Navigating the world of auto insurance in California can feel like driving through a dense fog. High costs and complex policies often leave drivers feeling overwhelmed and unsure of how to secure affordable coverage. This guide cuts through the confusion, providing a clear and concise path to finding cheap auto insurance in California, equipping you with the knowledge and strategies to secure the best possible rates without compromising necessary protection.

We’ll explore the key factors that influence insurance premiums, reveal effective strategies for reducing costs, and guide you through the process of comparing quotes and selecting the right policy. From understanding minimum coverage requirements to leveraging discounts and negotiating premiums, this guide empowers you to become a savvy consumer in the California auto insurance market.

Understanding California’s Auto Insurance Market

California’s auto insurance market is a complex landscape shaped by numerous factors, resulting in a wide range of premiums and coverage options. Understanding these factors is crucial for securing affordable and adequate protection.

Factors Influencing Auto Insurance Costs in California

Several key factors significantly impact the cost of auto insurance in California. These include the driver’s age and driving history (younger drivers and those with accidents or violations typically pay more), the type and age of the vehicle (newer, more expensive cars generally cost more to insure), location (urban areas often have higher rates due to increased accident risk), credit history (poor credit can lead to higher premiums), and the type and amount of coverage selected (more comprehensive coverage naturally costs more). Additionally, the insurer’s own risk assessment models and competitive pricing strategies play a role.

Types of Auto Insurance Coverage in California

California law mandates specific minimum coverage levels, but drivers can opt for more extensive protection. The primary types of coverage include liability coverage (bodily injury and property damage), which covers injuries or damages caused to others in an accident; uninsured/underinsured motorist (UM/UIM) coverage, protecting you if involved in an accident with an uninsured or underinsured driver; collision coverage, repairing or replacing your vehicle after an accident regardless of fault; and comprehensive coverage, covering damage from events other than collisions, such as theft, vandalism, or weather-related damage. Medical payments coverage (Med-Pay) can cover medical expenses for you and your passengers, regardless of fault.

Minimum Coverage Requirements vs. Recommended Coverage

California’s minimum liability coverage requirements are $15,000 for injuries or death to one person, $30,000 for injuries or death to multiple people in a single accident, and $5,000 for property damage. While meeting the minimum is legally sufficient, it may be inadequate to cover significant medical bills or property damage in a serious accident. Recommended coverage levels often exceed the minimum substantially, offering greater financial protection. For instance, many financial advisors suggest liability limits of $100,000/$300,000 or higher, along with uninsured/underinsured motorist coverage matching or exceeding liability limits. Adding collision and comprehensive coverage, while optional, is highly advisable to protect your vehicle investment.

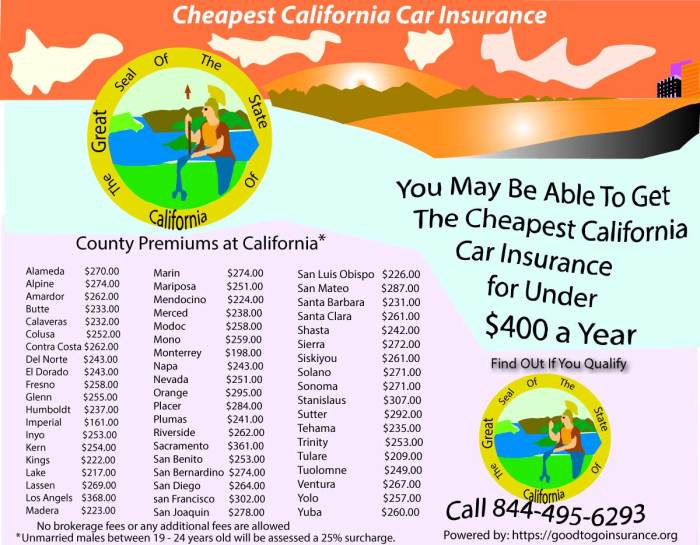

Average Insurance Premiums Across Major California Cities

The following table provides a comparison of average annual auto insurance premiums for a hypothetical 30-year-old driver with a clean driving record, driving a mid-sized sedan, and opting for minimum coverage in several major California cities. Note that these are estimates and actual premiums will vary depending on individual circumstances.

| City | Average Annual Premium (Estimate) |

|---|---|

| Los Angeles | $1,800 |

| San Francisco | $1,950 |

| San Diego | $1,650 |

| Sacramento | $1,500 |

Finding Affordable Auto Insurance Options

Securing affordable auto insurance in California requires a strategic approach. Understanding the factors influencing your premiums and exploring various policy options are crucial steps towards finding the best coverage at a price that fits your budget. This section Artikels key strategies and considerations to help you navigate the California auto insurance market effectively.

Strategies for Reducing Auto Insurance Premiums

Several strategies can significantly lower your California auto insurance premiums. Maintaining a clean driving record is paramount, as accidents and traffic violations directly impact your rates. Choosing a higher deductible can also reduce your premiums, although this means you’ll pay more out-of-pocket in the event of a claim. Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, from the same provider often results in discounts. Consider opting for a less expensive vehicle; the make, model, and year of your car heavily influence insurance costs. Finally, exploring discounts offered by your insurer for safe driving practices, such as completing a defensive driving course, can lead to savings.

Types of Auto Insurance Policies: Benefits and Drawbacks

California requires minimum liability coverage, protecting you financially if you cause an accident resulting in injury or property damage to others. Liability insurance, however, doesn’t cover your own vehicle’s damage. Collision coverage pays for repairs or replacement of your vehicle following an accident, regardless of fault. Comprehensive coverage protects against damage from events other than collisions, such as theft, vandalism, or natural disasters. While collision and comprehensive offer broader protection, they come with higher premiums. Weighing the potential costs of repairs or replacement against the added premium cost is crucial when deciding which coverages are necessary. For example, an older vehicle might not warrant the expense of collision and comprehensive coverage, while a newer, more expensive car would likely benefit from this broader protection.

Impact of Driving History and Credit Score on Insurance Rates

Your driving history is a major factor influencing your insurance rates. A clean record with no accidents or violations typically translates to lower premiums. Conversely, accidents, speeding tickets, and DUI convictions can significantly increase your rates. In California, insurers can also consider your credit score when determining your premiums. A good credit score often correlates with lower rates, while a poor credit score can lead to higher premiums. This practice is subject to certain regulations and varies among insurers. Improving your driving record and credit score can positively impact your insurance costs over time. For instance, maintaining a clean driving record for several years can lead to lower premiums, reflecting the reduced risk you present to the insurer.

Checklist for Comparing Insurance Quotes

Before selecting an auto insurance policy, it’s essential to compare quotes from multiple insurers. This checklist can assist you in the process:

- Coverage Levels: Compare liability limits, collision, and comprehensive coverage options.

- Deductibles: Evaluate the impact of different deductible amounts on your premium.

- Discounts: Inquire about available discounts for bundling, safe driving, and other factors.

- Customer Service: Consider the insurer’s reputation for customer service and claims handling.

- Financial Stability: Research the insurer’s financial strength and stability.

Obtaining multiple quotes allows you to compare prices and coverage options, ensuring you find the best value for your needs. Remember to provide consistent information across all quotes to ensure an accurate comparison.

Discounts and Savings Opportunities

Securing affordable auto insurance in California often hinges on understanding and leveraging the various discounts available. Many insurers offer a range of programs designed to reward safe driving habits and responsible vehicle ownership. By strategically exploring these options and utilizing comparison tools, you can significantly reduce your premium costs.

Common Auto Insurance Discounts in California

California auto insurers frequently offer discounts based on several key factors. These discounts can significantly lower your premiums, making insurance more manageable. Understanding these options is crucial for finding the best deal.

- Good Driver Discounts: Insurers reward drivers with clean driving records, typically offering discounts for accident-free periods of three or more years. The specific discount percentage varies by insurer and the length of your clean driving history.

- Bundling Discounts: Combining your auto insurance with other insurance policies, such as homeowners or renters insurance, from the same company often results in a substantial discount. This bundled approach simplifies your insurance management and usually saves you money.

- Safety Feature Discounts: Vehicles equipped with advanced safety features, such as anti-theft devices, airbags, anti-lock brakes (ABS), and electronic stability control (ESC), often qualify for discounts. These features demonstrate a commitment to safety, which insurers reward.

- Defensive Driving Course Discounts: Completing a state-approved defensive driving course can lead to a discount. These courses teach safer driving techniques and demonstrate a commitment to responsible driving habits.

- Multi-Car Discounts: Insuring multiple vehicles under one policy with the same insurer usually qualifies for a discount. This reflects the reduced risk associated with insuring several cars from a single household.

- Good Student Discounts: Students maintaining a high grade point average (GPA) may qualify for discounts. This reflects the insurer’s assessment of lower risk associated with responsible students.

Comparing Insurer Discount Programs

Different insurers offer varying discount programs and structures. Some may offer higher percentages for specific discounts, while others may have more comprehensive discount packages. For example, one insurer might offer a larger discount for bundling policies, while another might prioritize discounts for safety features. Direct comparison of individual insurer offerings is essential.

Utilizing Online Comparison Tools to Find Discounts

Online comparison tools streamline the process of finding discounts. These platforms allow you to input your personal information and vehicle details, generating quotes from multiple insurers simultaneously. Many tools highlight available discounts based on your profile. Remember to accurately provide all relevant information to ensure accurate discount calculations. Pay close attention to the fine print of each quote to understand precisely which discounts are applied and their impact on the final premium.

Tips for Negotiating Lower Insurance Premiums

While discounts are often pre-determined, there are strategies to negotiate lower premiums.

- Shop around: Obtaining quotes from multiple insurers is crucial. This allows for a direct comparison of premiums and discounts offered.

- Review your coverage: Evaluate your current coverage levels. Reducing unnecessary coverage can lower your premium. However, be mindful of maintaining adequate protection.

- Increase your deductible: Raising your deductible (the amount you pay out-of-pocket before insurance coverage begins) can lower your premium. This is a trade-off—a higher deductible means you’ll pay more in the event of a claim.

- Maintain a good driving record: This is the most impactful way to lower your premiums over the long term. Safe driving habits are consistently rewarded with discounts.

- Pay in full: Some insurers offer discounts for paying your premium in one lump sum rather than installments.

- Bundle policies: As mentioned earlier, combining your auto insurance with other insurance types from the same provider can lead to significant savings.

Understanding Insurance Policies

Choosing the right auto insurance policy in California requires understanding its key components. A standard policy Artikels the coverage you receive in the event of an accident or other covered incident. This understanding will help you make informed decisions about your coverage and ensure you’re adequately protected.

Key Components of a California Auto Insurance Policy

A typical California auto insurance policy includes several key components. These components define the scope of coverage and the responsibilities of both the insurer and the insured. Understanding these components is crucial for making informed decisions.

- Liability Coverage: This covers bodily injury and property damage you cause to others in an accident. It’s usually expressed as a three-number combination (e.g., 15/30/5), representing the maximum amounts paid for bodily injury per person ($15,000), bodily injury per accident ($30,000), and property damage per accident ($5,000).

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle repairs.

- Collision Coverage: This covers damage to your vehicle regardless of fault, such as in a collision with another car or an object. You pay a deductible before the insurance company covers the remaining costs.

- Comprehensive Coverage: This covers damage to your vehicle from non-collision events, such as theft, vandalism, fire, or hail. Like collision, a deductible applies.

- Medical Payments Coverage (Med-Pay): This covers medical expenses for you and your passengers, regardless of fault. It’s often a supplemental coverage that can help with immediate medical costs.

Filing a Claim

The process of filing a claim generally involves reporting the accident to the police (if necessary), contacting your insurance company as soon as possible, providing detailed information about the accident, and cooperating with the investigation. Your insurer will guide you through the process, which may involve providing documentation such as police reports, medical records, and repair estimates. Prompt notification is vital for a smooth claims process.

Common Exclusions and Limitations

It’s important to be aware that auto insurance policies usually have exclusions and limitations. Understanding these helps manage expectations and avoid misunderstandings.

- Driving under the influence (DUI): Most policies will not cover damages caused while driving under the influence of alcohol or drugs.

- Using your vehicle for business purposes: Personal auto insurance policies typically don’t cover accidents that occur while using your vehicle for business purposes; commercial insurance is required for that.

- Damage caused by wear and tear: Normal wear and tear on your vehicle is not covered.

- Pre-existing damage: Damage that existed before the accident is not covered.

- Specific exclusions stated in the policy: Carefully read your policy for any specific exclusions or limitations.

Policy Coverage Visual Representation

Imagine a circular infographic. The center circle represents your vehicle. The next concentric circle outwards represents Collision coverage (damage to your car regardless of fault). The next circle is Comprehensive coverage (damage from non-collision events). The largest outer circle represents Liability coverage (damage you cause to others). Smaller circles within the Liability circle could represent Bodily Injury and Property Damage coverage. A separate, smaller circle outside the main circles could represent Uninsured/Underinsured Motorist coverage, illustrating its separate protection. The deductible amount for Collision and Comprehensive could be noted within their respective circles. This visual representation clearly shows the layers of protection offered by a typical auto insurance policy.

Last Point

Securing cheap auto insurance in California doesn’t have to be a daunting task. By understanding the factors that affect your premiums, actively seeking discounts, and carefully comparing quotes, you can significantly reduce your costs without sacrificing essential coverage. Remember to regularly review your policy and adjust it as your needs and circumstances change. Armed with the right knowledge and strategies, you can confidently navigate the California auto insurance landscape and find a policy that fits both your budget and your safety requirements.

Frequently Asked Questions

What is SR-22 insurance and do I need it?

SR-22 insurance is proof of liability coverage required by the state after certain driving infractions (like DUI). You only need it if mandated by the DMV.

Can I get insurance without a driving history?

Yes, but it will likely be more expensive. Insurers may offer policies to new drivers, but expect higher rates until a driving history is established.

How often can I change my car insurance policy?

You can typically change your policy whenever your current policy term ends. Some insurers may allow changes mid-term but might charge fees.

What happens if I get into an accident and don’t have enough coverage?

You could be personally liable for costs exceeding your coverage limits. This could lead to significant financial hardship.