Finding the right home insurance can feel overwhelming. Navigating the complexities of coverage options, premiums, and deductibles requires careful consideration. This guide demystifies the process of obtaining and understanding a home insurance estimate, empowering you to make informed decisions that protect your most valuable asset: your home.

We’ll explore the key factors influencing your estimate, from your home’s features and location to your credit score and claims history. We’ll also guide you through the steps of obtaining multiple quotes, comparing them effectively, and ultimately choosing the policy that best suits your individual needs and budget. By the end, you’ll be confident in your ability to secure a home insurance estimate that provides comprehensive protection without breaking the bank.

Understanding Home Insurance Estimates

A home insurance estimate provides a preliminary assessment of the cost to insure your property. It’s a crucial first step in securing adequate protection for your home and belongings. Understanding the factors that influence this estimate empowers you to make informed decisions about your coverage.

Factors Influencing Home Insurance Costs

Several key factors determine the cost of your home insurance. These include the location of your property (risk of natural disasters, crime rates), the age and construction of your home (material type, building codes), the value of your home and its contents, your claims history (past claims can increase premiums), and the level of coverage you choose (higher coverage typically means higher premiums). For example, a home located in a hurricane-prone area will generally have higher premiums than one in a low-risk zone. Similarly, an older home may require more extensive coverage and therefore cost more to insure than a newly built home. Discounts are often available for features like security systems or fire-resistant roofing materials.

Quote versus Estimate

While often used interchangeably, a quote and an estimate differ slightly. A quote is a firm offer for a specific policy, based on the information provided. It is a fixed price, assuming the information provided is accurate. An estimate, on the other hand, is a preliminary assessment of the cost; it can change based on further information or a more detailed property inspection. Think of an estimate as a ballpark figure, while a quote is a binding offer.

Common Home Insurance Coverage Options

Understanding the various coverage options is essential for choosing the right policy. Common options include dwelling coverage (protecting the physical structure of your home), personal liability coverage (protecting you from lawsuits related to accidents on your property), personal property coverage (covering your belongings), loss of use coverage (providing temporary living expenses if your home becomes uninhabitable), and additional living expenses (covering the costs of temporary housing, meals, and other necessities if your home is damaged). Many policies also offer optional add-ons such as flood or earthquake insurance.

Comparison of Home Insurance Policies

| Policy Type | Coverage Focus | Typical Cost | Suitable for |

|---|---|---|---|

| Basic Homeowners Insurance | Dwelling, personal liability, personal property | Lower | Budget-conscious homeowners with minimal assets |

| Broad Homeowners Insurance | Expanded coverage including additional perils | Moderate | Homeowners seeking broader protection |

| Comprehensive Homeowners Insurance | Extensive coverage including high-value items and additional living expenses | Higher | Homeowners with valuable possessions and higher risk tolerance |

| Renters Insurance | Personal property, liability | Lower | Renters protecting their belongings and liability |

Obtaining a Home Insurance Estimate

Securing a home insurance estimate is a crucial first step in protecting your most valuable asset. Understanding the process, the required information, and the nuances of comparing estimates from different providers will empower you to make an informed decision and find the best coverage at the most competitive price.

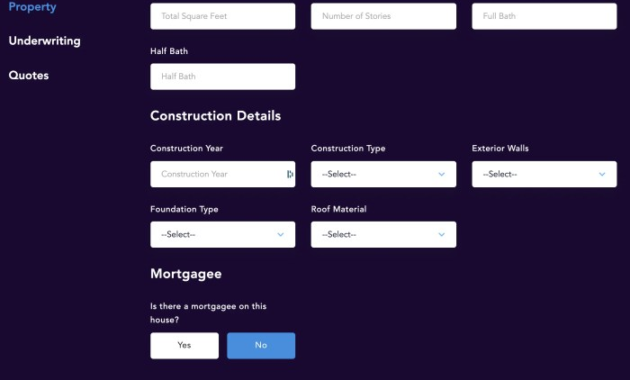

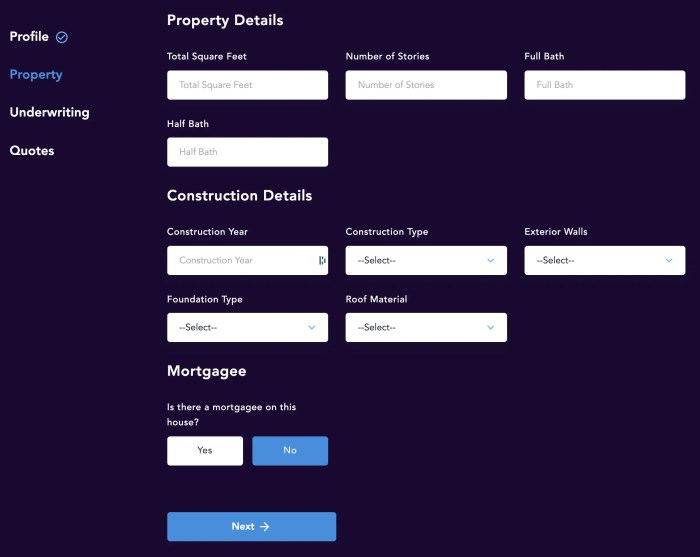

Getting a Home Insurance Estimate Online

Many insurance providers offer convenient online quoting tools. These tools typically involve a straightforward process, guiding you through a series of questions about your home and your desired coverage. The online process usually involves filling out a form, providing essential information, and receiving an immediate or near-immediate estimate. This eliminates the need for phone calls or in-person meetings, offering a quick and efficient way to get an initial understanding of potential costs. For example, many large national insurers like State Farm or Allstate have user-friendly online quoting systems.

Information Required for an Accurate Estimate

To obtain an accurate home insurance estimate, you will need to provide comprehensive information about your property and your needs. This typically includes your address, the year your home was built, its square footage, the number of bedrooms and bathrooms, the type of construction (e.g., brick, wood frame), and details about any upgrades or renovations. Furthermore, you’ll need to provide information about your desired coverage levels, such as liability limits and dwelling coverage. Providing accurate information about your home’s features, such as security systems or fire suppression systems, can impact the final estimate positively. Finally, details about any previous insurance claims can also influence the quote. Accurate and complete information ensures you receive a relevant and reliable estimate.

Comparing Estimates from Different Insurance Providers

Obtaining estimates from multiple providers is crucial for securing the best possible coverage at the most competitive price. Different insurers utilize different rating models and may offer varying levels of coverage for the same price. For example, one insurer might prioritize coverage for specific perils, such as floods or earthquakes, while another might offer a lower price for basic coverage. Comparing not only the price but also the specific coverage details, deductibles, and policy terms is essential. A seemingly cheaper policy might have higher deductibles or exclude important coverage elements. Therefore, a thorough comparison across multiple providers ensures a comprehensive understanding of the available options.

A Step-by-Step Guide for Securing Multiple Home Insurance Estimates

A systematic approach ensures you gather comprehensive information.

- Identify Potential Providers: Research and select at least three to five different insurance providers. This includes a mix of large national companies and smaller, regional insurers.

- Gather Necessary Information: Collect all the necessary information about your home, including its dimensions, age, construction materials, and any significant features.

- Obtain Online Quotes: Use the online quoting tools of each provider, inputting the same information consistently across all platforms.

- Request Detailed Policy Documents: Once you receive initial quotes, request detailed policy documents from each provider to review the fine print, including exclusions and specific coverage details.

- Compare Quotes and Coverage: Compare the quotes side-by-side, focusing on the overall price, coverage levels, deductibles, and policy terms.

Reviewing and Comparing Estimates

After gathering multiple estimates, a structured comparison is essential. Create a table comparing key aspects of each quote, including the total annual premium, the deductible amount, the coverage limits for dwelling, liability, and personal property, and any significant exclusions or limitations. Pay close attention to the specific perils covered by each policy and any additional features or discounts offered. This detailed comparison will allow you to make an informed decision based on your individual needs and budget. Consider using a spreadsheet to organize this information for easy analysis. For example, a simple table could list each provider, their premium, their deductible, and their coverage limits for dwelling and liability.

Deciphering Home Insurance Estimate Details

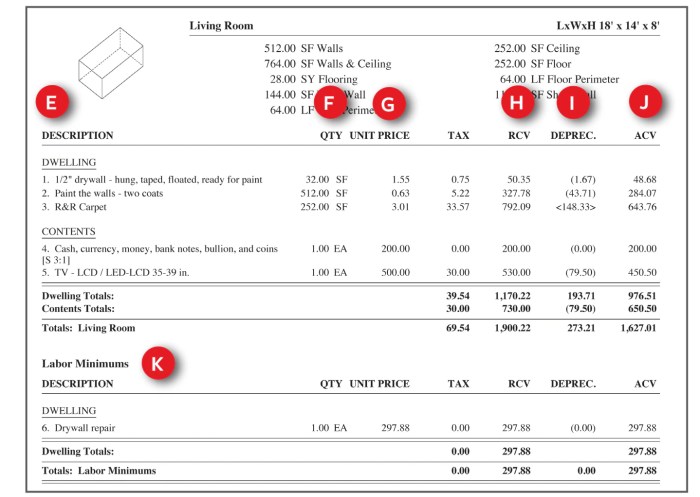

Understanding the details of your home insurance estimate is crucial to ensuring you have adequate coverage at a fair price. This section will break down key terms, potential hidden costs, and the importance of understanding policy limits and deductibles. By carefully reviewing your estimate, you can make informed decisions about your home insurance protection.

Key Terms in Home Insurance Estimates

A home insurance estimate uses specific terminology. Familiarizing yourself with these terms will allow you to better understand the coverage offered and the associated costs. For instance, “dwelling coverage” refers to the structure of your home, while “personal property coverage” protects your belongings inside. “Liability coverage” protects you financially if someone is injured on your property. “Additional living expenses” cover temporary housing costs if your home becomes uninhabitable due to a covered event. Understanding these distinctions is fundamental to assessing the adequacy of your policy.

Potential Hidden Costs and Fees

While the initial estimate provides a base price, additional fees and costs can arise. These might include policy fees, processing fees, or even increased premiums based on factors like your credit score or claims history. Some insurers might also add surcharges for specific features of your home, such as a swimming pool or older electrical systems. It’s essential to inquire about all potential fees upfront to avoid unexpected expenses. For example, a home with a pool might see a 10-15% increase in premiums compared to a similar home without one.

Policy Limits and Deductibles

Policy limits represent the maximum amount your insurer will pay for a covered loss. For example, a $500,000 dwelling coverage limit means the insurer will pay a maximum of $500,000 to rebuild your home in case of a total loss. Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, but you’ll pay more in the event of a claim. Choosing the right balance between deductible and premium requires careful consideration of your financial situation and risk tolerance. For instance, a $1,000 deductible might save you $100 annually on premiums, but you would need to cover the first $1,000 of any claim yourself.

Impact of Different Coverage Levels on Estimates

The level of coverage you choose significantly impacts the estimate. Increasing your dwelling coverage increases your premium but offers greater protection against significant losses. Similarly, higher liability limits provide more financial protection in case of lawsuits. Choosing optional coverages, such as flood or earthquake insurance, will also affect the overall cost. A comprehensive policy with high coverage limits will naturally result in a higher premium compared to a basic policy with lower limits. For instance, adding flood insurance to a policy in a high-risk flood zone could increase the annual premium by several hundred dollars, but offers crucial protection against flood damage.

Common Exclusions in Home Insurance Policies

It’s vital to understand what your policy *doesn’t* cover. Many standard policies exclude certain events or types of damage.

- Normal wear and tear

- Acts of war

- Nuclear hazards

- Intentional damage caused by the policyholder

- Earthquakes (unless specifically added as an endorsement)

- Flooding (unless specifically added as an endorsement)

- Pest infestations (often limited coverage)

Carefully reviewing the policy document to identify these exclusions is crucial to avoid surprises during a claim.

Factors Affecting Home Insurance Estimate Costs

Several key factors influence the cost of your home insurance estimate. Understanding these elements allows you to better anticipate your premiums and potentially make choices that could lower your costs. This section will explore the significant contributors to your final insurance price.

Location’s Influence on Home Insurance Costs

Your home’s location is a primary determinant of your insurance premium. Areas prone to natural disasters like hurricanes, earthquakes, wildfires, or floods command higher premiums due to the increased risk insurers face. For example, a coastal home in a hurricane-prone zone will typically cost significantly more to insure than a similar home located inland in a less disaster-vulnerable region. Furthermore, crime rates in a neighborhood also impact insurance costs; higher crime rates translate to a greater risk of burglary and vandalism, leading to increased premiums. The proximity to fire hydrants and the quality of local fire services also play a role; better fire protection often leads to lower premiums.

Impact of Home Features on Insurance Estimates

The characteristics of your home significantly influence insurance costs. Older homes, especially those lacking modern safety features, generally carry higher premiums due to an increased risk of damage or failure of older systems. Larger homes typically cost more to insure because there’s more to cover in case of damage. Conversely, homes equipped with modern security systems, such as alarm systems and fire suppression systems, usually qualify for discounts, reflecting the reduced risk to the insurer. The building materials used also matter; homes constructed with fire-resistant materials might receive lower premiums than those built with more combustible materials. The condition of the roof and the presence of updated electrical and plumbing systems are also factors considered.

Claims History’s Effect on Future Estimates

Your past claims history is a major factor in determining future insurance premiums. Filing multiple claims, particularly for significant damage, can significantly increase your premiums. Insurers view a history of claims as an indicator of higher risk, leading them to charge more to cover potential future losses. Conversely, maintaining a clean claims history, demonstrating responsible homeownership, often results in lower premiums and potentially even discounts. The type of claims also matters; minor claims might have a less significant impact than major claims.

Credit Score’s Role in Determining Insurance Premiums

In many jurisdictions, your credit score plays a role in determining your home insurance premiums. Insurers often use credit scores as an indicator of risk, with individuals possessing higher credit scores generally receiving lower premiums. The rationale behind this is that individuals with good credit history tend to be more responsible and financially stable, suggesting a lower likelihood of failing to pay premiums or neglecting home maintenance, thereby reducing the risk for the insurer. However, the extent to which credit score impacts premiums varies by state and insurer.

Visual Representation of Risk Factors and Premium Costs

Imagine a bar graph. The horizontal axis represents different risk factors, such as location (high-risk vs. low-risk), home age (old vs. new), security system (present vs. absent), claims history (multiple claims vs. no claims), and credit score (low vs. high). The vertical axis represents the premium cost. Each risk factor has a bar representing its premium impact. The bars for high-risk factors (e.g., high-risk location, old home, no security system, multiple claims, low credit score) would be significantly taller than the bars for low-risk factors. This visually demonstrates how each factor contributes to the overall premium cost, with a combination of high-risk factors resulting in a substantially higher premium than a combination of low-risk factors. For example, a home in a high-risk location with an old roof and a history of claims would have a much higher bar than a newer home in a low-risk area with a good credit score and no claims history.

Choosing the Right Home Insurance Policy

Selecting the optimal home insurance policy involves careful consideration of your individual needs and a thorough comparison of available options. This process ensures you receive adequate protection at a competitive price, safeguarding your most valuable asset. Understanding the nuances of different policies and employing effective negotiation strategies are key to achieving this.

Coverage Options and Individual Needs

Different home insurance policies offer varying levels of coverage. For example, a basic policy might cover only damage from fire or theft, while a comprehensive policy includes additional coverage for events like floods, earthquakes, or liability claims. Individuals living in high-risk areas, such as those prone to natural disasters, would benefit from more comprehensive coverage, even if the premium is higher. Similarly, homeowners with valuable possessions may need higher limits for personal property coverage. Conversely, a homeowner with a modest home and few valuables might find a basic policy sufficient and cost-effective. The key is to assess your specific risks and choose a policy that aligns with your needs and financial capacity.

Negotiating Lower Premiums

Several strategies can help you secure lower premiums. Bundling your home and auto insurance with the same provider often results in discounts. Maintaining a good credit score can also significantly impact your premium, as insurers often view it as an indicator of responsible financial behavior. Consider increasing your deductible; a higher deductible typically translates to lower premiums, though it means you’ll pay more out-of-pocket in case of a claim. Shopping around and comparing quotes from multiple insurers is crucial. Finally, demonstrating proactive risk mitigation, such as installing a security system or upgrading your plumbing, can often lead to premium reductions. For instance, a homeowner who installs a monitored security system might receive a 5-10% discount.

Evaluating the Value Proposition of Different Estimates

Comparing home insurance estimates requires more than just looking at the premium. Analyze the coverage details meticulously. A lower premium might come with significantly lower coverage limits, leaving you vulnerable in the event of a major loss. Consider the reputation and financial stability of the insurance provider. A financially sound insurer is more likely to pay out claims promptly and fairly. Calculate the total cost of ownership, factoring in potential deductibles and out-of-pocket expenses. For example, a policy with a slightly higher premium but a lower deductible might ultimately be more cost-effective in the long run, particularly if you’re risk-averse.

Checklist for Selecting a Home Insurance Policy

Before making a decision, use this checklist:

- Assess your property’s value and contents.

- Identify potential risks specific to your location and property.

- Obtain quotes from at least three different insurers.

- Carefully review the policy documents, paying attention to coverage limits, exclusions, and deductibles.

- Verify the insurer’s financial stability and customer service reputation.

- Compare the total cost of ownership, including premiums and potential out-of-pocket expenses.

- Consider adding optional coverage for specific risks, such as flood or earthquake damage.

- Choose a policy that offers the best balance of coverage and affordability.

Purchasing a Home Insurance Policy

After comparing estimates and selecting a suitable policy, the purchasing process is generally straightforward. First, complete the application form accurately and thoroughly, providing all necessary information about your property and personal details. Next, review the policy documents carefully before signing them to ensure you understand all terms and conditions. Finally, pay the premium as instructed, usually through a secure online portal or by mail. Once the payment is processed and the policy is activated, you’ll receive confirmation documentation. Remember to keep your policy documents in a safe place and review them periodically to ensure they continue to meet your needs.

Summary

Obtaining a home insurance estimate is a crucial step in protecting your home and financial well-being. By understanding the factors that influence your premium, comparing quotes from multiple providers, and carefully reviewing policy details, you can secure a policy that offers the right level of coverage at a competitive price. Remember, proactive planning and informed decision-making are key to finding the best home insurance solution for your unique circumstances. Take control of your insurance needs today and secure the peace of mind you deserve.

Answers to Common Questions

What is the difference between a home insurance quote and an estimate?

A quote is a firm offer of insurance coverage at a specific price, while an estimate is a preliminary calculation of the likely cost. Quotes are generally binding, whereas estimates can change based on further information.

How long does it take to get a home insurance estimate?

Online estimates can be generated instantly, while estimates from insurance agents may take a few days depending on the complexity of the application.

Can I get a home insurance estimate without providing my personal information?

No, accurate estimates require some personal and property information to assess risk accurately. However, the level of detail requested may vary between providers.

What happens if I make a claim after receiving an estimate?

Your premiums may increase after a claim, and future estimates will reflect this increased risk. The impact depends on the nature and cost of the claim.

What is the best time of year to get a home insurance estimate?

There’s no single “best” time, but shopping around several months before your policy renewal allows ample time for comparison and negotiation.