Securing affordable and comprehensive insurance for both your home and your vehicle is a crucial step in financial planning. Understanding the nuances of home car insurance quotes is key to making informed decisions and potentially saving significant money. This guide delves into the intricacies of obtaining, comparing, and selecting the best policy for your individual needs, empowering you to navigate the often-complex world of insurance with confidence.

From understanding the key components of a quote to mastering the art of comparison shopping, we’ll equip you with the knowledge to make the most of your insurance investment. We’ll explore how factors like location, vehicle type, driving history, and credit score influence your premiums, and provide actionable steps to secure the best possible rates. Let’s embark on this journey to financial security together.

Understanding “Home Car Insurance Quote”

A home car insurance quote is an estimate of the cost of insuring your vehicle(s) at your home address. It’s a crucial step in the process of obtaining car insurance, providing a snapshot of potential premiums before you commit to a policy. Understanding the components of a quote allows you to make informed decisions and potentially negotiate better rates.

Understanding the components of a home car insurance quote is vital for making informed decisions. Several factors influence the final premium, and understanding these allows you to compare quotes effectively and potentially save money.

Key Components of a Home Car Insurance Quote

A typical home car insurance quote will include several key elements. These elements are combined to generate the final premium you will be expected to pay. These elements typically include the cost of the policy itself, but also factors which are used to calculate that cost. These are often categorized into different sections on the quote itself.

- Vehicle Information: This section details your car’s make, model, year, and VIN. The insurer uses this to assess the vehicle’s value and risk of theft or damage. For example, a newer, high-value car will generally have a higher premium than an older, less expensive one.

- Driver Information: Your driving history, age, and location are all critical factors. A clean driving record with no accidents or violations will typically result in lower premiums. Younger drivers and those living in high-risk areas may face higher premiums.

- Coverage Options: The quote will Artikel the different coverage levels you’ve selected (e.g., liability, collision, comprehensive). Choosing higher coverage limits will usually result in a higher premium, but it also provides greater financial protection in case of an accident.

- Deductibles: Your chosen deductible—the amount you pay out-of-pocket before your insurance kicks in—significantly impacts your premium. Higher deductibles generally lead to lower premiums, while lower deductibles result in higher premiums.

- Premium Calculation: The quote will detail how the final premium is calculated, often showing a breakdown of the costs associated with each coverage option and factor.

Types of Home Car Insurance Quotes

Several types of home car insurance quotes are available, each offering a slightly different level of detail and commitment.

- Instant Online Quotes: These quotes are generated instantly through online tools, providing a quick estimate based on basic information. They often serve as a starting point for comparison shopping but may not include all the nuances of your specific situation.

- Detailed Quotes from Agents: These quotes are provided by insurance agents who take the time to discuss your needs and provide a more comprehensive assessment of your risk profile. They offer personalized advice and can help you choose the most appropriate coverage options.

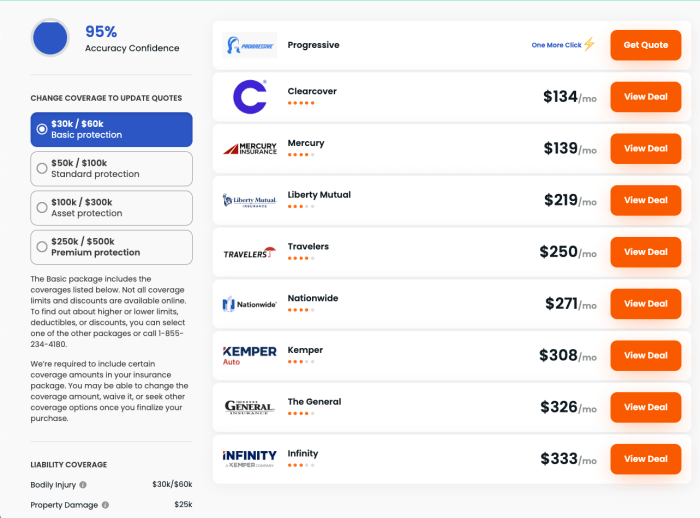

- Comparative Quotes: These quotes allow you to compare the premiums offered by different insurance providers side-by-side, enabling you to identify the best value for your needs. Many online comparison websites offer this service.

Factors Influencing Quote Variations

Several key factors significantly impact the price you’ll receive for your home car insurance quote. Understanding these influences allows for a more informed decision-making process when choosing a policy. This section will detail the most prominent variables affecting your premium.

Location’s Impact on Insurance Costs

Your location plays a crucial role in determining your insurance premium. Areas with higher rates of accidents, theft, and vandalism generally have higher insurance costs. This is because insurance companies assess risk based on statistical data from the region. For example, a densely populated urban area with a history of significant traffic congestion and high crime rates will likely command higher premiums compared to a rural area with lower accident rates and lower crime statistics. Insurance companies use sophisticated actuarial models that factor in numerous local variables to calculate these regional risk assessments.

Vehicle Type and Driving History Influence

The type of vehicle you own and your driving history are significant factors influencing your insurance quote. Sports cars and luxury vehicles often carry higher premiums due to their higher repair costs and increased likelihood of theft. Conversely, smaller, more economical cars typically result in lower premiums. Your driving history, including accidents, traffic violations, and driving record length, is also carefully considered. A clean driving record with no accidents or tickets will usually result in lower premiums, while a history of accidents or violations will significantly increase your costs. For instance, a driver with three at-fault accidents in the past five years will likely pay substantially more than a driver with a spotless record.

Homeowner’s Insurance and Combined Quotes

Bundling your home and car insurance with the same provider often results in significant discounts. Insurance companies offer these discounts as an incentive for customers to consolidate their policies. The savings are usually substantial, sometimes exceeding 10% or even more, depending on the insurer and your specific circumstances. This is because the administrative overhead is reduced for the insurer, allowing them to pass on the savings to the policyholder. This bundling strategy can also simplify the claims process, making it more convenient for the policyholder in case of an incident.

Credit Score and Claims History Effects

Your credit score and claims history are both considered by many insurers when determining your premium. A good credit score often correlates with responsible behavior, leading to lower premiums. Conversely, a poor credit score can result in higher premiums. Similarly, a history of filing insurance claims can increase your premiums, as it suggests a higher risk profile. For example, multiple claims within a short period could significantly impact your premium, signaling to the insurer a greater likelihood of future claims. This practice, however, is subject to state regulations and varies by insurer.

Comparison and Selection

Choosing the right home car insurance policy involves careful comparison of multiple quotes. This process ensures you secure the best coverage at a price that fits your budget. Understanding the nuances of different policies and leveraging effective comparison strategies are crucial for making an informed decision.

Comparing multiple home car insurance quotes effectively requires a systematic approach. Don’t just focus on the bottom line price; consider the overall value proposition.

Effective Comparison of Home Car Insurance Quotes

To effectively compare quotes, organize the information from each insurer into a clear and concise table. This will allow for easy side-by-side comparison of key features and costs. Consider including columns for the insurer’s name, annual premium, deductible amounts for different coverage types (collision, comprehensive, liability), coverage limits, and any additional features or discounts offered. For example, a table might compare Company A offering $1000 annual premium with a $500 collision deductible and $100,000 liability coverage against Company B offering $1200 annual premium with a $250 collision deductible and $250,000 liability coverage. This visual representation quickly highlights the trade-offs between price and coverage levels.

Factors to Consider When Choosing a Home Car Insurance Policy

Several factors influence the suitability of a home car insurance policy. These factors should be carefully weighed against the premium cost to ensure the chosen policy adequately protects your assets and aligns with your individual needs.

- Coverage Levels: Liability coverage protects you financially if you cause an accident. Collision and comprehensive coverage protect your vehicle in various situations. Higher coverage limits generally mean higher premiums but offer greater financial protection.

- Deductibles: A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles usually result in lower premiums, but you’ll pay more in the event of a claim.

- Discounts: Many insurers offer discounts for safe driving records, multiple-car policies, bundling home and auto insurance, and other factors. Actively seek out and utilize these discounts to lower your overall cost.

- Customer Service: Consider the insurer’s reputation for customer service. Read online reviews and check independent ratings to gauge their responsiveness and helpfulness in handling claims.

- Financial Stability of the Insurer: Choose an insurer with a strong financial rating, ensuring they can pay out claims even in the event of major losses. Independent rating agencies provide assessments of insurers’ financial strength.

Negotiating a Better Price on a Home Car Insurance Quote

While comparing quotes is essential, it’s also worth exploring options to negotiate a lower price with your preferred insurer.

Negotiating a lower premium often involves highlighting your positive attributes as a policyholder. For example, demonstrating a long, accident-free driving history, mentioning any safety features in your vehicle (anti-theft devices, advanced safety systems), or indicating your willingness to increase your deductible can be strong negotiating points. Don’t hesitate to politely inquire about available discounts you might have overlooked, or ask if they are willing to match a lower quote you received from a competitor. Remember to be polite and respectful throughout the negotiation process. A well-reasoned and polite approach often yields positive results.

Illustrative Examples

Understanding home car insurance quotes can be challenging, but real-world examples can clarify the process. Let’s explore scenarios to illustrate how various factors influence the final cost.

High Home Car Insurance Quote Scenario

Imagine Sarah, a 22-year-old driver with a brand new sports car, living in a high-crime urban area. She has a history of two minor accidents and one speeding ticket within the past three years. Her insurance quote is significantly higher than expected. Several factors contribute to this: her age (young drivers are statistically more likely to be involved in accidents), the type of vehicle (sports cars are often more expensive to repair), her location (higher crime rates lead to increased theft and accident claims), and her driving record (accidents and speeding tickets demonstrate higher risk). The insurer assesses her as a high-risk driver, resulting in a premium reflecting that increased risk.

Impact of Different Coverage Options on Quote Cost

Let’s consider John, a 45-year-old driver with a clean driving record, owning a mid-sized sedan and living in a suburban area. We’ll compare three coverage options:

Option 1: Basic Liability Coverage: This covers damages to other people’s property or injuries to others in an accident you cause. This option costs $500 annually.

Option 2: Liability + Collision: This adds collision coverage, which covers damages to your vehicle in an accident regardless of fault. This option costs $800 annually. The additional $300 reflects the cost of covering damage to John’s own vehicle.

Option 3: Comprehensive Coverage: This includes liability, collision, and comprehensive coverage, protecting against damage from events like theft, fire, or vandalism. This option costs $1000 annually. The extra $200 over the liability + collision option covers non-accident related damage.

Comparison of Quotes from Three Insurance Providers

A visual representation, in the form of a bar chart, would clearly show the difference in quotes from three different providers (Provider A, Provider B, and Provider C) for John’s chosen coverage option (Comprehensive). Provider A’s quote is represented by a bar reaching $1000, Provider B’s quote is shorter, reaching $900, and Provider C’s quote is the shortest, reaching $850. This visual would clearly illustrate that, even with the same coverage, prices vary significantly between providers, highlighting the importance of comparing quotes.

Final Review

Obtaining the right home car insurance quote requires careful consideration of multiple factors and a proactive approach to comparison shopping. By understanding the key elements of a quote, the impact of various influencing factors, and the different methods of acquisition, you can effectively navigate the process and secure a policy that provides comprehensive coverage at a competitive price. Remember to compare quotes from multiple providers, consider your individual needs, and don’t hesitate to negotiate for a better rate. Your financial well-being depends on making informed choices, and this guide serves as your roadmap to success.

Popular Questions

What is a bundled home and car insurance policy?

A bundled policy combines your home and auto insurance coverage under a single policy with a single provider, often resulting in discounts.

Can I get a quote without providing my driving history?

While some providers may offer simplified quotes initially, a complete driving history is usually required for a final, accurate quote.

How often should I review my home car insurance quote?

It’s recommended to review your policy annually, or whenever significant life changes occur (e.g., new car, home improvements, change in driving record).

What happens if I make a claim?

Filing a claim will impact your future premiums. The extent of the impact depends on the specifics of the claim and your insurance provider’s policies.