Securing affordable and comprehensive car insurance in Florida can feel like navigating a complex maze. This guide provides a clear path, illuminating the intricacies of the Florida car insurance market and empowering you to make informed decisions. We’ll explore the factors influencing premiums, compare coverage options, and equip you with strategies to find the best car insurance quotes tailored to your needs.

From understanding Florida’s unique regulatory landscape to mastering the art of comparing quotes and negotiating premiums, this comprehensive resource will serve as your trusted companion throughout the process. We’ll delve into the key factors that determine your insurance costs, including your driving history, age, location, and the type of coverage you choose. Ultimately, our aim is to demystify the process, ensuring you secure the best possible car insurance protection at a price that fits your budget.

Understanding Florida’s Car Insurance Market

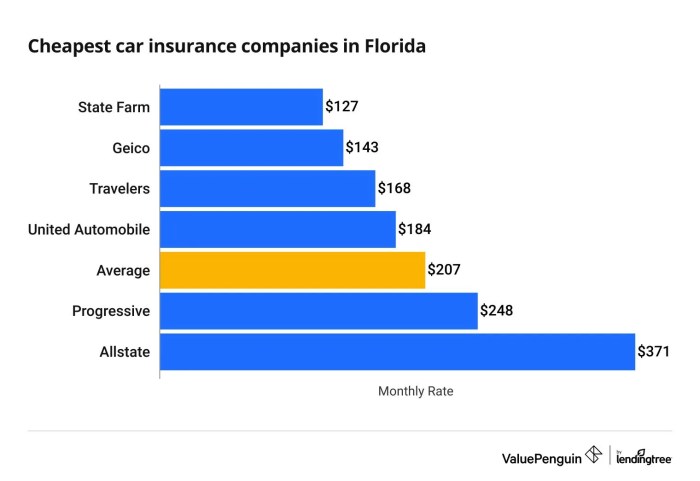

Florida’s car insurance market is notoriously complex and competitive, presenting unique challenges and opportunities for drivers. High population density, a significant number of tourists, and a susceptibility to severe weather events all contribute to a higher-than-average number of accidents and claims, impacting insurance costs. Understanding the nuances of this market is crucial for securing affordable and adequate coverage.

Florida’s car insurance premiums are influenced by a multitude of factors. These include the driver’s age, driving history (including accidents and traffic violations), credit score, type of vehicle, coverage levels, and location. The state’s geographic location, with its high frequency of severe weather events like hurricanes, also plays a significant role in premium calculations. Furthermore, the state’s legal environment, including its no-fault insurance system, influences the cost of insurance.

Factors Influencing Florida Car Insurance Premiums

Several key factors significantly impact the cost of car insurance in Florida. A driver’s age is a major determinant, with younger drivers typically paying higher premiums due to statistically higher accident rates. Driving history is another critical factor; multiple accidents or traffic violations will generally lead to increased premiums. Credit scores are also increasingly used by insurance companies to assess risk, with those possessing lower credit scores often facing higher premiums. The type of vehicle insured also matters; sports cars and luxury vehicles often command higher premiums than more economical models. The level of coverage chosen directly affects the premium; higher coverage limits result in higher costs. Finally, location plays a crucial role, as areas with higher accident rates or higher crime rates will usually have higher premiums.

Comparison of Florida’s Insurance Regulations with Other States

Florida’s insurance regulations differ significantly from those in other states. Florida operates under a “no-fault” insurance system, meaning that drivers are primarily responsible for their own medical expenses after an accident, regardless of fault. This system, while aiming to reduce litigation, can still lead to higher premiums due to the costs associated with Personal Injury Protection (PIP) coverage. Other states utilize a variety of systems, including “tort” systems, where fault is determined and the at-fault driver’s insurance is responsible for damages. The level of required coverage also varies widely between states. For instance, minimum liability coverage requirements in Florida are relatively low compared to some other states. This difference influences both the cost and the extent of protection offered by insurance policies.

Common Car Insurance Coverage Options in Florida

Several common car insurance coverage options are available in Florida. These include:

- Bodily Injury Liability: Covers medical expenses and other damages for injuries caused to others in an accident.

- Property Damage Liability: Covers the cost of repairing or replacing another person’s vehicle or property damaged in an accident.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for the policyholder and passengers in their vehicle, regardless of fault. This is mandatory in Florida.

- Uninsured/Underinsured Motorist (UM/UIM): Protects the policyholder in the event of an accident with an uninsured or underinsured driver.

- Collision: Covers damage to the policyholder’s vehicle resulting from an accident, regardless of fault.

- Comprehensive: Covers damage to the policyholder’s vehicle caused by events other than collisions, such as theft, vandalism, or weather damage.

Understanding these coverage options and their implications is vital for making informed decisions about car insurance in Florida. The appropriate level of coverage will vary depending on individual circumstances and risk tolerance.

Types of Car Insurance Coverage in Florida

Choosing the right car insurance in Florida involves understanding the various coverage options available. This ensures you have the appropriate protection while complying with state regulations. The types of coverage range from legally mandated minimums to more comprehensive plans offering broader protection.

Florida’s Minimum Car Insurance Requirements

Florida law mandates a minimum level of liability coverage for all drivers. This means you must carry at least $10,000 in Property Damage Liability coverage and $10,000 in Bodily Injury Liability coverage per person, with a total of $20,000 per accident. This coverage protects others if you cause an accident resulting in damage to their property or injuries. Failure to carry this minimum coverage can result in significant penalties, including license suspension and fines.

Liability Coverage

Liability insurance covers damages you cause to others in an accident. This includes medical bills, lost wages, and property repair costs for the other party. The amount of coverage you choose determines the maximum amount your insurer will pay. Higher liability limits offer greater protection against substantial claims. For example, a $100,000/$300,000 policy would pay up to $100,000 for injuries to one person and up to $300,000 for all injuries in a single accident. While the minimum is legally required, many drivers opt for higher limits to safeguard against potentially catastrophic financial losses.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This is optional coverage, but it’s highly recommended. If you’re involved in a collision, even if you weren’t at fault, collision coverage will help cover the costs of repairing your vehicle. For example, if a deer runs into your car, your collision coverage will help pay for the repairs, even though the deer is not at fault. The deductible, the amount you pay out-of-pocket before the insurance kicks in, is a factor in the cost.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or falling objects. Similar to collision coverage, this is optional, but it offers peace of mind against unexpected events. Imagine a tree falling on your car during a storm; comprehensive coverage would help pay for the repairs. Again, deductibles influence the overall cost.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It can cover your medical bills, lost wages, and vehicle repairs. Given the prevalence of uninsured drivers in Florida, this coverage provides crucial protection. For instance, if an uninsured driver causes an accident resulting in your injuries and significant vehicle damage, your uninsured/underinsured motorist coverage will help compensate for your losses.

Personal Injury Protection (PIP)

PIP coverage pays for your medical bills and lost wages, regardless of who caused the accident. It also covers your passengers. Florida requires PIP coverage, though the minimum is often insufficient to cover substantial medical expenses. While PIP is mandated, the coverage amount is a key consideration, with higher limits offering more comprehensive protection. A scenario where this would be beneficial is a single-car accident where you are injured. Your PIP would cover your medical bills even though there was no other party involved.

Saving Money on Car Insurance in Florida

Securing affordable car insurance in Florida is achievable through proactive strategies and a keen understanding of the market. By implementing certain measures and taking advantage of available options, drivers can significantly reduce their premiums without compromising necessary coverage. This section Artikels effective methods for lowering your car insurance costs.

Maintaining a Good Driving Record

A clean driving record is arguably the most significant factor influencing your car insurance premium. Insurance companies view drivers with a history of accidents and traffic violations as higher risks, leading to increased premiums. Conversely, a spotless record demonstrates responsible driving habits, making you a more attractive customer to insurers. Even minor infractions like speeding tickets can result in noticeable premium increases. Maintaining a clean record involves defensive driving practices, adhering to traffic laws, and avoiding any incidents that could lead to accidents or citations. The cumulative effect of accident-free years can translate to substantial savings over time. For example, a driver with five years of accident-free driving might qualify for a significant discount compared to someone with recent accidents.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, is a common and effective way to save money. Many insurance companies offer discounts for bundling, recognizing that a multi-policy customer is less likely to switch providers. This loyalty translates into lower premiums for all bundled policies. The exact savings will vary depending on the insurer and the specific policies bundled, but it’s often a substantial percentage reduction. For instance, bundling car and homeowners insurance could potentially save a homeowner 10-15% or more on their annual premiums.

Utilizing Available Discounts

Florida insurance companies offer a range of discounts designed to incentivize safe driving practices and responsible behavior. These discounts can significantly reduce your overall premium. Common discounts include:

- Good Student Discount: Offered to students maintaining a certain GPA.

- Defensive Driving Course Discount: Completing an approved defensive driving course often results in a discount.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can reduce your premium.

- Multi-car Discount: Insuring multiple vehicles under the same policy often qualifies for a discount.

- Pay-in-full Discount: Paying your premium in full upfront may result in a discount.

- Vehicle Safety Features Discount: Cars equipped with advanced safety features, such as anti-lock brakes or airbags, may qualify for a discount.

It’s crucial to inquire about all available discounts with your insurer. The availability and amount of each discount can vary between companies, so comparing quotes is vital to finding the best deal. For example, one company might offer a larger discount for good students, while another might offer a more substantial discount for anti-theft devices.

Last Point

Finding the right car insurance in Florida requires careful consideration of various factors and a strategic approach to comparing quotes. By understanding the intricacies of the market, leveraging online resources effectively, and strategically choosing your coverage, you can secure the best possible protection at a competitive price. Remember to regularly review your policy and explore options for discounts to ensure you remain adequately covered and financially responsible. Armed with the knowledge presented here, you can confidently navigate the Florida car insurance landscape and secure the coverage you need.

FAQs

What is the minimum car insurance coverage required in Florida?

Florida requires a minimum of $10,000 in Property Damage Liability and $10,000 in Personal Injury Protection (PIP).

How does my credit score affect my car insurance rates?

In Florida, insurers can consider your credit score when determining your premiums. A higher credit score generally translates to lower rates.

Can I get car insurance quotes without providing my personal information?

While some sites offer initial quote estimations without full details, you’ll generally need to provide more information to get a precise quote.

What is Uninsured/Underinsured Motorist coverage and why is it important in Florida?

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It’s crucial in Florida due to the high number of uninsured drivers.