Securing affordable and comprehensive car insurance is a crucial step in responsible vehicle ownership. The process, however, can feel daunting, with a multitude of factors influencing the final cost. Understanding how to estimate car insurance premiums empowers you to make informed decisions and potentially save significant money. This guide will navigate you through the complexities of obtaining accurate estimates, helping you find the best coverage at a price that fits your budget.

From identifying your specific needs and exploring various online quoting tools to understanding the key factors affecting your premiums, we’ll equip you with the knowledge to confidently navigate the car insurance landscape. We’ll delve into the intricacies of online estimators, highlighting their advantages and limitations, and provide practical advice to ensure you’re making the most informed choices possible.

Understanding “Estimate Car Insurance” Search Intent

The search term “estimate car insurance” reveals a user actively engaged in the car insurance purchasing process, seeking to understand the potential cost before committing to a policy. This seemingly simple phrase hides a range of underlying needs and intentions, reflecting various stages of the consumer journey.

Understanding the nuances of this search query is crucial for effectively targeting potential customers and providing them with the relevant information they need. This involves identifying the diverse user needs, pinpointing their position within the purchasing journey, and anticipating the type of information they’re seeking.

User Needs Behind “Estimate Car Insurance” Searches

Users searching for “estimate car insurance” have several primary needs. They might be comparing prices from different insurers, looking for a general idea of how much car insurance costs, or trying to determine if they can afford coverage before even considering specific policy details. Some may be shopping around for a new policy, while others might be renewing their existing one and want to see if they can find a better deal. Others still may be researching insurance costs as part of a larger financial planning process, considering the impact of car insurance on their overall budget.

Stages of the Car Insurance Purchasing Journey

The search term “estimate car insurance” reflects several stages in the car insurance purchasing journey. Early-stage users might be simply researching costs, while those further along are likely comparing quotes from multiple providers. Some users might be ready to purchase a policy immediately after obtaining an estimate, while others may require additional information or time for consideration. The search could signal a need for immediate action (e.g., needing insurance before driving a newly purchased car) or a more leisurely process (e.g., comparing options over several weeks). For example, a recent college graduate buying their first car might be in the early stages, focused on general cost estimates. Conversely, someone whose current policy is about to expire is likely further along, actively seeking quotes to ensure uninterrupted coverage.

Information Sought by Users

Users searching for “estimate car insurance” typically seek specific types of information. This includes the estimated cost of insurance based on their individual profile (age, driving history, vehicle type, location), a comparison of prices across different insurers, details about coverage options and their respective costs, and information on discounts or promotions. They might also want to understand the factors influencing the final cost, such as deductibles and coverage limits. A user might be looking for a simple price range, while another might need a detailed breakdown of the cost components.

Example User Persona: Sarah

Sarah is a 28-year-old marketing professional who recently purchased a new used car. She has a clean driving record and lives in a suburban area with a relatively low crime rate. She is currently researching car insurance options and wants to get an estimate of the cost before committing to a policy. She is primarily concerned with finding affordable coverage that meets her basic needs, and she is open to comparing different insurers to find the best deal. She is comfortable using online tools and resources to gather information and compare options. She values transparency and clear communication from insurance providers.

Factors Affecting Car Insurance Estimates

Getting an accurate car insurance estimate involves considering numerous factors. Understanding these factors allows you to better anticipate your premium and make informed decisions about your coverage. This section details the key elements influencing the final cost of your car insurance.

Driver Age

Driver age significantly impacts insurance premiums. Younger drivers, typically under 25, are statistically involved in more accidents and therefore present a higher risk to insurance companies. This higher risk translates to significantly higher premiums. Conversely, older drivers, particularly those in their 50s and 60s, often benefit from lower rates due to their generally improved driving records and lower accident frequency. Insurance companies use actuarial data to assess risk based on age demographics.

Driving History

Your driving history is a crucial factor. A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, accidents, speeding tickets, or DUI convictions will substantially increase your premiums. The severity and frequency of incidents significantly impact the increase. For example, a single minor accident might lead to a moderate increase, while multiple serious accidents or DUI convictions could lead to significantly higher premiums or even policy rejection.

Vehicle Type

The type of vehicle you drive also influences your insurance cost. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs and increased risk of theft. Conversely, smaller, less expensive cars typically have lower insurance premiums. Factors like safety ratings, repair costs, and theft statistics all contribute to the vehicle’s impact on the insurance estimate. For instance, a new, high-value SUV will cost more to insure than a used, smaller sedan.

Coverage Options

The level of coverage you choose directly affects your premium. Basic liability coverage, which only covers damages to others, is the least expensive. Adding comprehensive and collision coverage, which protects your own vehicle from damage, significantly increases the premium. Similarly, adding optional features like uninsured/underinsured motorist coverage or roadside assistance will also increase the cost. For example, opting for full coverage (liability, comprehensive, and collision) will be considerably more expensive than choosing only liability coverage.

| Factor | Description | Impact on Estimate | Example |

|---|---|---|---|

| Driver Age | The age of the primary driver. | Younger drivers typically pay more; older drivers often pay less. | A 20-year-old driver will likely pay more than a 50-year-old driver with a similar driving record and vehicle. |

| Driving History | Past accidents, tickets, and driving violations. | Clean record = lower premiums; incidents = higher premiums. | A driver with three speeding tickets will pay more than a driver with a clean record. |

| Vehicle Type | Make, model, year, and features of the vehicle. | Expensive, high-performance vehicles cost more to insure. | A new sports car will be more expensive to insure than a used economy car. |

| Coverage Options | The type and amount of coverage selected. | More coverage = higher premiums; less coverage = lower premiums. | Full coverage (liability, comprehensive, collision) will be more expensive than liability-only coverage. |

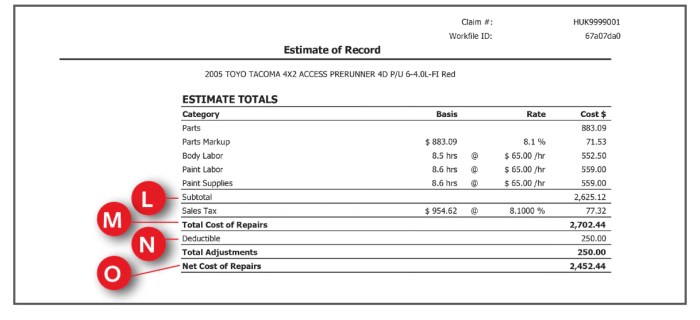

Illustrating the Estimation Process

Generating a car insurance estimate involves a complex interplay of data and calculations. The process aims to provide a prospective customer with a preliminary cost for coverage, allowing them to compare options before committing to a policy. Understanding this process is crucial for obtaining an accurate estimate and making informed decisions.

The estimation process can be visualized as a flow chart. Imagine a series of boxes connected by arrows. The first box is labeled “Input Data.” This box contains all the information provided by the user, such as the vehicle’s year, make, model, and VIN; the driver’s age, driving history (including accidents and violations), location, and desired coverage levels (liability, collision, comprehensive, etc.). Arrows then lead to subsequent boxes representing different calculation stages. One box represents the calculation of base premiums based on the vehicle’s risk profile. Another calculates adjustments based on the driver’s risk profile. A third box incorporates additional factors, such as discounts for safety features, multiple vehicle insurance, or good driving records. Finally, all these calculations converge in a final box displaying the estimated premium. This visual representation demonstrates how various factors are combined to arrive at a final figure.

Obtaining an Accurate Estimate Using an Online Tool

To obtain an accurate estimate using an online tool, follow these steps: First, locate a reputable insurance provider’s website. Next, navigate to their online quote tool. Carefully complete all the requested fields with accurate information. This includes providing precise details about your vehicle, your driving history, and your desired coverage levels. Double-check your entries for accuracy before submitting your request. The online tool will then process your information using its algorithms, and the resulting estimate will be displayed. Remember, providing inaccurate information can lead to a misleading estimate. For example, omitting a prior accident could significantly underestimate the true cost.

Discrepancies Between Online Estimates and Final Policy Premiums

Online estimates are just that – estimates. Several factors can lead to discrepancies between the initial online estimate and the final premium. These include additional factors not initially considered in the online quote, such as the specific details of your vehicle’s condition (which might be assessed during a physical inspection), or the identification of additional discounts that weren’t automatically applied online. Furthermore, the underwriting process might reveal information that affects your risk profile differently than the online estimator initially predicted. For instance, a more in-depth review of your driving record might reveal previously unknown infractions. Finally, the final premium may include additional fees or taxes not reflected in the initial estimate. For example, a $1000 online estimate could become $1050 after taxes and fees are added.

The Importance of Comparing Multiple Quotes

Comparing multiple quotes from different insurance providers is crucial before purchasing a policy. Different companies use different algorithms and risk assessment models, resulting in varying premiums for the same coverage. By obtaining quotes from several companies, you can ensure that you’re getting the most competitive price for the level of coverage you need. This comparison shopping process can save you a significant amount of money over the life of your policy. For example, one company might offer a lower rate for liability coverage, while another offers a better rate for collision coverage, depending on the driver’s risk profile and vehicle type.

Beyond the Estimate

Receiving a car insurance estimate is just the first step in securing the right coverage for your vehicle. Understanding what to do next is crucial to ensure you’re adequately protected and paying a fair price. This section Artikels the key actions you should take after receiving your estimate.

The estimate provides a preliminary cost; however, it’s vital to thoroughly review the details and make informed decisions before committing to a policy.

Reviewing Policy Details and Coverage Options

It’s essential to carefully examine the specifics of the insurance policy associated with your estimate. Don’t just focus on the price; understand what’s covered. Compare the coverage levels (liability, collision, comprehensive, etc.) offered, ensuring they align with your needs and risk tolerance. For example, if you have a newer car, comprehensive coverage might be more important to protect against theft or damage from events not involving a collision. Similarly, higher liability limits offer greater protection in case you’re at fault in an accident. Consider factors like your driving history, the value of your car, and your personal financial situation when evaluating coverage options. A detailed policy document will Artikel all the specifics, including deductibles, exclusions, and any additional riders you may have selected.

Negotiating Premiums with Insurance Providers

Many insurance companies are open to negotiating premiums, especially if you’re a loyal customer or can demonstrate a strong driving record. Before accepting the initial estimate, consider exploring ways to lower your premium. This might involve bundling your car insurance with other policies (like homeowners or renters insurance), opting for a higher deductible (accepting more financial responsibility in case of an accident in exchange for a lower premium), or taking a defensive driving course to demonstrate your commitment to safe driving. Be prepared to compare quotes from multiple insurers to leverage competition and potentially secure a better deal. Clearly articulate your needs and your willingness to switch providers if a better offer isn’t presented. Remember to be polite but firm during negotiations.

Taking Action After Receiving Your Estimate

After careful consideration of your estimate and policy details, several key actions should be taken:

- Compare quotes from multiple insurers: Don’t settle for the first estimate you receive. Shop around to compare prices and coverage options.

- Ask questions: If anything in the policy or estimate is unclear, don’t hesitate to contact the insurance provider for clarification.

- Read the fine print: Thoroughly review the policy document to understand all aspects of your coverage.

- Consider additional coverage: Evaluate whether you need additional coverage, such as roadside assistance or rental car reimbursement.

- Finalize your policy: Once you’re satisfied with the coverage and price, complete the application process and make the necessary payments.

Outcome Summary

Estimating car insurance doesn’t have to be a mystery. By understanding the factors influencing premiums, utilizing online quoting tools effectively, and comparing multiple quotes, you can gain a clear picture of your potential costs. Remember, securing the right coverage at the best possible price requires proactive research and informed decision-making. Take the time to compare options and don’t hesitate to negotiate with insurers to ensure you’re getting the best deal for your needs.

FAQ Compilation

What information do I need to get a car insurance estimate?

Typically, you’ll need your driver’s license information, vehicle details (make, model, year), address, driving history (including accidents and violations), and desired coverage levels.

Are online car insurance estimates always accurate?

Online estimates provide a good starting point, but they might not reflect the final premium exactly. Factors like your credit score and specific underwriting criteria can influence the final cost.

Can I get an estimate without providing my personal information?

Some websites offer preliminary estimates without requiring extensive personal data. However, for a precise quote, you’ll usually need to provide more detailed information.

How often should I re-estimate my car insurance?

It’s advisable to re-estimate your car insurance annually, or whenever significant changes occur (e.g., new car, change in address, improved driving record).