The term “full coverage” car insurance often evokes a sense of complete protection, but the reality is more nuanced. Many drivers misunderstand what’s truly included, leading to unexpected costs and inadequate coverage in the event of an accident. This guide unravels the complexities of full coverage, clarifying its components, limitations, and the factors that influence its cost. We’ll explore the essential coverages, optional add-ons, and the claims process, equipping you with the knowledge to make informed decisions about your auto insurance.

Understanding your car insurance is crucial for financial security. This guide aims to demystify the often-confusing world of full coverage, enabling you to choose a policy that best suits your needs and budget. We’ll delve into the specifics of collision and comprehensive coverage, the importance of uninsured/underinsured motorist protection, and the various optional add-ons available. By the end, you’ll have a clearer picture of what full coverage truly entails and how it can protect you on the road.

Defining “Full Coverage”

The term “full coverage” car insurance is frequently misunderstood, leading many drivers to believe they have more protection than they actually do. It’s crucial to understand exactly what this phrase encompasses to ensure you have the appropriate level of insurance for your needs and financial security.

Many believe “full coverage” protects against every possible scenario, from minor fender benders to total vehicle loss. However, this is a misconception. No insurance policy truly covers every eventuality. The term is more of a marketing shorthand than a precise legal definition.

Full Coverage Car Insurance Defined

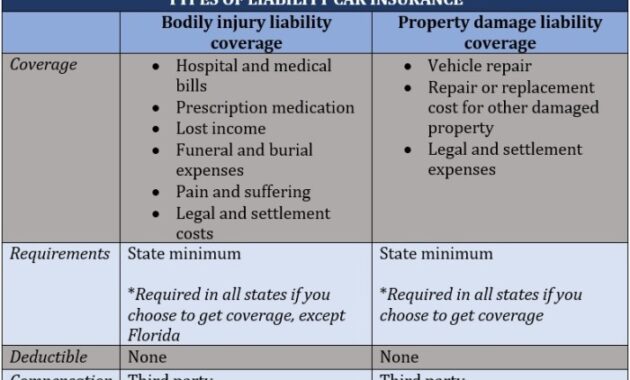

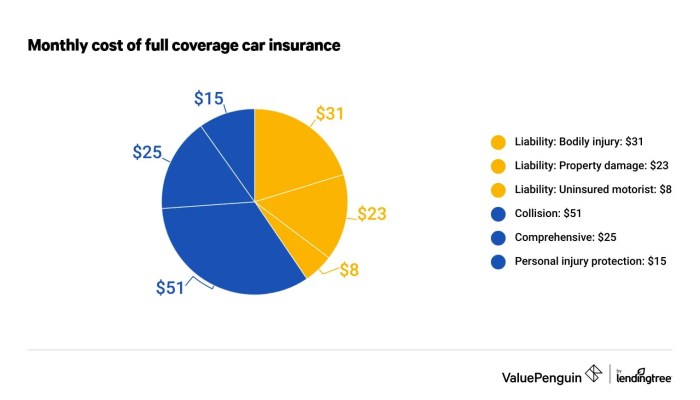

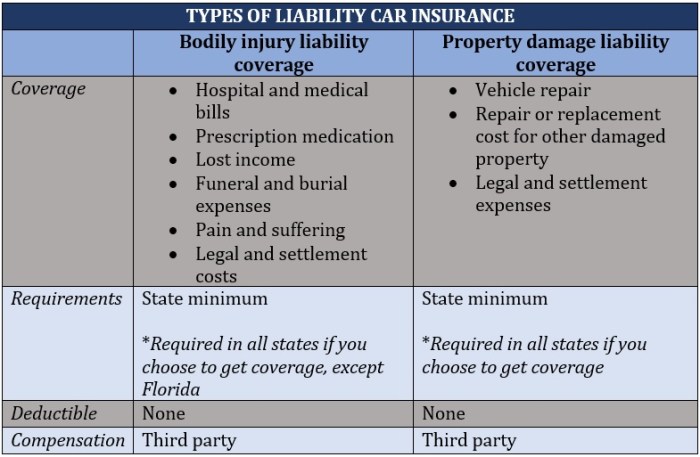

Full coverage car insurance typically combines liability insurance with comprehensive and collision coverage. Liability insurance covers damages or injuries you cause to others in an accident. Comprehensive coverage protects your vehicle from non-collision events like theft, vandalism, fire, or hail damage. Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. Additional coverages, such as uninsured/underinsured motorist protection and medical payments, are often included in what is considered “full coverage,” but this varies by insurer and policy.

Comparison with Other Insurance Options

Liability-only insurance is the minimum coverage required by most states. It only covers damages or injuries you cause to others. It does *not* cover damage to your own vehicle, regardless of who is at fault. This means if you’re in an accident, even if it’s not your fault, you’ll be responsible for the repair costs to your vehicle. Uninsured/underinsured motorist coverage is a separate option that can protect you if you are involved in an accident with a driver who is uninsured or underinsured.

Comparison of Car Insurance Coverage Types

| Coverage Type | Liability Only | Full Coverage (Example) | Comprehensive Only |

|---|---|---|---|

| Bodily Injury Liability | Covered | Covered | Not Covered |

| Property Damage Liability | Covered | Covered | Not Covered |

| Collision | Not Covered | Covered | Not Covered |

| Comprehensive | Not Covered | Covered | Covered |

| Uninsured/Underinsured Motorist | May be optional add-on | Often Included | May be optional add-on |

Components of Full Coverage

Full coverage car insurance, while offering extensive protection, isn’t a monolithic entity. Understanding its constituent parts is crucial for making informed decisions about your coverage. This section details the core components typically included in a full coverage policy, clarifying their respective roles and providing illustrative examples.

Collision Coverage

Collision coverage compensates for damage to your vehicle resulting from a collision with another vehicle or object, regardless of fault. This means that even if you cause the accident, your insurance will help pay for repairs or replacement of your car. The amount paid will usually be up to the actual cash value (ACV) of your vehicle, minus your deductible. For example, if your car is damaged in a fender bender with another car, collision coverage would pay for the repairs, less your deductible. Similarly, if you hit a tree, a wall, or another stationary object, collision coverage would apply. The payout is determined by the extent of the damage and the terms of your policy. High deductibles reduce your premiums but increase your out-of-pocket expenses in the event of a claim.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions. This includes a wide range of incidents, such as theft, vandalism, fire, hail, flood, and damage from animals. Unlike collision coverage, comprehensive coverage typically doesn’t have a fault element; it covers damage regardless of who is at fault. For example, if your car is stolen, comprehensive coverage will help replace it or compensate you for its value. If a tree falls on your car during a storm, or if a hail storm damages your vehicle, comprehensive coverage will typically cover the repairs or replacement costs. The specific events covered can vary slightly between insurance providers, so it’s essential to review your policy carefully.

Common Exclusions in Full Coverage Policies

It’s important to understand that even with full coverage, certain situations are generally not covered. Knowing these exclusions helps manage expectations and avoid potential surprises.

- Damage caused by wear and tear.

- Damage from intentional acts by the policyholder.

- Damage resulting from driving under the influence of alcohol or drugs.

- Damage caused by racing or other illegal activities.

- Damage resulting from mechanical or electrical breakdowns (unless covered under a separate warranty).

- Loss or damage to personal belongings inside the vehicle.

Additional Coverages

While full coverage car insurance provides a solid foundation of protection, many insurers offer optional add-ons designed to enhance your coverage and peace of mind. These additional coverages can significantly broaden the scope of protection, but they also come with added costs. Carefully considering your individual needs and driving habits is crucial when deciding which add-ons are worthwhile.

Adding these optional coverages can provide a more comprehensive safety net in various unforeseen circumstances. Understanding the benefits and associated costs will help you make an informed decision about your insurance policy.

Roadside Assistance

Roadside assistance coverage offers invaluable help in emergency situations on the road. This typically includes services such as towing, flat tire changes, jump starts, and lockout assistance. The cost varies depending on the insurer and the level of coverage, but it’s often a relatively small addition to your overall premium. For example, a driver stranded with a dead battery miles from home would greatly benefit from this coverage, avoiding potentially expensive towing fees and the inconvenience of waiting for assistance.

Rental Car Reimbursement

If your vehicle is damaged in an accident and requires repairs, rental car reimbursement coverage can help offset the cost of renting a temporary vehicle. This can be particularly helpful if your car is out of commission for an extended period. The coverage typically pays for a portion of the rental car expenses, up to a specified daily or total amount. Consider the potential cost of a rental car while your vehicle is being repaired; this coverage can significantly reduce that financial burden, particularly after a significant accident.

Uninsured/Underinsured Motorist Coverage

This coverage protects you in the event you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle repairs, even if the other driver is at fault and lacks sufficient insurance. The cost of this add-on varies but offers crucial protection in situations where the other driver’s insurance is inadequate to cover your losses. For instance, if you are involved in an accident with a driver who only carries liability insurance, this coverage would help cover the expenses beyond what the other driver’s insurance would provide.

Gap Insurance

Gap insurance covers the difference between what your car is worth at the time of a total loss and the amount you still owe on your loan or lease. This is particularly relevant during the early years of ownership when depreciation is high. The cost is typically a one-time fee or a small monthly addition to your premium. For example, if you totaled your car and still owed $10,000 on your loan but the car’s value was only $8,000, gap insurance would cover the $2,000 difference.

Table of Common Add-on Coverages

| Coverage | Benefits | Costs | Example Scenario |

|---|---|---|---|

| Roadside Assistance | Towing, jump starts, flat tire change, lockout assistance | Varies by insurer, typically a small monthly addition | Stranded with a dead battery far from home. |

| Rental Car Reimbursement | Covers rental car costs while your vehicle is being repaired | Varies by insurer, typically a daily or total limit | Car is undriveable for a week due to accident repairs. |

| Uninsured/Underinsured Motorist | Covers medical bills and vehicle repairs if hit by an uninsured or underinsured driver | Varies by insurer, a significant factor in overall premium | Accident with a driver who only carries minimum liability insurance. |

| Gap Insurance | Covers the difference between the car’s value and the loan amount in a total loss | One-time fee or small monthly addition | Totaled car with significant loan balance remaining. |

Ultimate Conclusion

Securing adequate car insurance is a vital aspect of responsible vehicle ownership. While “full coverage” offers extensive protection, it’s essential to understand its intricacies, limitations, and the various factors influencing its cost. This guide has provided a comprehensive overview, empowering you to assess your individual needs and choose a policy that aligns with your risk tolerance and financial situation. Remember to carefully review your policy documents and contact your insurer with any questions to ensure you have the appropriate coverage for your circumstances. Driving safely and being well-informed about your insurance are key to peace of mind on the road.

FAQs

What is the difference between liability and full coverage insurance?

Liability insurance covers damages you cause to others. Full coverage adds collision and comprehensive coverage, protecting your vehicle in accidents and from other damage.

Does full coverage cover damage from a natural disaster?

Generally, comprehensive coverage, a component of full coverage, covers damage from events like hail, floods, or fire, but specific exclusions may apply depending on your policy.

How does my driving record affect my full coverage premiums?

A poor driving record with accidents or violations will significantly increase your premiums as insurers view you as a higher risk.

Can I get full coverage if my car is older?

Yes, but the cost may be relatively higher compared to newer vehicles due to the lower vehicle value.

What happens if I’m involved in a hit and run?

Uninsured/underinsured motorist coverage, typically included in full coverage, helps cover your damages in such situations.