Navigating the complex world of business often requires a robust risk management strategy. Certificate insurance, a crucial component of this strategy, provides verification of a party’s liability insurance coverage. This comprehensive guide explores the intricacies of certificate insurance, clarifying its function, benefits, and legal implications, ultimately empowering businesses to make informed decisions about their risk management protocols.

From defining certificate insurance and its various types to outlining the process of obtaining one and addressing common misconceptions, we will delve into the practical applications and legal ramifications associated with this critical document. We will also examine how certificate insurance can foster stronger relationships with clients and vendors, and ultimately contribute to a more secure business environment.

What is Certificate Insurance?

Certificate insurance, often referred to as a certificate of insurance (COI), is a document that verifies an individual or business holds a specific type of insurance policy. It doesn’t represent the actual insurance policy itself, but rather acts as proof of coverage. Its core function is to provide assurance to a third party that the insured party possesses the necessary insurance protection to mitigate potential risks associated with a specific project, contract, or activity.

Certificate insurance plays a vital role in risk management, particularly in situations where one party requires verification of the other party’s insurance coverage before commencing a business transaction or undertaking a collaborative project. This verification process helps to protect all parties involved and minimizes potential financial losses due to unforeseen incidents.

Types of Certificate Insurance

Various types of insurance policies can be represented by a certificate of insurance. The specific type of insurance included will depend on the context and requirements of the requesting party. The certificate typically specifies the policy’s coverage limits, effective dates, and the names of the insured and insurer.

Industries Utilizing Certificate Insurance

Certificate insurance is widely used across numerous industries where risk mitigation is paramount. The need for a COI often arises in contractual agreements where one party needs assurance that the other party is adequately insured against potential liabilities.

For example, the construction industry frequently uses certificate insurance to demonstrate that contractors and subcontractors maintain sufficient liability and workers’ compensation coverage. This protects the general contractor and the property owner from potential financial repercussions resulting from accidents or injuries on the job site. Similarly, event organizers often require certificate insurance from vendors and service providers to ensure protection against potential damages or losses related to their services. This is common in industries like entertainment, hospitality, and event management. Finally, companies that lease or rent out equipment often require certificate insurance from their clients to protect their assets from damage or loss. This practice is seen in industries such as construction, transportation, and manufacturing.

How Certificate Insurance Works

Certificate insurance simplifies the process of verifying an insured party’s liability coverage. It acts as a readily available proof of insurance, eliminating the need for lengthy verification processes and ensuring all parties involved in a project or transaction have the necessary assurances regarding insurance protection. This streamlined approach saves time and resources while offering crucial risk mitigation.

A certificate of insurance (COI) is not an insurance policy itself; it’s a summary of key details from an existing policy. The process of obtaining one involves a straightforward request from a third party (e.g., a client, landlord, or general contractor) to the insured party’s insurance provider. The insurance provider then issues the certificate, providing verification of the coverage in place.

Obtaining a Certificate of Insurance

The process typically begins with a request from a third party requiring proof of insurance. This request often specifies the required coverage amounts and types. The insured party then contacts their insurance provider, usually through a phone call, email, or online portal, providing the necessary details for the certificate’s creation. The insurance provider verifies the policy information and issues the certificate to both the insured and the requesting party. The entire process can often be completed within a few business days, depending on the insurer’s response time.

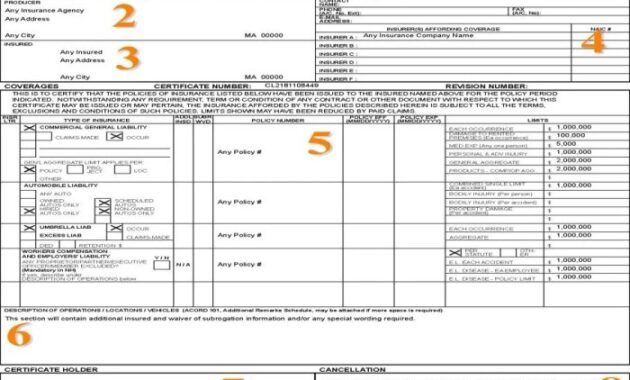

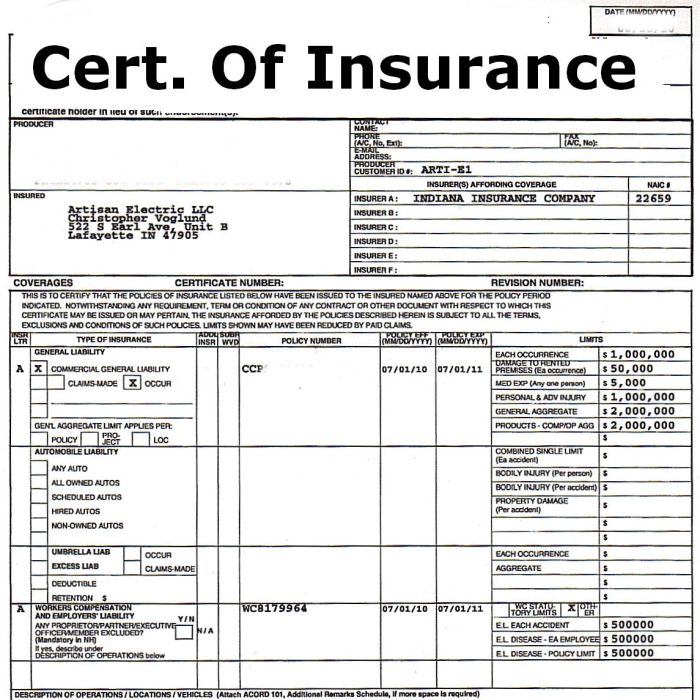

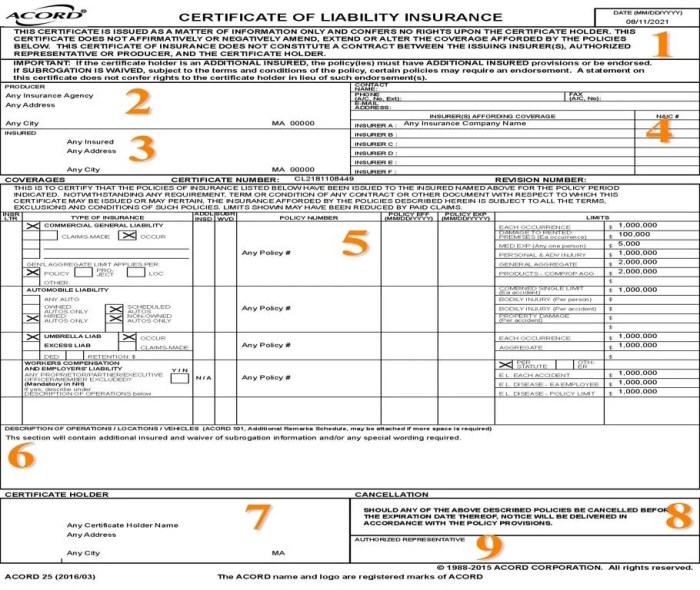

Key Information Included in a Certificate of Insurance

A COI includes essential information to confirm the existence and scope of the insurance coverage. This generally includes the insured’s name and address, the insurance company’s name and contact information, the policy number, the effective and expiration dates of the policy, a description of the covered operations or activities, the types of insurance coverage (e.g., general liability, workers’ compensation, auto liability), and the limits of liability for each type of coverage. For example, a COI for a construction project might detail general liability coverage with a limit of $1 million, workers’ compensation coverage, and auto liability coverage with specific limits. Crucially, the certificate also states that it is not a contract and does not alter the terms and conditions of the underlying insurance policy.

Legal Implications and Responsibilities Associated with Certificate Insurance

A COI is a crucial document in many contractual agreements. Its presence demonstrates due diligence and compliance with contractual obligations related to insurance. While the COI itself is not a legally binding contract, it’s a representation of the underlying insurance policy. Misrepresentation of information on the COI can have significant legal consequences, including potential liability for the insured party. For instance, if a COI states coverage that doesn’t actually exist, the insured party could face legal repercussions if a claim arises and the coverage is found to be insufficient. The requesting party also bears a responsibility to ensure the COI accurately reflects the required insurance coverage. Failure to do so could leave them vulnerable to risks associated with insufficient insurance protection for the project or activity.

Benefits of Using Certificate Insurance

Certificate insurance offers a compelling array of advantages for businesses of all sizes, significantly improving operational efficiency, risk management, and client relations. By providing readily available proof of insurance, it streamlines processes and fosters trust, ultimately contributing to a more secure and profitable business environment.

The core benefit lies in its ability to mitigate risk and enhance operational efficiency. It simplifies the verification process for clients and vendors, eliminating delays and potential disputes caused by lengthy verification procedures. This efficiency translates directly into cost savings and smoother workflows.

Risk Mitigation Through Certificate Insurance

Certificate insurance plays a crucial role in minimizing various risks faced by businesses. By providing immediate access to proof of insurance, it eliminates the uncertainty and delays associated with traditional verification methods. This reduces the likelihood of project delays, contract disputes, and potential financial losses stemming from inadequate insurance coverage. For example, a construction company requiring proof of liability insurance from its subcontractors can quickly verify coverage with a certificate, ensuring that work can proceed without interruption or legal risk. This immediate verification significantly minimizes the risk of unforeseen financial liabilities.

Improved Client and Vendor Relationships with Certificate Insurance

The ease and speed of verification offered by certificate insurance fosters stronger relationships with clients and vendors. The transparency and readily available proof of insurance build trust and confidence. For instance, a business providing services to a large corporation can quickly provide a certificate of insurance, demonstrating their commitment to risk management and reassuring the client of their financial responsibility. This proactive approach enhances the client’s confidence and strengthens the business relationship. Similarly, vendors requiring proof of insurance from their clients can quickly assess the risk and proceed with transactions with greater certainty, leading to smoother collaborations and increased efficiency.

Certificate Insurance and Legal Compliance

Certificate insurance plays a crucial role in ensuring legal compliance across various industries. Its use often stems from contractual obligations and legal requirements, minimizing potential risks and liabilities for all parties involved. Understanding these legal aspects is essential for businesses to operate within the bounds of the law and maintain strong, reliable relationships with their clients and partners.

Certificate insurance contributes significantly to meeting contractual obligations by providing verifiable proof of insurance coverage. This is particularly important in industries with high liability risks, where contracts often stipulate specific insurance requirements as a condition of engagement. Failure to meet these stipulations can result in significant financial and legal repercussions.

Legal Requirements for Certificate Insurance Across Industries

Many industries mandate or strongly recommend certificate insurance as a condition for undertaking specific projects or entering into contracts. These requirements vary depending on the industry’s inherent risks and regulatory frameworks. For instance, construction projects often require contractors to provide certificates of insurance demonstrating liability coverage, workers’ compensation insurance, and potentially other specialized coverages. Similarly, healthcare providers may need to provide certificates of insurance to hospitals or other healthcare facilities as a condition of providing services. Failure to provide the necessary certificates can lead to project delays, contract breaches, and legal disputes.

Certificate Insurance and Contractual Obligations

Contracts frequently specify insurance requirements, outlining the types and amounts of coverage needed. A certificate of insurance serves as documented proof that these requirements are met. This protects both parties involved. The client is assured of adequate protection in case of incidents or accidents, while the contractor or service provider demonstrates their commitment to fulfilling their contractual obligations. This transparency and verification process significantly reduce the risk of disputes arising from insurance-related issues. For example, a construction contract might specify a minimum liability coverage of $1 million. The contractor would then need to provide a certificate of insurance verifying this coverage to satisfy the contractual obligation.

Consequences of Non-Compliance with Certificate Insurance Requirements

Non-compliance with certificate insurance requirements can lead to a range of serious consequences. These consequences can include: contract termination, legal action, financial penalties, and reputational damage. A contractor failing to provide the required certificate of insurance might be barred from working on a project, leading to significant financial losses. Furthermore, they might face legal action from the client for breach of contract, potentially resulting in substantial damages. In some cases, non-compliance can even lead to license suspension or revocation for repeated violations. The lack of insurance coverage can also expose the client to significant liability if an incident occurs. The severity of the consequences depends on the specific circumstances, the nature of the contract, and the relevant legal jurisdictions.

Comparing Different Certificate Insurance Providers

Choosing the right certificate insurance provider is crucial for ensuring adequate coverage and seamless operations. Several factors should be considered when comparing providers, including coverage options, pricing structures, and the quality of customer support. A thorough comparison will help businesses find the best fit for their specific needs and budget.

Certificate Insurance Provider Comparison

Selecting a certificate insurance provider involves careful consideration of various factors. The following table compares three hypothetical providers to illustrate the key differences businesses might encounter. Remember that specific offerings and pricing can change, so it’s essential to check directly with each provider for the most up-to-date information.

| Provider Name | Coverage Options | Pricing Structure | Customer Support |

|---|---|---|---|

| InsureCert Solutions | General Liability, Workers’ Compensation, Professional Liability, Auto Liability; various coverage limits available. Offers customizable packages. | Tiered pricing based on coverage limits and number of certificates issued annually. Discounts available for multi-year contracts. | 24/7 online support portal, phone support during business hours, email response within 24 hours. Dedicated account manager for larger clients. |

| CertGuard Insurance | General Liability, Workers’ Compensation; limited options for specialized industries. Offers basic and premium packages. | Flat fee per certificate issued, with discounts for high-volume clients. Additional fees for expedited service. | Phone support during business hours, email support with response time varying depending on volume. Limited online resources. |

| SecureCert Pro | Wide range of coverage options including General Liability, Workers’ Compensation, Professional Liability, Umbrella Liability, and specialized endorsements for various industries. Highly customizable. | Usage-based pricing model, charges vary based on the number of certificates requested and the complexity of coverage. Transparent and detailed billing. | Dedicated account managers, 24/7 phone and email support, comprehensive online knowledge base and FAQs, proactive customer service outreach. |

Case Studies

Real-world examples best illustrate the value of certificate insurance. These case studies showcase how certificate insurance has protected businesses and individuals in diverse situations, highlighting its practical application and significant benefits.

Construction Company Project Delay

A mid-sized construction company, “BuildRight,” was contracted to build a large commercial building. The project timeline was critical, with significant penalties for delays. BuildRight secured certificate insurance to cover potential delays caused by unforeseen circumstances, such as material shortages or subcontractor issues. During construction, a key supplier experienced unforeseen production problems, delaying the delivery of crucial materials by several weeks. This delay threatened BuildRight’s ability to meet the project deadline and incur substantial financial penalties. However, because BuildRight had certificate insurance in place, the insurance provider covered the additional costs associated with the delay, including expedited shipping of materials and overtime pay for workers. This allowed BuildRight to complete the project on time, avoiding costly penalties and maintaining a positive relationship with the client. The outcome was a successful project completion without significant financial loss despite the unexpected setback.

Medical Practice Malpractice Claim

Dr. Anya Sharma, a successful cardiologist, utilized certificate insurance to protect her practice from potential malpractice claims. This is a common practice among medical professionals to mitigate the risk associated with medical errors or patient dissatisfaction. A patient, Mr. Jones, claimed that Dr. Sharma’s negligence during a procedure led to a complication requiring further treatment. While Dr. Sharma maintained her innocence and the claim was ultimately deemed unfounded after a thorough investigation, the legal process was lengthy and expensive. The legal fees and costs associated with defending herself against the claim were substantial. However, Dr. Sharma’s certificate insurance covered the majority of these legal costs, significantly reducing her financial burden and allowing her to focus on her practice. The outcome demonstrated the protective nature of certificate insurance, safeguarding Dr. Sharma from the significant financial and emotional stress associated with a malpractice claim, even one ultimately proven unfounded.

Ultimate Conclusion

In conclusion, certificate insurance serves as a vital tool for businesses seeking to mitigate risk, meet contractual obligations, and foster trust with stakeholders. By understanding the nuances of certificate insurance, businesses can proactively manage their exposure to liability and cultivate a more secure and stable operational environment. This guide has provided a foundational understanding, equipping readers to navigate the complexities of this essential risk management tool and leverage its benefits effectively.

Question Bank

What is the difference between a Certificate of Insurance (COI) and an actual insurance policy?

A COI is proof of insurance; it’s not the insurance policy itself. The policy contains the actual terms and conditions of coverage, while the COI summarizes key information from that policy.

How long is a Certificate of Insurance typically valid for?

The validity period varies depending on the insurer and the specific policy, but it’s often one year. Some may have shorter durations, requiring renewal.

What happens if I don’t provide a Certificate of Insurance when required?

Failure to provide a COI when required by contract or law can lead to contract breach, project delays, or even legal action depending on the specific circumstances.

Can I obtain a Certificate of Insurance for a specific project or event?

Yes, COIs can be tailored to cover specific projects or events, ensuring that coverage aligns with the specific needs and risks involved.