Navigating the world of private health insurance can feel like deciphering a complex code. This guide aims to illuminate the intricacies of various private insurance plans, empowering you with the knowledge to make informed decisions about your healthcare coverage. We’ll explore the different plan types, their associated costs, and the crucial factors to consider when selecting a plan that best suits your individual needs and budget.

From understanding HMOs and PPOs to deciphering deductibles and co-pays, we’ll break down the essential elements of private insurance. This comprehensive overview will equip you with the tools to compare plans effectively, analyze coverage details, and ultimately, secure the healthcare protection you deserve.

Types of Private Insurance Plans

Choosing a private health insurance plan can feel overwhelming due to the variety of options available. Understanding the key differences between these plans is crucial to selecting one that best suits your individual needs and budget. This section will Artikel the common types of private health insurance plans, highlighting their respective features, costs, and potential benefits and drawbacks.

Private Health Insurance Plan Types

The most common types of private health insurance plans are Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Point of Service (POS) plans, and Exclusive Provider Organizations (EPOs). Each plan operates differently, impacting your access to care and overall costs.

| Plan Type | Description | Cost Considerations | Key Features |

|---|---|---|---|

| HMO (Health Maintenance Organization) | Typically offers the lowest premiums but requires you to choose a primary care physician (PCP) within the network. Referrals are usually needed to see specialists. | Lower premiums, but higher out-of-pocket costs if you go outside the network. May have lower deductibles and copays within the network. | PCP required; referrals usually needed for specialists; in-network care only generally covered; preventative care often covered. |

| PPO (Preferred Provider Organization) | Offers more flexibility. You can see any doctor, in-network or out-of-network, but in-network care is cheaper. | Higher premiums than HMOs, but lower out-of-pocket costs for in-network care. Out-of-network care is significantly more expensive. | No PCP required; no referrals generally needed; in-network and out-of-network care covered (but at different rates); greater choice of providers. |

| POS (Point of Service) | Combines elements of HMOs and PPOs. You choose a PCP, but you have the option to see out-of-network doctors for a higher cost. | Premiums are typically between HMOs and PPOs. Out-of-network costs can be substantial. | PCP required; referrals may or may not be required; in-network and out-of-network care covered (at different rates); offers a balance between cost and flexibility. |

| EPO (Exclusive Provider Organization) | Similar to HMOs, requiring you to use in-network providers. Unlike HMOs, however, EPOs typically do not require a PCP referral to see specialists. | Premiums generally fall between HMOs and PPOs. Out-of-network coverage is usually very limited or nonexistent. | No PCP required (usually); referrals typically not required; in-network care only generally covered; often offers a wider choice of specialists than HMOs. |

Factors to Consider When Choosing a Plan

Selecting the right private health insurance plan depends on several individual factors. These include your health status, budget, healthcare needs, and preferred level of flexibility.

Consider the following aspects:

* Your Health Status: Individuals with pre-existing conditions may want to carefully examine the coverage offered by each plan type. A PPO might be more suitable if you anticipate needing frequent specialist visits or out-of-network care.

* Your Budget: Premiums, deductibles, copays, and out-of-pocket maximums all impact the overall cost of a plan. HMOs typically have lower premiums but may have higher out-of-pocket costs if you need care outside the network.

* Your Healthcare Needs: If you have a specific need for a particular specialist, verify that specialist is included in the network of your chosen plan. For example, someone with ongoing diabetes management might prioritize a plan with extensive coverage for diabetic care.

* Your Preference for Flexibility: PPOs offer the most flexibility, while HMOs and EPOs offer less choice but typically come with lower premiums. POS plans represent a compromise between cost and flexibility.

* Network of Providers: Review the network of doctors, hospitals, and other healthcare providers offered by the plan to ensure your preferred providers are included. A comprehensive provider directory is crucial for making an informed decision.

Coverage and Benefits

Understanding the coverage and benefits offered by private insurance plans is crucial for making informed healthcare decisions. The specifics vary widely depending on the plan, but a general overview can help individuals assess their needs and choose the right policy. This section will detail common coverage areas, variations in plan levels, and the financial implications of deductibles, co-pays, and out-of-pocket maximums.

Private insurance plans typically cover a broad range of medical services and treatments. The extent of coverage, however, depends on the specific plan and the chosen level of coverage.

Commonly Covered Medical Services and Treatments

Most private insurance plans include coverage for a wide array of healthcare services. The specific services covered may vary slightly between plans, but generally include the following:

- Doctor visits (primary care and specialist)

- Hospital stays (inpatient and outpatient)

- Surgery

- Diagnostic testing (X-rays, blood tests, MRIs, etc.)

- Prescription drugs (subject to formularies)

- Mental health services

- Rehabilitation services (physical therapy, occupational therapy)

- Preventive care (vaccinations, annual checkups)

- Emergency room visits

- Ambulance services

Variations in Coverage Levels

Private insurance plans are often categorized into different levels of coverage, reflecting the breadth and depth of services included and the cost-sharing responsibilities of the insured individual. These levels typically include:

- Basic Plans: These plans usually have lower premiums but higher out-of-pocket costs. They may have higher deductibles, co-pays, and out-of-pocket maximums, and may offer more limited choices of providers.

- Comprehensive Plans: These plans provide broader coverage, including a wider range of services and specialists. They typically have higher premiums than basic plans but lower out-of-pocket costs.

- Premium Plans: These plans offer the most extensive coverage, with the lowest out-of-pocket expenses. They usually include a wider network of providers and may offer additional benefits, such as vision and dental coverage. These plans come with the highest premiums.

Impact of Deductibles, Co-pays, and Out-of-Pocket Maximums

Understanding deductibles, co-pays, and out-of-pocket maximums is essential to comprehending the financial aspects of private insurance plans. These terms represent cost-sharing mechanisms between the insurance company and the insured.

- Deductible: This is the amount you must pay out-of-pocket for covered healthcare services before your insurance begins to pay. For example, a $1,000 deductible means you pay the first $1,000 of your medical expenses before your insurance coverage kicks in.

- Co-pay: This is a fixed amount you pay for a covered healthcare service at the time of service. For example, a $25 co-pay for a doctor’s visit means you pay $25 each time you see a doctor, regardless of the total cost of the visit.

- Out-of-Pocket Maximum: This is the maximum amount you will pay out-of-pocket for covered healthcare services in a given plan year. Once you reach your out-of-pocket maximum, your insurance company covers 100% of the remaining costs for covered services. For example, an out-of-pocket maximum of $5,000 means that once you’ve paid $5,000 in deductibles, co-pays, and other cost-sharing, your insurance will cover all remaining expenses for the rest of the year.

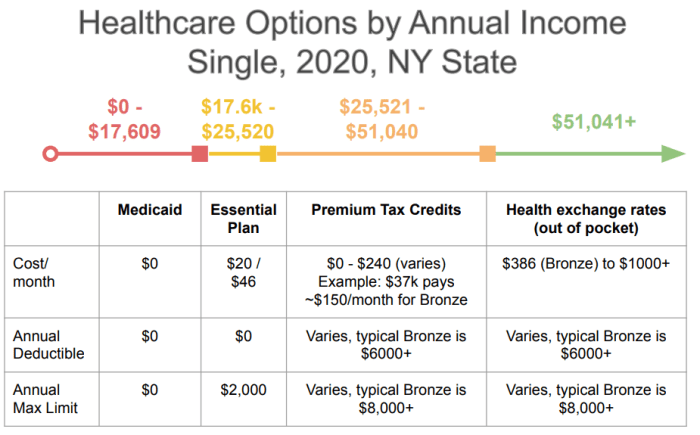

Cost and Affordability

Understanding the cost of private health insurance is crucial for making informed decisions. Premiums, the monthly payments you make for coverage, are influenced by a variety of factors, making it essential to carefully consider your individual circumstances. This section will explore these factors and offer strategies for managing costs.

Several key factors significantly impact the premium cost of private health insurance plans. These factors interact in complex ways to determine the final price. Understanding these factors allows for better planning and potentially lower overall healthcare expenses.

Factors Influencing Premium Costs

The cost of your private health insurance plan is not a fixed amount; it’s dynamically determined by a number of interconnected variables. These variables are often weighted differently by insurance providers, leading to a wide range of premium options.

- Age: Generally, older individuals tend to have higher premiums due to a statistically higher likelihood of needing more extensive healthcare services.

- Location: Premiums vary geographically. Areas with higher healthcare costs, such as those with a high concentration of specialists or expensive medical facilities, typically have higher premiums.

- Health Status: Individuals with pre-existing conditions or a history of significant health issues usually face higher premiums. Insurers assess risk based on this information.

- Family Size: Adding family members to a plan increases the overall cost. The more people covered, the higher the premium will be, reflecting the increased potential for healthcare utilization.

- Plan Type: The type of plan chosen (e.g., HMO, PPO, POS) significantly impacts cost. Plans with broader networks and more comprehensive coverage generally come with higher premiums.

Hypothetical Scenario: Family Insurance Costs

Consider the Smith family: John (45), Mary (42), and their two children (ages 10 and 12). They live in a high-cost area known for its advanced medical facilities. John has a history of high blood pressure, requiring regular medication. If they choose a comprehensive PPO plan, their premium could be significantly higher compared to a family living in a less expensive area, with no pre-existing conditions, and opting for a less comprehensive HMO plan. The increased age of the parents, their location, John’s health condition, and the family size all contribute to a higher overall premium. A less comprehensive plan, with higher deductibles and out-of-pocket maximums, might reduce the monthly premium but increase their financial risk if significant medical expenses arise.

Strategies to Reduce Insurance Costs

Several strategies can help individuals and families reduce their health insurance costs. Careful planning and consideration of these options can lead to significant savings over time.

- Compare Plans: Utilize online comparison tools and contact insurance providers directly to compare plans and premiums. This allows for informed decision-making.

- Consider High-Deductible Plans: High-deductible health plans (HDHPs) often have lower premiums but require a larger upfront payment before insurance coverage kicks in. This is a viable option for healthy individuals or families with limited healthcare needs.

- Explore Employer-Sponsored Plans: If eligible, take advantage of employer-sponsored health insurance plans, as they often offer lower premiums due to group rates and employer contributions.

- Maintain a Healthy Lifestyle: Preventing health issues through healthy habits can reduce the likelihood of needing expensive medical care, indirectly lowering insurance costs in the long run.

- Negotiate Premiums: Some insurers might be willing to negotiate premiums based on factors such as payment frequency or bundling multiple insurance products.

Choosing a Private Insurance Plan

Selecting the right private health insurance plan can feel overwhelming, given the variety of options and complexities involved. However, a systematic approach can simplify the process and help you find a plan that best suits your needs and budget. This guide Artikels key steps to make informed decisions.

A Step-by-Step Guide to Choosing a Private Health Insurance Plan

Understanding your healthcare needs is paramount before comparing plans. Consider your current health status, anticipated future healthcare requirements (pregnancy, chronic conditions), and your preferred healthcare providers. This assessment will guide your plan selection. Next, establish a budget. Determine how much you can comfortably allocate monthly towards premiums and out-of-pocket expenses. This will help you narrow down your options.

- Assess Your Healthcare Needs: Consider your current and anticipated future healthcare needs. Do you have any pre-existing conditions? Are you planning a family? Do you frequently visit specialists?

- Determine Your Budget: Establish a realistic monthly budget for premiums and out-of-pocket expenses. Remember to consider deductibles, co-pays, and coinsurance.

- Research Available Plans: Use online comparison tools or contact your employer’s benefits administrator (if applicable) to identify plans that meet your needs and budget. Compare plans based on network size, premiums, deductibles, co-pays, and out-of-pocket maximums.

- Compare Plan Details: Carefully review the Summary of Benefits and Coverage (SBC) for each plan. Pay close attention to the network of doctors and hospitals, covered services, and cost-sharing amounts.

- Choose a Plan: Based on your assessment and comparison, select the plan that best balances your needs, budget, and preferences.

- Enroll in the Plan: Complete the enrollment process within the designated timeframe to avoid delays in coverage.

Comparing Different Plans: A PPO Example

Let’s compare two hypothetical Preferred Provider Organization (PPO) plans, Plan A and Plan B. Plan A has a monthly premium of $300, a $1,000 deductible, and a 20% coinsurance after meeting the deductible. Plan B has a monthly premium of $400, a $500 deductible, and a 15% coinsurance after meeting the deductible. Both plans cover the same essential health benefits.

| Feature | Plan A | Plan B |

|---|---|---|

| Monthly Premium | $300 | $400 |

| Deductible | $1,000 | $500 |

| Coinsurance | 20% | 15% |

The choice between Plan A and Plan B depends on individual circumstances. Someone anticipating significant healthcare expenses might prefer Plan B despite the higher premium, as the lower deductible and coinsurance could result in lower overall costs. Conversely, someone expecting minimal healthcare utilization might find Plan A more cost-effective.

Understanding Insurance Policy Documents

Insurance policy documents, including the Summary of Benefits and Coverage (SBC), are crucial for understanding your plan’s details. These documents Artikel covered services, cost-sharing amounts (deductibles, co-pays, coinsurance), and out-of-pocket maximums. Carefully review the provider network directory to ensure your preferred doctors and hospitals are included. Understanding the explanation of benefits (EOB) statements you receive after medical services is also vital for tracking your healthcare spending and ensuring accurate billing. Pay close attention to terms like “in-network” and “out-of-network” providers, as the cost-sharing amounts will differ significantly. If anything is unclear, contact your insurance company for clarification.

It is vital to read and understand your policy documents thoroughly before making any decisions. Don’t hesitate to contact your insurance provider if you have any questions or need clarification.

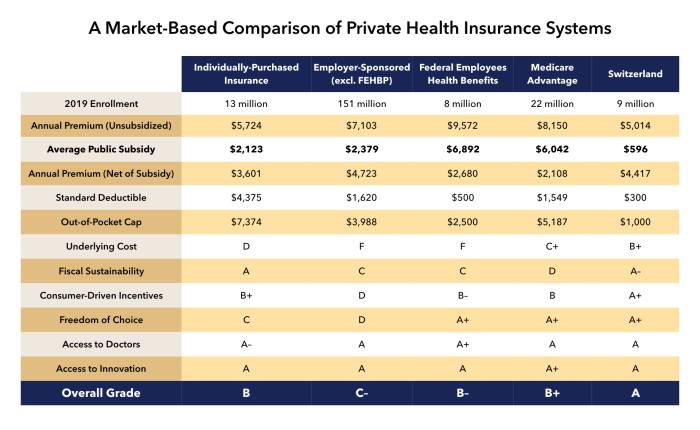

The Role of Private Insurance in Healthcare Systems

Private insurance plays a multifaceted role in healthcare systems worldwide, significantly influencing access to care, cost structures, and the overall organization of healthcare delivery. Its impact is complex, varying considerably depending on the specific design of the healthcare system and the regulatory environment. Understanding this role requires examining its influence on access, its relationship with healthcare expenditures, and its position relative to publicly funded healthcare options.

Private insurance’s impact on access to healthcare services is substantial. For individuals with private insurance coverage, access to a wider range of healthcare providers, specialists, and facilities is generally improved. This is because private insurers negotiate contracts with healthcare providers, creating networks of care that individuals can utilize. However, the extent of this improved access depends on the comprehensiveness of the insurance plan and the individual’s ability to afford the associated out-of-pocket costs, such as deductibles and co-pays. Conversely, those without private insurance may face significant barriers to accessing timely and appropriate care.

Private Insurance and Healthcare Costs

The relationship between private insurance and healthcare costs is a subject of ongoing debate. Private insurers, in their efforts to manage costs, negotiate prices with healthcare providers, potentially influencing the overall cost of healthcare services. However, the impact of these negotiations can be complex. While some argue that private insurers exert downward pressure on prices, others contend that the administrative costs associated with private insurance, including marketing, claims processing, and profit margins, add to the overall healthcare expenditure. Furthermore, the system of negotiating separate prices with each insurer can lead to administrative burdens for providers, increasing their overall costs. The resulting pricing structures can often be opaque and difficult for patients to understand. For example, the variation in prices for the same procedure across different providers within a single insurance network highlights the complexities of this cost dynamic.

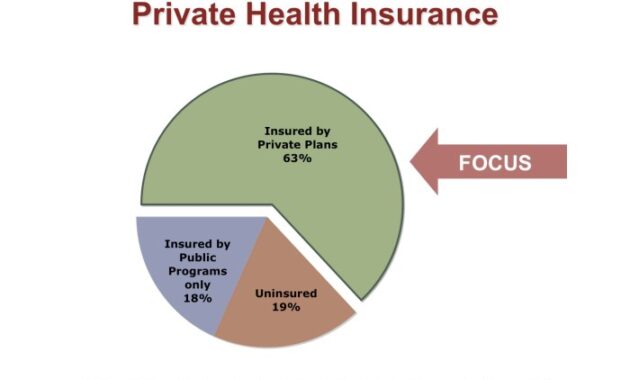

Private and Public Insurance in the US Healthcare System

The US healthcare system provides a clear example of the contrasting roles of private and public insurance. Private insurance plays a dominant role, covering a significant portion of the population through employer-sponsored plans and individually purchased policies. Public insurance programs, such as Medicare (for seniors and the disabled) and Medicaid (for low-income individuals and families), cover a substantial portion of the remaining population. The coexistence of these systems leads to a complex landscape of coverage, costs, and access. Private insurance often offers greater choice of providers and potentially more comprehensive coverage, but at a higher cost. Public insurance programs, while providing crucial coverage for vulnerable populations, may have limitations in terms of provider choice and the comprehensiveness of benefits. The interplay between these two systems creates a dynamic and sometimes fragmented healthcare landscape, with significant disparities in access and affordability based on an individual’s insurance status.

Last Point

Choosing the right private insurance plan is a significant decision impacting your financial well-being and access to healthcare. By understanding the nuances of different plan types, coverage levels, and cost considerations, you can confidently select a plan that aligns with your specific requirements. Remember to carefully review policy documents, compare plans side-by-side, and leverage available resources to optimize your healthcare coverage and minimize financial burden.

Key Questions Answered

What is the difference between an HMO and a PPO?

HMOs typically require you to choose a primary care physician (PCP) within their network, who then refers you to specialists. PPOs offer more flexibility, allowing you to see any doctor in their network without a referral, but usually at a higher cost.

Can I change my private insurance plan during the year?

Generally, you can only change your private insurance plan during the annual open enrollment period, unless you experience a qualifying life event (e.g., marriage, job loss) that allows for a special enrollment period.

What is a pre-existing condition, and how does it affect my coverage?

A pre-existing condition is a health problem you had before starting your insurance coverage. Under the Affordable Care Act (in the US, for example), most private insurance plans cannot deny coverage or charge higher premiums due to pre-existing conditions.

How do I file a claim with my private insurance company?

The claims process varies by insurance company. Typically, you’ll need to submit a claim form along with supporting documentation (e.g., medical bills, explanation of benefits) through mail, fax, or online portal.