Securing affordable and comprehensive car insurance is a crucial step for responsible drivers. The process, however, can feel overwhelming, navigating various companies, policies, and coverage options. This guide simplifies the journey of getting car insurance quotes, offering insights into effective strategies and resources to help you find the best coverage at the most competitive price.

We’ll explore different avenues for obtaining quotes – from utilizing comparison websites to directly contacting insurance providers. We’ll delve into the factors influencing your premiums, helping you understand what impacts your cost and how you might potentially lower it. Ultimately, our goal is to empower you with the knowledge to make informed decisions and secure the car insurance that best fits your needs and budget.

Understanding User Search Intent

The search query “get quotes for car insurance” reveals a user’s immediate need for price comparisons and potentially, a new insurance policy. Understanding the nuances behind this seemingly simple search is crucial for effectively tailoring responses and providing relevant information. The reasons for this search are multifaceted, reflecting diverse user needs and situations.

Several factors motivate individuals to search for car insurance quotes. These include the need for new coverage, a desire for better rates, a change in circumstances (like a new car or address), or simply proactive comparison shopping. The user profiles behind these searches vary significantly, influencing their expectations and the type of quotes they seek.

User Profiles and Their Needs

The following table categorizes different user profiles based on their needs, the type of quotes they are likely searching for, and their probable next actions after receiving quotes.

| User Profile | Need | Expected Quote Type | Likely Next Action |

|---|---|---|---|

| New Driver | Mandatory insurance coverage for a newly acquired vehicle. | Comprehensive coverage quotes, potentially including additional driver options. | Compare quotes, select a policy, and complete the application process. |

| Experienced Driver Renewing Policy | Renewal of existing car insurance policy, seeking better rates or coverage. | Quotes for similar coverage levels as their current policy, with potential for upgrades or downgrades. | Compare quotes with their current policy, potentially switching providers if a better deal is found. |

| Driver with Recent Accident or Violation | Insurance coverage after an accident or traffic violation, potentially seeking specialized high-risk coverage. | Quotes from insurers specializing in high-risk drivers, potentially with higher premiums. | Secure coverage that meets their needs, despite the increased risk. |

| Driver Purchasing a New Car | Insurance coverage for a newly purchased vehicle. | Quotes reflecting the value and features of the new car, including potential add-ons like gap insurance. | Select a policy that provides adequate coverage for their new vehicle. |

| Driver Seeking Lower Premiums | Reduced car insurance premiums without compromising essential coverage. | Quotes from multiple providers, focusing on price comparisons with similar coverage levels. | Select the policy offering the best value for money, balancing cost and coverage. |

Types of Car Insurance Quotes

The types of quotes users might seek are diverse, reflecting the range of insurance needs and preferences.

For example, a new driver might look for comprehensive coverage, including collision and liability, while an experienced driver might focus on comparing liability-only or minimum coverage options. Someone purchasing a luxury vehicle might seek quotes that include specific coverage for high-value cars. Conversely, a driver with a history of accidents might need to explore specialized high-risk insurance quotes. Finally, some users simply want a quick comparison of the cheapest options available, focusing solely on price.

Exploring Comparison Shopping Websites

Car insurance comparison websites have revolutionized the way consumers shop for coverage. These platforms offer a convenient way to compare quotes from multiple insurers simultaneously, saving time and potentially money. Understanding their features and functionalities is crucial for making informed decisions.

Features and Functionalities of Popular Car Insurance Comparison Websites

Most comparison websites share a core set of features designed to simplify the quote-gathering process. These typically include the ability to input personal and vehicle information, selection criteria for coverage types and limits, and instant quote generation from participating insurers. Advanced features may include detailed policy comparisons, customer reviews, and tools to help understand coverage options. Many sites also offer additional services such as assistance with claims filing or finding local insurance agents.

Comparison of Three Major Comparison Websites

Let’s compare three hypothetical examples: “CompareAuto,” “InsureSmart,” and “QuoteCentral.” CompareAuto excels in its user-friendly interface and wide range of insurer partners, but its detailed policy comparison features are limited. InsureSmart boasts a robust comparison tool with detailed policy breakdowns, but its insurer network is smaller than CompareAuto’s. QuoteCentral offers a unique feature—integration with credit score-based pricing—but its interface is less intuitive than the others. The strengths and weaknesses of each site highlight the importance of considering individual needs and priorities when selecting a comparison platform.

| Website | Pros | Cons |

|---|---|---|

| CompareAuto | Large insurer network, user-friendly interface | Limited detailed policy comparison |

| InsureSmart | Robust comparison tool, detailed policy breakdowns | Smaller insurer network |

| QuoteCentral | Credit score integration | Less intuitive interface |

Examples of Effective User Interfaces for Quote Comparison Tools

Effective user interfaces for quote comparison tools prioritize clarity and ease of navigation. A well-designed interface uses visual cues such as color-coding to highlight key differences between quotes. It presents information concisely, using clear and unambiguous language, avoiding jargon. Interactive elements, such as sortable columns and customizable filters, allow users to easily compare and contrast options. A good example would be a side-by-side comparison table, clearly showing price, coverage limits, and deductibles for each quote, with clear visual indicators to highlight the best value options.

Hypothetical User Flow for Obtaining Quotes on a Comparison Website

The user begins by entering basic information (age, location, driving history, vehicle details). The website then presents a list of insurers offering quotes based on the provided data. The user can refine the results using filters (e.g., coverage type, price range). Once the user selects a quote, they are redirected to the insurer’s website to complete the application process. The entire process should be intuitive and transparent, allowing the user to easily understand each step and make informed decisions. A clear progress bar would further enhance user experience.

Direct Insurance Company Websites

Obtaining car insurance quotes directly from insurance company websites offers a convenient and potentially insightful approach to securing coverage. This method allows for direct interaction with the insurer, bypassing third-party comparison sites. However, it also requires more individual effort in comparing multiple companies.

Directly interacting with insurance companies’ websites provides access to detailed policy information and allows you to tailor your coverage to your specific needs. This method can also lead to a more personalized experience with the insurer, fostering a stronger relationship. However, it requires more active participation from the consumer in comparing offerings across different providers.

Advantages and Disadvantages of Obtaining Quotes Directly

Directly obtaining quotes from insurance company websites presents several advantages and disadvantages. A key advantage is the potential for a more personalized experience, often including access to exclusive discounts or promotions not advertised elsewhere. You also gain direct access to customer service representatives for immediate clarification on policy details. However, comparing quotes across multiple company websites can be time-consuming, and you may miss out on deals offered through comparison sites that aggregate multiple insurers’ offerings. Furthermore, some companies might present their offerings in a less straightforward manner compared to comparison websites designed for ease of comparison.

Key Elements of a User-Friendly Quote Request Form

A user-friendly quote request form should be concise, clearly laid out, and intuitive to navigate. Essential elements include clear instructions, easily identifiable fields for necessary information, and a progress indicator to track the completion of the form. The form should avoid jargon and utilize plain language. Real-time validation of input fields, preventing submission of incomplete or inaccurate information, significantly enhances the user experience. Finally, a clear and prominent “Submit” button should be easily located. For example, a well-designed form might use drop-down menus for selecting coverage options, auto-populate fields based on previous entries (like address), and provide instant feedback on any errors.

Questions Users Should Be Prepared to Answer

Users should be prepared to provide accurate information regarding their vehicle, driving history, and personal details. This typically includes details about the vehicle’s make, model, year, and VIN number; the driver’s age, driving history (including accidents and violations), and address; and desired coverage levels (liability, collision, comprehensive). Providing accurate information ensures a precise quote and prevents delays in the process. For example, a user might need to provide details on their previous insurance policy, such as the policy number and expiration date.

Comparison of User Experiences: Comparison Websites vs. Direct Company Websites

The user experience differs significantly between using comparison websites and direct insurance company websites. Comparison websites typically offer a streamlined, side-by-side comparison of multiple insurers’ quotes, simplifying the decision-making process. However, the information provided might be less detailed. Direct company websites provide more in-depth information about specific policies, but require more individual effort to compare across multiple insurers. A comparison website might present a quick overview of coverage options and pricing from several companies, while a direct company website might offer detailed policy documents and the ability to customize coverage options.

Factors Influencing Car Insurance Quotes

Securing the best car insurance rate involves understanding the numerous factors insurance companies consider. These factors, often intertwined, significantly impact the final premium you’ll pay. By understanding these influences, you can make informed decisions to potentially reduce your costs.

Several key elements contribute to the calculation of your car insurance premium. These factors are carefully weighed by insurance companies to assess the level of risk associated with insuring you. A comprehensive understanding of these elements is crucial for obtaining competitive quotes.

Driver Demographics and History

Insurance companies use demographic data to assess risk. Age, for example, plays a significant role. Younger drivers, statistically, are involved in more accidents, leading to higher premiums. Conversely, older drivers with clean records often qualify for lower rates. Driving history is paramount; accidents, speeding tickets, and DUI convictions significantly increase premiums due to the heightened risk they represent. A history of claims can lead to higher premiums for several years following the incident. For instance, a young driver with a recent speeding ticket might see a 20-30% increase compared to a driver with a clean record, while a driver with a DUI could face a much more substantial increase, potentially doubling or tripling their premium.

The impact of driving history on insurance premiums is substantial. Accidents and violations directly reflect the likelihood of future claims.

Vehicle Characteristics

The type of vehicle you drive significantly affects your insurance cost. Sports cars and luxury vehicles, often associated with higher repair costs and a greater risk of theft, typically command higher premiums. Conversely, smaller, less expensive vehicles usually result in lower premiums. Vehicle features such as anti-theft devices can positively influence your rate, offering a discount for enhanced security. For example, a new high-performance sports car will likely cost significantly more to insure than a used, smaller sedan. The difference could be several hundred dollars annually.

Location and Coverage

Your location influences your insurance premium due to variations in accident rates and theft statistics. Areas with high crime rates or frequent accidents tend to have higher premiums. The type of coverage you choose also affects the cost. Comprehensive and collision coverage, offering broader protection, is typically more expensive than liability-only coverage. For example, someone living in a densely populated urban area with a high crime rate will likely pay more than someone living in a rural area with lower crime rates. Similarly, opting for comprehensive coverage adds to the premium compared to only carrying liability coverage.

Methods to Lower Premiums

Several strategies can help lower your car insurance premiums. Maintaining a clean driving record is paramount. Consider increasing your deductible; a higher deductible typically results in a lower premium. Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can often lead to discounts. Exploring different insurance providers and comparing quotes is essential to find the most competitive rates. Finally, taking a defensive driving course may also qualify you for a discount.

Illustrative Examples of Quote Results

Understanding how car insurance quotes are presented is crucial for making informed decisions. This section provides detailed examples of quote results from both a major insurer and a comparison website, highlighting key information and visual elements. This will help you navigate the process of obtaining and comparing quotes effectively.

Example Quote from a Major Insurer

Let’s imagine a quote from a hypothetical major insurer, “National Auto Insurance,” for a 35-year-old driver with a clean driving record, driving a 2020 Honda Civic, living in a suburban area with a low crime rate. The quote might look like this:

Policyholder: John Smith

Vehicle: 2020 Honda Civic, Sedan

Coverage: Liability ($100,000/$300,000), Collision, Comprehensive

Deductible: $500 Collision, $500 Comprehensive

Annual Premium: $1,200

Monthly Payment: $100

Additional Features: Roadside assistance, rental car reimbursement

The quote would likely also include a breakdown of the cost of each coverage type, possibly showing a higher premium for collision and comprehensive coverage compared to liability only. It might also list discounts applied, such as a good driver discount or a multi-vehicle discount if applicable. A clear summary of the policy’s terms and conditions would be provided, potentially including links to detailed policy documents. The quote would clearly state the effective date of the policy and any renewal options.

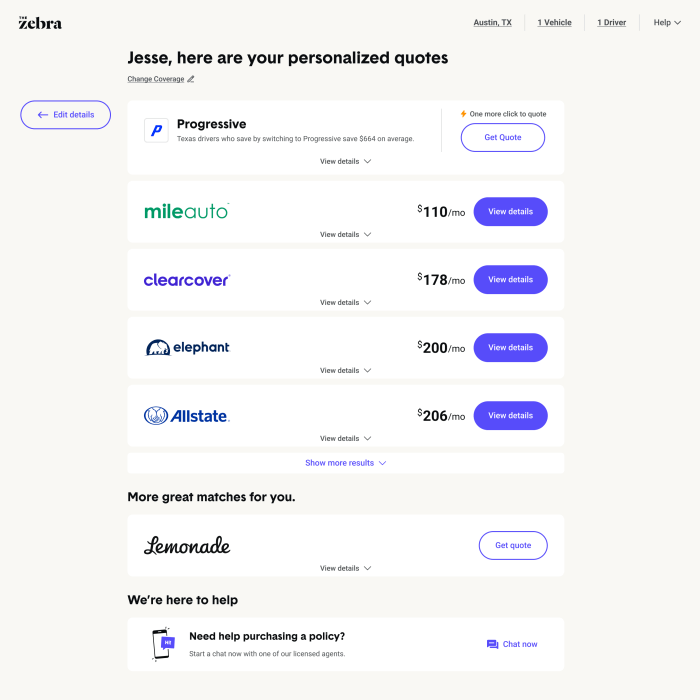

Example Comparative Quote Display from a Comparison Website

A comparison website, such as “CompareAutoInsurance.com” (hypothetical), would present quotes from multiple insurers side-by-side in a table format. Each row would represent a different insurer, with columns displaying key information such as the annual premium, monthly payment, coverage options, deductible, and any included features. For instance:

| Insurer | Annual Premium | Monthly Payment | Coverage | Deductible |

|---|---|---|---|---|

| National Auto Insurance | $1200 | $100 | Liability, Collision, Comprehensive | $500 |

| Best Value Insurance | $1100 | $92 | Liability, Collision, Comprehensive | $1000 |

| Secure Auto Insurance | $1350 | $113 | Liability, Collision, Comprehensive, Roadside Assistance | $500 |

The website might also use color-coding or visual cues to highlight the cheapest or best-rated options. It could include filters to refine the search based on coverage levels, deductibles, and other preferences. Crucially, the website would clearly indicate that it is a comparison service and that the final policy terms and conditions would be determined by the individual insurer.

Visual Representation of Policy Details within a Quote Result Page

The visual representation of a quote result page is crucial for ease of understanding. Generally, insurers and comparison websites prioritize clarity and conciseness. Key information like the total premium and monthly payment would be prominently displayed, often in larger font sizes or bold text. A summary of the coverage included, deductibles, and any additional features would follow, often presented in a bulleted list or table format. Graphs or charts could be used to visually represent the breakdown of the premium cost by coverage type. The page should also include clear calls to action, such as buttons to purchase the policy or request further information. Furthermore, a clear and concise explanation of any additional fees or surcharges would be presented.

Concluding Remarks

Finding the right car insurance involves careful consideration of your individual needs and a strategic approach to comparing quotes. Whether you opt for a comparison website or contact insurers directly, understanding the factors influencing premiums and utilizing available resources will significantly improve your chances of securing a competitive policy. Remember to carefully review all policy details before making a final decision to ensure you have the coverage you need at a price you can afford.

FAQ Corner

What information will I need to get a car insurance quote?

Typically, you’ll need your driver’s license information, vehicle details (make, model, year), address, and driving history. Some insurers may also ask about your credit score.

How often should I compare car insurance quotes?

It’s recommended to compare quotes annually, or even more frequently if your circumstances change significantly (e.g., new car, change of address, driving record changes).

Can I get a quote without providing my driving history?

No, your driving history is a crucial factor in determining your insurance premium. Insurers use this information to assess your risk.

What does “uninsured/underinsured motorist” coverage mean?

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle repairs.