Securing affordable car insurance in New York can feel like navigating a complex maze. High costs and varying coverage options often leave drivers feeling overwhelmed. This guide demystifies the process, providing practical strategies and insights to help New York residents find the best balance between cost and comprehensive protection. We’ll explore the factors influencing premiums, unveil effective cost-saving techniques, and empower you to make informed decisions about your car insurance.

From understanding New York’s unique insurance market and comparing quotes from different providers to identifying potential discounts and improving your driving habits, we’ll cover everything you need to know to secure cheap car insurance without compromising on essential coverage. This comprehensive guide equips you with the knowledge to confidently navigate the complexities of the New York car insurance landscape and achieve significant savings.

Understanding New York’s Car Insurance Market

Navigating the New York car insurance market can feel complex, but understanding the key factors influencing costs and coverage options is crucial for securing affordable and adequate protection. This section will clarify the intricacies of New York’s car insurance landscape.

Factors Influencing Car Insurance Costs in New York

Several factors significantly impact the price of car insurance in New York. These include your driving history (accidents, violations), age and driving experience, the type of vehicle you drive (make, model, and safety features), your location (urban areas tend to be more expensive due to higher accident rates), and your credit history (in some cases). Insurance companies use a complex algorithm considering these factors to assess risk and determine premiums. For instance, a young driver with multiple speeding tickets living in New York City will likely pay considerably more than an older driver with a clean record living in a rural area driving a less expensive vehicle.

Types of Car Insurance Coverage in New York

New York offers various car insurance coverages. Liability coverage is mandatory and protects you financially if you cause an accident resulting in injuries or property damage to others. This coverage is typically split into bodily injury liability (covering medical expenses and lost wages for others) and property damage liability (covering repairs to other vehicles or property). Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. Collision coverage pays for repairs to your vehicle regardless of fault, while comprehensive coverage covers damage from events like theft, vandalism, or natural disasters. Personal injury protection (PIP) covers medical expenses and lost wages for you and your passengers, regardless of fault.

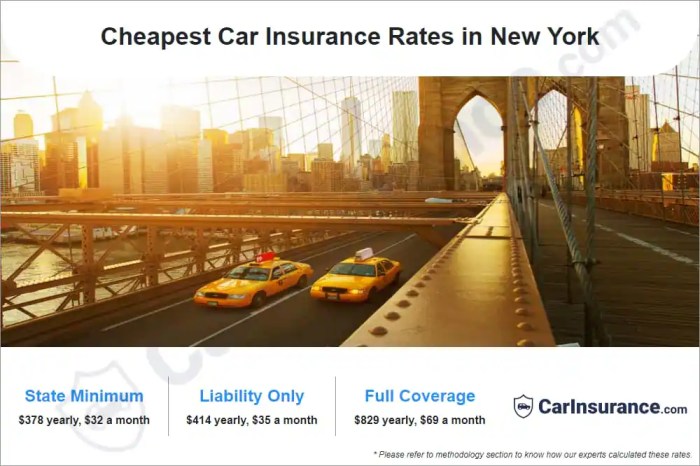

Minimum Coverage Requirements versus Recommended Coverage Levels

New York State mandates minimum liability coverage of 25/50/10. This means $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage. However, these minimums may not be sufficient to cover significant damages in a serious accident. Recommended coverage levels often exceed the minimums, providing greater financial protection. For example, increasing liability coverage to 100/300/100 provides substantially more protection against substantial claims. Adding uninsured/underinsured motorist coverage at higher limits is also highly recommended, given the prevalence of uninsured drivers. The decision of what coverage level to choose should be based on your individual risk tolerance and financial situation.

Impact of Driving History on Insurance Premiums

Your driving record significantly impacts your car insurance premiums in New York. Accidents and traffic violations, such as speeding tickets or DUIs, will typically lead to higher premiums. The severity and frequency of incidents directly correlate with increased costs. For instance, a single at-fault accident might result in a premium increase of 20-30%, while multiple violations or serious accidents could lead to much higher increases or even policy cancellation. Maintaining a clean driving record is crucial for securing lower insurance rates. Conversely, a long period of accident-free driving can lead to discounts and lower premiums over time.

Factors Affecting Insurance Costs

Several key factors influence the cost of car insurance in New York. Understanding these factors can help you make informed decisions and potentially save money on your premiums. These factors interact in complex ways, so it’s not always a simple case of adding or subtracting individual impacts.

Age, Gender, and Driving Record

Insurance companies consider age, gender, and driving record as significant predictors of risk. Younger drivers, statistically, are involved in more accidents, leading to higher premiums. Similarly, gender plays a role, with historical data often showing differences in accident rates between men and women. A clean driving record, free of accidents and violations, typically results in lower premiums, while a history of accidents or traffic violations significantly increases costs. For example, a young male driver with a history of speeding tickets will likely pay substantially more than an older female driver with a spotless record.

Vehicle Type

The type of vehicle you insure also impacts your premium. Generally, sports cars and high-performance vehicles are considered riskier and thus more expensive to insure than sedans or smaller cars. SUVs and trucks often fall somewhere in between, depending on their size and features. Motorcycles, due to their inherent vulnerability, typically command significantly higher premiums than cars. For instance, insuring a high-powered sports car will be considerably more expensive than insuring a fuel-efficient compact car.

Location

Your location within New York State significantly affects your insurance rates. Areas with higher crime rates, more traffic congestion, and a greater frequency of accidents tend to have higher insurance premiums. Rural areas, generally, have lower rates than densely populated urban centers like New York City. For example, someone living in a quiet suburban town will likely pay less than someone living in Manhattan.

Impact of Factors on Premium Costs

| Factor | Low Cost Example | Average Cost Example | High Cost Example |

|---|---|---|---|

| Age | 55-year-old driver with clean record | 30-year-old driver with one minor accident | 18-year-old driver with multiple violations |

| Gender | Female driver with clean record (depending on age and other factors, this might be similar to the average cost example) | Male driver with clean record (depending on age and other factors, this might be similar to the average cost example) | Male driver with multiple violations (This might be similar to the high-cost example for age) |

| Driving Record | No accidents or violations in the past 5 years | One minor accident in the past 3 years | Multiple accidents and speeding tickets in the past 2 years |

| Vehicle Type | Small, fuel-efficient sedan | Mid-size SUV | High-performance sports car or motorcycle |

| Location | Rural area with low accident rates | Suburban area with moderate accident rates | Urban area with high accident rates (e.g., New York City) |

Saving Money on Car Insurance

Securing affordable car insurance in New York can feel like navigating a maze, but with the right strategies, you can significantly reduce your premiums. This section explores practical steps to lower your costs, focusing on driving habits, record maintenance, and deductible choices.

Improving Driving Habits to Lower Premiums

Safe driving is not just about avoiding accidents; it’s a key factor in determining your insurance rates. Insurance companies heavily weigh your driving record, and consistently demonstrating safe driving habits can lead to lower premiums. This includes avoiding speeding tickets, maintaining a safe following distance, and practicing defensive driving techniques. Many insurers offer discounts for completing defensive driving courses, which not only improve your driving skills but also demonstrate your commitment to safety to your insurance provider. Consider installing a telematics device in your vehicle; these devices track your driving behavior and reward safer driving with lower rates.

Maintaining a Clean Driving Record to Reduce Costs

A clean driving record is arguably the most significant factor in determining your car insurance costs. Even a single moving violation, such as speeding or running a red light, can substantially increase your premiums. Multiple violations or accidents can lead to significantly higher rates or even policy cancellation. Careful adherence to traffic laws, defensive driving techniques, and maintaining your vehicle in good condition all contribute to a clean driving record. Remember, avoiding accidents is paramount, as accident claims are the most impactful factor in premium calculations.

Implications of Increasing Your Deductible on Your Premium

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Increasing your deductible will lower your monthly premium. However, this means you’ll pay more if you have an accident. Carefully weigh the trade-off between a lower monthly payment and a higher potential out-of-pocket expense in case of an accident. Consider your financial situation and risk tolerance when deciding on your deductible amount. For example, a driver with a significant emergency fund might comfortably opt for a higher deductible to secure lower premiums, whereas someone with limited savings might prefer a lower deductible, even with higher monthly payments.

Actionable Steps to Reduce Car Insurance Expenses

A proactive approach to managing your car insurance can lead to substantial savings. Here are some actionable steps you can take:

- Shop around and compare quotes from multiple insurers. Don’t settle for the first quote you receive.

- Maintain a good driving record by avoiding traffic violations and accidents.

- Consider increasing your deductible to lower your premium, but ensure you can afford the higher out-of-pocket expense in case of an accident.

- Bundle your car insurance with other types of insurance, such as homeowners or renters insurance, to potentially receive a discount.

- Ask your insurer about available discounts, such as those for good students, safe drivers, or multiple-car policies.

- Maintain your vehicle in good condition to reduce the risk of accidents and potentially qualify for discounts.

- Explore telematics programs offered by your insurer to monitor your driving and earn potential discounts.

- Consider your coverage needs carefully and avoid purchasing unnecessary coverage.

Resources for Finding Cheap Car Insurance

Finding affordable car insurance in New York can feel overwhelming, but with the right resources and understanding, you can secure a policy that fits your budget without compromising necessary coverage. This section will Artikel key resources to aid your search for cheap car insurance.

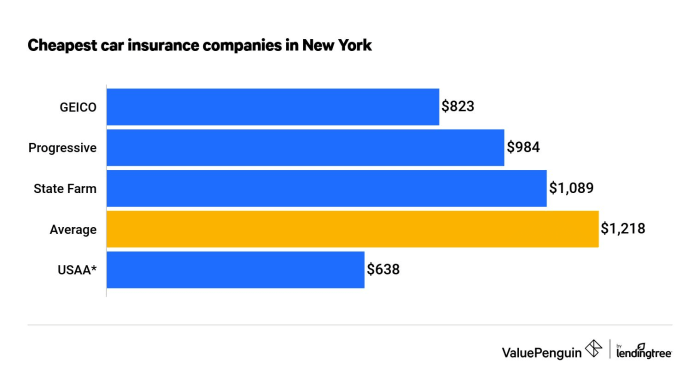

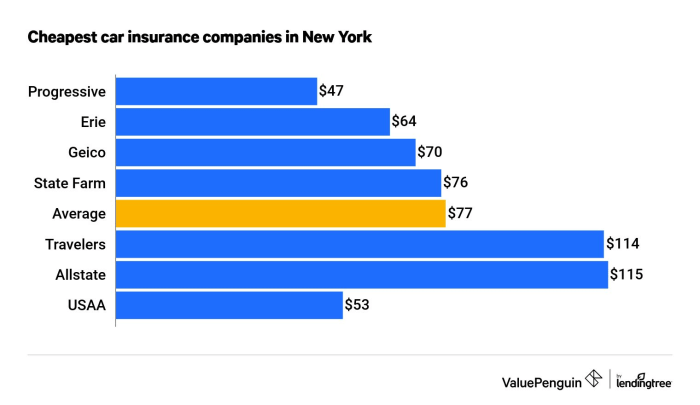

Reputable Car Insurance Companies in New York

Several reputable insurance companies operate throughout New York, each offering varying policy options and price points. It’s crucial to compare quotes from multiple providers to find the best deal. Remember that price shouldn’t be the sole determining factor; consider the company’s reputation for customer service and claims handling as well.

- Geico

- State Farm

- Progressive

- Allstate

- Liberty Mutual

- Nationwide

This is not an exhaustive list, and many other reputable companies operate within the state. Consider researching smaller, regional insurers as well, as they sometimes offer competitive rates.

Consumer Protection Agencies and Dispute Resolution

New York State offers robust consumer protection for insurance matters. If you encounter issues with your insurer, several agencies can provide assistance.

- New York State Department of Financial Services (NYDFS): The NYDFS regulates the insurance industry in New York and handles consumer complaints. Their website provides resources for filing complaints and understanding your rights.

- Your Local Consumer Protection Agency: Many counties and municipalities have their own consumer protection agencies that can offer support and guidance with insurance disputes.

- Mediation and Arbitration: If direct communication with your insurer fails, consider mediation or arbitration as a less expensive alternative to litigation.

Websites and Organizations Offering Assistance

Several online platforms and organizations specialize in helping consumers find affordable car insurance. These resources often provide comparison tools, allowing you to easily compare quotes from different insurers.

- The Insurance Information Institute (III): This organization offers unbiased information about insurance, including resources to help consumers find affordable coverage.

- Independent Insurance Agents: Independent agents represent multiple insurance companies, allowing them to compare policies and find the best fit for your needs. They can be a valuable resource, particularly for those overwhelmed by the many choices available.

- Online Comparison Websites: Numerous websites allow you to input your information and receive quotes from multiple insurers simultaneously. While convenient, remember to verify the accuracy of the information provided and compare the actual policy details.

Types of Car Insurance Policies and Their Benefits

Understanding the different types of car insurance coverage is essential for making an informed decision. Each policy offers varying levels of protection, influencing the overall cost.

- Liability Insurance: This covers damages or injuries you cause to others in an accident. It’s usually legally required in New York.

- Collision Insurance: This covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive Insurance: This covers damage to your vehicle from events other than accidents, such as theft, vandalism, or weather-related damage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver.

- Personal Injury Protection (PIP): This covers medical expenses and lost wages for you and your passengers, regardless of fault. New York is a no-fault state, meaning PIP is often mandatory.

Final Thoughts

Finding cheap car insurance in New York doesn’t have to be a daunting task. By understanding the factors influencing premiums, utilizing available discounts, and actively managing your driving record, you can significantly reduce your insurance costs. Remember to compare quotes from multiple providers, carefully review policy details, and don’t hesitate to seek assistance from consumer protection agencies if needed. With a proactive approach and the right information, you can secure affordable and adequate car insurance coverage that meets your needs.

FAQ Explained

What is the minimum car insurance coverage required in New York?

New York requires a minimum of 25/50/10 liability coverage. This means $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage.

Can I get car insurance if I have a DUI on my record?

Yes, but it will likely be significantly more expensive. Your rates will depend on the specifics of your DUI and the insurer.

How often can I change my car insurance policy?

You can usually change your policy at any time, although there might be penalties depending on your contract terms. Most policies renew annually.

What is SR-22 insurance?

SR-22 insurance is a certificate of insurance filed with the state demonstrating proof of financial responsibility, often required after serious driving violations.