Liability insurance: a term that might sound intimidating, but understanding its nuances can offer significant peace of mind. This comprehensive guide explores the world of liability insurance, demystifying its complexities and highlighting its critical role in protecting your personal and professional assets. We’ll delve into various types of liability coverage, explore what’s covered (and what’s not), and examine the factors influencing costs. Ultimately, we aim to equip you with the knowledge to make informed decisions about your liability insurance needs.

From the everyday risks we face to the more specialized exposures inherent in various professions, liability insurance acts as a crucial safety net. This guide will dissect the intricacies of claims processes, the importance of adequate coverage, and the specific considerations for different industries, offering practical insights and illustrative examples to solidify your understanding.

Defining Liability Insurance Coverage

Liability insurance is a crucial type of coverage that protects individuals and businesses from financial losses arising from claims of negligence or wrongdoing that cause bodily injury or property damage to others. Essentially, it safeguards you against the costs associated with defending yourself in legal proceedings and compensating injured parties. Understanding the different types of liability insurance available is key to ensuring adequate protection.

Liability insurance operates on the principle of indemnification, meaning the insurance company agrees to compensate the policyholder for covered losses up to the policy limits. This compensation can include legal fees, court costs, medical expenses, and settlement payments. The policyholder’s responsibility is to report incidents promptly and cooperate with the insurer’s investigation.

Types of Liability Insurance

Several types of liability insurance cater to specific needs and risks. Choosing the right type depends heavily on the nature of your work, activities, and potential exposures to liability.

| Type of Liability Insurance | Coverage Description | Examples of Covered Situations | Typical Policyholders |

|---|---|---|---|

| General Liability Insurance | Covers bodily injury or property damage caused by your business operations or premises. | A customer slips and falls in your store; a delivery truck damages a parked car. | Businesses of all sizes, property owners. |

| Professional Liability Insurance (Errors & Omissions Insurance) | Protects professionals from claims of negligence or mistakes in their professional services. | A doctor misdiagnoses a patient; an accountant makes an error in tax preparation. | Doctors, lawyers, accountants, consultants, architects. |

| Product Liability Insurance | Covers claims arising from injuries or damages caused by a defective product you manufactured or sold. | A faulty appliance causes a fire; a consumer is injured by a defective toy. | Manufacturers, distributors, retailers. |

| Commercial Auto Liability Insurance | Covers bodily injury or property damage caused by your business vehicles. | A company car is involved in an accident; a delivery truck hits a pedestrian. | Businesses that operate vehicles for business purposes. |

Situations Requiring Liability Insurance

Liability insurance proves indispensable in numerous scenarios. Failing to have adequate coverage can lead to devastating financial consequences.

For example, a small business owner without general liability insurance could face bankruptcy if a customer is injured on their premises and sues for significant damages. Similarly, a freelance graphic designer lacking professional liability insurance could be personally liable for substantial costs if their design work causes a client financial losses. A manufacturer without product liability insurance could face crippling lawsuits if a defective product causes harm. These scenarios underscore the critical importance of securing appropriate liability coverage tailored to individual circumstances and potential risks.

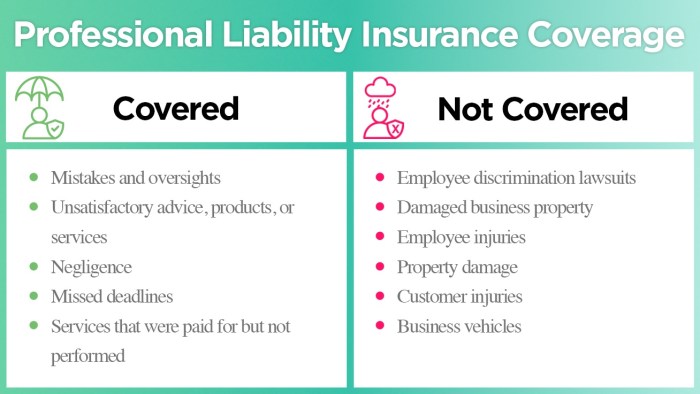

What Liability Insurance Covers

Liability insurance protects you from financial losses arising from claims of bodily injury or property damage caused by you or someone in your care. It essentially covers the cost of defending yourself against lawsuits and paying settlements or judgments if you’re found legally responsible. The specific coverage depends on the type and details of your policy.

Liability insurance policies typically cover a range of incidents, but it’s crucial to understand that there are limitations and exclusions. This means that not every event that causes harm will be covered. Careful review of your policy wording is always advisable.

Covered Events and Incidents

A standard liability policy generally covers accidents that occur on your property or as a result of your actions, provided they are deemed accidental and not intentional. This includes incidents such as a visitor slipping and falling on your icy walkway, a dog bite occurring on your property, or damage caused to a neighbor’s car while you were backing out of your driveway. Coverage often extends to incidents involving your family members living in your household. Furthermore, some policies provide coverage for certain types of professional liability, depending on the specific policy purchased. For example, a professional liability policy might cover a doctor for a malpractice claim.

Common Exclusions in Liability Insurance Policies

It’s equally important to understand what your liability insurance *doesn’t* cover. Common exclusions include intentional acts (such as assault or battery), business-related activities (unless specifically covered by a separate business liability policy), damage to your own property, and injuries caused by operating a vehicle (usually covered by auto insurance). Many policies also exclude coverage for specific types of hazardous activities, like operating a drone for commercial purposes without specific endorsements. Certain pre-existing conditions may also be excluded, and this can vary widely between insurers and policies.

Examples of Covered and Denied Claims

A claim for medical expenses incurred by a guest who tripped and fell on your porch would likely be covered, assuming it was an accident and not due to negligence on your part (e.g., you knowingly left a dangerous hazard). Conversely, a claim arising from a physical altercation you initiated would likely be denied, as intentional acts are generally excluded. Similarly, damage to your own vehicle during a traffic accident would not be covered under your liability policy; it would fall under your collision coverage (if applicable) in your auto insurance. A claim resulting from damage caused by a business activity conducted from your home, without appropriate endorsements, would also likely be denied.

Common Scenarios Where Liability Insurance Provides Protection

Understanding the scenarios where liability insurance offers protection is crucial. Here are some common examples:

- A child playing in your yard injures themselves on a piece of playground equipment.

- Your dog bites a neighbor’s child.

- A guest slips and falls on your property.

- You accidentally damage a neighbor’s fence while mowing your lawn.

- You are sued for defamation.

- You cause property damage during a social event held at your home.

Importance of Adequate Liability Insurance Coverage

Having the right amount of liability insurance is crucial for protecting your financial well-being. Underestimating your potential liability exposure can lead to devastating consequences, far exceeding the cost of adequate coverage. This section will explore the critical importance of securing sufficient liability insurance and the potential repercussions of failing to do so.

The consequences of inadequate liability insurance coverage can be severe and far-reaching. Insufficient coverage leaves you personally vulnerable to significant financial losses, potentially impacting your assets, savings, and even your future financial stability. In the event of a claim exceeding your policy limits, you become personally responsible for the difference, potentially leading to bankruptcy or crippling debt.

Financial Implications of Insufficient Coverage

The financial implications of insufficient liability insurance are substantial and can extend beyond immediate costs. A lawsuit resulting from an accident or incident covered by an inadequate policy could result in judgments far exceeding your policy limits. This means you would be personally liable for the remaining amount, potentially leading to the seizure of assets like your home, savings, or other investments to satisfy the judgment. Legal fees associated with defending yourself in a lawsuit can also add significantly to your financial burden, further compounding the problem. For example, a car accident resulting in serious injuries could easily generate medical bills, lost wages, and pain and suffering claims exceeding hundreds of thousands of dollars. If your liability coverage is only $100,000, you would be personally responsible for the remaining amount, a potentially catastrophic financial blow.

Scenarios Illustrating Insufficient Coverage

Consider a scenario involving a homeowner whose dog bites a neighbor’s child, resulting in significant medical expenses and ongoing therapy costs. If the homeowner’s liability coverage is insufficient, they could face substantial personal liability, potentially jeopardizing their home and savings. Another example could be a business owner whose client suffers a serious injury on their premises due to negligence. If the business’s liability insurance is inadequate, the owner could face bankruptcy as they are responsible for the extensive medical bills, lost wages, and potential legal fees associated with the incident. These examples highlight the critical need for a comprehensive liability insurance policy with limits appropriate to the potential risks involved.

Benefits of Sufficient Liability Insurance Coverage

Sufficient liability insurance provides a critical safety net, offering peace of mind and financial protection against unforeseen events. It protects your personal assets, ensuring that a single incident doesn’t wipe out your life savings or leave you facing financial ruin. Furthermore, it can help mitigate the stress and emotional burden associated with legal disputes, allowing you to focus on recovery and resolution rather than financial devastation. Adequate coverage can significantly reduce the financial risks associated with accidents, injuries, or other incidents that may lead to legal action, providing a much-needed buffer against potentially catastrophic financial losses. It’s an investment in your future financial security, safeguarding against unforeseen circumstances.

Liability Insurance and Specific Industries

Liability insurance needs vary significantly across different industries, reflecting the unique risks and potential exposures each faces. Understanding these variations is crucial for businesses to secure appropriate coverage and mitigate potential financial losses from liability claims. The level of risk, the potential severity of claims, and the regulatory environment all play a role in determining the type and amount of liability insurance needed.

Liability Insurance in Healthcare

The healthcare industry faces exceptionally high liability risks. Medical malpractice, patient injuries, and data breaches are significant concerns. Physicians, nurses, hospitals, and other healthcare providers need comprehensive professional liability insurance (also known as medical malpractice insurance) to cover claims arising from alleged negligence or errors in medical treatment. Additional coverage may be needed for general liability to address non-medical incidents, such as slips and falls on hospital premises. Cybersecurity insurance is also increasingly important to cover data breaches involving patient information.

Liability Insurance in Construction

Construction projects inherently involve significant risks. Worker injuries, property damage, and third-party injuries are common occurrences. Construction companies need robust general liability insurance to cover claims arising from these incidents. Workers’ compensation insurance is mandatory in most jurisdictions to cover medical expenses and lost wages for employees injured on the job. Commercial auto insurance is also crucial to protect against liability arising from accidents involving company vehicles. Umbrella liability insurance can provide additional coverage beyond the limits of the underlying policies.

Liability Insurance in Manufacturing

Manufacturing presents a unique set of liability exposures. Product liability is a major concern, covering claims arising from defects in manufactured goods that cause injury or damage. General liability insurance is necessary to cover other potential liabilities, such as injuries to visitors on the premises or property damage caused by company operations. Environmental liability insurance may be needed to cover costs associated with pollution or environmental damage. Employers’ liability insurance covers claims from employees injured during work, distinct from workers’ compensation.

| Industry | Key Risks & Exposures | Suitable Liability Coverage | Additional Considerations |

|---|---|---|---|

| Healthcare | Medical malpractice, patient injuries, data breaches | Professional liability (medical malpractice), general liability, cybersecurity insurance | High premiums due to high risk; compliance with HIPAA regulations |

| Construction | Worker injuries, property damage, third-party injuries | General liability, workers’ compensation, commercial auto insurance, umbrella liability | Strict adherence to safety regulations; potential for large claims |

| Manufacturing | Product liability, injuries on premises, environmental damage | General liability, product liability, employers’ liability, environmental liability | Stringent quality control measures; potential for product recalls |

Illustrative Scenarios

Understanding the practical implications of liability insurance requires examining real-world scenarios where its presence or absence significantly impacts financial outcomes. The following examples highlight the crucial role liability insurance plays in mitigating risk.

Scenario: Crucial Protection Provided by Liability Insurance

Imagine Sarah, a freelance photographer, is hired to shoot a corporate event. During the event, she accidentally knocks over a valuable piece of equipment belonging to the client, causing $10,000 worth of damage. Sarah’s liability insurance policy, with a $1 million liability limit and a $500 deductible, covers the repair costs. She pays the deductible, and her insurer covers the remaining $9,500. Without insurance, Sarah would have faced a significant financial burden, potentially impacting her business and personal finances. This scenario demonstrates how liability insurance protects against unforeseen accidents and their associated costs, ensuring business continuity and personal financial stability.

Scenario: Inadequate Liability Insurance Leading to Significant Financial Losses

Consider a small bakery, “Sweet Success,” owned by John. A customer slips on a wet floor, resulting in a broken leg and subsequent medical bills of $50,000, along with a lawsuit demanding $100,000 for pain and suffering. Sweet Success only carries a $25,000 general liability policy. While the insurance covers the medical bills, John is personally liable for the remaining $75,000. To cover this, he is forced to sell his bakery, depleting his savings and potentially facing personal bankruptcy. This stark example illustrates the devastating consequences of insufficient liability insurance coverage, highlighting the importance of obtaining adequate protection to safeguard personal and business assets.

Summary

Securing adequate liability insurance is not merely a financial precaution; it’s a strategic investment in safeguarding your future. By understanding the intricacies of coverage, claims processes, and industry-specific needs, you can effectively mitigate potential risks and protect yourself from devastating financial consequences. This guide has provided a foundation for navigating the world of liability insurance, empowering you to make informed choices and secure your well-being.

Helpful Answers

What is the difference between general and professional liability insurance?

General liability covers bodily injury or property damage caused by your business operations. Professional liability (errors and omissions insurance) covers claims of negligence or mistakes in professional services.

How long does it take to process a liability insurance claim?

Processing times vary depending on the complexity of the claim and the insurance company. It can range from a few weeks to several months.

Can I get liability insurance if I have a history of claims?

Yes, but your premiums will likely be higher. Insurance companies consider claims history when assessing risk.

What happens if my liability insurance coverage is insufficient?

You will be personally liable for any damages exceeding your policy limits, potentially leading to significant financial losses.

Is liability insurance required by law?

The requirement for liability insurance varies by industry, location, and type of business. Some professions or businesses mandate it, while others may not.