Workers’ compensation insurance is a critical aspect of responsible business ownership, offering crucial protection for both employers and employees. This comprehensive guide delves into the intricacies of workers’ compensation insurance policies, exploring everything from coverage details and premium calculations to the claims process and regulatory compliance. We aim to provide a clear and accessible understanding of this vital insurance type, empowering businesses to make informed decisions and ensure a safe and secure work environment.

Navigating the complexities of workers’ compensation can feel daunting, but with a thorough understanding of its components, businesses can effectively manage risk, comply with legal obligations, and foster a positive and safe workplace culture. This guide will equip you with the knowledge necessary to confidently handle all aspects of your workers’ compensation insurance policy.

Claims Process

Filing a workers’ compensation claim can seem daunting, but understanding the process can significantly ease the experience. This section details the steps involved, the roles of both employer and employee, common disputes, potential challenges, and best practices for documentation.

The workers’ compensation claims process generally involves several key steps, beginning with the immediate reporting of the injury and culminating in the resolution of the claim. Effective communication and documentation are crucial throughout this process.

Steps in Filing a Workers’ Compensation Claim

The steps involved in filing a claim typically follow a sequence, though specifics may vary by state and employer policies. Prompt and accurate reporting is essential to ensure a smooth process.

- Report the Injury Immediately: Notify your supervisor and/or employer as soon as possible after the injury occurs. This initial report is crucial for initiating the claims process.

- Seek Medical Attention: Obtain medical treatment from a qualified healthcare provider. It’s advisable to seek treatment from a doctor or specialist approved by your employer or insurer to avoid potential complications later in the claims process.

- Complete Claim Forms: Your employer will likely provide necessary claim forms. Complete these accurately and thoroughly, providing all requested information. Any inaccuracies can delay or complicate the claim.

- Submit Supporting Documentation: Gather any relevant documentation, such as medical records, witness statements, and photographs of the accident scene. This supporting evidence helps substantiate the claim.

- Follow Up on the Claim: Regularly follow up with your employer and the insurance company to check the status of your claim. Proactive communication can help prevent delays and misunderstandings.

Employer and Employee Roles in the Claims Process

Both the employer and the employee play distinct yet interconnected roles in ensuring a successful claims process. Cooperation and clear communication are vital for a smooth resolution.

- Employer’s Role: Employers are responsible for maintaining a safe work environment, providing necessary claim forms, and cooperating with the insurance company throughout the process. They should also promptly report the incident to their insurer.

- Employee’s Role: Employees are responsible for reporting the injury immediately, seeking appropriate medical attention, completing claim forms accurately, and providing all necessary documentation. They should also cooperate with the employer and insurer throughout the process.

Common Claim Disputes and Their Resolutions

Disputes can arise during the claims process due to various factors. Understanding common issues and their resolutions is important for navigating potential conflicts.

- Causation Disputes: Disputes may arise if there is a question about whether the injury was directly caused by the workplace. Resolution often involves medical evaluations and investigation of the incident.

- Extent of Disability Disputes: Disagreements can occur regarding the severity and duration of the disability. Independent medical examinations (IMEs) and functional capacity evaluations (FCEs) may be used to determine the extent of the disability.

- Lost Wage Disputes: Disputes may arise over the calculation of lost wages. Careful documentation of earnings and medical absences is crucial for resolving such disputes.

Potential Challenges Faced During the Claims Process

Several challenges can hinder the claims process, including delays, bureaucratic hurdles, and communication breakdowns. Proactive measures can help mitigate these challenges.

- Delays in Processing: Claims processing can be slow due to paperwork, medical evaluations, and investigations. Regular follow-up is essential to ensure the claim moves forward.

- Communication Barriers: Misunderstandings between the employee, employer, and insurer can delay or complicate the process. Clear and consistent communication is vital.

- Medical Documentation Issues: Incomplete or inaccurate medical documentation can lead to disputes and delays. Ensuring complete and accurate medical records is crucial.

Documenting a Workplace Injury

Thorough documentation is critical for a smooth claims process. This includes accurate and detailed records of the injury and its aftermath.

- Incident Report: Complete a detailed incident report immediately after the injury, including date, time, location, description of the incident, witnesses, and any immediate injuries.

- Medical Records: Maintain complete and accurate medical records, including doctor’s notes, test results, and treatment plans. These records are essential for substantiating the claim.

- Photographs and Videos: If possible, take photographs or videos of the accident scene and any visible injuries. This visual evidence can be invaluable in supporting the claim.

- Witness Statements: Obtain written statements from any witnesses to the incident. These statements provide additional evidence to support the claim.

Benefits for Employees

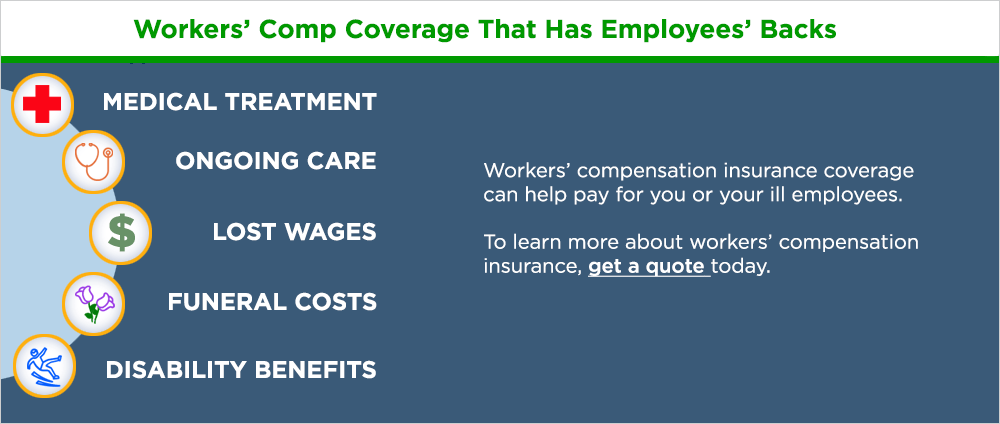

Workers’ compensation insurance provides crucial financial and medical support to employees injured on the job. Understanding the benefits available is vital for both employees and employers. This section details the types of benefits, the process for determining benefit amounts, and factors influencing benefit duration.

Types of Benefits Covered

Workers’ compensation policies typically cover a range of benefits designed to help injured employees recover and return to work. These benefits aim to compensate for lost wages, cover medical expenses, and provide support for long-term disabilities. The specific benefits and their availability can vary slightly depending on state laws and the specifics of the insurance policy.

Determining Benefit Amounts

The amount of benefits an employee receives depends on several factors, including the nature and severity of the injury, the employee’s average weekly wage, and state-specific regulations. For lost wages, benefits are often calculated as a percentage of the employee’s pre-injury average weekly wage. Medical expenses are typically covered in full, provided they are deemed reasonable and necessary for treatment. Disability payments, such as temporary or permanent disability benefits, are determined based on the employee’s ability to work and the extent of their impairment. Each state has its own established formula for calculating these benefits. Documentation, such as medical reports and wage statements, is crucial in determining the appropriate benefit amount.

Examples of Benefit Types

- Medical Expenses: This covers all reasonable and necessary medical treatment related to the work injury, including doctor visits, hospital stays, surgery, physical therapy, medications, and assistive devices.

- Lost Wages: Temporary disability benefits replace a portion of the employee’s lost wages while they are unable to work due to the injury. Permanent disability benefits provide ongoing support if the injury results in long-term impairment affecting earning capacity.

- Disability Payments: These payments compensate for the loss of earning capacity due to a work-related injury. Temporary total disability pays for complete inability to work, while permanent partial disability covers situations where the employee can return to work with limitations. Permanent total disability benefits are for individuals who can no longer work at all.

Duration of Benefits

The duration of benefits depends on the nature and severity of the injury and the employee’s progress in recovery. Temporary disability benefits usually end when the employee is medically cleared to return to work or reaches maximum medical improvement (MMI). Permanent disability benefits can continue indefinitely, depending on the extent of the permanent impairment and the state’s regulations. Regular medical evaluations and progress reports are essential in determining the ongoing need for benefits.

Comparison of Benefits Offered by Different Insurance Providers

It’s important to note that benefit amounts and specific coverage details can vary significantly between different workers’ compensation insurance providers. While a direct comparison is difficult without specific policy details, the following table provides a general overview of potential variations:

| Insurance Provider | Lost Wage Benefit Percentage | Medical Expense Coverage | Disability Benefit Options |

|---|---|---|---|

| Provider A | 66.7% of average weekly wage | Full coverage of reasonable and necessary medical expenses | Temporary Total, Temporary Partial, Permanent Partial, Permanent Total |

| Provider B | 70% of average weekly wage | Full coverage with pre-authorization required for certain procedures | Temporary Total, Permanent Partial, Permanent Total |

| Provider C | 60% of average weekly wage with a maximum weekly benefit cap | Full coverage with a network of preferred providers | Temporary Total, Temporary Partial, Permanent Total |

Risk Management and Prevention

Proactive risk management is crucial for employers to minimize workplace accidents and injuries, thereby reducing workers’ compensation costs and fostering a safer work environment. A comprehensive approach involves identifying hazards, implementing preventative measures, and providing thorough safety training. This section details strategies to achieve these goals.

Strategies for Reducing Workplace Accidents and Injuries

Implementing effective risk management strategies requires a multifaceted approach. This includes conducting thorough workplace hazard assessments, establishing and enforcing safety rules and procedures, providing appropriate personal protective equipment (PPE), and maintaining well-maintained equipment and facilities. Regular inspections, employee feedback mechanisms, and prompt investigation of incidents are also vital components of a robust safety program. For instance, a construction company might implement a “toolbox talk” program, where daily safety briefings are conducted before work begins, addressing specific hazards relevant to the day’s tasks. A manufacturing plant could implement a lockout/tagout procedure for machinery maintenance, ensuring equipment is safely de-energized before work commences.

Importance of Safety Training and its Impact on Workers’ Compensation Costs

Safety training significantly reduces workplace accidents and, consequently, workers’ compensation claims. Well-trained employees are better equipped to identify and avoid hazards, use safety equipment correctly, and follow established safety protocols. This translates to lower incident rates, reduced medical expenses, and decreased lost-time claims, resulting in substantial savings on workers’ compensation premiums. For example, a company that invests in comprehensive training on proper lifting techniques can significantly reduce back injuries, a common cause of workers’ compensation claims. Similarly, training on the safe operation of machinery can minimize the risk of equipment-related accidents.

Examples of Effective Safety Programs and Their Implementation

Effective safety programs are tailored to the specific hazards present in a given workplace. A successful program combines elements such as regular safety inspections, employee participation in safety committees, and a robust reporting system for near misses and incidents. For instance, a hospital might implement a comprehensive infection control program, including training on proper hand hygiene and the use of personal protective equipment. A retail store might focus on training employees on safe lifting techniques and the prevention of slips, trips, and falls. The key is to involve employees in the process, creating a culture of safety where everyone feels empowered to report hazards and contribute to a safer work environment. These programs are usually monitored through key performance indicators (KPIs) such as the number of reported incidents, lost-time injury rates, and the cost of workers’ compensation claims.

Common Workplace Hazards and Methods for Mitigating Risks

Common workplace hazards include slips, trips, and falls; exposure to hazardous chemicals; improper lifting techniques; and machine-related injuries. Mitigation strategies vary depending on the hazard. For slips, trips, and falls, this could involve improving lighting, addressing spills promptly, and providing appropriate footwear. For chemical exposure, it includes providing appropriate PPE, such as gloves and respirators, and ensuring adequate ventilation. For improper lifting, training on proper lifting techniques is crucial. For machine-related injuries, implementing lockout/tagout procedures, providing appropriate guarding, and ensuring regular equipment maintenance are essential.

Visual Representation of a Safe Workplace Environment

Imagine a brightly lit warehouse with clearly marked walkways, free of clutter and obstructions. Employees wear appropriate safety footwear and high-visibility vests. Heavy machinery is equipped with safety guards, and warning signs are prominently displayed near potential hazards. Spill kits are readily available, and emergency exits are clearly marked and unobstructed. Workers are actively participating in safety training and using provided PPE correctly. The overall atmosphere reflects a culture of safety and mutual respect, where employees feel comfortable reporting hazards and participating in safety initiatives. This visual represents a workplace where proactive risk management and a commitment to safety are paramount.

Epilogue

Securing adequate workers’ compensation insurance is not merely a legal requirement; it’s a testament to a company’s commitment to its employees’ well-being and a proactive approach to risk management. By understanding the intricacies of policy coverage, premium calculations, claims procedures, and regulatory compliance, businesses can effectively mitigate potential liabilities and foster a safer work environment. This guide serves as a foundational resource for navigating the world of workers’ compensation, empowering businesses to make informed decisions that protect both their employees and their bottom line.

FAQ Corner

What happens if my employer doesn’t have workers’ compensation insurance?

In most jurisdictions, employers are legally required to carry workers’ compensation insurance. Failure to do so can result in significant penalties, including fines and potential legal action from injured employees.

Can I choose my own doctor after a workplace injury?

Typically, your employer’s workers’ compensation insurer may initially direct you to a network of approved physicians. However, you may have options to seek a second opinion or choose a different physician under certain circumstances; check your policy or consult with the insurer.

How long does the workers’ compensation claims process usually take?

The duration of a workers’ compensation claim varies greatly depending on the severity of the injury, the complexity of the case, and the responsiveness of all parties involved. It can range from a few weeks to several months or even longer in more complex cases.

What if my workers’ compensation claim is denied?

If your claim is denied, you usually have the right to appeal the decision. This often involves submitting additional documentation and potentially seeking legal counsel to represent your case.