The unwavering bond between humans and their pets often leads to significant financial commitments, especially when unexpected illnesses or injuries arise. Understanding the cost of pet insurance is crucial for responsible pet ownership, ensuring both your furry friend’s well-being and your financial stability. This guide delves into the intricacies of pet insurance costs, offering insights into factors influencing premiums, comparing different coverage options, and providing strategies for finding affordable plans. We aim to equip you with the knowledge to make informed decisions and protect your beloved companion.

From breed-specific predispositions to the type of coverage selected, numerous variables impact the final cost. This exploration will unpack these factors, providing a clear picture of how much pet insurance can cost and how to navigate the complexities of policy selection to find the best fit for your budget and your pet’s needs. We’ll also examine cost-saving strategies and offer real-world examples to illustrate the potential financial benefits of pet insurance.

Factors Influencing Pet Insurance Costs

Several key factors contribute to the overall cost of pet insurance premiums. Understanding these elements allows pet owners to make informed decisions when choosing a plan that best suits their budget and their pet’s needs. These factors interact in complex ways, leading to a wide range of premium costs.

Breed

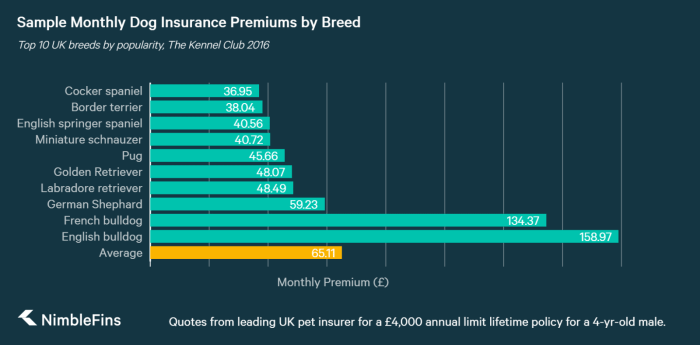

A pet’s breed significantly influences insurance premiums. Certain breeds are predisposed to specific health issues, leading to higher expected veterinary costs. For example, breeds prone to hip dysplasia (like German Shepherds) or certain types of cancer (like Golden Retrievers) will generally command higher premiums than breeds with a lower incidence of these conditions. Insurers use actuarial data on breed-specific health risks to determine these premiums.

Age

Similar to human health insurance, a pet’s age is a critical factor. Younger animals generally have lower premiums because they are statistically less likely to require extensive veterinary care. As pets age, the risk of illness and injury increases, resulting in higher premiums to reflect this increased risk. Senior pets, especially those over seven years old, often face the highest premiums.

Pre-existing Conditions

Pre-existing conditions are a major factor affecting insurance costs. These are health issues a pet had before the insurance policy started. Most pet insurance policies will not cover pre-existing conditions, meaning that any treatment related to these conditions will not be reimbursed. This is a crucial point to consider when purchasing insurance; it is often better to insure a pet young and healthy to avoid this exclusion.

Location

Geographic location plays a role in determining premiums. The cost of veterinary care varies significantly across regions. Areas with higher veterinary costs, often metropolitan areas or regions with specialized veterinary services, will typically result in higher insurance premiums. This reflects the insurer’s need to cover the increased cost of claims in these areas.

Coverage Level

The level of coverage chosen directly impacts the premium cost. Accident-only plans cover only injuries resulting from accidents, while accident and illness plans cover both accidents and illnesses. Comprehensive plans offer the broadest coverage, including routine care, such as vaccinations and wellness checkups. Higher coverage levels naturally result in higher premiums because they cover a wider range of potential veterinary expenses.

Impact of Medical History

A pet’s medical history heavily influences the cost of insurance. A pet with a history of health problems, even if those problems are currently under control, will likely face higher premiums. Insurers assess the likelihood of future health issues based on the pet’s medical history. Thorough disclosure of a pet’s medical history is crucial for obtaining accurate and appropriate coverage.

Premium Cost Comparison Across Breeds and Age Groups

The following table provides a hypothetical example of average premium costs for different breeds and age groups. These are illustrative figures and actual premiums may vary depending on the insurer, coverage level, and other factors.

| Breed | Age Range | Average Premium (Annual) | Coverage Type |

|---|---|---|---|

| Golden Retriever | 0-2 years | $400 | Accident & Illness |

| Golden Retriever | 7-9 years | $800 | Accident & Illness |

| Siamese Cat | 0-2 years | $300 | Accident & Illness |

| Siamese Cat | 7-9 years | $600 | Accident & Illness |

| German Shepherd | 0-2 years | $500 | Accident & Illness |

| German Shepherd | 7-9 years | $1000 | Accident & Illness |

Types of Pet Insurance Coverage and Their Costs

Understanding the different types of pet insurance and their associated costs is crucial for pet owners seeking financial protection. The market offers a variety of plans, each with its own coverage levels, deductibles, and reimbursement methods. Choosing the right plan depends on your pet’s breed, age, health history, and your budget.

Pet insurance policies generally fall into two main categories: accident-only and comprehensive. Accident-only plans cover injuries resulting from accidents, such as broken bones or lacerations. Comprehensive plans offer broader coverage, encompassing both accidents and illnesses. Within these categories, further variations exist, influencing the overall cost.

Reimbursement and Indemnity Plans

Reimbursement plans, also known as reimbursement-based plans, allow you to seek veterinary care from any vet and then submit your claim for reimbursement. The insurer will cover a percentage of the vet bill, up to your policy’s coverage limit, after you have met your deductible. Indemnity plans, on the other hand, offer a predetermined amount for specific treatments or conditions, regardless of the actual cost incurred. For instance, an indemnity plan might pay $500 for a cruciate ligament surgery, even if the actual cost was $700 or $300. Reimbursement plans typically have higher premiums than indemnity plans because they offer more flexibility and potentially higher payouts.

Coverage Limits and Deductibles

Coverage limits define the maximum amount your insurer will pay out for a specific condition or during a policy year. For example, a plan might have a $5,000 annual limit or a $10,000 lifetime limit. Deductibles are the amount you must pay out-of-pocket before your insurance coverage kicks in. Deductibles can be annual or per condition. A higher deductible usually results in a lower premium, while a lower deductible means a higher premium. Common deductible options range from $100 to $500 or more. For instance, a plan with a $250 annual deductible will require you to pay the first $250 of veterinary expenses each year before the insurance company starts covering the costs.

Coverage Options and Cost Implications

The cost of pet insurance is significantly influenced by the specific coverage options included in the plan. Below is a list illustrating the common coverage options and their general cost impact.

- Accidents: This covers injuries from accidents, such as broken bones, lacerations, and ingestion of foreign objects. This is typically included in even the most basic plans, and its cost impact is minimal, often bundled with other coverages.

- Illnesses: Covers illnesses such as infections, allergies, and chronic conditions. Including illness coverage increases the premium considerably compared to accident-only plans.

- Surgeries: Covers surgical procedures necessitated by accidents or illnesses. The cost impact depends on the extent of surgical coverage; comprehensive plans offering broader surgical coverage will naturally cost more.

- Wellness Care: This covers routine preventative care like vaccinations, dental cleanings, and parasite prevention. While not always included in basic plans, adding wellness care can significantly increase the premium, though it provides valuable preventative benefits.

- Prescription Medications: Coverage for ongoing prescription medications needed to manage chronic conditions. Inclusion of this coverage adds to the premium, especially for pets with pre-existing conditions or requiring long-term medication.

- Alternative Therapies: Some plans offer coverage for alternative therapies like acupuncture or chiropractic care. This coverage is often optional and will increase the cost of the premium.

Cost-Saving Strategies for Pet Insurance

Securing affordable pet insurance requires careful consideration of various factors and proactive strategies. By understanding the nuances of policy options and employing smart planning, pet owners can significantly reduce their overall insurance costs without compromising essential coverage. This section explores several effective approaches to achieving cost-effective pet insurance.

Finding Affordable Pet Insurance Options

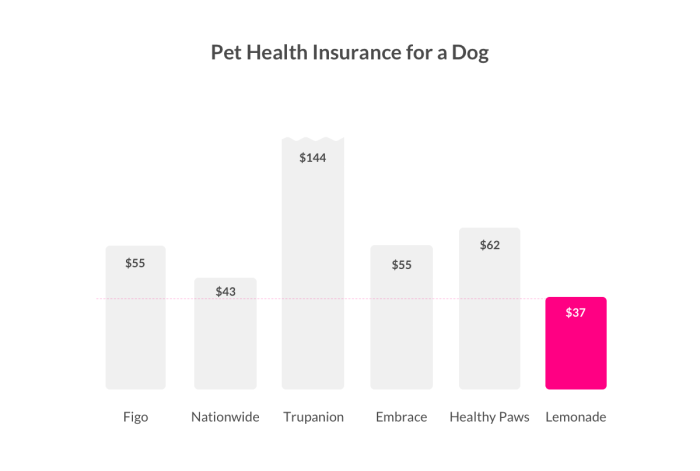

Several avenues exist for finding competitively priced pet insurance. Online comparison tools allow you to input your pet’s details and receive quotes from multiple insurers simultaneously, facilitating a side-by-side comparison of premiums and coverage. Directly contacting insurance providers and discussing your specific needs can also yield beneficial results, potentially uncovering discounts or tailored plans. Consider the reputation and financial stability of the insurer before making a decision, ensuring they can meet your needs in the long term. Reading online reviews and seeking recommendations from other pet owners can also provide valuable insights.

Benefits of Bundling Pet Insurance with Other Insurance Types

While not universally available, some insurance providers offer discounts when bundling pet insurance with other policies, such as home or auto insurance. This bundling strategy can lead to considerable savings on your overall insurance premiums. Contact your existing insurers to inquire about potential discounts for adding pet insurance to your existing portfolio. The specific savings will vary based on the insurer and the types of insurance policies involved. For example, a hypothetical scenario could see a 10% discount on pet insurance when bundled with a home insurance policy from the same provider.

Impact of Higher Deductibles on Overall Cost

Choosing a higher deductible significantly reduces your monthly or annual premiums. A higher deductible means you pay more out-of-pocket for veterinary expenses before the insurance coverage kicks in. However, this trade-off can result in substantial savings on your premiums, making it a viable strategy for pet owners comfortable with higher upfront costs. For instance, a policy with a $500 deductible might be significantly cheaper than one with a $100 deductible, even though the overall coverage limits might be the same. Careful consideration of your pet’s health history and your financial capacity to cover a higher deductible is crucial before making this decision.

Preventative Care and Long-Term Cost Reduction

Investing in preventative care, such as regular check-ups, vaccinations, and dental cleanings, can substantially reduce the likelihood of expensive health issues down the line. Many insurers offer discounts or rewards programs for pet owners who actively engage in preventative care. These programs can incentivize proactive health management and reduce the overall cost of pet ownership and insurance premiums. For example, a policy might offer a 5% discount on premiums if your pet receives all recommended vaccinations and annual check-ups. The long-term savings from preventing serious illnesses far outweigh the initial cost of preventative care, both in terms of direct veterinary expenses and insurance premiums.

Final Review

Ultimately, the cost of pet insurance is a balancing act between the level of coverage desired and your budget. While premiums may seem substantial upfront, the potential savings from unexpected veterinary bills can be significant, offering peace of mind and protecting your pet’s health. By carefully considering the factors Artikeld in this guide and comparing different providers, you can find a pet insurance plan that provides adequate coverage without breaking the bank. Remember, proactive planning and informed decision-making are key to ensuring your pet receives the best possible care throughout their life.

FAQ Compilation

What is a waiting period in pet insurance?

A waiting period is a timeframe after policy activation before certain types of coverage become effective. This typically applies to pre-existing conditions and sometimes specific procedures.

Can I cancel my pet insurance policy?

Yes, you can usually cancel your pet insurance policy, but there might be cancellation fees depending on your provider and policy terms. Check your policy documents for specifics.

Does pet insurance cover preventative care?

Some pet insurance plans offer wellness care add-ons or separate wellness plans covering preventative care like vaccinations and routine checkups, but it’s not always included in basic accident and illness coverage.

How often are pet insurance premiums adjusted?

Premiums are typically reviewed and adjusted annually, sometimes more frequently depending on the insurer and factors like your pet’s age and health.