Navigating the world of auto insurance in New Jersey can feel like driving through a dense fog. Premiums vary wildly, and finding the absolute cheapest option requires understanding the intricacies of coverage, discounts, and your own driving profile. This guide cuts through the confusion, providing a clear path to securing affordable yet comprehensive auto insurance tailored to your needs.

We’ll explore the mandatory coverage requirements, delve into the factors influencing your premiums (from driving history to vehicle type), and equip you with strategies to negotiate lower rates. Learn how to leverage discounts, compare quotes effectively, and ultimately find the best balance between cost and protection.

Understanding NJ Auto Insurance Requirements

Securing the right auto insurance in New Jersey is crucial for responsible drivers. Understanding the state’s requirements and the factors influencing your premium is key to finding affordable yet adequate coverage. This section will clarify the mandatory coverages and explore the elements that determine your insurance costs.

Mandatory Auto Insurance Coverage in NJ

New Jersey is a no-fault state, meaning your own insurance policy will primarily cover your injuries and damages regardless of who caused the accident. However, this doesn’t eliminate the need for liability coverage, which protects you financially if you cause an accident that injures someone else or damages their property. The minimum required coverage includes liability insurance, Personal Injury Protection (PIP), and Uninsured/Underinsured Motorist (UM/UIM) coverage. These are not optional; they are legally mandated. Failure to carry the minimum required coverage can result in significant penalties, including fines and license suspension.

Factors Influencing NJ Auto Insurance Premiums

Several factors contribute to the cost of your auto insurance premium in New Jersey. These factors are carefully considered by insurance companies to assess risk and determine appropriate pricing. Understanding these factors can help you make informed decisions to potentially lower your premiums.

- Driving Record: Accidents and traffic violations significantly impact your premium. A clean driving record typically translates to lower premiums, while multiple accidents or serious violations can lead to substantially higher costs.

- Vehicle Type: The type of car you drive influences your premium. Sports cars and high-performance vehicles are generally considered higher risk and therefore more expensive to insure than smaller, more economical cars.

- Age and Gender: Statistically, younger drivers and males tend to have higher accident rates, leading to higher premiums. As drivers age and accumulate years of safe driving, premiums often decrease.

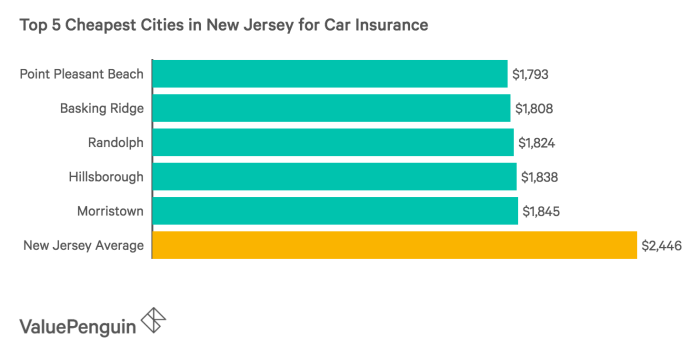

- Location: Your address influences your premium because insurance companies assess the risk of accidents and theft in different areas. Areas with higher crime rates or more frequent accidents may result in higher premiums.

- Credit History: In many states, including New Jersey, your credit history can be a factor in determining your insurance rates. A good credit score often correlates with lower premiums.

- Coverage Levels: Choosing higher coverage limits for liability, PIP, and UM/UIM will naturally increase your premium. However, higher limits provide greater financial protection in the event of a serious accident.

Comparison of Auto Insurance Coverage Types in NJ

Different types of auto insurance coverage offer varying levels of protection. Understanding the distinctions between these coverages is crucial for choosing a policy that meets your specific needs and budget.

| Coverage Type | Description | Example |

|---|---|---|

| Liability | Covers bodily injury and property damage caused to others in an accident you are at fault for. | You cause an accident injuring another driver; your liability coverage pays for their medical bills and vehicle repairs. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers, regardless of fault. | You are injured in an accident, even if it’s your fault; PIP covers your medical bills and lost income. |

| Uninsured/Underinsured Motorist (UM/UIM) | Protects you if you are injured by an uninsured or underinsured driver. | An uninsured driver hits you; your UM/UIM coverage helps pay for your medical bills and vehicle repairs. |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | You hit a tree; your collision coverage pays for the repairs to your car. |

| Comprehensive | Covers damage to your vehicle from non-collision events like theft, vandalism, or weather damage. | Your car is stolen; your comprehensive coverage helps replace your vehicle. |

Finding the Cheapest Providers

Securing the most affordable auto insurance in New Jersey requires careful consideration of various factors and a strategic approach to finding the right provider. Understanding the pricing structures and available discounts offered by different companies is crucial in minimizing your premiums.

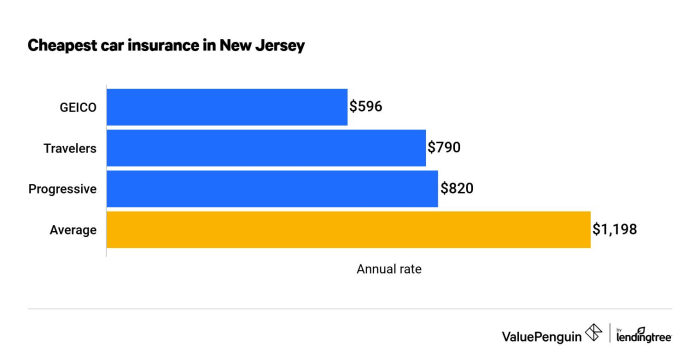

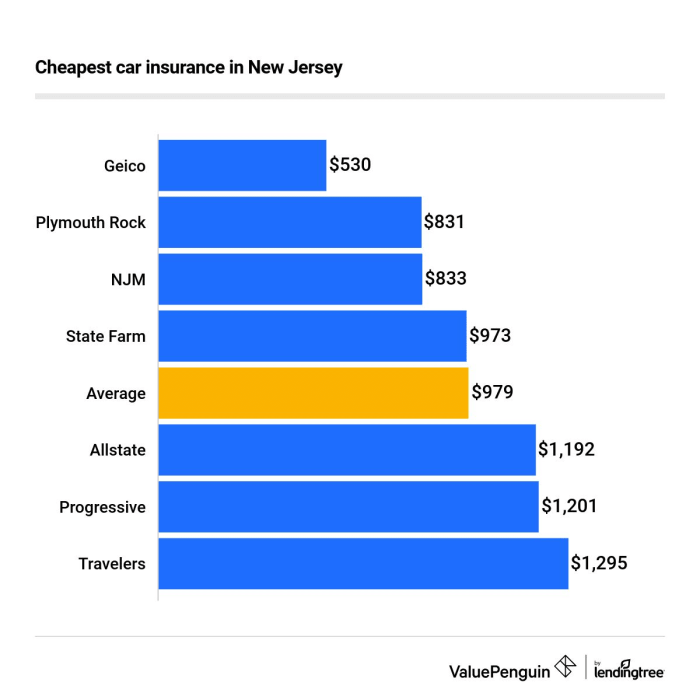

Several major auto insurance companies operate within New Jersey, each with its own pricing model and discount offerings. Comparing these companies allows consumers to make informed decisions and potentially save significant amounts of money on their annual premiums.

Major Auto Insurance Companies in NJ and Their Pricing Structures

Several large insurers are prominent in the New Jersey market. These include, but are not limited to, State Farm, Geico, Allstate, Progressive, and Liberty Mutual. Each company employs a unique algorithm to determine premiums, considering factors such as driving history, vehicle type, location, and coverage levels. While specific pricing varies greatly depending on individual circumstances, general comparisons can highlight potential cost differences. For example, one might find that Geico frequently advertises competitive rates for young drivers, while State Farm might offer better rates for those with established driving records and multiple vehicles insured. Allstate often emphasizes bundled discounts, while Progressive is known for its name-your-price tool. Liberty Mutual may present itself as a solid option for various driver profiles. It’s important to obtain personalized quotes from each company to compare effectively.

Discounts Offered by NJ Auto Insurance Companies

Most major insurers offer a range of discounts to incentivize safe driving habits and customer loyalty. These discounts can significantly reduce premiums. Common discounts include:

- Good Driver Discounts: Awarded to drivers with clean driving records, typically free of accidents and moving violations for a specified period.

- Defensive Driving Course Discounts: Completing an approved defensive driving course often results in a premium reduction.

- Bundling Discounts: Insuring multiple vehicles or combining auto insurance with other types of insurance (homeowners, renters) under one policy often leads to substantial savings.

- Multi-Car Discounts: Similar to bundling, this discount applies when insuring more than one vehicle under the same policy.

- Payment Plan Discounts: Paying your premiums annually instead of monthly may result in a discount.

- Anti-theft Device Discounts: Installing anti-theft devices in your vehicle can lower your premiums.

Strategies for Negotiating Lower Insurance Premiums

Negotiating lower premiums requires proactive engagement with insurance providers. Several strategies can help secure more favorable rates:

- Shop Around and Compare Quotes: Obtain quotes from multiple insurers to identify the most competitive options. Use online comparison tools or contact companies directly.

- Review Your Coverage Needs: Assess your current coverage levels. Reducing unnecessary coverage can lower premiums, but ensure you maintain adequate protection.

- Improve Your Driving Record: Maintaining a clean driving record is the most effective way to lower your premiums long-term. Avoid accidents and traffic violations.

- Bundle Your Insurance: Combine your auto insurance with other types of insurance, such as homeowners or renters insurance, to take advantage of bundling discounts.

- Negotiate Directly: Once you have identified a preferred insurer, contact them directly to discuss your premium and explore the possibility of negotiating a lower rate, particularly if you have a long-standing relationship with the company or can demonstrate loyalty.

Factors Affecting Insurance Costs

Several key factors influence the cost of auto insurance in New Jersey. Understanding these factors can help you make informed decisions and potentially save money on your premiums. These factors interact in complex ways, so it’s not always possible to predict the exact cost, but understanding their individual impact is crucial.

Driving History’s Impact on Insurance Rates

Your driving record significantly impacts your insurance premiums. Insurance companies assess risk based on past behavior. Accidents and traffic violations demonstrate a higher likelihood of future incidents, leading to increased premiums. For example, a single at-fault accident could raise your rates by 20-40%, while multiple accidents or serious violations like DUI could lead to even steeper increases. Conversely, a clean driving record with no accidents or tickets for several years can qualify you for significant discounts. Maintaining a good driving record is the most effective way to keep your insurance costs low.

Age, Gender, and Location’s Influence on Insurance Costs

Insurance companies utilize statistical data to assess risk. Younger drivers, particularly those under 25, generally pay higher premiums due to higher accident rates in this demographic. Gender can also play a role, although the extent varies by insurer and state regulations. Historically, males in this age bracket have been statistically shown to have more accidents than females. Location significantly influences premiums due to variations in crime rates, accident frequency, and the cost of vehicle repairs in different areas. Living in a high-risk area typically translates to higher insurance premiums.

Vehicle Type and Insurance Premiums

The type of vehicle you drive significantly affects your insurance costs. Higher-performance vehicles, luxury cars, and vehicles with a history of theft or accidents tend to have higher premiums due to increased repair costs and higher risk of theft or damage. Conversely, smaller, less expensive vehicles typically command lower premiums.

| Vehicle Type | Premium Impact | Example | Reasoning |

|---|---|---|---|

| Sports Car | High | Porsche 911 | Higher repair costs, higher theft risk, higher potential for speeding tickets |

| Luxury Sedan | Medium-High | Mercedes-Benz S-Class | Expensive repairs, higher theft risk |

| Compact Car | Medium | Honda Civic | Moderate repair costs, lower theft risk |

| Pickup Truck | Medium-High | Ford F-150 | Higher repair costs, potential for higher accident rates |

Exploring Discounts and Savings

Securing the cheapest auto insurance in New Jersey often involves more than just comparing prices; it’s about strategically leveraging available discounts. Many insurers offer a range of savings opportunities, allowing you to significantly reduce your premium. Understanding these discounts and how to qualify for them is key to minimizing your annual cost.

Many factors influence the cost of car insurance, and taking advantage of discounts can substantially lower your premium. By understanding the types of discounts available and actively pursuing them, you can significantly reduce your overall insurance expenditure. This section details common discounts and provides a practical guide to maximizing your savings.

Available Discounts

New Jersey auto insurance companies offer a variety of discounts to incentivize safe driving and responsible insurance practices. Common discounts include good driver discounts, which reward drivers with clean driving records and few or no accidents or violations. Bundling your auto insurance with other policies, such as homeowners or renters insurance, from the same provider often results in a significant discount. Several insurers also offer discounts for using telematics-based safe driving apps that monitor your driving habits. These apps track factors like speed, acceleration, and braking, rewarding safer driving with lower premiums. Other potential discounts include those for completing defensive driving courses, being a member of certain organizations (like AARP), and having anti-theft devices installed in your vehicle.

Steps to Maximize Discount Eligibility

To maximize your chances of qualifying for multiple discounts, follow these steps:

- Maintain a clean driving record: Avoid accidents and traffic violations to qualify for good driver discounts. This is often the most significant discount available.

- Bundle your insurance policies: Combine your auto insurance with other insurance policies, such as homeowners or renters insurance, from the same company.

- Install anti-theft devices: Installing an alarm system or other anti-theft devices can reduce your premium, demonstrating your commitment to vehicle security.

- Enroll in a telematics program: Many insurers offer discounts for participating in their safe driving programs, which typically involve using a mobile app to track your driving behavior.

- Complete a defensive driving course: Successfully completing a state-approved defensive driving course can often result in a discount.

- Explore organizational memberships: Check if your affiliations with any organizations (e.g., AARP) offer insurance discounts.

- Inquire about additional discounts: Contact insurance providers directly to inquire about any other discounts you might qualify for; some offer discounts based on your profession or educational background.

Comparing Insurance Quotes Effectively

Comparing quotes from multiple insurers is crucial to finding the best deal. Don’t just focus on the initial price; consider the discounts each company offers and whether you meet the eligibility criteria. Use online comparison tools, but also contact insurers directly to discuss your specific circumstances and available discounts. Be sure to provide accurate information to all insurers to ensure you receive accurate quotes. Consider factors beyond price, such as customer service ratings and claims handling processes. A slightly higher premium might be worth it if the insurer has a better reputation for handling claims efficiently and fairly. Creating a spreadsheet to compare quotes side-by-side, noting all discounts applied, can greatly aid in this process. For example, if Company A offers a $100 discount for bundling and Company B offers a $75 discount for safe driving, you can directly compare the total savings.

Understanding Policy Details

Choosing the right auto insurance policy in New Jersey involves understanding the specific terms and conditions that govern your coverage. This section will clarify common policy elements, helping you make informed decisions about your protection and premiums. Careful consideration of these details ensures you have the appropriate coverage for your needs and budget.

Policy Terms and Conditions

Standard auto insurance policies in New Jersey include several key terms and conditions. These define the extent of coverage, your responsibilities as a policyholder, and the insurer’s obligations in the event of an accident or claim. Understanding these terms is crucial for avoiding misunderstandings and ensuring a smooth claims process. For instance, the definition of “covered driver” will specify who is permitted to operate your vehicle under the policy. Similarly, the policy will Artikel the procedures for reporting accidents, filing claims, and cooperating with investigations. Specific exclusions, such as damage caused by intentional acts, will also be detailed within the policy document. Always read your policy carefully to understand its complete scope and limitations.

Deductible Options and Premium Impact

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums, while lower deductibles result in higher premiums. The choice depends on your risk tolerance and financial situation. For example, a $500 deductible on collision coverage will likely result in a lower monthly premium than a $1000 deductible, but you will pay more out-of-pocket in the event of an accident. Conversely, a higher deductible, like $2500, significantly reduces your premium but exposes you to greater financial risk in the event of a claim. Carefully weighing the trade-off between premium cost and out-of-pocket expenses is crucial when selecting your deductible. Consider your emergency fund and ability to absorb unexpected costs when making this decision.

Choosing Appropriate Coverage Limits

Coverage limits define the maximum amount your insurance company will pay for a specific type of claim. These limits are typically expressed as per-accident and per-person amounts for bodily injury liability and property damage liability. For example, a 25/50/25 policy means $25,000 per person for bodily injury, $50,000 total per accident for bodily injury, and $25,000 for property damage. Selecting adequate coverage limits is essential to protect yourself from significant financial losses in the event of a serious accident. While higher limits result in higher premiums, they provide greater financial security. Consider factors such as your assets, potential liabilities, and the risk of accidents in your area when determining the appropriate coverage limits for your needs. Underestimating your liability coverage could lead to devastating financial consequences if you are involved in a severe accident.

Closure

Securing the cheapest auto insurance in NJ is not about sacrificing essential coverage; it’s about making informed decisions. By understanding the factors influencing your premiums, leveraging available discounts, and carefully comparing quotes, you can significantly reduce your costs without compromising your safety and financial security. Remember, the journey to finding the perfect policy is a proactive one – take control, compare, and save!

FAQ Compilation

What is the minimum required coverage in NJ?

New Jersey mandates minimum liability coverage, typically 15/30/5, meaning $15,000 for injury per person, $30,000 for injury per accident, and $5,000 for property damage. However, higher limits are strongly recommended.

Can I bundle my home and auto insurance for a discount?

Yes, many insurers offer significant discounts for bundling your home and auto insurance policies. This is a common and effective way to lower your overall costs.

How does a speeding ticket affect my insurance rates?

Speeding tickets and other moving violations will increase your premiums. The impact depends on the severity of the violation and your insurer’s specific rating system.

What is a SR-22 form and when is it required?

An SR-22 is a certificate of insurance that proves you maintain the minimum required auto insurance coverage. It’s often required after serious driving offenses or DUI convictions.