Planning for the future can feel daunting, but securing your loved ones’ financial well-being is a vital step. AARP life insurance offers a range of plans designed to meet diverse needs and budgets, providing peace of mind during life’s transitions. This comprehensive guide explores the various AARP life insurance options, helping you understand their benefits, limitations, and suitability for your specific circumstances.

We’ll delve into the specifics of coverage amounts, premium structures, and available riders, comparing AARP’s offerings to those of other providers. We’ll also examine customer experiences, the claims process, and address common questions to equip you with the knowledge needed to make an informed decision about your life insurance needs.

AARP Life Insurance Product Overview

AARP offers several life insurance plans designed to meet the diverse needs and budgets of its members. These plans provide financial protection for loved ones in the event of the policyholder’s death, offering peace of mind and security. Understanding the differences between these plans is crucial in selecting the most appropriate coverage.

AARP Life Insurance Plan Descriptions

AARP partners with several insurance providers to offer a range of life insurance options, including term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, while permanent life insurance offers lifelong coverage. Specific plan details, including coverage amounts, premiums, and rider options, vary based on the provider and the individual’s age, health, and other factors. It’s important to consult directly with an AARP-affiliated insurance provider or a qualified insurance agent for precise details. The following are general descriptions and may not represent all available plans or their current offerings.

Coverage Amounts, Premiums, and Rider Options

Coverage amounts typically range from $10,000 to $1,000,000, depending on the plan and the applicant’s qualifications. Premiums are determined by several factors, including age, health, smoking status, and the chosen coverage amount. Riders, which are optional additions to the policy, can enhance coverage, such as adding accidental death benefits or a waiver of premium rider in case of disability. Specific rider options and their costs vary by plan and provider. For instance, a term life insurance policy might offer a return of premium rider, while a whole life policy might allow for a long-term care rider.

Application Process and Required Documentation

The application process typically involves completing an application form, undergoing a medical examination (for some plans), and providing necessary documentation. Required documentation might include proof of identity, age, and income, as well as medical records. The application process and required documentation may vary depending on the chosen plan and the insurance provider. The AARP website and affiliated insurance provider websites typically provide detailed instructions and forms.

Comparison of AARP Life Insurance Plans

The following table compares three hypothetical AARP-affiliated life insurance plans to illustrate the differences in features. Remember that actual plans and their features may vary, and this is for illustrative purposes only. Consult directly with a provider for accurate, up-to-date information.

| Plan Name | Type | Coverage Amount (Example) | Premium (Example – Annual) |

|---|---|---|---|

| Example Term Life Plan | Term Life | $250,000 | $500 |

| Example Whole Life Plan | Whole Life | $100,000 | $1,500 |

| Example Universal Life Plan | Universal Life | $500,000 | $1,000 (flexible premiums) |

Target Audience and Suitability

AARP life insurance products are designed to cater to the specific needs and circumstances of individuals in their later years, offering a range of options to fit diverse financial situations and life goals. Understanding the target audience and the suitability of these products is crucial for making informed decisions about life insurance coverage.

AARP life insurance policies primarily target individuals aged 50 and older, although some plans may have slightly different eligibility requirements. This age group often faces unique financial challenges and life transitions, such as retirement planning, healthcare expenses, and estate planning, making life insurance a significant consideration. The suitability of AARP life insurance is strongly tied to factors such as the individual’s health, income, existing assets, and desired level of coverage. For instance, individuals with significant assets to protect or those wanting to leave a legacy for their families may find AARP’s offerings particularly appealing.

Ideal Customer Profile

The ideal customer for AARP life insurance is typically a retired or soon-to-be-retired individual aged 50 or older, who is seeking affordable and straightforward life insurance coverage. They may be concerned about leaving behind financial burdens for their loved ones or ensuring their final expenses are covered. These individuals often value simplicity and ease of access to information and services. They might also be attracted to the reputation and brand recognition associated with AARP, signifying trustworthiness and reliability. This profile encompasses a broad range of individuals, from those with modest financial means to those with more substantial assets, all united by a shared need for affordable and accessible life insurance solutions.

Suitability Across Age Groups and Financial Situations

AARP life insurance’s suitability varies depending on the specific policy and the individual’s circumstances. For example, a simpler term life insurance policy might be suitable for a healthy 55-year-old with a moderate income who wants affordable coverage for a specific period. Conversely, a more comprehensive whole life policy might be more appropriate for a wealthier 70-year-old seeking long-term coverage and potential cash value growth. The affordability and flexibility of AARP’s options make them suitable for a wider range of financial situations compared to some competitors who may offer only high-premium, high-coverage options. The range of coverage amounts and payment options further enhances their suitability for individuals with varied financial capacities.

Comparison with Other Providers

AARP life insurance competes with numerous other providers in the market, each offering unique features and benefits. Direct comparisons are complex due to the variability in policy types, coverage amounts, and individual circumstances. However, a key differentiator for AARP is its focus on simplicity and ease of understanding, often providing straightforward policies with transparent pricing. Other providers might offer more complex policies with potentially higher returns or additional benefits, but at the cost of increased complexity and higher premiums. AARP’s association with a well-known and trusted organization provides an added layer of reassurance for many customers. Ultimately, the best provider depends on the individual’s specific needs and preferences.

Reasons for Choosing AARP Life Insurance

The decision to choose AARP life insurance often rests on several factors. Below is a list highlighting key reasons why someone might opt for AARP’s offerings:

- Simplicity and ease of understanding: Policies are often designed to be straightforward and easy to comprehend.

- Affordability: AARP frequently offers competitive premiums, making life insurance accessible to a wider range of individuals.

- Reputation and trustworthiness: The AARP brand carries significant weight, assuring customers of reliability and financial stability.

- Range of options: A variety of policy types and coverage amounts cater to diverse needs and budgets.

- Accessibility: The application process and customer service are often designed for ease of use, particularly for older adults.

Potential Drawbacks and Limitations

While AARP life insurance offers several advantages, it’s crucial to understand its potential limitations before making a purchase decision. Not every individual or family’s needs will be best served by this type of policy, and comparing it to alternatives is essential for informed decision-making. This section will explore areas where AARP life insurance may fall short.

AARP life insurance policies, like many other life insurance products, may not be the optimal choice for everyone. Certain factors, such as individual health conditions, age, and financial circumstances, can significantly influence the suitability of this type of coverage. A thorough understanding of these factors is key to making an informed decision.

Limitations Based on Health and Age

Individuals with pre-existing health conditions may find it challenging to qualify for AARP life insurance or may receive higher premiums compared to healthier applicants. The underwriting process considers health history, and those with significant health concerns may be denied coverage or offered policies with limited benefits. Similarly, applicants at older ages often face higher premiums or restricted coverage options due to increased mortality risk. For example, a 70-year-old applicant might find the premiums prohibitively expensive or the coverage amounts significantly lower than what they could secure at a younger age. This highlights the importance of considering life insurance needs earlier in life.

Comparison with Other Insurance Types

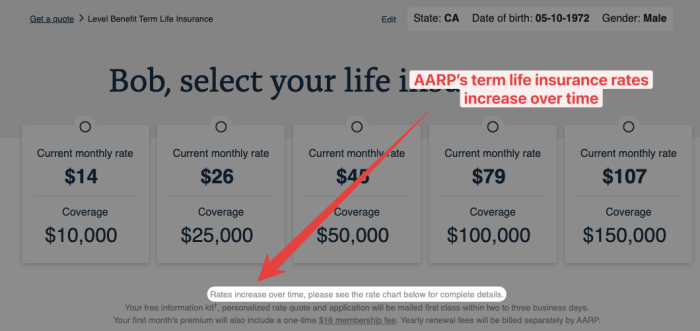

AARP life insurance primarily offers term life and whole life insurance options. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, at a fixed premium. Whole life insurance, on the other hand, offers lifelong coverage and builds cash value. However, compared to other term life insurance providers, AARP’s offerings might not always provide the lowest premiums or the highest coverage amounts for a given premium. Similarly, whole life policies from other companies might offer more competitive cash value growth or other features. Choosing the right type of insurance depends heavily on individual needs and financial goals. For instance, someone needing high coverage for a short period might find a term policy from a different provider more cost-effective, while someone seeking long-term coverage and cash value accumulation might find better options elsewhere.

Potential Disadvantages of Purchasing AARP Life Insurance

It’s important to weigh the potential drawbacks before committing to an AARP life insurance policy. Below is a list of potential disadvantages:

- Higher premiums compared to other insurers for similar coverage.

- Limited coverage amounts available, particularly for older applicants.

- May not be suitable for individuals with significant health concerns.

- Less flexibility in policy customization compared to some competitors.

- Potential for less competitive cash value growth in whole life policies.

Illustrative Scenarios

AARP life insurance policies can offer valuable financial protection for families facing various life events. The following scenarios illustrate how different policy types and coverage amounts can provide crucial support during challenging times. Remember, these are examples, and individual needs will vary. It’s crucial to consult with a financial advisor to determine the best coverage for your specific circumstances.

Scenario 1: Protecting a Family’s Financial Future

The Miller family, with two young children and a mortgage, wants to ensure their children’s education and financial stability if something were to happen to either parent. Mr. Miller, age 45, purchases a $500,000 term life insurance policy through AARP. The policy’s premiums are affordable, given his age and health. In the event of his unexpected death, the $500,000 death benefit would cover the mortgage, provide for the children’s education fund, and offer a financial cushion for Mrs. Miller. This allows the family to maintain their lifestyle and avoid significant financial hardship.

Scenario 2: Supplementing Retirement Income

The Garcia family, nearing retirement, wants to ensure their retirement savings can support their lifestyle. Mrs. Garcia, age 62, purchases a $250,000 whole life insurance policy. This policy provides a death benefit to cover any outstanding debts and supplement their retirement income, ensuring a comfortable lifestyle for Mr. Garcia. The policy also builds cash value over time, which can be accessed for emergencies or other needs during retirement. This strategy provides both a death benefit and a potential source of funds during their retirement years.

Scenario 3: Addressing Estate Taxes

The Johnson family owns a successful small business and anticipates significant estate taxes upon the death of Mr. Johnson, age 70. They purchase a $1 million life insurance policy to help cover these anticipated taxes. This ensures that the business can remain in the family and avoids the need for forced liquidation of assets to cover estate tax obligations. The policy’s death benefit would provide the liquidity needed to pay the estate taxes without disrupting the family’s business operations.

Final Wrap-Up

Choosing the right life insurance policy is a significant financial decision, and understanding the nuances of each plan is crucial. AARP life insurance presents a viable option for many, offering competitive coverage and a range of benefits. By carefully considering your individual needs, financial situation, and the information presented here, you can confidently select a policy that aligns with your goals and secures the future of your family. Remember to compare options and consult with a financial advisor for personalized guidance.

Key Questions Answered

What is the age limit for AARP life insurance?

Eligibility requirements vary depending on the specific plan, but generally, AARP life insurance is available to individuals within a certain age range, often extending beyond the typical limits of other insurers.

Can I increase my coverage amount later?

The possibility of increasing coverage depends on the policy type and the insurer’s terms. Some policies allow for adjustments, while others may have restrictions based on age and health.

What happens if I miss a premium payment?

Missing a premium payment can result in a lapse in coverage. The policy may be cancelled, though grace periods are often offered, and reinstatement may be possible depending on the policy terms.

What types of riders are available with AARP life insurance?

AARP offers various riders, such as accidental death benefits, long-term care riders, and others, which enhance the base policy’s coverage. Specific rider availability depends on the chosen plan.