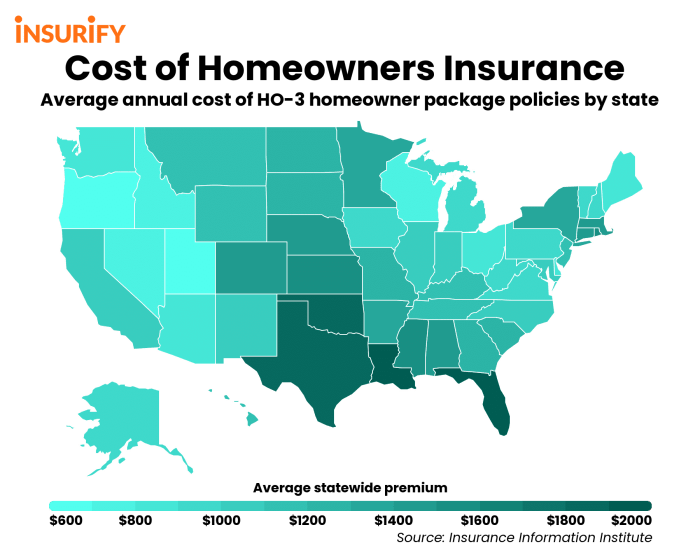

Navigating the Florida home insurance market can feel like traversing a hurricane-prone coastline – challenging, but achievable with the right guidance. High premiums are a common concern for Florida homeowners, driven by factors like hurricane risk, increasing property values, and a complex regulatory landscape. This guide aims to illuminate the path toward securing affordable yet adequate home insurance coverage, empowering you to make informed decisions and protect your most valuable asset.

We’ll delve into the key factors influencing insurance costs, explore various coverage options, compare leading insurers, and offer practical strategies for lowering your premiums. From understanding the impact of your home’s features and location to leveraging discounts and negotiating rates, we provide actionable insights to help you find the cheapest home insurance in Florida that meets your specific needs.

Finding the Cheapest Home Insurance Providers

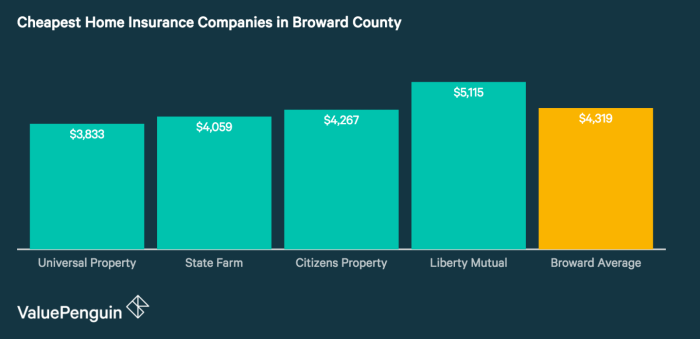

Securing affordable home insurance in Florida is crucial, given the state’s vulnerability to hurricanes and other natural disasters. Understanding the market and the factors influencing premiums is key to finding the best value. This section details how to navigate the Florida home insurance landscape and identify the most cost-effective options for your needs.

Florida Home Insurance Providers

Several home insurance companies operate within Florida, varying significantly in size, reputation, and the types of policies they offer. Choosing a provider involves considering not only price but also financial stability and customer service.

Categorizing insurers by size and reputation is difficult due to constantly shifting market dynamics. However, we can broadly classify them as large national carriers, regional insurers, and smaller, specialized companies. Large national carriers often offer broader coverage options and more established financial stability, but may not always provide the most competitive pricing for specific situations. Regional insurers may offer more tailored solutions and potentially lower premiums for certain risk profiles, but their financial strength might be less established. Smaller, specialized companies may focus on niche markets, offering competitive rates for those who fit their criteria. Always check a company’s financial rating (e.g., from AM Best) before purchasing a policy.

Discounts Offered by Insurers

Many insurers offer various discounts to incentivize policyholders and reward responsible behavior. These discounts can significantly reduce premiums. Common discounts include:

- Multi-policy discounts: Bundling home and auto insurance with the same provider often results in a discount.

- Home security discounts: Installing security systems, such as alarms and monitored systems, can lower premiums due to reduced risk.

- Claim-free discounts: Maintaining a clean claim history often leads to lower premiums over time.

- Loyalty discounts: Long-term policyholders may qualify for discounts as a reward for their continued business.

- Protective device discounts: Installing hurricane shutters or impact-resistant windows can significantly reduce premiums due to decreased damage potential.

Factors Affecting Home Insurance Premiums

Several factors influence the cost of home insurance in Florida. Understanding these factors allows for better preparation and potential cost savings.

These factors include, but are not limited to:

- Credit score: Insurers often use credit scores as an indicator of risk. A higher credit score generally leads to lower premiums.

- Home features: The age, construction materials, and overall condition of your home significantly impact premiums. Newer homes with modern building codes typically receive lower rates.

- Location: Your home’s location plays a crucial role. Properties in high-risk areas prone to hurricanes, flooding, or wildfires typically have higher premiums.

- Coverage amount: The amount of coverage you choose impacts your premium. Higher coverage amounts naturally result in higher premiums.

- Deductible: Choosing a higher deductible can lower your premium, but you will pay more out-of-pocket in the event of a claim.

Comparison of Home Insurance Providers

The following table compares five hypothetical insurers (replace with actual insurers and data). Remember that these are examples and actual premiums and ratings can vary based on individual circumstances.

| Company Name | Average Premium | Coverage Highlights | Customer Rating |

|---|---|---|---|

| Insurer A | $1,500 | Comprehensive coverage, high liability limits | 4.2 stars |

| Insurer B | $1,200 | Standard coverage, reasonable liability limits | 3.8 stars |

| Insurer C | $1,800 | Extensive coverage, including flood insurance | 4.5 stars |

| Insurer D | $1,000 | Basic coverage, lower liability limits | 3.5 stars |

| Insurer E | $1,400 | Good coverage, competitive pricing | 4.0 stars |

Strategies for Reducing Home Insurance Costs

Lowering your home insurance premiums in Florida requires a proactive approach. By implementing several strategies, you can significantly reduce your annual costs without compromising the essential protection your policy provides. This involves understanding your policy, making smart home improvements, and exploring available options for savings.

Several factors influence your home insurance premiums. These include your home’s location, age, construction materials, and the level of coverage you choose. However, many factors are within your control, allowing you to actively manage your costs.

Home Improvements to Reduce Premiums

Making certain improvements to your home can demonstrate to insurers that you’re mitigating risk, leading to lower premiums. These upgrades show a commitment to property maintenance and safety, reducing the likelihood of claims.

- Strengthening Security: Installing a modern security system with alarm monitoring, reinforced doors, and impact-resistant windows can significantly reduce your risk profile and, consequently, your premium. Insurance companies often offer discounts for these security measures.

- Upgrading Roofing Materials: Replacing an older roof with impact-resistant shingles is a substantial investment that can lead to considerable savings on your insurance. These shingles are designed to withstand strong winds and hail, reducing the risk of damage from severe weather events common in Florida.

- Installing Hurricane Shutters or Impact-Resistant Windows: These upgrades provide significant protection against hurricane damage, a major concern in Florida. Insurance companies recognize this and often offer substantial discounts for homes equipped with these protective measures. The cost savings over time can easily offset the initial investment.

- Maintaining Your Property: Regularly maintaining your home, including plumbing, electrical systems, and landscaping, demonstrates responsible homeownership and lowers the likelihood of costly repairs. This careful upkeep can positively influence your insurer’s assessment of your risk.

Bundling Home and Auto Insurance

Bundling your home and auto insurance policies with the same insurer is a common and effective strategy to lower your overall costs. Insurers frequently offer discounts for bundling, recognizing the reduced administrative overhead and increased customer loyalty. This can result in a substantial saving compared to purchasing separate policies from different companies. For example, a hypothetical 10% discount on both your home and auto insurance could represent significant annual savings.

Government Assistance Programs and Subsidies

While there aren’t widespread government-sponsored subsidies specifically for home insurance in Florida, several programs might indirectly assist homeowners facing financial hardship. It’s crucial to research local and state-level initiatives, such as those focusing on affordable housing or disaster relief. Contacting your local government agencies or community organizations can provide information on available resources and potential assistance programs. These programs may not directly reduce your insurance premiums but can offer financial assistance to manage the overall cost of homeownership.

Negotiating Lower Premiums

Effective negotiation with your insurer can sometimes yield surprisingly positive results. Preparing for the negotiation is key.

- Shop Around and Compare Quotes: Obtain quotes from multiple insurers to understand the market value of your insurance needs. This information strengthens your negotiating position.

- Highlight Home Improvements: Emphasize the upgrades you’ve made to your home, particularly those that reduce risk, such as security systems or hurricane protection. Provide documentation of these improvements.

- Consider Raising Your Deductible: A higher deductible means lower premiums. Carefully weigh the financial implications of a higher deductible against the potential savings.

- Maintain a Clean Claims History: A history of few or no claims demonstrates responsible homeownership and can influence your insurer’s willingness to offer discounts or favorable rates.

- Be Polite and Persistent: A respectful and persistent approach can often lead to better outcomes. Don’t be afraid to politely push for a better deal, especially if you’ve been a loyal customer.

Illustrative Examples of Home Insurance Policies

Understanding the differences between home insurance policies is crucial for securing adequate protection without unnecessary expense. Three sample policies, each with varying coverage levels, will illustrate this point. Remember that actual premiums will vary based on location, property specifics, and the insurer.

Policy Comparisons: Coverage and Cost

We’ll compare three fictional policies – “Basic,” “Standard,” and “Premium” – to highlight the differences in coverage and associated costs. These examples are for illustrative purposes only and do not reflect specific policies offered by any particular insurer.

Policy: Basic – This policy offers minimal coverage, focusing primarily on liability and dwelling protection with lower limits. It typically has a higher deductible, leading to lower premiums. Coverage for personal property may also be limited.

Policy: Standard – This represents a balanced approach, offering more comprehensive coverage than the Basic policy, including increased limits for dwelling, personal property, and liability. Deductibles are generally lower than the Basic policy, resulting in a higher premium. Additional coverage options may be included.

Policy: Premium – This policy provides the most extensive coverage, with high limits for all aspects, including dwelling, personal property, liability, and often additional coverage for specific perils such as flooding or earthquakes (usually requiring separate endorsements). This level of protection comes with the highest premium and typically the lowest deductible.

A table summarizing the key differences follows:

| Feature | Basic Policy | Standard Policy | Premium Policy |

|---|---|---|---|

| Dwelling Coverage | $150,000 | $250,000 | $400,000 |

| Personal Property Coverage | $75,000 | $125,000 | $200,000 |

| Liability Coverage | $100,000 | $300,000 | $500,000 |

| Deductible | $2,500 | $1,000 | $500 |

| Annual Premium (Estimate) | $800 | $1,200 | $1,800 |

Scenario: Benefit of Increased Coverage

Imagine a homeowner with a $200,000 home. A fire causes $175,000 in damage. With the Basic policy, they would receive $150,000 minus their $2,500 deductible, leaving them $50,000 short to rebuild. However, with the Standard policy, they would likely recover the full cost of repairs, highlighting the benefit of increased coverage despite the higher premium. The peace of mind provided by knowing their home will be fully restored is invaluable.

Scenario: Higher Deductible for Lower Premium

A homeowner with a modest income might opt for a higher deductible to reduce their premium. For example, choosing a $2,500 deductible instead of a $1,000 deductible on a Standard policy could result in a significant premium reduction, potentially saving hundreds of dollars annually. They would need to have sufficient savings to cover the higher deductible in case of a claim. This strategy balances affordability with risk tolerance.

Last Point

Securing affordable home insurance in Florida requires careful consideration of multiple factors, from your home’s characteristics and location to the insurer’s reputation and coverage offerings. By understanding the intricacies of the market and employing the strategies Artikeld in this guide, you can confidently navigate the process and obtain the best possible protection for your investment. Remember, the cheapest policy isn’t always the best; prioritizing adequate coverage alongside affordability is crucial for peace of mind.

FAQ Compilation

What is the average cost of home insurance in Florida?

The average cost varies significantly based on location, coverage, and the homeowner’s risk profile. It’s best to obtain personalized quotes from multiple insurers.

Can I get home insurance if I have a previous claim?

Yes, but a previous claim will likely increase your premiums. Be transparent with insurers about your claims history.

What is Citizens Property Insurance Corporation?

Citizens is Florida’s insurer of last resort. It provides coverage to homeowners who can’t find insurance in the private market, often at higher rates.

How often can I review my home insurance policy?

You can typically review and adjust your policy annually. It’s advisable to do so to ensure your coverage aligns with your current needs and to potentially negotiate better rates.