The cost of motorcycle insurance can vary wildly, influenced by a complex interplay of factors. Understanding these factors is crucial for riders seeking affordable yet comprehensive coverage. This guide delves into the key elements that determine your motorcycle insurance price, empowering you to make informed decisions and secure the best possible protection for your ride.

From the type of motorcycle you own to your riding experience and geographic location, numerous variables contribute to the final premium. We’ll explore these factors in detail, providing clear explanations and practical advice to help you navigate the world of motorcycle insurance and find the right policy at the right price. We’ll also cover different coverage options, strategies for finding affordable insurance, and essential information about understanding your policy.

Factors Influencing Motorcycle Insurance Costs

Several key factors interact to determine the final cost of your motorcycle insurance. Understanding these elements can help you make informed decisions and potentially save money. These factors range from the inherent risks associated with your motorcycle itself to your personal riding history and location.

Motorcycle Type and Insurance Premiums

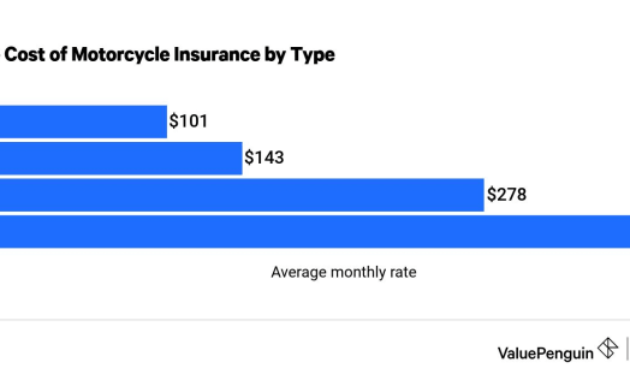

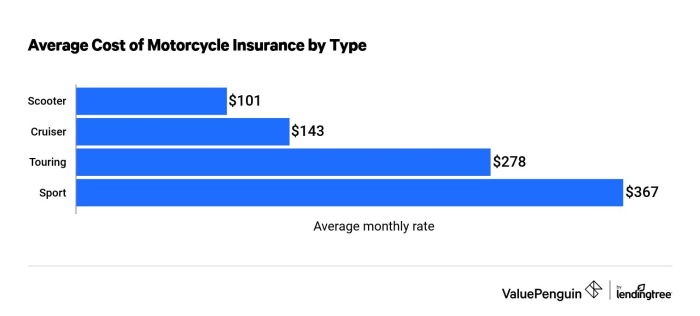

The type of motorcycle you own significantly impacts your insurance premium. Insurers categorize motorcycles into different classes based on engine size, power, performance capabilities, and perceived risk. Sportbikes, for instance, often fall into higher risk categories due to their speed and performance, leading to higher premiums compared to cruisers or standard motorcycles. Similarly, high-performance motorcycles with larger engine displacements typically command higher premiums than smaller, less powerful bikes. A powerful sportbike like a Ducati Panigale V4 would likely have a higher premium than a Honda Rebel 300. The higher the potential for accidents due to the motorcycle’s characteristics, the higher the premium.

Rider Experience and Insurance Pricing

Your riding experience is a crucial factor in determining your insurance rate. Novice riders, typically those with less than three years of riding experience, are considered higher risk and therefore face significantly higher premiums. Insurers view them as statistically more likely to be involved in accidents due to a lack of experience and skill. Conversely, experienced riders with clean driving records and a proven history of safe riding tend to qualify for lower premiums. A hypothetical comparison might show a novice rider paying $1500 annually, while an experienced rider with a spotless record pays $800 for similar coverage. The longer your accident-free riding history, the better your rates will likely be.

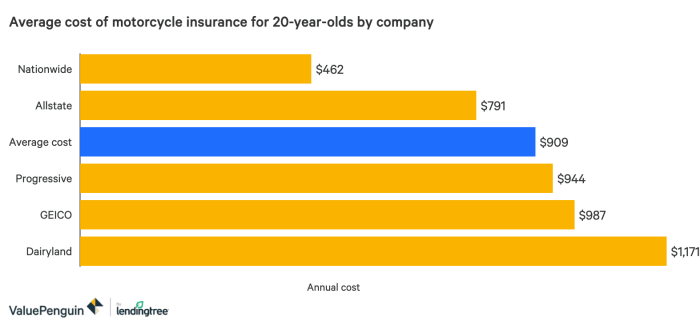

Rider Age and Insurance Costs

The age of the rider significantly influences insurance costs. Younger riders, particularly those in the 16-25 age range, are generally associated with higher risk due to factors like inexperience, higher accident rates, and potentially riskier driving behaviors. Older, more experienced riders often enjoy lower premiums reflecting their statistically lower accident involvement.

| Age Range | Average Premium | Premium Variation Percentage | Risk Factor Explanation |

|---|---|---|---|

| 16-25 | $1200 | +50% | Higher accident rates, inexperience |

| 26-35 | $900 | +20% | Improved experience, lower accident rates |

| 36-55 | $750 | 0% | Established experience, lower risk profile |

| 56+ | $650 | -10% | Lower accident rates, mature driving habits |

Geographic Location and Motorcycle Insurance Rates

Your location plays a substantial role in determining your insurance costs. Urban areas with high traffic density and a higher frequency of accidents typically have higher insurance rates than rural areas with lower traffic volume. States with stricter regulations or higher accident rates also tend to have higher premiums. For example, a coastal region prone to hurricanes might have higher rates due to the increased risk of damage. Similarly, states with higher traffic congestion and accident rates will generally have higher motorcycle insurance premiums compared to states with lower traffic density and accident rates.

Coverage Options and Their Impact on Price

Choosing the right motorcycle insurance coverage significantly impacts your premium. Understanding the different levels of protection and their associated costs is crucial for securing adequate coverage without overspending. This section will detail various coverage options and how they affect your insurance premium.

Liability Coverage Levels and Premium Effects

Liability coverage protects others if you cause an accident. The amount of coverage you choose directly influences your premium. Higher liability limits (e.g., $100,000/$300,000 bodily injury liability versus $25,000/$50,000) offer greater protection but come with a higher price tag. For instance, increasing your liability limits from the minimum state requirement to higher levels could increase your annual premium by $50 to $200 or more, depending on your location and insurer. However, the peace of mind knowing you’re adequately protected against significant financial liability in the event of a serious accident often outweighs the increased cost.

Comprehensive and Collision Coverage Cost Differences

Comprehensive coverage protects your motorcycle against damage from non-collision events like theft, vandalism, or fire. Collision coverage pays for repairs or replacement if your motorcycle is damaged in an accident, regardless of fault. Comprehensive coverage typically costs less than collision coverage, as the risk of non-collision events is generally lower. For example, comprehensive coverage might add $100-$200 annually to your premium, while collision coverage could add $300-$500 or more, depending on factors like your motorcycle’s value and your driving record.

Comprehensive coverage would be beneficial if your motorcycle were stolen from your driveway, while collision coverage would be essential if you were involved in a crash that damaged your bike. Consider the value of your motorcycle and your risk tolerance when deciding on these coverages.

Uninsured/Underinsured Motorist Coverage and Price Impact

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you’re injured in an accident caused by a driver without adequate insurance or who is uninsured. This coverage is especially important because it covers your medical bills and lost wages even if the at-fault driver is unable to compensate you. Adding UM/UIM coverage typically increases your premium by a modest amount, perhaps $25-$75 annually, but the protection it offers is invaluable, especially in areas with high rates of uninsured drivers. For example, if an uninsured driver causes a crash resulting in $50,000 in medical bills, your UM/UIM coverage would help cover these expenses.

Cost of Optional Coverages: Roadside Assistance and Passenger Coverage

Several optional coverages can enhance your motorcycle insurance policy.

- Roadside Assistance: This coverage can provide towing, fuel delivery, and other services if you experience a breakdown. The cost varies, typically adding $25-$50 annually to your premium. The benefit is convenience and peace of mind in emergency situations.

- Passenger Coverage: This coverage extends liability protection to your passengers if they are injured in an accident you cause. The cost varies depending on your insurer and the level of coverage chosen, but it might add $10-$30 annually. The benefit is the added protection for your passengers, avoiding potential legal issues and financial burdens.

Understanding Insurance Policies and Terms

Understanding the terms and conditions of your motorcycle insurance policy is crucial for ensuring you have the right coverage and know what to expect in case of an accident or claim. This section clarifies key policy elements and guides you through the claims process, policy changes, and cancellation procedures.

Key Terms and Conditions in a Standard Motorcycle Insurance Policy

A standard motorcycle insurance policy includes several key terms and conditions. Familiarizing yourself with these terms will help you understand your coverage and responsibilities.

- Policy Period: The duration of your insurance coverage, typically one year.

- Named Insured: The individual(s) listed on the policy who are covered.

- Covered Vehicles: The specific motorcycle(s) covered under the policy, identified by make, model, and Vehicle Identification Number (VIN).

- Liability Coverage: Protects you financially if you cause injury or property damage to others. This usually includes bodily injury liability and property damage liability.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re injured by an uninsured or underinsured driver.

- Collision Coverage: Pays for damage to your motorcycle in an accident, regardless of fault.

- Comprehensive Coverage: Covers damage to your motorcycle from events other than collisions, such as theft, vandalism, or fire.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Premium: The amount you pay for your insurance coverage.

- Exclusions: Specific events or circumstances not covered by the policy, such as intentional acts or damage caused by wear and tear.

The Motorcycle Insurance Claims Process

Filing a claim can seem daunting, but following these steps will help ensure a smoother process.

- Report the Accident: Immediately report the accident to the police and your insurance company. Obtain a police report number if applicable.

- Gather Information: Collect contact information from all involved parties, including witnesses. Take photos or videos of the accident scene and any damage to your motorcycle and other vehicles.

- File a Claim: Contact your insurance company to file a claim. Provide them with all relevant information, including the police report number (if applicable), photos, and witness statements.

- Cooperate with the Investigation: Your insurance company may require you to provide additional information or attend an inspection of your motorcycle.

- Review the Settlement Offer: Once your claim is processed, review the settlement offer carefully to ensure it accurately reflects the damages.

Canceling or Changing a Motorcycle Insurance Policy

You can cancel or change your policy, but be aware of potential fees or penalties.

To cancel, typically you must provide written notice to your insurer within a specified timeframe. Early cancellation may result in a short-rate refund, meaning you receive less than a pro-rata refund based on the unused portion of the policy. Changes to your policy, such as adding or removing coverage, may also involve adjustments to your premium.

Sample Motorcycle Insurance Declaration Page

The declaration page is the summary of your policy. A text-based representation might look like this:

Policy Number: 1234567890

Named Insured: John Doe

Policy Effective Date: 01/01/2024

Policy Expiration Date: 12/31/2024

Vehicle Description: 2023 Harley-Davidson Road Glide, VIN: ABC1234567

Liability Coverage: $100,000 Bodily Injury, $50,000 Property Damage

Uninsured/Underinsured Motorist Coverage: $50,000

Collision Coverage: $500 Deductible

Comprehensive Coverage: $500 Deductible

Premium: $1200

Summary

Securing affordable motorcycle insurance requires careful consideration of various factors and a proactive approach to finding the best coverage for your needs. By understanding the key influences on price, comparing quotes from multiple insurers, and maintaining a safe riding record, you can significantly reduce your premiums while ensuring adequate protection. Remember to regularly review your policy and adjust coverage as needed to reflect changes in your circumstances or your motorcycle.

FAQ Overview

What is the average motorcycle insurance price?

The average price varies significantly based on the factors discussed in this guide. It’s impossible to give a single average, but obtaining multiple quotes is the best way to determine your personal average.

Can I get motorcycle insurance without a license?

Generally, no. Most insurers require a valid motorcycle license to issue a policy. Exceptions may exist in limited circumstances, but this is uncommon.

How often can I change my motorcycle insurance policy?

You can typically change your policy at any time, although there may be fees or penalties depending on your insurer and the specifics of your policy. Contact your insurer directly to understand their policy changes process.

What happens if I modify my motorcycle?

You should always inform your insurer of any modifications to your motorcycle, as this can affect your coverage and premium. Failure to disclose modifications could invalidate your policy in the event of a claim.

Does my credit score affect my motorcycle insurance rate?

In some states, your credit score can be a factor in determining your insurance premium. This practice varies by state and insurer.