Navigating the complexities of car insurance can feel like driving through a fog. One often-overlooked yet potentially crucial element is gap insurance. This insurance bridges the gap between what you owe on your car loan and its actual market value after an accident, preventing significant financial hardship in the event of a total loss. This guide will demystify gap insurance, explaining its benefits, costs, and suitability for various drivers.

We’ll explore different types of gap insurance, the claims process, and factors influencing cost. We’ll also compare gap insurance to other car insurance options, helping you determine if it’s the right choice for your circumstances. Through real-world scenarios and FAQs, we aim to provide a clear and comprehensive understanding of this valuable financial tool.

What is Gap Insurance?

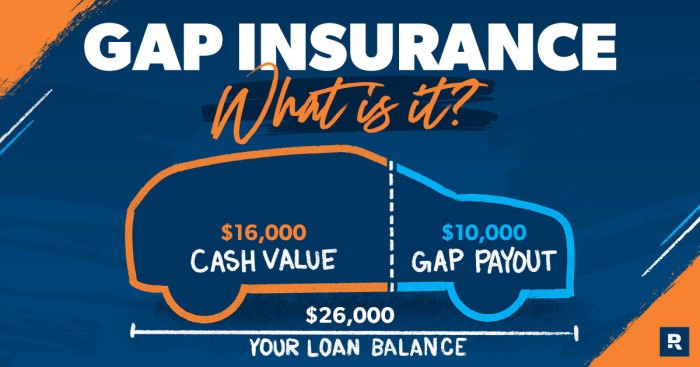

Gap insurance is a valuable, yet often overlooked, protection for car owners. In simple terms, it covers the difference between what your car is worth at the time of a total loss (or theft) and what you still owe on your auto loan. This difference, often called the “gap,” can be substantial, especially in the early years of a car loan when depreciation is high. Without gap insurance, you’d be responsible for paying this gap out of pocket, even if your insurance company pays out the full value of your vehicle according to its current market value.

Types of Gap Insurance

Gap insurance policies aren’t all created equal. Understanding the variations helps you choose the best coverage for your needs. Several types exist, each offering slightly different levels of protection.

- Loan/Lease Gap Insurance: This is the most common type, covering the difference between your loan or lease payoff amount and the actual cash value of your vehicle after a total loss.

- Guaranteed Asset Protection (GAP) Insurance: Often offered by lenders, this type of insurance specifically covers the gap between the vehicle’s value and the loan balance. It typically covers the full amount of the gap.

- Dealer-Offered GAP Insurance: Purchased at the dealership during the car buying process, this option offers convenience but might come at a higher price than other options.

- Independent GAP Insurance: This option provides flexibility and often allows for more customized coverage choices, potentially offering a better price than dealer-offered plans.

Benefits of Purchasing Gap Insurance

Purchasing gap insurance offers significant financial protection against unexpected losses. The most obvious benefit is the avoidance of a potentially large out-of-pocket expense should your vehicle be totaled or stolen. For example, imagine you finance a new car for $30,000. After a year, the car’s value depreciates to $22,000, but you still owe $27,000. Without gap insurance, you would be responsible for the $5,000 difference. With gap insurance, this burden is lifted.

Benefits of Not Purchasing Gap Insurance

The primary benefit of foregoing gap insurance is the lower upfront cost. You’ll save on the premium payments. However, this savings comes with the risk of significant financial hardship in the event of a total loss. It’s a gamble, weighing the potential cost of a gap against the cost of the insurance premium. The decision depends largely on your personal financial situation and risk tolerance. Consider factors such as your loan term, the rate of depreciation for your vehicle model, and your emergency fund’s capacity to handle such an unexpected expense.

How Gap Insurance Works

Gap insurance bridges the financial gap between what your car is worth at the time of a total loss and the amount you still owe on your auto loan or lease. It protects you from being left with a significant debt after an accident or theft, even if your vehicle is fully insured. This is especially important in the early years of a loan when depreciation is significant.

Gap insurance works by paying off the remaining balance on your auto loan or lease after your primary insurance company has paid out its claim. Your primary insurance typically covers the actual cash value (ACV) of your vehicle, which depreciates over time. However, the amount you owe on your loan might be significantly higher than the ACV, especially if you financed a new car. Gap insurance steps in to cover this difference.

Filing a Gap Insurance Claim

The process of filing a gap insurance claim is relatively straightforward. First, report the loss to both your primary insurance company and your gap insurance provider. Provide all necessary documentation, including the police report (if applicable), loan information, and details of the accident or theft. Your primary insurance company will assess the damage and determine the ACV of your vehicle. They will then issue a payment for that amount. Once you receive this payment, submit it along with all relevant documentation to your gap insurance provider. They will then calculate the difference between the ACV and the remaining loan balance and pay you the remaining amount. The exact procedures and documentation required may vary slightly depending on your insurer.

Obtaining a Gap Insurance Policy

Obtaining a gap insurance policy is usually done at the time of purchasing a new vehicle or refinancing an existing loan. Many dealerships offer gap insurance as an add-on to the purchase agreement. You can also obtain it directly from your lender or an independent insurance provider. The process generally involves providing information about your vehicle, loan, and driving history. The insurer will then assess your risk and provide a quote. Once you accept the quote and pay the premium, your coverage will begin.

Scenarios Where Gap Insurance is Beneficial

Gap insurance is particularly beneficial in situations where the depreciation of your vehicle is substantial, such as when your vehicle is relatively new. For example, imagine you finance a new car for $30,000, and after two years, it’s in a total loss accident. Your insurance company determines the ACV is $20,000. You still owe $25,000 on the loan. Gap insurance would cover the $5,000 difference, preventing you from having to pay this amount out-of-pocket. Another scenario is total loss due to theft. Even with comprehensive coverage, the ACV may be significantly less than the remaining loan balance, and gap insurance would cover that difference. Finally, a situation involving a financed vehicle with a longer loan term will likely experience higher depreciation during the early years of the loan, making gap insurance even more beneficial.

Gap Insurance vs. Other Insurance Options

Gap insurance, while valuable, isn’t a replacement for standard car insurance. Understanding its relationship to other coverage types is crucial for making informed decisions about your vehicle protection. This section will compare gap insurance with comprehensive and collision coverage, highlighting their differences and how they work together.

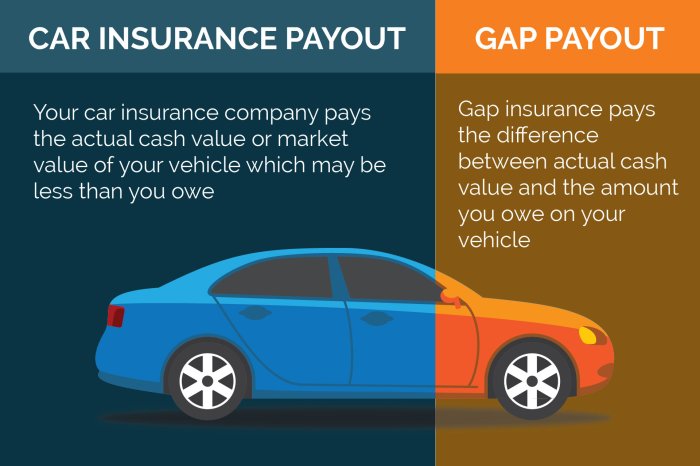

Many drivers assume their existing car insurance fully protects them from financial loss after an accident. However, this isn’t always the case. Standard comprehensive and collision coverage typically only covers the actual cash value (ACV) of your vehicle after an accident or theft, which depreciates significantly over time. This is where gap insurance steps in to bridge the gap between the outstanding loan amount and the ACV.

Comprehensive and Collision Coverage

Comprehensive and collision insurance are standard components of most car insurance policies. Comprehensive covers damage to your vehicle from non-collision events like theft, vandalism, or hail damage. Collision coverage handles damage resulting from a collision with another vehicle or object. Both typically pay out the ACV of your vehicle, meaning the amount your car is worth at the time of the loss, not the amount you still owe on your loan.

Gap Insurance Coverage

Gap insurance is designed to cover the difference between the amount you owe on your auto loan and the actual cash value (ACV) of your vehicle after a total loss or theft. For example, if you owe $25,000 on your car loan, but the ACV is only $18,000 after an accident, gap insurance would cover the remaining $7,000.

How Gap Insurance Complements Other Policies

Gap insurance doesn’t replace comprehensive or collision coverage; it complements them. It fills the financial gap that standard insurance often leaves behind. You still need comprehensive and collision coverage to address the ACV of your vehicle. Gap insurance then addresses the difference, ensuring you’re not left with a significant debt after a total loss. Consider it an additional layer of protection, particularly valuable during the early years of a car loan when depreciation is most significant. It provides peace of mind knowing that you won’t be burdened with debt after a major incident.

Finding and Choosing a Gap Insurance Provider

Securing gap insurance is a crucial step in protecting your financial investment in a vehicle. However, the market offers a variety of providers, each with its own terms and conditions. Carefully selecting a provider is essential to ensure you receive the best coverage at a competitive price. This section will guide you through the process of finding and choosing a suitable gap insurance provider.

Choosing the right gap insurance provider requires careful consideration of several key factors. A thorough assessment will help you secure the most appropriate and cost-effective coverage for your needs. Ignoring these factors could lead to inadequate protection or unexpectedly high premiums.

Factors to Consider When Selecting a Gap Insurance Provider

Several factors influence the suitability of a gap insurance provider. Evaluating these aspects will significantly improve your decision-making process, leading to a more informed choice.

- Financial Stability and Reputation: Check the provider’s financial strength and history. Look for companies with a long-standing reputation for paying claims promptly and fairly. Independent ratings agencies can offer valuable insights into a company’s financial health.

- Coverage Details and Exclusions: Carefully review the policy document to understand the specific coverage offered, including any limitations or exclusions. Pay close attention to the definition of “gap,” the length of coverage, and any deductibles.

- Claims Process: Understand the claims process in detail. A straightforward and efficient claims process can significantly reduce stress during a difficult time. Look for providers with positive customer reviews regarding their claims handling.

- Customer Service: Assess the provider’s customer service responsiveness and helpfulness. A responsive and knowledgeable customer service team can address your questions and concerns effectively.

- Price and Value: Compare prices from multiple providers, but don’t solely focus on the cheapest option. Consider the overall value offered, including the level of coverage, claims process, and customer service.

Tips for Finding Reputable and Affordable Gap Insurance Options

Finding reputable and affordable gap insurance requires proactive research and comparison shopping. These tips can help you navigate the market effectively and find a suitable provider.

- Compare Quotes from Multiple Providers: Obtain quotes from at least three different providers to compare prices and coverage options. This allows for a more informed decision based on a wider range of choices.

- Read Online Reviews and Testimonials: Check online reviews and testimonials from other customers to gauge the provider’s reputation and the quality of their services. Websites like Trustpilot or Yelp can offer valuable insights.

- Check with Your Auto Lender or Insurer: Your auto lender or existing car insurance provider may offer gap insurance options. In some cases, bundling insurance products can lead to discounts.

- Look for Independent Ratings: Seek out independent ratings of insurance companies from reputable financial rating agencies. These ratings provide an objective assessment of a company’s financial stability.

- Understand Your Needs: Before starting your search, clearly define your needs and the level of coverage you require. This will help you narrow down your options and focus on providers that meet your specific requirements.

Questions to Ask Potential Gap Insurance Providers

Asking the right questions can significantly impact your decision-making process. This checklist ensures you gather the necessary information to make an informed choice.

- Details regarding the definition of “gap” in their policy. This clarifies exactly what situations are covered.

- Information on the claims process, including required documentation and timelines. This helps you understand what to expect in case of a claim.

- Clarification on any exclusions or limitations in the coverage. This ensures you are fully aware of what is and isn’t covered.

- Details on their customer service procedures and contact information. This helps you assess their responsiveness and accessibility.

- A clear explanation of the policy’s terms and conditions. This ensures a full understanding of the agreement.

Illustrative Scenarios

Understanding gap insurance benefits requires examining real-world situations where it proves invaluable and others where it offers little advantage. The following scenarios illustrate the potential impact of gap insurance on your financial well-being.

Gap Insurance Preventing Significant Financial Loss

Imagine Sarah, a young professional, who recently purchased a brand-new SUV for $35,000. She financed the entire amount with a 60-month loan. Six months later, she was involved in a serious accident, totaling her vehicle. Her insurance company assessed the vehicle’s actual cash value (ACV) at $28,000, considering depreciation. This left Sarah with a $7,000 shortfall – the difference between the amount she owed on the loan and the insurance payout. However, because Sarah had purchased gap insurance, the insurer covered this $7,000 gap, preventing her from incurring significant additional debt. Without gap insurance, Sarah would have been responsible for paying off the remaining loan balance herself, a considerable financial burden.

Scenario Where Gap Insurance Would Not Be Beneficial

Consider John, who purchased a used car for $10,000, paying cash. He chose not to purchase gap insurance. A year later, his car was totaled in an accident. His insurance company paid out the ACV, which was $8,000. In this instance, gap insurance would not have been beneficial because John didn’t finance the vehicle, and the insurance payout, though less than the purchase price, was sufficient to cover his loss. He suffered a loss of $2,000, but the gap insurance would not have covered this difference because there was no outstanding loan.

Gap Insurance Value After a Total Loss Accident

Let’s examine the case of Michael, who bought a new sedan for $25,000, financing $20,000. After two years of payments, he owed $15,000. Unfortunately, a drunk driver caused a collision, resulting in a total loss of Michael’s vehicle. The insurance company’s appraisal valued the car at $18,000. This would still leave Michael with a $3,000 debt. However, Michael’s foresight in purchasing gap insurance proved crucial. The gap insurance policy covered the $3,000 difference between the insurance payout and the outstanding loan balance, relieving him of this unexpected financial burden. This scenario highlights how gap insurance protects against depreciation and provides financial peace of mind in the event of a total loss, especially when significant loan balances remain.

Closure

Ultimately, the decision of whether or not to purchase gap insurance is a personal one, dependent on individual financial situations and risk tolerance. However, understanding the potential benefits and drawbacks, as Artikeld in this guide, empowers you to make an informed choice. By carefully weighing the costs against the protection offered, you can determine if gap insurance provides the financial security you need to navigate the unexpected events of car ownership with greater peace of mind. Remember to compare quotes from multiple providers to secure the best coverage at a competitive price.

Expert Answers

What happens if my car is stolen and I have gap insurance?

If your car is stolen and declared a total loss, your gap insurance will cover the difference between your loan payoff amount and the car’s actual cash value, much like in an accident.

Can I get gap insurance after I’ve already purchased my car?

Yes, you can often purchase gap insurance after buying your car, but it’s typically best to obtain it soon after purchase to ensure full coverage.

Does gap insurance cover damage from accidents that aren’t total losses?

No, gap insurance only covers the difference in value after a total loss (theft or accident resulting in a total loss). It does not cover repairs or partial losses.

How long does gap insurance coverage last?

The duration of gap insurance coverage varies by provider and policy, but it typically covers the length of your car loan or lease.

Is gap insurance worth it if I have a large down payment on my car?

Even with a large down payment, gap insurance might still be beneficial. The amount you owe could still exceed the car’s depreciated value after an accident or theft.