Navigating the world of car insurance can feel like deciphering a complex code. Premiums vary wildly, influenced by a multitude of factors that often leave drivers scratching their heads. Understanding these factors, however, is key to securing affordable and appropriate coverage. This guide unravels the mysteries behind car insurance pricing, offering insights into the key elements that determine your final cost.

From the impact of your age and driving record to the type of vehicle you drive and where you live, we’ll explore the multifaceted nature of car insurance pricing. We’ll also delve into the different types of coverage available, helping you understand which options best suit your needs and budget. Ultimately, this guide empowers you to make informed decisions and find the best possible car insurance deal.

Types of Car Insurance Coverage

Choosing the right car insurance coverage can feel overwhelming, but understanding the different types available is crucial for protecting yourself and your vehicle. This section will Artikel the key types of coverage, their purposes, and factors influencing their cost. Remember, specific coverage needs vary depending on individual circumstances and risk factors.

Liability Coverage

Liability insurance covers damages or injuries you cause to others in an accident. It’s typically mandatory and protects you from potentially devastating financial consequences.

- Bodily Injury Liability: Pays for medical expenses, lost wages, and pain and suffering of others injured in an accident you caused. Cost factors include your driving record, location, and the coverage limits you choose (e.g., $100,000 per person/$300,000 per accident).

- Property Damage Liability: Covers the cost of repairing or replacing the other person’s vehicle or property damaged in an accident you caused. Cost factors are similar to bodily injury liability, including your driving record and the chosen coverage limits.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. This is optional but highly recommended.

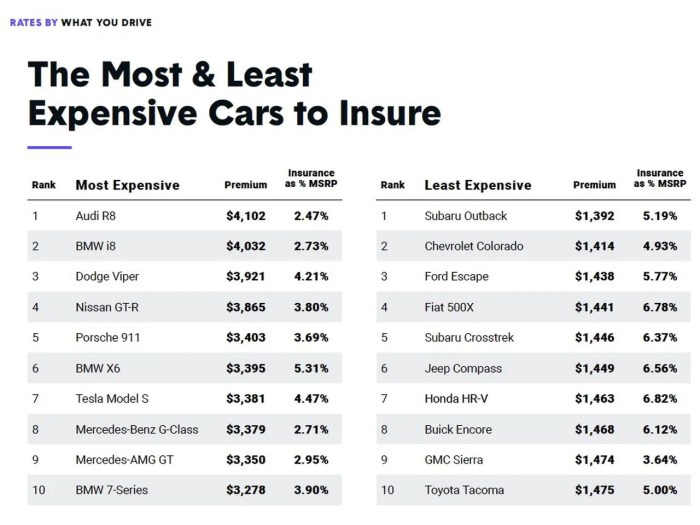

- Collision Repair/Replacement: Covers damage to your vehicle caused by a collision with another vehicle or object, such as a tree or pole. Cost factors include the age, make, and model of your vehicle, your deductible (the amount you pay before insurance kicks in), and your driving record.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. This is also optional, but provides broad protection.

- Non-Collision Damage Repair/Replacement: Covers damage from events like hail, floods, fire, theft, or vandalism. Cost factors include similar variables to collision coverage, with the addition of the likelihood of such events in your area.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It can cover your medical bills and vehicle repairs, even if the at-fault driver doesn’t have sufficient insurance.

- Protection from Uninsured Drivers: Covers medical expenses, lost wages, and property damage if you are injured by an uninsured driver. Cost factors depend on your location and the level of coverage selected.

Coverage Level Comparisons

Higher coverage levels generally offer greater protection but come with higher premiums. For example, a higher liability limit provides more financial security in the event of a serious accident, but will increase your monthly payment. A lower deductible on collision and comprehensive coverage means lower out-of-pocket costs after an accident, but a higher premium.

Situations Where Specific Coverage is Most Important

Liability coverage is mandatory in most states and is crucial for protecting yourself from significant financial liability in the event of an accident where you are at fault. Collision and comprehensive coverage are most important for newer vehicles, as repairs or replacement costs can be substantial. Uninsured/underinsured motorist coverage is vital in areas with a high percentage of uninsured drivers, providing a safety net in case of an accident with such a driver. For example, someone driving a new luxury car might opt for higher collision and comprehensive coverage limits to protect their significant investment, while someone driving an older car might choose lower limits or forgo these coverages altogether. Similarly, someone living in a high-risk area for theft might prioritize comprehensive coverage.

Last Word

Securing affordable car insurance requires careful consideration of various factors and a proactive approach. By understanding the elements that influence premiums, comparing quotes diligently, and maintaining a safe driving record, you can significantly reduce your costs and secure the coverage you need. Remember, informed decision-making is the key to navigating the complexities of car insurance and achieving peace of mind on the road.

FAQ Insights

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others in an accident. Collision coverage pays for repairs to your vehicle, regardless of fault.

How often should I review my car insurance policy?

It’s advisable to review your policy annually, or whenever significant life changes occur (e.g., new car, marriage, change of address).

Can I get my car insurance canceled?

Yes, your insurance can be canceled for various reasons, including non-payment of premiums, fraudulent claims, or repeated violations of policy terms.

What is a SR-22 form?

An SR-22 is a certificate of insurance that proves you have the minimum liability insurance required by your state after a serious driving offense.

How does my credit score affect my car insurance rate?

In many states, your credit score is a factor in determining your insurance premiums. A higher credit score generally leads to lower rates.