Securing affordable car insurance is a crucial yet often daunting task. The market is saturated with options, each promising the lowest rates, but navigating the complexities of coverage, deductibles, and hidden fees can leave even the savviest consumer feeling overwhelmed. This guide delves into the world of cheap car insurance agencies, providing insights into how to find the best deal without compromising essential protection.

We’ll explore the critical factors influencing your premium, empowering you to make informed decisions. From understanding policy coverage to avoiding potential scams, we aim to equip you with the knowledge and strategies necessary to confidently navigate the search for affordable and reliable car insurance.

Defining “Cheap Car Insurance”

Finding affordable car insurance is a priority for many drivers. However, “cheap” shouldn’t solely be defined by the premium amount. A truly comprehensive understanding requires considering the overall value you receive for your money, encompassing the level of coverage, deductibles, and potential hidden costs.

Understanding that the lowest premium doesn’t always equate to the best value is crucial. Extremely low-priced policies often come with significant trade-offs that could leave you financially vulnerable in the event of an accident. These trade-offs can significantly impact your financial security.

Trade-offs Associated with Extremely Low-Priced Policies

Lower premiums often translate to reduced coverage, higher deductibles, or both. This means you’ll pay less upfront, but you’ll shoulder a larger portion of the costs if you’re involved in an accident or need to file a claim. For instance, a policy with minimal liability coverage might leave you personally responsible for substantial damages if you’re at fault in a collision. Similarly, a high deductible means you’ll have to pay a larger sum out-of-pocket before your insurance kicks in. This can be a substantial burden, especially in the aftermath of a significant accident. Choosing a policy based solely on price without carefully considering these factors can lead to unexpected and potentially devastating financial consequences.

Comparison of Cheap Car Insurance Policies

The following table illustrates the key differences between various levels of car insurance policies, highlighting the trade-offs between premium cost and coverage. Remember that these are examples and actual prices will vary based on individual factors like driving history, location, and the specific insurer.

| Policy Type | Premium (Annual Estimate) | Liability Coverage | Deductible |

|---|---|---|---|

| Basic Liability | $300 | $25,000/$50,000/$10,000 | $1000 |

| Liability with Uninsured Motorist | $450 | $25,000/$50,000/$10,000 + Uninsured/Underinsured Motorist | $1000 |

| Comprehensive and Collision (High Deductible) | $800 | $100,000/$300,000/$50,000 + Uninsured/Underinsured Motorist + Comprehensive & Collision | $2000 |

| Comprehensive and Collision (Low Deductible) | $1200 | $100,000/$300,000/$50,000 + Uninsured/Underinsured Motorist + Comprehensive & Collision | $500 |

Identifying Cheap Car Insurance Agencies

Finding affordable car insurance can feel like navigating a maze, but understanding key factors and asking the right questions can significantly simplify the process. This section will equip you with the tools to identify and select a cheap car insurance agency that meets your specific needs.

Factors to Consider When Searching for Affordable Car Insurance

Several factors influence the cost of car insurance. Understanding these factors empowers you to make informed decisions and potentially save money. Ignoring these aspects can lead to paying more than necessary.

- Driving History: Your driving record, including accidents and traffic violations, significantly impacts your premiums. A clean driving history translates to lower rates.

- Vehicle Type and Age: The make, model, year, and safety features of your vehicle affect insurance costs. Generally, newer, safer cars are cheaper to insure than older, less-safe models.

- Location: Where you live influences your insurance rates. Areas with higher accident rates or theft rates typically have higher premiums.

- Coverage Levels: The amount of coverage you choose impacts your premiums. While comprehensive coverage offers more protection, it also costs more than liability-only coverage.

- Deductibles: A higher deductible (the amount you pay out-of-pocket before insurance coverage kicks in) results in lower premiums. Conversely, a lower deductible means higher premiums.

- Credit Score: In many states, your credit score is a factor in determining your insurance rates. A good credit score can lead to lower premiums.

- Discounts: Many insurers offer discounts for various factors, such as bundling insurance policies (home and auto), being a good student, or having safety features in your car. Actively seeking these discounts can save you money.

Questions to Ask Potential Insurance Providers

Before committing to a policy, it’s crucial to ask specific questions to ensure transparency and understanding. Failing to do so can lead to unexpected costs and dissatisfaction.

- What is the total cost of my insurance premium, including all applicable fees and taxes?

- What specific coverages are included in my policy, and what are the limits for each coverage?

- What is my deductible amount, and what would my out-of-pocket expenses be in different scenarios (e.g., accident, theft)?

- What discounts are available to me, and how can I qualify for them?

- What is the claims process, and how long does it typically take to resolve a claim?

- What are the policy’s cancellation terms and conditions?

- What is the customer service process, and how can I contact the insurer if I have questions or need assistance?

Comparison of Different Agency Types

Different insurance agencies offer varying levels of service and cost structures. Understanding these differences helps you choose the best fit.

| Agency Type | Advantages | Disadvantages |

|---|---|---|

| Online-Only | Often lower premiums due to reduced overhead costs; convenient and accessible 24/7; easy comparison shopping. | Limited or no in-person assistance; potential difficulties resolving complex issues; may lack personalized service. |

| Brick-and-Mortar | Personalized service; in-person assistance with policy questions and claims; established reputation and trust. | Generally higher premiums due to higher overhead costs; less convenient access; potentially less competitive pricing. |

| Hybrid (Online and Brick-and-Mortar) | Combines the convenience of online access with the personalized service of a physical location; offers flexibility in how you interact with the insurer. | Premiums may be higher than purely online agencies but potentially lower than purely brick-and-mortar agencies; may not offer the full range of benefits of either model. |

Factors Influencing Car Insurance Costs

Several interconnected factors determine the price you pay for car insurance. Understanding these factors allows you to make informed decisions that could potentially save you money. Your insurance premium isn’t simply a random number; it’s a calculation based on your individual risk profile and the perceived likelihood of you filing a claim.

Your personal characteristics, driving habits, and the vehicle itself all play a significant role in shaping your insurance costs. Location also matters, as risk levels vary considerably across different geographical areas.

Age and Driving Experience

Younger drivers, particularly those with less than three years of driving experience, typically face higher insurance premiums. This is because statistically, they are involved in more accidents than older, more experienced drivers. Insurance companies assess risk based on historical data, and this data shows a clear correlation between age and accident frequency. As you gain experience and a clean driving record, your premiums generally decrease. For example, a 16-year-old new driver can expect to pay significantly more than a 50-year-old with a 30-year clean driving record.

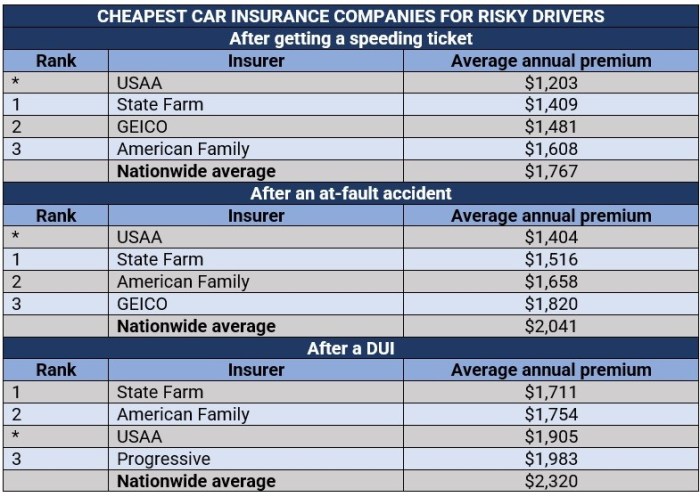

Driving History

Your driving record is a crucial factor. Accidents, speeding tickets, and other moving violations significantly increase your premiums. Each incident reflects a higher risk to the insurance company. Multiple offenses can lead to substantial increases, sometimes even resulting in policy cancellation. Conversely, maintaining a clean driving record, free of accidents and violations, can lead to lower premiums and even discounts from some insurers.

Type of Vehicle

The type of car you drive directly impacts your insurance cost. Sports cars and luxury vehicles, often more expensive to repair, typically command higher premiums due to their higher repair costs and greater potential for theft. Conversely, smaller, less expensive vehicles usually attract lower premiums. Factors like safety features (airbags, anti-lock brakes) also influence premiums; cars with advanced safety features may receive discounts.

Location

Where you live significantly influences your insurance rates. Areas with high crime rates, frequent accidents, or higher vehicle theft rates tend to have higher insurance premiums. Insurance companies analyze claims data by zip code and adjust premiums accordingly. Someone living in a rural area with a low crime rate may pay less than someone living in a densely populated urban center with a high accident rate.

Visual Representation of Factors Influencing Premiums

Imagine a pie chart. The entire circle represents your total car insurance premium. The largest slice might represent your driving history (perhaps 40%), reflecting its significant influence. The next largest slice could be your age and driving experience (30%). The remaining slices would represent your vehicle type (15%), location (10%), and other factors (5%), such as credit score and coverage choices. This illustrates that while multiple factors contribute, some have a considerably greater impact than others. The exact proportions would vary depending on individual circumstances.

Finding the Best Deal

Securing the cheapest car insurance involves more than just picking the first low quote you see. A strategic approach, encompassing comparison shopping and negotiation, is crucial to finding the best deal tailored to your specific needs. This section Artikels effective strategies to navigate the car insurance market and achieve significant savings.

Finding the lowest premium requires a proactive and informed approach. This involves utilizing comparison websites, contacting insurers directly, and leveraging your bargaining power. By understanding your options and employing effective negotiation tactics, you can significantly reduce your annual insurance costs.

Comparing Car Insurance Quotes

Effectively comparing car insurance quotes requires a systematic approach. Begin by using online comparison tools, which allow you to input your information once and receive quotes from multiple insurers simultaneously. This saves considerable time and effort. Next, contact insurers directly to verify quotes and ask about any additional discounts or promotions they might offer that aren’t reflected on comparison sites. Finally, meticulously compare the quotes, paying close attention to not only the premium but also the coverage details, deductibles, and any limitations.

Obtaining and Comparing Quotes: A Step-by-Step Guide

- Gather necessary information: This includes your driver’s license number, vehicle information (make, model, year), address, and driving history (including any accidents or violations).

- Use online comparison websites: Enter your information into multiple comparison websites to receive a range of quotes. Note that the quotes provided may be estimates and may not reflect the final price.

- Contact insurers directly: Follow up with insurers whose quotes interest you to discuss specific coverage options and ask about any potential discounts. This personal touch can sometimes uncover hidden savings.

- Compare quotes side-by-side: Create a spreadsheet or use a comparison tool to meticulously analyze the quotes. Consider the premium, coverage details, deductibles, and any additional features.

- Review policy documents: Before committing to a policy, carefully read the policy documents to ensure you understand the terms and conditions.

Negotiating for a Lower Premium

Negotiating your car insurance premium is a legitimate and often effective way to save money. Many insurers are willing to negotiate, especially if you’re a loyal customer or have a clean driving record. Begin by politely explaining your situation and highlighting your positive driving history and any safety features on your vehicle. Then, inquire about potential discounts for bundling policies (home and auto), taking a defensive driving course, or increasing your deductible. Finally, don’t hesitate to compare offers from other insurers to leverage competition. For example, stating “I received a quote from another company that’s significantly lower” can often motivate an insurer to offer a better deal. Remember to remain polite and professional throughout the negotiation process.

Conclusion

Ultimately, finding the cheapest car insurance isn’t just about the premium; it’s about finding the right balance between cost and comprehensive coverage. By carefully considering the factors Artikeld in this guide, asking the right questions, and comparing quotes diligently, you can secure a policy that offers peace of mind without breaking the bank. Remember, thorough research and a proactive approach are key to securing the best deal.

Top FAQs

What does “cheap car insurance” truly mean?

It’s not solely about the lowest premium. “Cheap” should consider the balance between price and the level of coverage offered. A very low premium might mean significantly higher deductibles or limited coverage, ultimately costing more in the event of an accident.

How can I compare quotes effectively?

Use online comparison tools, but also contact agencies directly. Ensure you’re comparing apples to apples – same coverage levels for accurate price comparisons. Don’t hesitate to negotiate.

What are some red flags to watch out for with insurance agencies?

High-pressure sales tactics, unusually low premiums without explanation, difficulty contacting the agency, and lack of licensing or registration are all potential red flags indicating a fraudulent operation.

What’s the difference between liability and collision coverage?

Liability coverage pays for damages to others’ property or injuries in an accident you cause. Collision coverage pays for damage to your vehicle regardless of fault.

Can my driving record affect my insurance rates?

Yes, significantly. Accidents, speeding tickets, and DUIs drastically increase premiums. Maintaining a clean driving record is crucial for securing affordable rates.