Insurance premiums: the often-misunderstood cost of safeguarding your future. Understanding how these premiums are calculated and what factors influence them is crucial for making informed decisions about your financial well-being. This guide delves into the intricacies of insurance premiums, exploring the various elements that contribute to their overall cost and offering strategies to manage and potentially reduce your expenses.

From the impact of age and driving history on car insurance to the role of health factors in health insurance, we’ll unravel the complexities of premium determination. We will also examine the influence of external factors, such as inflation and government regulations, and explore how consumers can leverage various strategies to minimize their premium payments. Prepare to gain a clearer understanding of this vital aspect of personal finance.

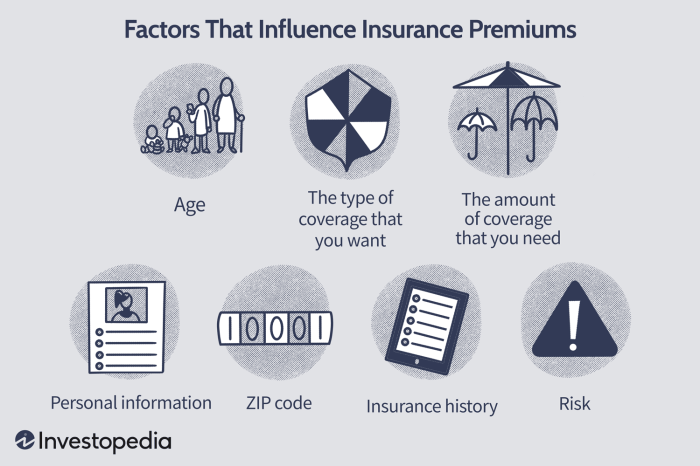

Factors Influencing Insurance Premiums

Insurance premiums, the regular payments you make for coverage, are determined by a complex interplay of factors. Understanding these factors can help you make informed decisions about your insurance choices and potentially lower your costs. This section will explore some of the key elements that insurers consider when calculating premiums across various insurance types.

Age and Insurance Premiums

Age significantly impacts insurance premium calculations. Younger drivers, for example, statistically have a higher rate of accidents than older, more experienced drivers. This increased risk translates to higher car insurance premiums for younger individuals. Conversely, older drivers, while potentially having some health concerns, often benefit from years of safe driving, leading to lower premiums in some cases. Similarly, in health insurance, age is a crucial factor, with premiums generally increasing as individuals age due to the higher likelihood of needing more extensive medical care. However, some plans offer age-based discounts to mitigate this.

Driving History and Car Insurance Premiums

Your driving history is a major determinant of your car insurance premium. A clean driving record with no accidents or traffic violations will typically result in lower premiums. Conversely, accidents, speeding tickets, and DUI convictions will significantly increase your premiums, reflecting the higher risk you represent to the insurer. The severity of the incident also plays a role; a minor fender bender will likely have a less substantial impact than a major accident causing significant damage or injury. Some insurers even offer discounts for completing defensive driving courses, demonstrating a commitment to safe driving practices.

Coverage Levels and Premium Differences

Different levels of insurance coverage correspond to different premium costs. Liability insurance, which covers damages to others, is typically less expensive than comprehensive coverage, which also covers damage to your own vehicle. Adding collision coverage, which protects against damage from collisions with other vehicles or objects, further increases the premium. The higher the coverage limits you choose, the greater the premium will be. For example, choosing higher liability limits means the insurance company will pay out more in the event of an accident, resulting in a higher premium for that increased protection.

Health Factors and Health Insurance Premiums

Health insurance premiums are significantly influenced by various health factors. Pre-existing conditions, such as diabetes or heart disease, generally lead to higher premiums because these conditions increase the likelihood of needing more medical care. Lifestyle factors such as smoking, obesity, and lack of exercise can also impact premiums, as these factors contribute to increased health risks. Family history of certain diseases may also be considered, although the extent of this influence varies between insurance providers. It’s important to note that the Affordable Care Act (ACA) in the United States protects individuals with pre-existing conditions from being denied coverage, but premiums may still reflect the increased risk.

Impact of Risk Factors on Premiums Across Insurance Types

| Risk Factor | Auto Insurance | Homeowners Insurance | Health Insurance |

|---|---|---|---|

| Age (Younger Driver/Individual) | Higher | Potentially Higher (less experience managing a home) | Potentially Lower (depending on plan) |

| Poor Driving/Health History | Higher | Potentially Higher (claims history) | Higher |

| Location (High-Risk Area) | Higher | Higher | Potentially Higher (access to care) |

| Credit Score (in some states) | Potentially Higher | Potentially Higher | N/A |

Understanding Premium Calculation Methods

Insurance premium calculation is a complex process, involving a blend of statistical modeling, actuarial science, and risk assessment. Understanding the methodology behind these calculations provides valuable insight into how insurance companies determine the cost of coverage. This section will detail the key components of this process.

Car Insurance Premium Calculation: A Step-by-Step Breakdown

A typical car insurance premium calculation involves several key steps. First, the insurer gathers information about the applicant, including driving history (accidents, violations), vehicle details (make, model, year), location (address, crime rates), and coverage choices (liability, collision, comprehensive). This data is then fed into a proprietary rating algorithm. This algorithm considers various factors, weighting them according to their statistical significance in predicting the likelihood of a claim. For example, a history of speeding tickets might increase the premium significantly more than a minor fender bender. Finally, the algorithm calculates a base premium, which is then adjusted based on discounts (e.g., safe driver discounts, multi-car discounts) and added fees (e.g., surcharge for young drivers). The final figure represents the premium the insured will pay.

Statistical Models in Risk Prediction

Insurers utilize sophisticated statistical models, often employing techniques like regression analysis and machine learning, to predict the likelihood of an insured individual filing a claim. For example, a model might analyze thousands of past claims to identify correlations between factors like age, driving history, and the frequency of accidents. This analysis allows insurers to develop risk scores, which are then used to adjust premiums. A higher risk score translates to a higher premium, reflecting the increased probability of a claim. A real-world example could be a model predicting a higher accident probability for young drivers with a history of speeding tickets, leading to a higher premium for this demographic.

The Role of Actuarial Science

Actuarial science plays a crucial role in determining insurance premiums. Actuaries are highly trained professionals who use statistical methods and financial models to assess risk and set premiums. They analyze vast datasets of past claims, demographic information, and economic trends to predict future claims costs. This analysis is crucial for ensuring that premiums are sufficient to cover expected payouts while maintaining the financial stability of the insurance company. Actuaries also help to design insurance products, ensuring that they are both financially viable and meet the needs of consumers.

Insurance Rating Systems

Insurance companies employ various rating systems to categorize and assess risk. These systems consider a wide range of factors, including those mentioned previously. Some common rating systems include territory-based rating (premiums vary by geographic location due to factors like accident rates and crime statistics), driver-based rating (considering individual driving history and experience), and vehicle-based rating (assessing the safety features and repair costs associated with specific vehicle models). The specific rating system and the weighting of different factors can vary significantly between insurance companies, leading to differences in premium quotes for the same coverage.

Life Insurance Premium Calculation: A Flowchart

[Imagine a flowchart here. The flowchart would begin with “Applicant Information” (age, health, smoking status, desired coverage amount). This would flow to “Risk Assessment” (using actuarial tables and health assessments). Next would be “Premium Calculation” (applying actuarial models and interest rates). Finally, it would end with “Premium Quote”. Each step would have associated decision points and calculations, illustrating the complexity of the process. The flowchart would visually represent the sequential steps involved in determining a life insurance premium, highlighting the interplay between applicant data and actuarial models.]

Strategies for Reducing Insurance Premiums

Reducing your insurance premiums can significantly impact your personal finances. By implementing smart strategies, you can lower your monthly expenses without compromising necessary coverage. This section explores several effective methods for achieving premium reductions across different insurance types.

Lowering Car Insurance Premiums

Several factors influence car insurance premiums. Understanding these factors allows for proactive measures to lower your costs.

- Maintain a clean driving record: Accidents and traffic violations directly increase premiums. Defensive driving and adherence to traffic laws are crucial.

- Choose a higher deductible: Opting for a higher deductible reduces your monthly premium, but remember you’ll pay more out-of-pocket in case of an accident.

- Bundle your insurance: Combining car insurance with other policies, such as homeowners or renters insurance, often results in significant discounts.

- Shop around and compare quotes: Different insurers offer varying rates. Comparing quotes from multiple companies ensures you secure the best deal.

- Consider car safety features: Vehicles equipped with anti-theft devices or advanced safety features may qualify for lower premiums.

- Improve your credit score: Insurers often use credit scores to assess risk. A higher credit score can lead to lower premiums.

Lowering Health Insurance Premiums

Health insurance premiums can be substantial. However, there are ways to mitigate these costs.

- Enroll during open enrollment: Taking advantage of open enrollment periods allows you to compare plans and choose the most cost-effective option for your needs.

- Consider a high-deductible plan: High-deductible health plans (HDHPs) often come with lower premiums but require higher out-of-pocket payments before insurance coverage kicks in. This is suitable for individuals who are generally healthy and can afford higher deductibles.

- Take advantage of employer-sponsored plans: Many employers offer subsidized health insurance, significantly reducing the employee’s contribution.

- Explore government assistance programs: Programs like Medicaid and the Affordable Care Act (ACA) marketplace offer subsidies and tax credits to make health insurance more affordable.

- Maintain a healthy lifestyle: A healthy lifestyle can reduce your risk of illness, potentially influencing your premium rates in the long run, although this is not always directly reflected in your premiums immediately.

Bundling Insurance Policies

Bundling insurance policies, such as home, auto, and umbrella insurance, from the same provider often results in significant savings. Insurers frequently offer discounts for bundling, rewarding customer loyalty and streamlining administrative processes. The exact discount varies depending on the insurer and the specific policies bundled. For example, a 10-15% discount on your total premium is not uncommon.

Benefits of a Good Credit Score for Insurance

A good credit score is often a factor in determining insurance premiums. Insurers view a good credit score as an indicator of responsible financial behavior, correlating it with a lower risk of claims. Consequently, individuals with higher credit scores often qualify for lower premiums across various insurance types. Improving your credit score can lead to substantial long-term savings on insurance costs.

Impact of Increasing Deductibles on Premiums

Increasing your deductible—the amount you pay out-of-pocket before your insurance coverage begins—directly reduces your premium. However, this involves a trade-off: a higher deductible means you’ll pay more in the event of a claim. The following table illustrates this trade-off:

| Deductible | Monthly Premium | Annual Premium | Out-of-Pocket Risk |

|---|---|---|---|

| $500 | $150 | $1800 | High risk of smaller claims, low risk of large claims |

| $1000 | $120 | $1440 | Moderate risk of smaller claims, moderate risk of large claims |

| $2000 | $90 | $1080 | Low risk of smaller claims, high risk of large claims |

| $5000 | $60 | $720 | Very low risk of smaller claims, very high risk of large claims |

Illustrative Examples of Premium Changes

Insurance premiums are dynamic, fluctuating based on a variety of factors related to risk assessment. Understanding how these factors impact premiums is crucial for informed decision-making. The following examples illustrate how different circumstances can lead to significant changes in insurance costs.

Increased Auto Insurance Premium Due to At-Fault Accident

A driver, let’s call him Alex, was involved in a car accident where he was deemed at-fault. Before the accident, Alex had a clean driving record and paid an annual premium of $800 for his comprehensive auto insurance. The accident resulted in $5,000 worth of damage to the other vehicle and $2,000 in damage to his own car. His insurance company paid out $7,000 to cover the damages. As a result of the at-fault accident, Alex’s insurance premium increased to $1,200 annually. This 50% increase reflects the heightened risk Alex now presents to the insurance company. Factors contributing to this increase include the claim amount, the severity of the accident, and the increased likelihood of future accidents. The insurer recalculated his risk profile based on the accident, leading to a higher premium.

Decreased Homeowner’s Insurance Premium Due to Home Improvements

Sarah, a homeowner, decided to make several improvements to her house to enhance its safety and security. Before the improvements, her annual homeowner’s insurance premium was $1,500. She installed a state-of-the-art security system with 24/7 monitoring, replaced her aging roof with impact-resistant shingles, and installed updated smoke detectors and a fire suppression system. These improvements significantly reduced the risk of theft, fire damage, and wind damage. As a result, her insurance company reduced her annual premium to $1,200, a decrease of $300, reflecting the lower risk profile of her property. The insurer recognized the value of these preventative measures and adjusted her premium accordingly.

Increased Health Insurance Premium Due to Change in Health Status

John, a 40-year-old, previously enjoyed a clean bill of health and paid a monthly health insurance premium of $300. Following a routine checkup, he was diagnosed with high blood pressure. His doctor recommended lifestyle changes and medication. As a result of this diagnosed health condition, John’s monthly premium increased to $450. This 50% increase reflects the higher likelihood of needing medical care due to his new diagnosis. The insurance company’s actuarial models incorporate factors like age, pre-existing conditions, and medication requirements to determine premiums. John’s increased risk profile directly translated to a higher premium.

Summary

Navigating the world of insurance premiums can feel like deciphering a complex code, but with a better understanding of the underlying factors and strategies, you can take control of your insurance costs. By carefully considering your risk profile, comparing providers, and implementing cost-saving measures, you can ensure you’re getting the best possible coverage at a price that fits your budget. Remember, informed choices lead to better financial outcomes.

FAQ Compilation

What is an actuarial table, and how does it relate to insurance premiums?

An actuarial table is a statistical tool used by insurance companies to predict the likelihood of certain events, such as death or accidents. This data helps insurers assess risk and set premiums accordingly. Higher risk profiles, as indicated by the actuarial table, generally result in higher premiums.

Can I negotiate my insurance premiums?

While you can’t always negotiate the base rate, you can often negotiate discounts by bundling policies, maintaining a good driving record, or exploring different coverage options. It’s worth discussing your situation with your insurer to see if any discounts apply.

How often do insurance premiums change?

Premiums can change annually, or even more frequently, depending on your insurer and policy type. Factors like claims history, changes in risk assessment, and market fluctuations can all trigger premium adjustments.

What happens if I don’t pay my insurance premium?

Failure to pay your insurance premium can result in policy cancellation. This leaves you without coverage and potentially exposes you to significant financial liability in the event of an accident or other covered incident. Contact your insurer immediately if you anticipate difficulty making a payment.