Whole life insurance, a cornerstone of long-term financial planning, offers a unique blend of life-long coverage and cash value accumulation. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in effect for your entire life, providing a guaranteed death benefit to your beneficiaries. This comprehensive guide delves into the intricacies of whole life insurance, exploring its features, benefits, costs, and suitability for various financial situations.

We will examine the mechanics of cash value growth, the various ways to access these funds, and the tax implications of death benefits. We’ll also compare whole life insurance to other types of life insurance, helping you understand its place within a broader financial strategy. Whether you’re a seasoned investor or just beginning to explore your financial options, this guide provides the knowledge you need to make informed decisions about whole life insurance.

Defining Whole Life Insurance

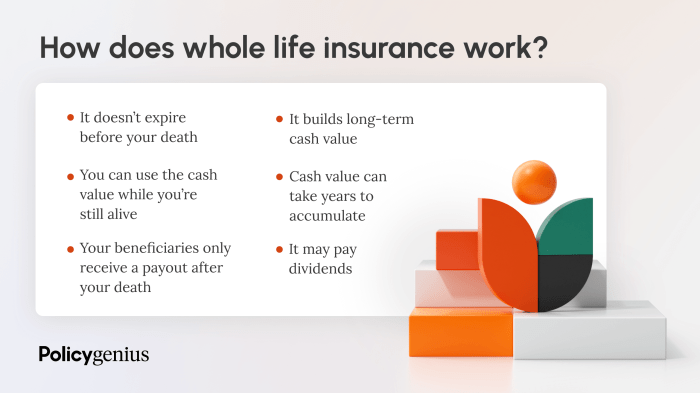

Whole life insurance is a type of permanent life insurance policy designed to provide lifelong coverage as long as premiums are paid. Unlike term life insurance, which covers a specific period, whole life insurance offers a death benefit that remains in effect for the insured’s entire life. This coverage is coupled with a cash value component that grows tax-deferred over time.

Whole life insurance policies have several core features. The most significant is the guaranteed death benefit, a fixed sum paid to the beneficiaries upon the insured’s death. Another key feature is the cash value accumulation. This cash value grows over time through the accumulation of premiums and investment earnings, and it can be borrowed against or withdrawn under certain conditions. Finally, whole life policies typically offer a fixed premium, meaning the premium amount remains constant throughout the policy’s duration.

Whole Life vs. Term Life Insurance

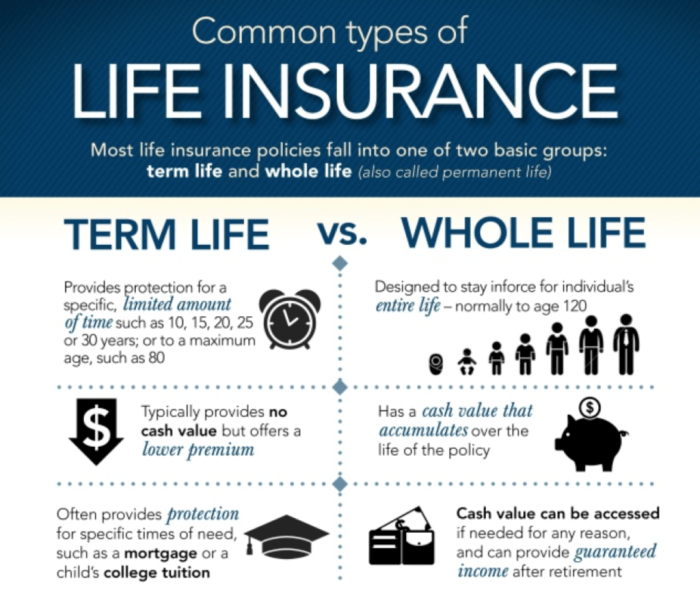

The primary difference between whole life and term life insurance lies in the duration of coverage. Term life insurance provides coverage for a specific period (e.g., 10, 20, or 30 years), after which the policy expires unless renewed. If the insured dies within the term, the death benefit is paid. If the insured survives the term, the policy ends, and no further coverage is provided. Whole life insurance, on the other hand, offers lifelong coverage, provided premiums are consistently paid. Term life insurance is generally less expensive than whole life insurance due to its limited coverage period. The cash value component is another key differentiator; whole life policies build cash value, while term life policies do not.

Types of Whole Life Insurance Policies

Whole life insurance policies can be broadly categorized as participating or non-participating. Participating policies, often issued by mutual insurance companies, share a portion of the company’s profits with policyholders in the form of dividends. These dividends can be taken as cash, used to reduce premiums, added to the cash value, or left to accumulate. Non-participating policies, typically offered by stock insurance companies, do not pay dividends. The premiums for non-participating policies are generally lower than those for participating policies, reflecting the absence of dividend payouts. Another distinction lies in the level of customization offered. Some policies offer flexible premium options allowing adjustments based on financial situations, while others maintain a fixed premium throughout the policy’s lifetime.

Benefits and Drawbacks of Whole Life Insurance

| Benefit | Drawback |

|---|---|

| Lifelong coverage | Higher premiums compared to term life insurance |

| Cash value accumulation | Lower death benefit per premium dollar compared to term life insurance |

| Tax-deferred growth of cash value | Potential for lower returns than other investment options |

| Potential for borrowing against cash value | Complexity of policy features and potential for misunderstanding |

Costs and Fees Associated with Whole Life Insurance

Whole life insurance, while offering lifelong coverage and a cash value component, comes with a range of costs and fees that significantly impact the overall policy value and its long-term financial implications. Understanding these costs is crucial for making an informed decision about whether whole life insurance is the right choice for your financial situation. It’s essential to compare these costs to the potential benefits before committing to a policy.

Understanding how these costs impact the policy’s cash value growth is critical. These fees directly reduce the amount of money accumulating in the cash value portion of your policy, potentially diminishing its long-term growth and the amount available for withdrawals or loans. Therefore, a thorough cost analysis is paramount before purchasing a whole life policy.

Impact of Costs on Policy Value

The fees associated with whole life insurance directly affect the policy’s cash value accumulation. A significant portion of your premium payments goes towards covering these costs rather than directly contributing to the cash value. High fees can significantly slow down or even negate the growth of your cash value over time. For example, a policy with high administrative fees and mortality charges will have a lower cash value compared to a similar policy with lower fees, even if the premium payments are the same. This is particularly important to consider in the long term, as the compounding effect of these fees can be substantial. Careful consideration should be given to the fee structure when comparing different whole life insurance policies.

Comparison with Other Life Insurance Types

Whole life insurance typically has a higher cost structure compared to term life insurance. Term life insurance offers coverage for a specific period, usually 10, 20, or 30 years, and generally has significantly lower premiums. However, term life insurance provides no cash value accumulation. Universal life insurance and variable universal life insurance offer cash value accumulation, but their cost structures can vary depending on the investment options chosen. The cost of whole life insurance should be carefully weighed against the benefits of lifelong coverage and cash value accumulation when compared to these alternatives. Each policy type caters to different needs and risk tolerances, so a comprehensive cost-benefit analysis is crucial.

Common Whole Life Insurance Fees

Understanding the various fees is essential for evaluating the true cost of a whole life policy. These fees can significantly impact the policy’s cash value growth and overall return on investment. It’s crucial to compare fee structures across different insurers before making a purchase decision.

- Mortality Charges: These charges reflect the insurer’s assessment of the risk of death within the insured’s age group. Higher mortality charges mean a larger portion of your premium goes towards covering the insurer’s risk, leaving less for cash value accumulation.

- Administrative Fees: These fees cover the insurer’s costs associated with managing the policy, such as record-keeping, customer service, and policy administration. They are typically a fixed annual charge or a percentage of the cash value.

- Premium Loading Fees: These fees cover the insurer’s costs of selling and marketing the policy. They are often included in the premium amount.

- Surrender Charges: These fees are applied if you cancel or surrender the policy before a certain period. They are designed to compensate the insurer for lost revenue and administrative costs.

- Rider Fees: If you add optional riders to your policy, such as accelerated death benefits or long-term care benefits, these riders will usually have additional fees associated with them.

Illustrative Example

Understanding the growth of a whole life insurance policy can be best visualized graphically. A typical chart would show the interplay between the policy’s cash value and the death benefit over time. This allows for a clear understanding of how these components change and interact throughout the policy’s duration.

Imagine a graph with time on the horizontal axis (typically in years) and monetary value on the vertical axis. Two lines would be plotted: one representing the cash value accumulation and the other showing the death benefit.

Cash Value and Death Benefit Growth Over Time

The cash value line starts at a low point, reflecting the initial investment (premiums paid less expenses). It then gradually increases, showing an upward trend, though the slope might not be consistently steep. The increase is influenced by the credited interest rate, which fluctuates annually, and premium payments. Conversely, the death benefit line starts higher than the cash value and also shows a steady upward trajectory, generally exceeding the cash value growth at every point in time. The death benefit line’s increase is usually determined by the policy’s structure, often exhibiting a smoother, more predictable upward slope compared to the cash value line’s fluctuations. The gap between the death benefit and cash value represents the insurance protection component.

Impact of Interest Rates on Policy Growth

A higher credited interest rate will cause both lines to rise more steeply. The cash value line will reflect a more rapid increase in accumulation, resulting in a faster growth of the policy’s value. The death benefit might also increase at a faster rate, although this depends on the specific policy’s design. Conversely, lower interest rates will lead to a flatter growth trajectory for both lines, with a slower accumulation of cash value and a less dramatic increase in the death benefit. For example, a period of low interest rates could result in a significantly less pronounced upward slope for both lines compared to a period of higher rates. A scenario with a consistently high interest rate will show a much steeper ascent for both lines compared to a scenario with low and fluctuating interest rates.

Impact of Premiums on Policy Growth

Increased premium payments will result in a steeper upward slope for the cash value line. Higher premiums provide more funds for investment, leading to faster cash value growth. The death benefit line might also increase at a slightly faster rate, although this depends on the specific policy’s design; many policies maintain a fixed death benefit growth schedule regardless of premium fluctuations. Reduced premium payments, conversely, would result in a less steep slope for the cash value line, indicating slower accumulation. The death benefit line, however, is typically unaffected by premium changes unless the policy’s structure specifically ties the death benefit to premium levels. For instance, if premiums are consistently higher than the minimum required, the cash value line will reflect that quicker accumulation. Conversely, if premiums are at the minimum level for several years, the cash value line will show a slower, gentler growth.

Understanding Policy Riders and Add-ons

Whole life insurance policies offer a foundation of lifelong coverage, but their flexibility extends significantly through the addition of riders and add-ons. These optional features can tailor your policy to better meet your specific needs and circumstances, providing enhanced protection and benefits beyond the core coverage. Understanding these riders is crucial for maximizing the value of your whole life insurance policy.

Common Whole Life Insurance Riders and Add-ons

Several common riders modify or enhance the basic death benefit of a whole life insurance policy. These riders can provide additional financial protection or address specific concerns, such as long-term care needs or accidental death. Careful consideration of your individual needs and risk tolerance is essential when selecting riders.

Examples of Rider Benefits

Let’s illustrate how riders can enhance policy benefits. Imagine a policyholder with a $500,000 whole life policy who adds a Waiver of Premium rider. If they become disabled and unable to work, the rider would waive future premium payments, ensuring the policy remains active despite their inability to pay. Similarly, a Long-Term Care rider could provide access to funds for assisted living or in-home care should the policyholder require it, without impacting the death benefit.

Cost and Benefit Comparison of Policy Riders

The cost of each rider varies depending on factors like the policyholder’s age, health, and the specific terms of the rider. Generally, riders increase the overall premium. However, the added benefits often outweigh the increased cost, especially if the covered event occurs. For example, the cost of a Waiver of Premium rider is relatively low compared to the potential financial burden of losing the ability to pay premiums. Conversely, a Long-Term Care rider can be more expensive but offers significant financial protection against potentially high long-term care costs. A careful cost-benefit analysis is recommended before adding any rider.

Summary of Policy Riders and Their Features

| Rider Name | Description | Benefits | Costs |

|---|---|---|---|

| Waiver of Premium | Waives future premiums if the policyholder becomes totally disabled. | Maintains policy coverage without further premium payments during disability. | Increased premium compared to a base policy. |

| Accidental Death Benefit | Pays an additional death benefit if death results from an accident. | Provides extra financial security for beneficiaries in case of accidental death. | Increased premium. The amount of the additional benefit is usually a multiple of the base death benefit. |

| Long-Term Care Rider | Provides funds for long-term care expenses, such as nursing home care or in-home assistance. | Covers potentially significant long-term care costs, potentially preserving assets for beneficiaries. | Significantly increased premium; the cost varies greatly depending on the benefit amount and policyholder’s age and health. |

| Guaranteed Insurability Rider | Allows the policyholder to purchase additional insurance coverage at specific times in the future without undergoing a new medical examination. | Protects against future increases in premiums or uninsurability due to health changes. | Increased premium; the cost is relatively small compared to the potential benefit of securing future insurability. |

Last Point

Understanding whole life insurance requires careful consideration of its multifaceted nature. While it offers lifelong coverage and cash value accumulation, it’s crucial to weigh the associated costs and fees against the long-term benefits. This guide has provided a framework for evaluating whole life insurance’s suitability for your individual circumstances. Remember to consult with a qualified financial advisor to determine if whole life insurance aligns with your specific financial goals and risk tolerance. Making an informed decision about such a significant financial commitment is paramount to securing your future and the well-being of your loved ones.

FAQ Summary

What are the tax implications of withdrawing cash value from my whole life insurance policy?

Withdrawals from your cash value are generally considered a tax-free return of your premiums up to the amount you’ve contributed. Any amount exceeding your contributions is taxed as ordinary income.

Can I change my beneficiaries on a whole life insurance policy?

Yes, you can usually change your beneficiaries at any time by contacting your insurance company and completing the necessary paperwork. The process and required forms will vary depending on the insurance provider.

How does the interest rate affect my cash value growth?

Whole life insurance policies typically credit interest to your cash value account. The interest rate offered is usually a fixed rate or a variable rate, depending on the policy type. A higher interest rate will lead to faster cash value growth.

What happens to my policy if I stop paying premiums?

If you stop paying premiums, your policy will lapse, meaning the coverage will end, and you will lose the cash value accumulation. However, some policies offer grace periods, and some policies have options to continue coverage with reduced benefits.