General liability insurance is a cornerstone of responsible business operation, protecting companies from financial ruin stemming from accidents, injuries, or property damage caused by their operations or employees. Understanding the nuances of different general liability insurance companies and their policies is crucial for mitigating risk and ensuring business continuity. This exploration delves into the key aspects of general liability insurance, empowering businesses to make informed decisions about their coverage.

From defining the core components of general liability insurance and identifying leading providers, to understanding policy coverage, exclusions, and premium factors, this guide offers a comprehensive overview. We will examine how to choose the right insurer, negotiate favorable terms, and ultimately, safeguard your business against unforeseen liabilities. Real-world scenarios will illustrate the practical application of this critical insurance.

Defining General Liability Insurance

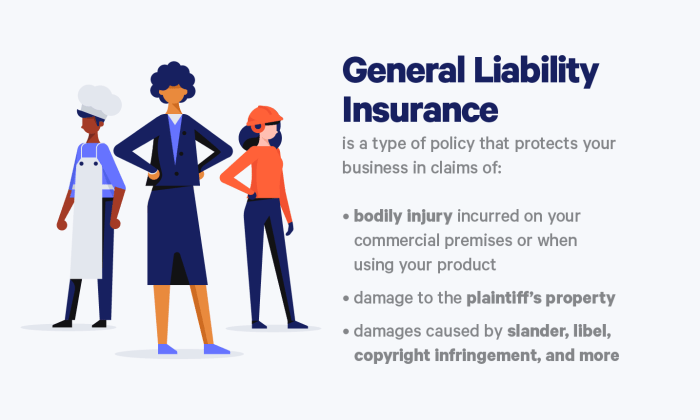

General liability insurance is a crucial type of coverage for businesses of all sizes, protecting them from financial losses resulting from accidents, injuries, or property damage caused by their operations or employees. It acts as a safety net, safeguarding your business against potentially crippling lawsuits and associated costs. Understanding its core components is vital for any business owner.

General liability insurance primarily covers bodily injury, property damage, and advertising injury. Bodily injury encompasses physical harm or sickness caused by your business operations. Property damage refers to harm inflicted on someone else’s property. Advertising injury covers claims related to false advertising, libel, or slander. The policy typically covers legal defense costs, settlements, and judgments resulting from covered incidents.

Businesses Requiring General Liability Insurance

A wide range of businesses benefit from general liability insurance. Nearly any business that interacts with the public, employs others, or operates in a physical space should consider this coverage. This includes, but is not limited to, retailers, restaurants, contractors, consultants, manufacturers, and service providers. Even small home-based businesses can find themselves vulnerable to liability claims. The need for this insurance hinges on the inherent risks associated with the nature of the business operations.

Situations Requiring General Liability Insurance

Consider the following scenarios to illustrate the importance of general liability coverage: a customer slips and falls in your store, a contractor damages a client’s property during a renovation, or a disgruntled customer sues your company for defamation. These situations, and countless others, can lead to substantial financial burdens if you lack adequate insurance. The costs of legal representation, medical expenses, property repairs, and potential settlements can quickly overwhelm a business without proper protection. General liability insurance mitigates these risks by covering these expenses.

Comparison of General Liability Policies

| Policy Type | Coverage | Cost | Suitability |

|---|---|---|---|

| Basic General Liability | Covers standard bodily injury and property damage claims. | Generally lower premiums. | Suitable for small businesses with low-risk operations. |

| Broad General Liability | Includes broader coverage, potentially encompassing additional perils or higher coverage limits. | Higher premiums than basic policies. | Suitable for businesses with moderate to high-risk operations or those needing greater protection. |

| Tailored General Liability | Customized to meet the specific needs and risks of a particular business. | Premiums vary significantly based on customization. | Suitable for businesses with unique or complex risk profiles. |

| Excess Liability (Umbrella Policy) | Provides additional coverage beyond the limits of an underlying general liability policy. | Higher premiums, but crucial for substantial asset protection. | Suitable for businesses with significant assets or high exposure to liability claims. |

Major General Liability Insurance Companies

Choosing the right general liability insurance provider is crucial for businesses of all sizes. The right insurer offers not only financial protection but also peace of mind, knowing you’re covered in case of unforeseen incidents. This section will profile five leading general liability insurance companies in the US, highlighting their key features, benefits, and overall reputation.

Leading General Liability Insurance Companies in the US

The following list presents five prominent general liability insurance companies operating within the United States. It’s important to remember that the “best” company depends heavily on individual business needs and risk profiles. This information is for general knowledge and should not be considered exhaustive or a recommendation for a specific provider.

- The Hartford: Known for its comprehensive coverage options and strong financial stability, The Hartford offers a range of general liability policies tailored to various industries. They are often praised for their responsive customer service and straightforward claims process. Customer reviews generally reflect positive experiences with their claims handling and policy clarity, though some mention higher premiums compared to competitors.

- Liberty Mutual: A large, well-established insurer, Liberty Mutual provides robust general liability coverage with various customization options. They are frequently lauded for their strong financial backing and extensive network of agents. Customer feedback often highlights their user-friendly online portal and efficient claims processing. However, some users have reported occasional difficulties reaching customer support.

- Chubb: Chubb is recognized for its high-quality service and focus on risk management for larger businesses. They offer comprehensive coverage and personalized solutions, often incorporating risk mitigation strategies. While known for excellent service, their premiums are generally higher, reflecting their specialized approach and clientele. Customer reviews frequently emphasize the professionalism and expertise of their representatives.

- State Farm: A prominent name in the insurance industry, State Farm offers general liability coverage primarily to small businesses. Their widespread availability and relatively straightforward policies make them an accessible option for many. Customer reviews are mixed, with some praising their ease of access and local agents, while others mention limitations in coverage options for larger or more complex businesses.

- Travelers: Travelers is a major player in the commercial insurance market, providing a wide range of general liability options. They are known for their robust online tools and resources for policy management. Customer reviews highlight their comprehensive coverage and digital capabilities, but some users have noted a more complex claims process compared to other providers.

Policy Coverage and Exclusions

Understanding the scope of a general liability (GL) insurance policy is crucial for businesses. A GL policy protects businesses from financial losses due to bodily injury or property damage caused by their operations or products. However, it’s equally important to understand what is *not* covered to avoid unexpected gaps in protection.

Common Coverage Areas

General liability policies typically cover several key areas. These coverages aim to protect the insured from financial responsibility stemming from accidents or incidents related to their business operations. The specific details of coverage can vary depending on the policy and the insurer, so it’s vital to carefully review the policy wording.

- Bodily Injury Liability: This covers medical bills, lost wages, and pain and suffering resulting from injuries sustained on the insured’s premises or caused by the insured’s operations. For example, a customer slipping and falling in a store would be covered under this section.

- Property Damage Liability: This covers damage to third-party property caused by the insured’s negligence. An example would be a contractor accidentally damaging a client’s building during renovations.

- Personal and Advertising Injury: This broader coverage encompasses libel, slander, copyright infringement, and other offenses that may lead to lawsuits. This protects the business against claims related to its advertising or marketing materials, for instance, a false statement made in an advertisement.

- Medical Payments: This coverage provides for medical expenses for individuals injured on the insured’s premises or as a result of the insured’s operations, regardless of fault. This is often a smaller coverage amount than the bodily injury liability coverage.

Typical Exclusions

Standard general liability policies exclude certain types of claims. These exclusions are carefully defined within the policy document and are essential for understanding the limitations of coverage.

- Intentional Acts: The policy generally won’t cover damages resulting from intentional acts of the insured or their employees. For example, if a business owner deliberately assaults a customer, that would not be covered.

- Contractual Liability: Liability assumed through a contract is typically excluded unless specifically included in the policy as an endorsement. For example, a contract that requires a company to take responsibility for damages caused by a subcontractor might not be covered without specific contractual liability coverage.

- Pollution or Environmental Damage: Damage resulting from pollution or environmental contamination is often excluded, requiring separate environmental liability insurance.

- Employee Injuries (Workers’ Compensation): Injuries to employees are covered under workers’ compensation insurance, not general liability.

- Auto Accidents: Damage caused by owned or operated vehicles typically requires separate commercial auto insurance.

Examples of Denied Claims

Several scenarios can lead to a claim being denied. It’s crucial to understand these possibilities to manage risk effectively.

- A claim for damage caused by an employee acting outside the scope of their employment. For example, an employee using company equipment for personal use and causing damage would likely be excluded.

- A claim resulting from a known hazard that was not addressed. If a business owner was aware of a dangerous condition on their property (e.g., a broken stair) and failed to fix it, resulting in an injury, the claim might be denied or partially denied.

- A claim for damages caused by an excluded activity. If a business engages in activities not covered by the policy (e.g., performing work outside the stated business operations), claims resulting from those activities would likely be denied.

General Liability Claim Process Flowchart

The following describes a typical claim process. The specific steps may vary slightly depending on the insurance company.

(Imagine a flowchart here. The flowchart would start with “Incident Occurs,” branching to “Report Incident to Insurer.” This would then branch to “Insurer Investigates,” followed by “Insurer Determines Coverage.” If coverage is determined, the flow continues to “Settlement or Defense Provided.” If coverage is denied, the flow ends there. If a lawsuit occurs, a branch would lead to “Legal Representation Provided” and then ultimately to “Settlement or Verdict.”)

Factors Affecting Premium Costs

Several interconnected factors influence the cost of general liability insurance premiums. Understanding these factors allows businesses to better manage their risk and potentially secure more favorable rates. This section will examine key elements impacting premium calculations, providing a clearer picture of how insurers assess risk.

Business Size and Industry

The size and type of business significantly impact general liability insurance premiums. Larger businesses, with more employees and potentially higher revenue, generally face higher premiums due to increased exposure to potential liabilities. Similarly, businesses operating in high-risk industries, such as construction or manufacturing, will typically pay more than those in lower-risk sectors, like retail or office administration. For example, a large construction firm will likely pay substantially more than a small bookstore because the potential for accidents and resulting lawsuits is significantly higher in construction. The insurer considers the inherent risks associated with each industry when setting premiums.

Claims History

A company’s claims history is a crucial determinant of its insurance premiums. Insurers meticulously track the number and severity of past claims. A history of numerous or significant claims will almost certainly lead to higher premiums, reflecting the increased risk associated with that business. Conversely, a clean claims history, demonstrating a strong safety record and effective risk management, can result in lower premiums, potentially earning discounts or preferred rates. For instance, a company with a history of multiple workplace injury claims might see a substantial increase in premiums, while a company with no claims for several years could qualify for a discount.

Other Factors Influencing Premium Costs

The following table summarizes how various factors can influence general liability insurance premiums. Note that the impact of each factor can vary significantly depending on the specific insurer and the individual circumstances of the business.

| Factor | Impact on Premium Cost | Example | Mitigation Strategy |

|---|---|---|---|

| Business Size | Generally higher for larger businesses | A large manufacturing plant vs. a small bakery | Implement robust safety measures and risk management programs |

| Industry Type | Higher for high-risk industries | Construction vs. retail | Invest in safety training and equipment; maintain thorough safety records |

| Claims History | Higher with a history of claims | Multiple worker’s compensation claims vs. no claims | Implement thorough safety protocols, employee training, and risk assessment |

| Location | Higher in high-crime or disaster-prone areas | Business in a high-crime city vs. a rural town | Choose a safer location or invest in enhanced security measures |

| Number of Employees | Generally higher with more employees | A company with 100 employees vs. a company with 10 employees | Improve safety training and protocols to reduce workplace accidents. |

| Type of Business Operations | Higher for businesses with inherently risky operations | A demolition company vs. an accounting firm | Implement rigorous safety protocols specific to the nature of the business operations. |

Choosing the Right Insurance Company

Selecting the right general liability insurance company is crucial for protecting your business from potential financial losses. The wrong choice could leave you vulnerable to lawsuits and significant expenses. A thorough evaluation process, considering various factors, ensures you secure adequate coverage at a competitive price.

Criteria for Selecting a Suitable General Liability Insurer

Several key criteria should guide your selection process. These include the insurer’s financial stability, claims handling process, customer service reputation, and policy coverage options. A financially sound insurer is less likely to become insolvent and unable to pay claims. Efficient claims handling minimizes disruptions to your business operations. Positive customer reviews indicate a company’s responsiveness and professionalism. Finally, ensure the policy’s coverage adequately addresses your specific business needs and risks.

A Step-by-Step Guide to Finding the Best Policy

Finding the best general liability insurance policy involves a systematic approach. First, accurately assess your business’s risk profile to determine the appropriate coverage level. Second, obtain quotes from multiple insurers, comparing their policy offerings and pricing. Third, carefully review policy documents, paying close attention to coverage details, exclusions, and conditions. Fourth, check the insurer’s financial strength ratings from independent agencies like A.M. Best. Fifth, compare customer reviews and ratings to gauge the insurer’s reputation for claims handling and customer service. Finally, choose the policy that best balances comprehensive coverage, reasonable cost, and a reputable insurer.

Negotiating Favorable Terms and Premiums

Negotiating favorable terms and premiums is possible, though it requires preparation and effective communication. Begin by understanding your business’s risk profile and the market value of similar policies. Compare quotes from different insurers and highlight any discrepancies in coverage or pricing. Consider bundling your general liability insurance with other types of coverage, such as workers’ compensation or commercial auto insurance, to potentially secure a discount. Demonstrate a commitment to risk mitigation through safety measures and training programs, as this can influence premium calculations. Finally, don’t hesitate to politely negotiate premium amounts and policy terms, presenting a well-reasoned case for adjustments. For instance, a business with a strong safety record might negotiate a lower premium than a business with a history of incidents.

The Importance of Reading Policy Documents Carefully

Thoroughly reviewing your policy documents is paramount. Don’t simply skim the information; carefully read every clause, definition, and exclusion. Pay particular attention to the policy’s coverage limits, the types of claims covered, and any specific exclusions. Understanding the policy’s terms and conditions ensures you know exactly what is and isn’t covered. If anything is unclear, contact the insurer directly to seek clarification. Misunderstandings can lead to disputes later on when you need to file a claim. Ignoring this step could leave you with inadequate protection or unexpected costs.

Illustrative Scenarios

Understanding how general liability insurance works in practice is best achieved through real-world examples. The following scenarios illustrate both successful claims and denied claims, highlighting the importance of policy details and careful selection of coverage.

Successful Claim: Slip and Fall at a Coffee Shop

A bustling coffee shop, “The Daily Grind,” experienced a customer slip and fall due to a spilled beverage that wasn’t immediately cleaned up. The customer, Ms. Jones, sustained a broken wrist requiring medical attention and physical therapy. The Daily Grind, possessing a comprehensive general liability policy with a sufficient liability limit, filed a claim. The insurance company investigated, confirming the accident occurred on their premises due to their negligence. Ms. Jones’ medical bills, lost wages, and pain and suffering were covered by the policy, preventing a significant financial burden on the coffee shop. The settlement avoided costly litigation, protecting The Daily Grind’s reputation and financial stability. The total claim amounted to $25,000, well within the coffee shop’s $1 million liability limit.

Denied Claim: Damaged Equipment Due to Employee Negligence

“Tech Solutions,” a computer repair business, had an employee accidentally damage a client’s expensive server during a repair. The damage was significant, costing over $10,000 to replace. Tech Solutions filed a claim under their general liability policy. However, their policy specifically excluded coverage for damage to property in the care, custody, or control of the insured. Because the server was in Tech Solutions’ possession during the repair, the claim was denied. Tech Solutions was left responsible for the full cost of the server replacement, a substantial financial blow to their business. This highlights the importance of understanding policy exclusions and potentially securing additional coverage like professional liability insurance for situations involving damage to client property.

Comparison of Policy Options: Two Different Scenarios, Two Different Outcomes

Let’s consider two similar scenarios involving property damage, but with different policy options.

Scenario A: A catering company, “Elegant Events,” accidentally damages a client’s antique table while setting up for a wedding. Their policy includes “property damage” coverage with a $50,000 limit. The damage is assessed at $30,000. Elegant Events successfully files a claim, and the insurance company covers the repair costs.

Scenario B: A different catering company, “Simple Bites,” experiences the same incident. However, their policy only covers “bodily injury” and specifically excludes damage to property in the care, custody, or control of the insured. Similar to the Tech Solutions example, Simple Bites’ claim is denied, leaving them financially responsible for the damages. This illustrates the critical difference between policies and the importance of reviewing policy language carefully. The seemingly minor difference in policy wording leads to vastly different outcomes in terms of financial responsibility.

Concluding Remarks

Securing adequate general liability insurance is not merely a compliance issue; it’s a strategic decision that safeguards your business’s financial health and reputation. By carefully considering the factors Artikeld in this guide—from understanding policy nuances and selecting reputable companies to proactively managing risk—businesses can confidently navigate the complexities of liability coverage. A well-informed approach ensures peace of mind and protects your investment in the long term.

Expert Answers

What is the difference between general liability and professional liability insurance?

General liability covers bodily injury or property damage caused by your business operations. Professional liability (errors and omissions insurance) covers claims of negligence or mistakes in professional services.

How long does it take to get a general liability insurance policy?

The application and approval process typically takes a few days to a couple of weeks, depending on the insurer and the complexity of your business.

Can I get general liability insurance if my business has a history of claims?

Yes, but your premiums will likely be higher. Insurers consider claims history when assessing risk.

What happens if I file a false claim?

Filing a false claim is considered insurance fraud and can result in severe penalties, including fines and even criminal charges.