Navigating the world of auto insurance in New Jersey can feel like traversing a complex maze. Finding cheap NJ auto insurance doesn’t mean sacrificing essential coverage; it’s about understanding the factors that influence premiums and employing smart strategies to secure affordable protection. This guide unravels the intricacies of NJ auto insurance, empowering you to make informed decisions and save money without compromising your safety on the road.

From understanding the different types of coverage and available discounts to mastering the art of comparing quotes and negotiating premiums, we’ll equip you with the knowledge and tools to find the best auto insurance policy for your needs and budget. We’ll delve into the impact of driving history, age, car type, and location on your insurance costs, providing actionable strategies to lower your premiums legally and ethically. Prepare to become a savvy consumer in the New Jersey auto insurance market.

Factors Affecting Insurance Premiums

Securing affordable auto insurance in New Jersey involves understanding the key factors that influence premium costs. Several elements contribute to the final price you pay, and being aware of these can help you make informed decisions to potentially lower your premiums. This section will detail some of the most significant factors.

Driving History

Your driving record significantly impacts your insurance premiums. A clean driving history, free of accidents and traffic violations, typically results in lower rates. Conversely, accidents, especially those resulting in significant damage or injuries, will substantially increase your premiums. The severity and frequency of violations also matter; multiple speeding tickets or more serious offenses like DUI convictions will lead to significantly higher costs. Insurance companies use a points system to assess risk; more points equate to higher premiums. For example, a driver with a history of at-fault accidents might see their premiums double or even triple compared to a driver with a spotless record.

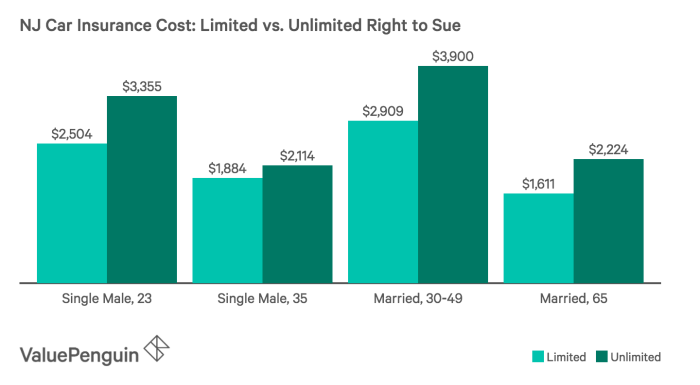

Age and Gender

Insurance companies consider age and gender when assessing risk. Statistically, younger drivers, particularly those in their late teens and early twenties, are involved in more accidents than older drivers. This higher risk translates to higher premiums for younger drivers. Gender also plays a role, though the impact varies by state and insurance company. Historically, male drivers, especially young males, have been statistically associated with a higher accident rate than female drivers, leading to potentially higher premiums for men in some cases. However, this is constantly evolving and data-driven, and the differences are becoming less pronounced in recent years.

Vehicle Type and Model

The type and model of your car significantly influence your insurance costs. Luxury vehicles, sports cars, and high-performance models are generally more expensive to insure due to their higher repair costs and increased risk of theft. Conversely, smaller, less expensive vehicles usually have lower insurance premiums. Safety features also play a role; cars with advanced safety technology, such as anti-lock brakes, airbags, and electronic stability control, may qualify for discounts. For example, a new Tesla Model S, with its high value and advanced technology, will have a considerably higher premium than a used Honda Civic.

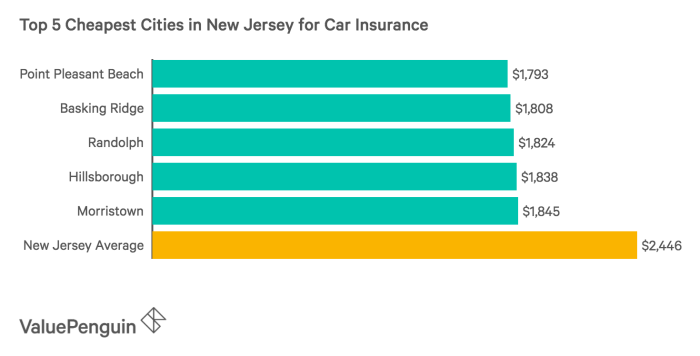

Location in NJ

Your location within New Jersey significantly affects your car insurance rates. Areas with higher rates of accidents, theft, and vandalism generally have higher insurance premiums. Urban areas, for instance, often have higher rates than more rural areas due to increased traffic congestion and higher risk of vehicle damage. Insurance companies utilize detailed geographic data to assess risk in specific zip codes, leading to variations in premiums even within a relatively small geographical area. A driver residing in a high-crime area of Newark might pay considerably more than a driver in a quieter suburban community in central New Jersey.

Saving Money on NJ Auto Insurance

Securing affordable auto insurance in New Jersey is achievable through a combination of strategic planning and responsible driving habits. By understanding the factors influencing your premiums and implementing the right strategies, you can significantly reduce your annual costs. This section Artikels several effective methods for lowering your insurance premiums legally and ethically.

Strategies for Lowering Insurance Premiums

Several actions can lead to lower premiums. Improving your credit score, for example, can significantly impact your insurance rates, as insurers often view a higher credit score as an indicator of lower risk. Similarly, opting for a higher deductible, while requiring a larger upfront payment in case of an accident, will usually lower your monthly premiums. This is because you are accepting more financial responsibility. Finally, maintaining a clean driving record is paramount. Accidents and traffic violations significantly increase premiums, sometimes doubling or tripling your costs.

Safe Driving Habits and Reduced Insurance Costs

Safe driving habits directly translate into lower insurance costs. Maintaining a clean driving record, free from accidents and traffic violations, is the most significant factor. For example, avoiding speeding tickets, which are often accompanied by increased premiums, can save hundreds of dollars annually. Similarly, defensive driving courses, which teach techniques to avoid accidents, can sometimes lead to discounts. These courses demonstrate your commitment to safe driving, a factor many insurers consider when determining premiums. Furthermore, always wearing a seatbelt is crucial, not only for your safety but also for potentially lowering your insurance rates. Insurers often offer discounts to drivers who consistently wear seatbelts.

Bundling Auto Insurance with Other Insurance Types

Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, often results in significant savings. Many insurance companies offer discounts for bundling policies, as it simplifies their administrative processes and reduces their risk. For instance, bundling your auto and homeowners insurance with the same company might result in a 10-15% discount on your overall premium. This discount can add up to substantial savings over the policy term. It’s always advisable to compare quotes from different insurers offering bundled packages to find the most competitive rates.

Appealing a High Insurance Premium

If you believe your insurance premium is unfairly high, you have the right to appeal. Carefully review your policy and identify any potential inaccuracies or discrepancies. For instance, if your driving record is incorrectly reported, you can provide documentation to correct it. Gather all relevant documents, such as your driving record, accident reports, and any other supporting evidence. Contact your insurance company directly to initiate the appeal process. Clearly explain your reasons for appealing and provide supporting documentation. If your initial appeal is unsuccessful, you may wish to consider contacting your state’s Department of Insurance for assistance. They can investigate your claim and potentially mediate a resolution.

Understanding Insurance Policies

Choosing the right auto insurance policy in New Jersey requires understanding the different coverage options, their costs, and how to file a claim. This section will clarify key aspects of your policy to help you make informed decisions and protect yourself financially.

Coverage Types, Costs, and Savings

Understanding the various coverage types and how they affect your premium is crucial. The following table Artikels common coverages, factors influencing their cost, and potential strategies for saving money.

| Coverage Type | Description | Typical Cost Factors | Potential Savings Strategies |

|---|---|---|---|

| Liability Coverage | Pays for damages and injuries you cause to others in an accident. | Driving record, age, vehicle type, location. Higher limits increase cost. | Maintain a clean driving record, consider higher deductibles (but ensure you can afford them), bundle with other insurance policies (homeowners, renters). |

| Collision Coverage | Covers damage to your vehicle regardless of fault. | Vehicle’s make, model, year, and value; your deductible amount. | Increase your deductible (if financially feasible), consider dropping collision coverage on older vehicles with low value. |

| Comprehensive Coverage | Covers damage to your vehicle from non-collision events (theft, vandalism, weather). | Vehicle’s make, model, year, and value; location (higher risk areas cost more). | Increase your deductible, consider dropping this coverage on older vehicles with low value. |

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | Protects you if you’re hit by an uninsured or underinsured driver. | State minimums are low; higher limits increase cost. | While increasing limits is advisable, carefully weigh the cost versus the potential benefit. |

Filing a Claim After an Accident

Following an accident, promptly reporting the incident to your insurance company is vital. This usually involves contacting your insurer by phone or online, providing details of the accident (date, time, location, involved parties, police report number if applicable), and cooperating fully with the investigation. You may need to provide a detailed accident report, photos of the damage, and medical records if injuries are involved. The claims process can take time, depending on the complexity of the accident and the extent of the damages. Your insurer will guide you through each step.

Policy Exclusions and Limitations

Insurance policies contain exclusions—specific events or circumstances not covered—and limitations—restrictions on the amount of coverage provided. Carefully reviewing your policy’s terms and conditions is crucial to understand what is and isn’t covered. Common exclusions might include damage caused by wear and tear, intentional acts, or driving under the influence. Limitations often relate to the maximum payout for specific types of claims (e.g., a maximum amount for medical expenses). Understanding these limitations prevents unexpected financial burdens if an accident occurs.

Uninsured/Underinsured Motorist Coverage Explained

Uninsured/underinsured motorist (UM/UIM) coverage is crucial because it protects you and your passengers if you’re involved in an accident with a driver who lacks sufficient insurance or is uninsured altogether. In New Jersey, many drivers carry the minimum required liability insurance, which may not be enough to cover significant medical bills or vehicle repairs. UM/UIM coverage compensates you for your medical expenses, lost wages, and vehicle damage in such situations. It’s highly recommended to purchase UM/UIM coverage with limits that exceed the state minimums to ensure adequate protection. For example, if you are involved in an accident with an uninsured driver and sustain $50,000 in medical bills, your UM/UIM coverage will help cover these costs if your policy includes such a high limit.

Illustrative Examples

Understanding the impact of various factors on your New Jersey auto insurance premiums can be simplified through real-life scenarios. The following examples illustrate how different situations can significantly affect your costs.

DUI’s Impact on Insurance Premiums

A DUI conviction drastically increases your insurance premiums. Let’s consider John, a 32-year-old driver in Newark, NJ, with a clean driving record and a 2018 Honda Civic. Before his DUI, his annual premium was approximately $1200. After his conviction, his insurer increased his premium by 150%, resulting in an annual cost of $3000. This significant increase typically remains in effect for several years, often three to five, depending on the insurer and the specifics of the offense. John’s driving record will also show the DUI, making it harder to secure lower rates even after the surcharge period expires. He might see his rates gradually decrease over time, but they may never fully return to their pre-DUI level.

Cost Savings of a Clean Driving Record

Maintaining a clean driving record offers substantial long-term savings. Consider Sarah, a 28-year-old driver in Trenton, NJ, who has maintained a spotless driving record for the past eight years. She drives a 2020 Toyota Camry. Because of her excellent driving history, she qualifies for significant discounts and enjoys an annual premium of approximately $800. If Sarah had even one at-fault accident during those eight years, her premium could easily have been $1500 or more annually, representing a $700 difference per year and a cumulative savings loss of $5600 over eight years.

Minimum vs. Comprehensive Coverage

The cost difference between minimum and comprehensive coverage can be substantial. Let’s compare the annual premiums for a 2023 Hyundai Tucson in the town of Edison, NJ. Minimum coverage, meeting New Jersey’s state-mandated liability limits, might cost approximately $750 annually. However, comprehensive coverage, which includes collision, comprehensive, and uninsured/underinsured motorist protection, could cost around $1500 annually. This $750 difference reflects the added protection against various risks such as accidents, theft, and damage from natural disasters. While minimum coverage fulfills legal requirements, comprehensive coverage offers significantly greater financial security in case of an accident or other unforeseen event.

Last Recap

Securing cheap NJ auto insurance is achievable with careful planning and a thorough understanding of the market. By actively comparing quotes, leveraging discounts, and practicing safe driving habits, you can significantly reduce your premiums without compromising necessary coverage. Remember, the cheapest policy isn’t always the best; prioritize comprehensive protection that aligns with your individual risk profile and financial capabilities. Armed with the knowledge presented here, you’re now equipped to navigate the landscape of NJ auto insurance confidently and economically.

FAQ Compilation

What is SR-22 insurance, and do I need it?

SR-22 insurance is a certificate of insurance that proves you maintain the minimum required auto liability coverage. It’s typically required by the state after a serious driving offense, like a DUI. You only need it if mandated by the DMV.

Can I pay my insurance annually instead of monthly?

Many insurers offer the option to pay annually, often resulting in a small discount compared to monthly payments. Check with your provider for availability and potential savings.

What happens if I get into an accident and don’t have enough coverage?

If your coverage limits are lower than the damages caused, you’ll be personally liable for the difference. This could result in significant financial consequences, including lawsuits and debt.

How often can I get my insurance rates reviewed?

You can request a review of your rates at any time, especially if your circumstances have changed (e.g., improved driving record, new car with better safety features). Many insurers offer annual reviews automatically.