: Compare quotes from multiple insurers to identify the most competitive rates.

- Bundle Policies: Combine your car insurance with other policies, such as homeowners or renters insurance, to potentially receive discounts.

- Improve Your Driving Record: Maintain a clean driving record to qualify for lower premiums. Defensive driving courses can also help.

- Increase Your Deductible: Raising your deductible can lower your premium, but be prepared to pay more out-of-pocket in the event of a claim.

- Consider Telematics Programs: Some insurers offer telematics programs that track your driving habits. Safe driving can result in premium discounts.

- Ask About Discounts: Inquire about available discounts, such as good student, multi-car, or military discounts.

Understanding Utah’s High-Risk Driver Insurance Market

Navigating the car insurance landscape in Utah can be challenging, especially for drivers considered high-risk. This section clarifies the options, costs, and processes involved for individuals with a less-than-perfect driving record. Understanding these factors is crucial for securing affordable and appropriate coverage.

High-risk drivers in Utah, typically those with multiple accidents, serious violations (like DUIs), or prior lapses in insurance coverage, face significantly higher premiums than those with clean driving records. Insurance companies assess risk based on statistical data correlating driving history with accident likelihood. This leads to a higher-risk classification and consequently, more expensive insurance.

Insurance Options for High-Risk Drivers

Several options exist for high-risk drivers seeking car insurance in Utah. These range from specialized high-risk insurers to state-mandated programs, each with its own implications for cost and coverage. It’s important to compare options carefully to find the best fit for individual needs and budgets. Some insurers may offer more lenient underwriting practices than others. Non-standard insurers, specializing in high-risk drivers, often provide coverage, although at a higher premium. Working with an independent insurance agent can be beneficial in navigating these options.

Cost Comparison: Utah vs. National Averages

Precise cost comparisons between Utah and national averages for high-risk drivers are difficult to pinpoint due to the variability in factors like age, vehicle type, and specific violations. However, it’s generally accepted that high-risk insurance costs tend to be higher in Utah compared to national averages, though the extent of the difference varies greatly depending on the driver’s profile. A driver with multiple DUIs in Utah, for example, might pay substantially more than a similar driver in a state with a less stringent regulatory environment or lower average claim costs. This disparity often stems from factors such as Utah’s specific regulations, the cost of healthcare, and the prevalence of certain types of accidents.

Finding Affordable Insurance for High-Risk Drivers

Finding affordable insurance as a high-risk driver requires proactive research and strategic approaches. Begin by comparing quotes from multiple insurers, including those specializing in non-standard auto insurance. Consider factors like the type of coverage needed, deductibles, and payment options. Improving your driving record through defensive driving courses can demonstrate a commitment to safer driving and potentially lead to lower premiums over time. Maintaining continuous insurance coverage is also vital, as gaps in coverage can significantly impact future rates. Exploring discounts for things like bundling policies or safety features on your vehicle can also help.

Appealing an Insurance Rate Increase

If you believe your insurance rate increase is unjustified, you have the right to appeal. This usually involves contacting your insurer directly and providing documentation to support your case. This documentation might include evidence of improved driving habits, completion of defensive driving courses, or any mitigating circumstances surrounding past accidents or violations. Understanding the specific reasons for the increase is the first step. If an informal appeal is unsuccessful, you may need to explore further options, potentially involving regulatory bodies or legal counsel. It is advisable to carefully review your policy and any supporting documentation before initiating an appeal.

Illustrative Examples of Utah Car Insurance Scenarios

Understanding the practical application of Utah’s car insurance laws is crucial. The following scenarios illustrate common situations Utah drivers may encounter, highlighting the importance of adequate coverage and responsible driving.

Minor Car Accident Claims Process

Imagine Sarah, a Utah resident, is involved in a minor fender bender. Her car sustains $2,000 in damage, and the other driver’s car has $1,500 in damage. Both drivers exchange information, including insurance details. Sarah contacts her insurance company, reporting the accident and providing the necessary documentation, such as police reports (if applicable) and photos of the damage. Her insurance company initiates a claims process, investigating the accident and assessing the damages. Depending on her policy and the at-fault determination, Sarah’s insurer might cover her damages and potentially pursue reimbursement from the other driver’s insurance. The process could involve appraisals, negotiations, and potentially legal action if a settlement cannot be reached. This scenario demonstrates the importance of having comprehensive coverage to protect against unexpected repair costs. The process typically involves multiple steps and can take several weeks to resolve.

Significant Rate Increase Following DUI Conviction

John, a Utah driver, is convicted of driving under the influence (DUI). His insurance company, upon learning of the conviction, significantly increases his premiums. This increase reflects the heightened risk associated with DUI offenders. Insurance companies view DUI convictions as indicators of increased likelihood of future accidents. The rate increase could be substantial, potentially doubling or tripling his previous premium. In some cases, insurance companies may even cancel his policy altogether, forcing him to seek high-risk insurance, which typically comes with even higher premiums and more restrictive coverage options. This scenario highlights the severe financial consequences of DUI convictions beyond the legal penalties. The increase is not arbitrary; it’s based on actuarial data showing a higher accident rate among DUI offenders.

Benefits of Uninsured/Underinsured Motorist Coverage

Maria, a Utah driver with comprehensive insurance, including uninsured/underinsured motorist (UM/UIM) coverage, is struck by an uninsured driver. The other driver’s negligence causes significant injuries and $50,000 in damages to Maria’s vehicle. Without UM/UIM coverage, Maria would be responsible for covering her medical bills and vehicle repairs herself. However, because she has UM/UIM coverage, her own insurance policy covers her medical expenses and vehicle damage, even though the at-fault driver is uninsured. This scenario underscores the critical role of UM/UIM coverage in protecting drivers from the financial burden of accidents caused by uninsured or underinsured motorists, a common occurrence in Utah and nationwide. The specific coverage limits Maria has will determine the extent of her reimbursement.

Conclusive Thoughts

Successfully navigating the world of Utah car insurance requires a blend of understanding and proactive planning. By carefully considering your individual needs, comparing different providers, and staying informed about relevant laws and regulations, you can secure the optimal coverage at a price that fits your budget. Remember, the right car insurance isn’t just a policy; it’s a shield protecting you from unforeseen circumstances on Utah’s roads.

FAQ Insights

What happens if I get into an accident without car insurance in Utah?

Driving without insurance in Utah results in significant penalties, including fines, license suspension, and potential legal repercussions if you’re at fault in an accident.

Can I get car insurance if I have a DUI on my record in Utah?

Yes, but it will likely be more expensive. High-risk insurance providers specialize in insuring drivers with less-than-perfect driving records.

How often can I expect my car insurance rates to change in Utah?

Rates can change annually, or even more frequently, depending on factors like your driving record, claims history, and changes in your personal circumstances.

What is the difference between liability and comprehensive coverage in Utah?

Liability coverage protects you financially if you cause an accident, while comprehensive coverage protects your vehicle from damage caused by non-collision events (e.g., theft, vandalism, hail).