Securing your home is a significant investment, and understanding the nuances of home insurance is crucial. Navigating the world of home insurance companies quotes can feel overwhelming, with a myriad of options and varying coverage levels. This guide provides a clear and concise path to finding the best policy to protect your most valuable asset.

From understanding the factors influencing quote prices to comparing different companies and choosing the right coverage, we’ll equip you with the knowledge to make informed decisions. We’ll explore various methods for obtaining quotes, highlighting the pros and cons of each approach, and offering practical tips for effective comparison shopping.

Understanding Home Insurance Quotes

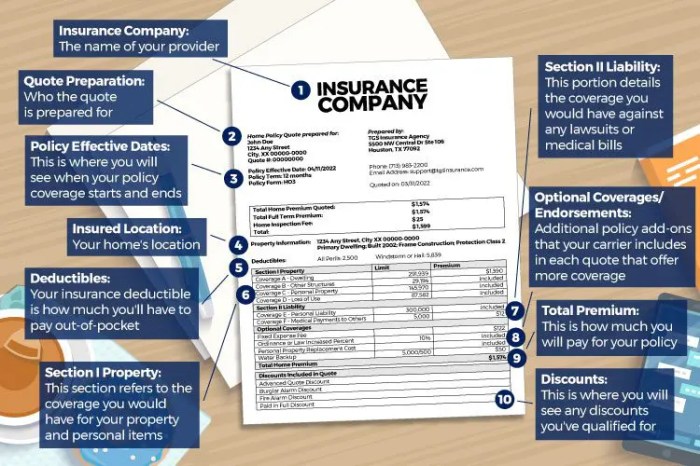

Obtaining a home insurance quote is a crucial first step in protecting your most valuable asset. A quote provides a detailed estimate of the cost to insure your home and its contents against various risks. Understanding these quotes is essential for making informed decisions about your coverage and budget.

Home insurance quotes represent the estimated annual premium an insurance company would charge to cover your home and its belongings against specified perils. The significance lies in its ability to allow homeowners to compare different policies and insurers, ultimately finding the best balance of coverage and price.

Factors Influencing Home Insurance Quote Costs

Several factors significantly influence the cost of a home insurance quote. These factors are considered by insurance companies to assess the level of risk associated with insuring a particular property. A higher risk profile typically translates to a higher premium.

These factors include the location of the property (risk of natural disasters, crime rates), the age and condition of the home (structural integrity, building materials), the coverage amount (the value of the home and its contents), the deductible amount (the amount the homeowner pays before the insurance coverage kicks in), and the homeowner’s claims history (previous insurance claims filed). Additionally, the type of coverage selected (basic, comprehensive, or specialized) also impacts the final quote. For example, a home in a hurricane-prone area will generally have a higher premium than a similar home in a low-risk area.

Types of Coverage Included in Home Insurance Quotes

Home insurance quotes typically include several types of coverage, each designed to protect against specific risks. Understanding these different coverages is essential for choosing a policy that adequately meets your needs.

Common coverages include dwelling coverage (protecting the physical structure of the home), personal liability coverage (protecting against lawsuits resulting from accidents on your property), loss of use coverage (covering additional living expenses if your home becomes uninhabitable due to a covered event), and personal property coverage (protecting your belongings inside and sometimes outside your home). Some policies also offer additional coverage options such as flood insurance (requires a separate policy in most cases) or earthquake insurance (often a separate rider).

Comparison of Home Insurance Quote Types

Different insurers offer various types of home insurance policies, each with its own set of features and price points. Understanding the key differences can help you make an informed choice.

| Policy Type | Coverage Level | Deductible Options | Premium Range (Example) |

|---|---|---|---|

| Basic | Covers dwelling, liability, and personal property at a minimum level. | Higher deductibles are usually cheaper. | $500 – $1000 per year |

| Comprehensive | Includes broader coverage for dwelling, liability, personal property, and additional living expenses. | Wide range of deductible options available. | $1000 – $2000 per year |

| High-Value Homes | Specifically designed for homes with a higher replacement cost, often including enhanced coverage and specialized features. | Often higher deductibles but with increased coverage limits. | $2000+ per year |

| Renters Insurance | Covers personal belongings and liability for renters. | Typically lower premiums than homeowner’s insurance. | $100 – $500 per year |

Finding and Comparing Home Insurance Quotes

Securing the best home insurance coverage often involves navigating a landscape of different providers and policy options. Understanding how to effectively find and compare quotes is crucial to ensuring you receive adequate protection at a competitive price. This process involves utilizing various resources and employing strategic comparison techniques to identify the most suitable policy for your individual needs.

Methods for Obtaining Home Insurance Quotes

Consumers can obtain home insurance quotes through three primary avenues: online comparison websites, independent insurance agents, and direct interaction with insurance companies. Online comparison websites allow you to input your details and receive multiple quotes simultaneously, providing a convenient way to compare options. Independent insurance agents act as intermediaries, working with multiple insurance companies to find the best fit for your circumstances. Directly contacting insurance companies allows you to build a relationship with a specific provider and potentially negotiate terms. Each method offers advantages and disadvantages depending on your preferences and needs.

Best Practices for Comparing Home Insurance Quotes

Effectively comparing home insurance quotes requires a systematic approach. Don’t simply focus on the premium; delve deeper into the coverage details. Consider using a spreadsheet or a dedicated comparison tool to organize the information from each quote. This organized approach will help you identify the best value for your money. Remember that the lowest premium doesn’t always equate to the best policy.

Key Information to Consider When Comparing Quotes

Before making a decision, carefully review the following aspects of each quote:

- Premium Amount: The total annual cost of the insurance policy.

- Coverage Limits: The maximum amount the insurer will pay for covered losses (e.g., dwelling coverage, liability coverage).

- Deductibles: The amount you pay out-of-pocket before the insurance coverage kicks in.

- Policy Exclusions: Specific events or damages not covered by the policy.

- Discounts: Available discounts for things like security systems, multiple policies, or claims-free history.

- Customer Reviews and Ratings: Research the insurer’s reputation for claims handling and customer service.

- Financial Strength Rating: Check the insurer’s financial stability to ensure they can meet their obligations.

Flowchart Illustrating the Steps Involved in Obtaining and Comparing Quotes

The process of obtaining and comparing home insurance quotes can be visualized using a flowchart. Imagine a flowchart starting with a box labeled “Start.” The next box would be “Choose Method (Online, Agent, Direct).” This branches to three separate paths, each leading to a box representing obtaining quotes via the chosen method. These paths then converge at a box labeled “Gather Quote Information.” Following this, a box labeled “Compare Quotes Using Key Factors (Premium, Coverage, Deductible, etc.)” is displayed. This box leads to a decision box: “Is the best policy identified?” A “Yes” path leads to a box labeled “Select Policy,” while a “No” path loops back to the “Compare Quotes” box. Finally, a “Select Policy” box leads to the “End” box, completing the process. This visual representation clearly Artikels the steps involved in securing the most suitable home insurance policy.

Understanding Policy Details and Coverage

Choosing a home insurance policy involves more than just comparing prices; it requires a thorough understanding of the coverage details. This section will clarify the different types of coverage, highlight crucial exclusions and limitations, and illustrate how specific coverages can protect you in various scenarios. A well-informed decision ensures you have the right protection for your most valuable asset.

Types of Home Insurance Coverage

Home insurance policies typically include several key coverage areas designed to protect your home and belongings against various risks. Understanding these components is crucial for selecting a policy that meets your specific needs. Liability coverage protects you against financial losses arising from accidents or injuries on your property. Dwelling coverage protects the physical structure of your home, while personal property coverage safeguards your belongings within the home. Additional coverages, such as loss of use and additional living expenses, can provide further financial support during unforeseen events.

Policy Exclusions and Limitations

It is equally important to understand what your policy *doesn’t* cover. All home insurance policies have exclusions—specific events or circumstances that are not covered under the policy. These can include things like flood damage (often requiring separate flood insurance), earthquake damage (similarly requiring specialized coverage), or intentional acts of damage by the policyholder. Furthermore, limitations may restrict the amount of coverage provided for certain items or types of losses. Carefully reviewing the policy document to identify these exclusions and limitations is crucial to avoid unexpected financial burdens in the event of a claim.

Examples of Beneficial Coverages

Consider this scenario: a tree falls on your house during a storm. Dwelling coverage would help pay for repairs or reconstruction. Now, imagine a fire damages your home, forcing you to live elsewhere temporarily. Additional living expenses coverage would reimburse you for the costs of temporary accommodation, meals, and other essential expenses. Finally, if someone is injured on your property and sues you, liability coverage would protect you from significant financial losses. These examples highlight how different coverage options provide comprehensive protection against various risks.

Common Coverage Options and Associated Costs

The cost of home insurance varies based on several factors, including location, property value, coverage amounts, and the insurer. The following table provides a general overview of common coverage options and their potential cost ranges. Remember, these are estimates, and actual costs can vary significantly.

| Coverage Type | Description | Typical Coverage Amount | Estimated Annual Cost Range |

|---|---|---|---|

| Dwelling | Covers damage to the structure of your home. | $250,000 – $1,000,000+ | $500 – $2,000+ |

| Personal Property | Covers damage or loss of your belongings inside your home. | $100,000 – $500,000+ | $200 – $1,000+ |

| Liability | Protects you against lawsuits for injuries or damages caused on your property. | $100,000 – $500,000+ | $100 – $500+ |

| Additional Living Expenses | Covers temporary living costs if your home becomes uninhabitable due to a covered event. | 20% – 30% of dwelling coverage | Included in most policies, cost varies with dwelling coverage |

Illustrating Coverage Scenarios

Understanding how your home insurance policy works in real-life situations is crucial. The following scenarios illustrate how different coverage types respond to common home-related incidents. Remember, specific payouts depend on your policy limits, deductible, and the specifics of your claim.

Fire Damage Scenario

A fire, originating from a faulty electrical appliance, severely damages your kitchen and living room. The fire department successfully extinguishes the blaze, but smoke and water damage affect other areas of the house. Your home insurance policy’s “dwelling coverage” would address the structural damage to your home, covering the cost of repairs or rebuilding. “Personal property coverage” would compensate for damaged or destroyed furniture, appliances, and personal belongings. “Additional living expenses” coverage might reimburse you for temporary housing and meals while repairs are underway. The claim process involves filing a report with your insurer, providing documentation (photos, receipts, etc.), and cooperating with an adjuster who will assess the damage and determine the payout. For instance, if your dwelling coverage is $300,000 and the damage is assessed at $50,000, you would receive $50,000 (minus your deductible), assuming no other policy limitations apply. Similarly, your personal property coverage would cover the value of lost or damaged items up to your policy limit.

Theft Scenario

Burglars break into your home and steal several valuable items, including jewelry, electronics, and antiques. The level of coverage you have significantly impacts your claim. A basic policy might have a low limit on personal property coverage, potentially leaving you with significant out-of-pocket expenses. A higher coverage level, however, would offer a greater payout. Your policy’s “personal property coverage” section is relevant here. The claim process would involve reporting the theft to the police and your insurer, providing a detailed list of stolen items with proof of ownership (receipts, photos, appraisals). The insurer would investigate and determine the value of the stolen goods, paying out up to your policy limit for covered items. For example, if your policy has a $50,000 personal property limit and $1,000 deductible, and $20,000 worth of items were stolen, you would receive $19,000. Note that some items might have specific sub-limits (e.g., jewelry).

Water Damage Scenario

A severe storm causes a pipe to burst in your basement, leading to significant water damage. Your home insurance policy likely covers water damage caused by sudden and accidental events, such as a burst pipe. However, coverage for water damage from gradual leaks or neglect is often excluded or limited. The “dwelling coverage” and “personal property coverage” sections of your policy would apply, covering the cost of repairs to the structure and replacement of damaged belongings. However, there might be exclusions for specific types of water damage, such as flooding from a river or prolonged exposure to rain. The claim process is similar to other scenarios: reporting the incident, providing documentation, and cooperating with the adjuster. The insurer will assess the damage and determine the payout based on your policy limits and deductible. If the damage is extensive and exceeds your coverage limits, you may need to explore additional resources, like supplemental insurance or government assistance programs.

Ultimate Conclusion

Finding the right home insurance is a journey, not a race. By carefully considering your individual needs, comparing quotes meticulously, and understanding policy details, you can secure comprehensive coverage at a competitive price. Remember to prioritize financial stability and customer service when selecting a provider, ensuring peace of mind knowing your home is adequately protected. Take control of your insurance needs and make an informed decision that safeguards your future.

Helpful Answers

What is the difference between an insurance agent and a broker?

An agent represents a single insurance company, while a broker works with multiple companies to find you the best options.

How often should I review my home insurance policy?

It’s advisable to review your policy annually, or whenever there’s a significant change in your home’s value or your personal circumstances.

What happens if I underinsure my home?

Underinsurance can lead to significant out-of-pocket expenses in the event of a claim, as you may only receive a partial payout.

Can I get home insurance quotes without providing my personal information?

While some initial information is usually required for a basic quote, you can often avoid providing sensitive details until you’ve narrowed down your choices.

What is a deductible and how does it affect my premium?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium.