Securing affordable and comprehensive auto insurance in Florida can feel like navigating a complex maze. This guide unravels the intricacies of obtaining a Florida auto insurance quote, offering insights into the factors influencing costs, comparing providers, and empowering you to make informed decisions. Understanding the nuances of Florida’s insurance market is crucial for securing the best coverage at a competitive price.

From understanding the various coverage options and the impact of your driving history to comparing online quote platforms and deciphering policy documents, we’ll equip you with the knowledge to confidently navigate the process. We’ll also explore common pitfalls and offer practical tips to ensure you’re adequately protected while optimizing your insurance spending.

Understanding Florida’s Auto Insurance Market

Navigating the Florida auto insurance market requires understanding several key factors that significantly impact costs and coverage. This includes a complex interplay of regulatory frameworks, demographic trends, and the competitive landscape of insurance providers. This section will explore these factors to provide a clearer picture of the state’s unique insurance environment.

Factors Influencing Auto Insurance Costs in Florida

Several interconnected factors contribute to the often-high cost of auto insurance in Florida. These factors range from the state’s high population density and traffic congestion to the prevalence of fraudulent claims and the frequency of severe weather events. High litigation costs and the state’s “no-fault” insurance system also play a significant role. For example, the high number of uninsured motorists increases the risk for insured drivers, leading to higher premiums. Similarly, the state’s susceptibility to hurricanes and other natural disasters necessitates higher premiums to cover potential damages.

Types of Auto Insurance Coverage in Florida

Florida mandates specific minimum coverage levels for all drivers. These include Personal Injury Protection (PIP), which covers medical expenses and lost wages for the insured and passengers regardless of fault; Property Damage Liability (PDL), which covers damages to other vehicles or property; and Bodily Injury Liability (BIL), which covers medical expenses and other damages to others injured in an accident caused by the insured. Beyond these minimum requirements, drivers can opt for additional coverage such as Uninsured/Underinsured Motorist (UM/UIM) protection, which covers damages caused by uninsured or underinsured drivers; Collision coverage, which covers damages to the insured’s vehicle regardless of fault; and Comprehensive coverage, which covers damages caused by events other than collisions, such as theft or weather damage.

Pricing Strategies of Major Florida Auto Insurance Providers

Major Florida auto insurance providers employ diverse pricing strategies, often reflecting their risk assessment models and target markets. Some insurers may focus on attracting low-risk drivers with competitive pricing and discounts, while others may prioritize higher-risk drivers, charging accordingly. These strategies are often influenced by factors such as credit scores, driving history, age, and the type of vehicle insured. For instance, a company specializing in insuring young drivers might have higher premiums than one targeting older, more experienced drivers with clean records. The competitive landscape compels insurers to constantly adjust their pricing models to remain attractive to consumers while maintaining profitability.

Regulatory Environment Governing Auto Insurance in Florida

The Florida Office of Insurance Regulation (OIR) oversees the state’s auto insurance market, setting minimum coverage requirements, regulating rates, and investigating consumer complaints. The OIR’s influence on the market is substantial, shaping the competitive dynamics and protecting consumers from unfair practices. Regulations surrounding rate increases, policy provisions, and claims handling are constantly subject to review and potential adjustments, reflecting the ever-evolving nature of the insurance landscape. The regulatory framework aims to strike a balance between ensuring consumer protection and allowing insurers to operate profitably.

The “Florida Auto Insurance Quote” Search Process

Finding the right auto insurance in Florida can feel overwhelming, given the diverse range of providers and policy options. Understanding the typical online quote search process, its potential pitfalls, and available resources is crucial for securing the best coverage at a competitive price. This section details the steps involved, common challenges, and tools to streamline your search.

Consumers typically begin their search by entering relevant s into a search engine (e.g., “cheap car insurance Florida,” “best auto insurance quotes Florida”). This leads them to various insurance company websites, comparison websites, or insurance brokers’ platforms. The process then involves providing personal and vehicle information to generate personalized quotes. This data typically includes driver’s license information, vehicle details, driving history, and desired coverage levels.

Steps in the Online Quote Acquisition Process

The online quote acquisition process generally follows a structured path. A user-friendly flow chart can help visualize this process and highlight potential pain points.

Flow Chart: Obtaining a Florida Auto Insurance Quote Online

[Imagine a flowchart here. The flowchart would start with “Search for Auto Insurance Quotes,” branching to “Company Websites,” “Comparison Websites,” and “Insurance Brokers.” Each branch would then lead to “Enter Personal Information,” followed by “Enter Vehicle Information,” and finally “Receive Quote.” Each step would have a potential pain point indicated, such as “Difficult Navigation,” “Confusing Forms,” “Inaccurate Information Request,” or “Hidden Fees.” The final box would be “Compare Quotes and Choose Policy.”]

Common Pain Points During the Search Process

Several factors can frustrate consumers during their search for Florida auto insurance quotes online. Understanding these pain points allows for better navigation of the process.

- Inaccurate or Incomplete Information Requests: Websites often request unnecessary or confusing information, leading to delays and frustration.

- Difficult Website Navigation: Poorly designed websites with complex layouts make finding the quote process challenging.

- Hidden Fees and Charges: Unexpected fees or add-ons that are not clearly disclosed can significantly impact the final cost.

- Lack of Transparency in Coverage Options: Understanding the nuances of different coverage levels and deductibles can be difficult.

- Difficulty Comparing Quotes: Comparing quotes across different platforms with varying formats and levels of detail can be time-consuming.

Comparison of Online Quote Platforms

Different online platforms offer varying features and levels of user-friendliness. Comparing these features can help consumers make informed decisions.

| Platform | Ease of Use | Features | Customer Support |

|---|---|---|---|

| Example Platform A (e.g., a major insurer’s website) | Good – straightforward process, clear instructions | Basic quote generation, limited coverage options | Phone and email support |

| Example Platform B (e.g., a comparison website) | Excellent – easy comparison across multiple insurers | Wide range of insurers, detailed coverage comparisons | Online chat and email support |

| Example Platform C (e.g., an independent insurance broker’s website) | Good – personalized service, expert advice | Customized quotes, access to niche insurers | Phone and in-person consultations |

| Example Platform D (e.g., a smaller insurer’s website) | Fair – simple interface, but limited features | Basic quote generation, limited coverage options | Email support only |

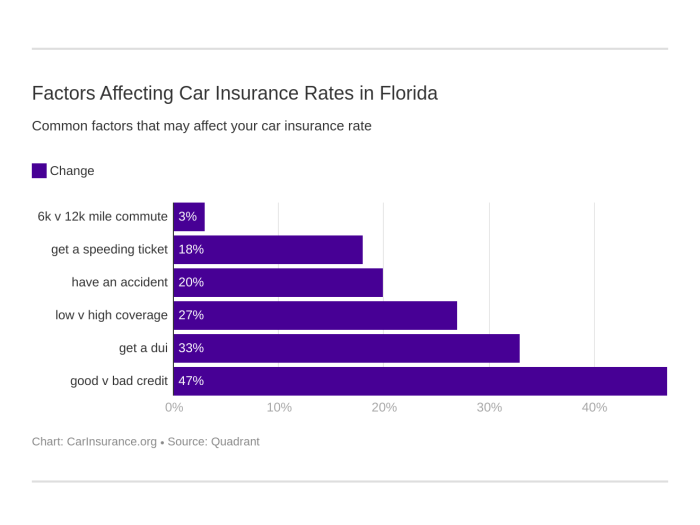

Factors Affecting Quote Prices

Several key factors influence the price of your Florida auto insurance quote. Understanding these elements can help you make informed decisions and potentially secure more affordable coverage. These factors interact in complex ways, so a single change can have a ripple effect on your overall premium.

Driving History’s Impact on Premiums

Your driving record significantly impacts your insurance premiums. Insurance companies analyze your history to assess your risk. A clean record, free of accidents and traffic violations, generally results in lower premiums. Conversely, accidents, especially those resulting in significant damage or injuries, and traffic violations like speeding tickets or DUIs, will substantially increase your premiums. The severity and frequency of incidents are key considerations. For example, a single minor fender bender might lead to a moderate increase, while multiple serious accidents or a DUI could result in significantly higher premiums or even policy rejection. Many companies utilize a points system, where each violation adds points, directly correlating to higher premiums.

Vehicle Type and Age

The type and age of your vehicle are major factors in determining insurance costs. Generally, newer vehicles, particularly those with advanced safety features like anti-lock brakes and airbags, are considered less risky and therefore attract lower premiums. Conversely, older vehicles, especially those with a history of repairs or known mechanical issues, are often associated with higher premiums due to increased risk of accidents and higher repair costs. The type of vehicle also plays a role; sports cars and high-performance vehicles typically have higher premiums than sedans or smaller vehicles because of their higher repair costs and greater potential for accidents. For example, insuring a brand-new electric SUV might be cheaper than insuring a used sports car of the same value.

Location and Demographics

Your location and demographic information influence your insurance rates. Areas with high crime rates, frequent accidents, or a high density of vehicles tend to have higher insurance premiums due to increased risk. Similarly, demographic factors like age and gender can also play a role, as certain demographics are statistically associated with higher accident rates. For example, young drivers (under 25) generally pay more because of their statistically higher accident risk. Living in a rural area with fewer accidents might lead to lower premiums compared to a densely populated urban center with high traffic congestion.

Discounts Offered by Insurance Companies

Many insurance companies offer various discounts to reduce premiums. These discounts can significantly lower your overall cost. Understanding and taking advantage of these can save you money.

- Good Student Discount: Offered to students maintaining a certain GPA.

- Safe Driver Discount: Rewards drivers with a clean driving record over a specified period.

- Multi-Vehicle Discount: Provides a discount for insuring multiple vehicles under the same policy.

- Bundling Discount: Offers a discount when bundling auto insurance with other types of insurance, such as homeowners or renters insurance.

- Anti-theft Device Discount: Reduces premiums if your vehicle is equipped with an anti-theft device.

Comparison of Insurance Providers

Choosing the right auto insurance provider in Florida can significantly impact your premiums and the level of coverage you receive. This section compares three major insurers – State Farm, Geico, and Progressive – to illustrate the variations in coverage options and pricing. Remember that rates are highly individualized and depend on numerous factors.

Direct comparison of insurance providers reveals significant differences in pricing and coverage offerings. While all three companies offer standard liability, collision, and comprehensive coverage, the specific details and pricing can vary considerably. Furthermore, each insurer utilizes different algorithms and data points to personalize quotes, leading to varying results even for individuals with similar profiles.

Coverage Options and Price Ranges

The following table presents a simplified comparison of coverage options and price ranges for liability, collision, and comprehensive coverage for a hypothetical 30-year-old driver with a clean driving record in a mid-size sedan in a medium-risk Florida zip code. Actual prices will vary based on individual circumstances.

| Coverage Type | State Farm (Price Range) | Geico (Price Range) | Progressive (Price Range) |

|---|---|---|---|

| Liability ($100,000/$300,000) | $500 – $700/year | $450 – $650/year | $400 – $600/year |

| Collision | $600 – $900/year | $550 – $850/year | $500 – $800/year |

| Comprehensive | $400 – $600/year | $350 – $550/year | $300 – $500/year |

Note: These are estimated price ranges and do not reflect all possible discounts or surcharges. Actual quotes should be obtained directly from each insurer.

Insurer Use of Customer Data

Each insurer uses a proprietary algorithm to assess risk and personalize quotes. Factors considered often include driving history (accidents, tickets), credit score, age, location, vehicle type, and even driving habits if telematics are used. For example, State Farm might weigh credit score more heavily, while Progressive might place greater emphasis on driving history data obtained through their Snapshot program. Geico might use a combination of factors, weighting them differently based on individual risk profiles.

Switching Auto Insurance Providers

Switching auto insurance providers in Florida is generally a straightforward process. First, obtain quotes from several insurers to compare prices and coverage options. Once you’ve chosen a new provider, provide them with the necessary information, including your driver’s license and vehicle information. Your new insurer will handle the cancellation of your existing policy. It’s crucial to maintain continuous coverage to avoid gaps in your insurance protection. You should also confirm the effective date of your new policy to ensure a seamless transition.

Understanding Policy Documents and Fine Print

Navigating the complexities of an auto insurance policy can feel daunting, but understanding its key components is crucial for ensuring you have the right coverage and avoiding unexpected costs. This section will guide you through the essential parts of a typical Florida auto insurance policy, highlighting areas that often cause confusion.

Key Sections of a Florida Auto Insurance Policy

A standard Florida auto insurance policy typically includes several key sections. These sections define your coverage, responsibilities, and the terms of your agreement with the insurance company. Understanding each section is vital to avoid disputes or unexpected financial burdens later. The Declarations page summarizes your policy’s key details, including coverage limits, premiums, and the covered vehicles. The Insuring Agreements section Artikels the specific promises the insurance company makes to you, detailing what they will cover in case of an accident or other covered event. The Exclusions section lists the situations or circumstances where coverage does not apply. The Conditions section Artikels your responsibilities as a policyholder, such as cooperating with investigations and notifying the insurer promptly of accidents. Finally, the Definitions section clarifies the meaning of key terms used throughout the policy.

The Importance of Understanding Policy Exclusions and Limitations

Policy exclusions and limitations are critical aspects of your insurance policy. Exclusions specify events or circumstances that are not covered by your policy, while limitations define the extent of coverage for specific events. For instance, a policy might exclude coverage for damage caused by wear and tear, or it might limit liability coverage to a specific amount. Failing to understand these limitations can lead to significant out-of-pocket expenses in the event of a claim. For example, if your policy excludes coverage for damage caused by driving under the influence of alcohol, and you are involved in an accident while intoxicated, your claim will likely be denied. Understanding these limitations allows you to make informed decisions about the level of coverage you need.

Common Misunderstandings Regarding Auto Insurance Policies

Many common misunderstandings stem from a lack of careful policy review. One frequent misconception is believing that collision coverage automatically covers all damage to your vehicle. Collision coverage only covers damage resulting from a collision with another vehicle or object, not damage from other causes like hail or vandalism. Another misunderstanding involves the difference between liability and uninsured/underinsured motorist coverage. Liability coverage protects you if you cause an accident, while uninsured/underinsured motorist coverage protects you if you are involved in an accident caused by someone without adequate insurance. Many believe their health insurance will cover all medical expenses after an accident; however, it’s essential to understand the interplay between health insurance and Personal Injury Protection (PIP) coverage provided by your auto insurance.

A Guide to Effectively Reading and Interpreting Policy Documents

Reading an insurance policy requires patience and attention to detail. Begin by reviewing the Declarations page to understand the basic terms of your policy. Then, carefully read the Insuring Agreements section to understand the types of coverage you have. Pay close attention to the Exclusions and Limitations sections, noting any situations where coverage might not apply. If any terms or conditions are unclear, don’t hesitate to contact your insurance agent or company for clarification. Keep a copy of your policy readily available, and make sure to review it annually or whenever you make changes to your coverage. Using a highlighter to mark key sections and making notes in the margins can help you understand the document better. Consider consulting with an independent insurance professional if you find the policy language particularly complex.

Illustrative Examples of Insurance Scenarios

Understanding insurance scenarios helps clarify the value of different coverage options. The following examples illustrate real-world situations where specific types of coverage become crucial.

Minor Accident Claim Process

Imagine you’re slowly backing out of a parking spot and lightly tap another parked car, causing a small dent in its bumper. This is considered a minor accident. You would first contact your insurance company to report the incident, providing details such as the date, time, location, and the other driver’s information (if known). Your insurer will likely initiate a claims process, potentially involving a claims adjuster who will assess the damage. Depending on your policy and the extent of the damage, you might be responsible for a deductible. The insurance company will then either pay for the repairs directly to the other driver’s preferred repair shop or reimburse you for the cost of repairs if you handle it. The entire process, from reporting to resolution, could take several weeks, depending on the insurer’s efficiency and the complexity of the damage assessment.

Uninsured/Underinsured Motorist Coverage

Consider a scenario where you’re stopped at a red light and are rear-ended by another driver. This driver is either uninsured or underinsured, meaning their liability coverage is insufficient to cover your medical bills and vehicle repairs. This is where uninsured/underinsured motorist (UM/UIM) coverage becomes essential. Your own UM/UIM coverage will step in to compensate you for your medical expenses, lost wages, and vehicle damage, up to your policy limits. Without this coverage, you would be responsible for all costs associated with the accident, potentially leading to significant financial hardship. For example, if your medical bills total $10,000 and the other driver only has $5,000 in liability coverage, your UM/UIM coverage would cover the remaining $5,000, assuming your policy limit is high enough.

Comprehensive Coverage Benefits

Picture this: you wake up one morning to find your car severely damaged by a falling tree branch during a storm. Your car’s windshield is shattered, and the roof is dented. This type of damage is not caused by a collision but rather by an external event. Comprehensive coverage steps in to repair or replace your vehicle, regardless of who is at fault. Without comprehensive coverage, you would be responsible for the entire cost of repairs, which could be substantial. For example, replacing a windshield and repairing roof damage from a fallen tree could easily cost several thousand dollars. Comprehensive coverage offers peace of mind against unexpected damage from events such as hailstorms, floods, fire, vandalism, or theft.

Collision Coverage Necessity

Imagine you’re driving in heavy rain and lose control of your car, sliding into a ditch. Your vehicle sustains significant damage, including a bent frame and broken headlights. This is a collision, regardless of whether another vehicle was involved. Collision coverage will pay for the repairs or replacement of your vehicle, minus your deductible. Without collision coverage, you would bear the full cost of repairing the damage, which could be exceptionally high given the extent of the damage described. In this example, the repair costs could easily reach into the tens of thousands of dollars, depending on the vehicle’s make, model, and the extent of the damage to the frame and other parts.

Final Thoughts

Obtaining a Florida auto insurance quote doesn’t have to be daunting. By understanding the key factors influencing your premiums, comparing providers effectively, and carefully reviewing your policy, you can secure the best possible coverage for your needs and budget. Remember, informed choices lead to better protection and peace of mind on Florida’s roads.

General Inquiries

What is the minimum auto insurance coverage required in Florida?

Florida requires a minimum of $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL).

How often can I get a new auto insurance quote?

You can obtain a new quote as often as you like, but keep in mind that frequent inquiries may temporarily affect your credit score.

Can I get a quote without providing my driving history?

While some providers might offer preliminary quotes without full driving history, a complete application requiring this information will be necessary for final pricing.

What happens if I have a lapse in my auto insurance coverage?

A lapse in coverage can significantly increase your future premiums. It may also lead to legal complications in case of an accident.

How do I file a claim after an accident?

Contact your insurance provider immediately after the accident to report the incident and follow their instructions for filing a claim. Gather all necessary information, such as police reports and witness statements.