The Michigan Department of Insurance (MDI) plays a vital role in protecting Michigan residents and ensuring the stability of the state’s insurance market. From regulating insurance companies and licensing agents to mediating consumer complaints and overseeing financial solvency, the MDI’s responsibilities are far-reaching and critical to the economic well-being of the state. This guide provides a detailed overview of the MDI’s functions, its regulatory processes, and the resources it offers to both consumers and industry professionals.

Established to protect consumers and maintain a stable insurance market, the MDI’s history is intertwined with the evolution of the insurance industry in Michigan. Its multifaceted responsibilities encompass licensing and regulation, consumer protection, financial oversight, and the enforcement of state insurance laws. Understanding the MDI’s structure and operations is essential for anyone involved in or affected by the insurance industry in Michigan.

Overview of the Michigan Department of Insurance (MDI)

The Michigan Department of Insurance (MDI) is a state agency responsible for regulating the insurance industry within the state of Michigan. Its history stretches back to the late 19th century, evolving from earlier forms of insurance oversight to its current comprehensive regulatory role. The MDI’s work directly impacts the financial security and consumer protection of Michigan residents.

MDI Mission and Statutory Responsibilities

The MDI’s mission is to protect Michigan consumers by ensuring a fair, stable, and competitive insurance market. This mission is accomplished through the enforcement of Michigan’s insurance laws and regulations. Statutorily, the MDI is responsible for licensing and regulating insurance companies, agents, and brokers operating within the state. This includes reviewing rates, investigating complaints, and taking action against those who violate insurance laws. Furthermore, the MDI plays a crucial role in ensuring the solvency of insurance companies to protect policyholders’ claims.

MDI Organizational Structure

The MDI is structured into several key departments, each with specific responsibilities. While the exact structure may vary slightly over time, key divisions generally include those focused on market conduct (overseeing the fair practices of insurers), financial regulation (monitoring the financial stability of insurers), licensing (managing the licensing and registration of insurance professionals), and consumer services (handling consumer complaints and providing information). These divisions work collaboratively to achieve the MDI’s overall mission.

Types of Insurance Regulated by the MDI

The MDI regulates a wide range of insurance products. The following table provides a summary:

| Insurance Type | Description | Examples | Regulatory Focus |

|---|---|---|---|

| Auto Insurance | Coverage for vehicle accidents. | Liability, collision, comprehensive | Rate regulation, consumer protection |

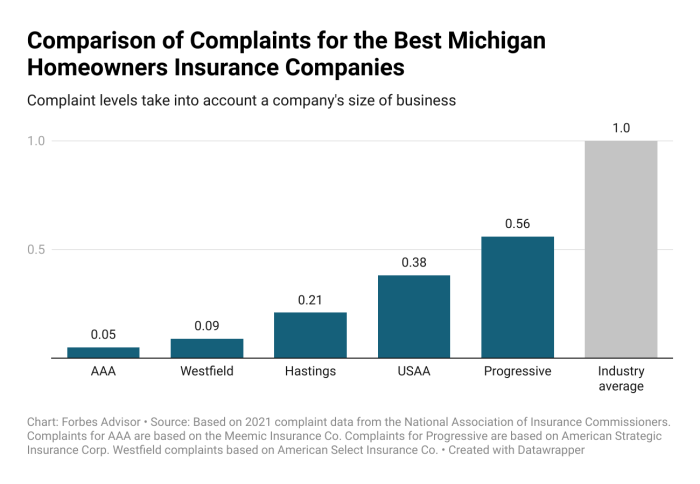

| Homeowners Insurance | Coverage for damage to a home and its contents. | Dwelling, personal property, liability | Financial solvency of insurers, market conduct |

| Health Insurance | Coverage for medical expenses. | Individual, family, employer-sponsored | Market regulation, compliance with the Affordable Care Act |

| Life Insurance | Coverage for death benefits. | Term life, whole life, universal life | Financial stability of insurers, consumer protection |

Licensing and Regulation within the MDI

The Michigan Department of Insurance (MDI) plays a crucial role in overseeing the insurance industry within the state, ensuring consumer protection and market stability. This involves a comprehensive licensing and regulatory framework governing all aspects of insurance operations, from initial licensing to ongoing compliance and disciplinary actions.

Obtaining an Insurance License in Michigan

The process of obtaining an insurance license in Michigan requires fulfilling specific educational, examination, and background check requirements. Applicants must first complete pre-licensing education courses approved by the MDI, covering relevant insurance principles and practices. Following successful completion, applicants must pass a state-administered licensing examination demonstrating competency in their chosen insurance line(s). Finally, a thorough background check is conducted to verify the applicant’s suitability for working in the insurance industry. The entire process can take several weeks or months, depending on the applicant’s preparation and the processing time of the MDI.

Maintaining an Insurance License

Maintaining an active insurance license in Michigan requires ongoing compliance with various MDI regulations. Licensees must complete continuing education courses annually to stay updated on industry changes and best practices. They are also obligated to report any changes in their business structure, employment status, or disciplinary actions to the MDI promptly. Failure to meet these requirements can result in license suspension or revocation. Specific continuing education requirements vary based on the type of license held.

Disciplinary Actions Against Licensees

The MDI possesses the authority to take disciplinary actions against licensees who violate state insurance laws or regulations. These actions can range from issuing warnings and fines to suspending or revoking licenses. More severe violations may lead to legal action, including criminal charges in some cases. The MDI investigates complaints against licensees and conducts audits to ensure compliance. The severity of the disciplinary action is determined based on the nature and severity of the violation, as well as the licensee’s history.

Common Violations and Their Consequences

Common violations include misrepresentation of insurance products, failure to comply with continuing education requirements, engaging in unfair or deceptive business practices, and mishandling of client funds. Consequences for these violations can range from fines and license suspension to criminal prosecution, depending on the severity of the infraction and the intent involved. For example, misrepresentation of policy benefits could lead to significant fines and the loss of the license, while failure to complete continuing education may result in a temporary suspension until the requirements are met.

Flowchart Illustrating the Licensing Process

The flowchart would begin with the “Application Submission” box, followed by a “Pre-Licensing Education Completion” box. A decision diamond would then assess whether the education is complete; a “Yes” path leads to the “Licensing Examination” box, while a “No” path loops back to the “Pre-Licensing Education Completion” box. Following successful completion of the exam (another decision diamond), a “Background Check” box is reached. After a successful background check, the final box would be “License Issuance”. A “No” path in the background check or exam stages would lead to a “License Denied” box.

Consumer Protection and Resources Offered by the MDI

The Michigan Department of Insurance (MDI) is dedicated to protecting Michigan consumers by ensuring a fair and competitive insurance marketplace. This involves enforcing consumer protection laws, providing resources to help consumers navigate the insurance system, and resolving disputes between consumers and insurance companies. The MDI strives to empower consumers to make informed decisions about their insurance needs and to seek redress when necessary.

The MDI enforces numerous consumer protection laws designed to prevent unfair and deceptive insurance practices. These laws cover various aspects of insurance, including policy terms, claims handling, and marketing practices. Specific examples include regulations against discriminatory practices, requirements for clear and understandable policy language, and prohibitions against unfair claim settlement practices. The MDI actively monitors insurance companies to ensure compliance with these laws and takes appropriate action against those found in violation.

MDI’s Consumer Complaint Handling Process

The MDI provides a straightforward process for consumers to file complaints against insurance companies. Consumers can submit complaints online, by mail, or by phone. The MDI’s trained staff carefully reviews each complaint, investigating the matter thoroughly. This may involve contacting the insurance company to obtain their perspective and relevant documentation. The MDI aims to resolve complaints fairly and efficiently, often mediating between the consumer and the insurance company to reach a mutually agreeable solution. If mediation fails, the MDI may take further action, such as issuing a cease and desist order or initiating formal administrative proceedings. The entire process is designed to be accessible and supportive to consumers.

Resources Available to Consumers

Consumers facing issues with their insurance can access various resources offered by the MDI. These resources include informative publications on various insurance topics, online tools and resources to help consumers compare insurance options and understand their policies, and access to trained staff who can answer questions and provide guidance. The MDI website provides a wealth of information, including frequently asked questions and answers, consumer alerts about scams, and details on filing a complaint. Additionally, the MDI offers educational materials and workshops to help consumers better understand insurance concepts and their rights.

Frequently Asked Questions about Insurance

Understanding insurance can be complex. The following are answers to some commonly asked questions:

- What should I do if my insurance claim is denied? Review your policy carefully to understand the coverage and reasons for denial. Contact your insurance company to discuss the denial and request a detailed explanation. If you are still unsatisfied, file a complaint with the MDI.

- How can I compare insurance quotes? Use online comparison tools, contact multiple insurance providers directly, and carefully review the policy details, coverage, and pricing before making a decision.

- What are my rights as an insurance consumer? You have the right to fair and equitable treatment, clear and understandable policy language, and prompt handling of your claims. You also have the right to file a complaint with the MDI if you believe your rights have been violated.

- What types of insurance are regulated by the MDI? The MDI regulates a wide range of insurance products, including auto, home, health, life, and disability insurance.

- How can I verify if an insurance company is licensed in Michigan? Check the MDI’s website for a list of licensed insurers or contact the MDI directly.

Financial Oversight and Solvency of Insurance Companies

The Michigan Department of Insurance (MDI) plays a critical role in maintaining the financial stability of the insurance market within the state. This involves rigorous monitoring of insurance companies’ financial health and a proactive approach to addressing potential insolvency issues. The MDI’s actions directly impact the security of policyholders and the overall stability of the Michigan insurance landscape.

The MDI employs a multifaceted approach to monitor the financial health of insurance companies operating in Michigan. This involves regular reviews of financial statements, on-site examinations, and analysis of various financial ratios and risk assessments. The department uses a combination of quantitative and qualitative measures to gain a comprehensive understanding of an insurer’s financial strength and ability to meet its obligations. Early intervention and corrective actions are key components of this process.

Methods for Monitoring Financial Health

The MDI utilizes several methods to assess the financial health of insurance companies. These include, but are not limited to, the review of annual statements, which provide a detailed overview of an insurer’s financial position. These statements are meticulously examined for signs of weakness or potential problems. Additionally, the MDI conducts on-site examinations of insurers’ operations, allowing for a more in-depth assessment of their risk management practices and internal controls. This hands-on approach helps to identify any potential vulnerabilities not readily apparent from financial statements alone. Furthermore, the MDI employs sophisticated analytical tools to assess various financial ratios and risk measures, providing a quantitative basis for evaluating an insurer’s solvency. These tools are constantly refined to reflect evolving industry practices and risks.

Dealing with Insolvent Insurance Companies

When an insurance company becomes insolvent, the MDI initiates a controlled process to protect policyholders and minimize disruption to the insurance market. This typically involves taking control of the insurer’s assets and liabilities. The MDI may then work to arrange for the transfer of policies to another solvent insurer or initiate liquidation proceedings to distribute available assets to creditors and policyholders. The priority is to ensure that policyholders receive the benefits they are entitled to, even if the original insurer is no longer operational. The MDI’s role is to act as a regulator and protector of the public interest during these challenging situations.

Ensuring Solvency of the Michigan Insurance Market

The MDI’s role in ensuring the solvency of the Michigan insurance market extends beyond individual company oversight. The department actively works to create and maintain a regulatory environment that promotes financial stability. This includes establishing and enforcing appropriate capital requirements for insurers, developing and implementing effective risk-based supervision frameworks, and promoting market transparency and competition. The MDI also collaborates with other state insurance departments and national organizations to share information and best practices, ensuring a consistent and effective approach to solvency regulation across the country. The MDI’s proactive and preventative approach to solvency regulation aims to avoid crises and protect Michigan’s consumers.

Comparison of Financial Solvency Measures

The MDI uses several financial solvency measures to assess the financial health of insurance companies. The specific weights and importance of these measures can vary depending on the type of insurer and the specific circumstances.

| Solvency Measure | Description | Advantages | Limitations |

|---|---|---|---|

| Risk-Based Capital (RBC) Ratio | Compares an insurer’s capital to its risk profile. | Provides a comprehensive view of solvency risk. | Can be complex to calculate and interpret. |

| Policyholder Surplus | The difference between an insurer’s assets and liabilities. | Simple and readily available. | Doesn’t fully capture risk profile. |

| Combined Ratio | Measures the insurer’s underwriting profitability. | Indicates the effectiveness of underwriting practices. | Can be influenced by factors other than solvency. |

| Investment Income Ratio | Measures the return on investment relative to premiums. | Indicates the effectiveness of investment strategy. | Can be volatile due to market fluctuations. |

Significant Legislation and Recent Developments

The Michigan Department of Insurance (MDI) operates within a dynamic regulatory environment, constantly adapting to evolving legislation, technological advancements, and judicial interpretations. Understanding these changes is crucial for both the insurance industry and consumers in Michigan. This section highlights key legislative actions, regulatory shifts, and legal precedents that have shaped the MDI’s activities in recent years.

Key Legislative Actions Impacting the MDI

Several pieces of legislation have significantly impacted the MDI and the insurance landscape in Michigan. For example, the passage of [Specific Legislation Name and Year, e.g., the “Act to Modernize Insurance Regulation,” 2023] introduced [brief description of impact, e.g., new requirements for data security and privacy within the insurance industry, leading to updated MDI guidelines and enforcement procedures]. Another example is [Specific Legislation Name and Year, e.g., the “Consumer Protection Act Amendment,” 2022] which [brief description of impact, e.g., strengthened consumer protections related to unfair claims practices, resulting in increased MDI oversight and investigations]. These legislative changes have necessitated significant adjustments within the MDI’s operational framework and enforcement strategies.

Recent Changes in MDI Regulations and Policies

The MDI has implemented several key regulatory changes in response to both legislative mandates and evolving industry needs. One notable example is the [Specific Regulatory Change, e.g., updated regulations concerning the use of artificial intelligence in underwriting], which [brief description of impact, e.g., establishes clear guidelines and oversight for AI applications to ensure fairness and transparency]. Another significant change involves [Specific Regulatory Change, e.g., the revised procedures for processing insurance license applications], designed to [brief description of impact, e.g., streamline the application process and reduce processing times for applicants]. These policy adjustments reflect the MDI’s commitment to modernizing its operations and ensuring a fair and efficient regulatory environment.

Impact of Recent Legal Cases and Rulings

Recent legal cases have had a notable influence on the MDI’s approach to regulation and enforcement. For instance, the outcome of [Specific Case Name and Year] [brief description of impact, e.g., clarified the legal definition of “unfair claim settlement practices,” prompting the MDI to revise its investigative protocols and enforcement actions]. This case highlighted the importance of [Specific aspect, e.g., clear and consistent application of regulations to ensure fairness and protect consumer rights]. Similarly, the ruling in [Specific Case Name and Year] [brief description of impact, e.g., set a precedent for the handling of disputes related to insurance coverage in specific circumstances]. These legal developments directly shape the MDI’s ongoing efforts to ensure regulatory compliance and protect the interests of both consumers and insurers.

Impact of Technological Advancements on MDI Operations

Technological advancements are fundamentally transforming the MDI’s operational efficiency and regulatory capabilities. The increasing use of [Specific Technology, e.g., data analytics and machine learning] allows for [brief description of impact, e.g., more effective identification of potential fraud and risk assessment]. The MDI’s adoption of [Specific Technology, e.g., online platforms for licensing and complaint filing] has streamlined processes, improving service delivery for both industry stakeholders and consumers. These technological upgrades represent a significant investment in modernizing the MDI’s infrastructure and enhancing its ability to regulate effectively in a rapidly evolving digital landscape. The transition to digital systems also requires ongoing adaptation and training to ensure staff proficiency and data security.

The MDI’s Role in Specific Insurance Types

The Michigan Department of Insurance (MDI) plays a crucial role in overseeing various insurance sectors, ensuring fair practices and consumer protection across the board. Its regulatory approach varies depending on the specific type of insurance, reflecting the unique risks and complexities associated with each.

Auto Insurance Regulation in Michigan

The MDI’s regulation of auto insurance in Michigan is particularly significant given the state’s unique history and recent legislative changes. The MDI is responsible for licensing and monitoring auto insurers, ensuring they comply with state laws regarding minimum coverage requirements, rate filings, and claims handling. This includes oversight of the no-fault system, a key component of Michigan’s auto insurance landscape, which dictates how medical and other related expenses are handled following accidents. The MDI actively works to prevent unfair or deceptive practices and ensures insurers are financially sound enough to meet their obligations to policyholders. Recent legislative reforms have focused on cost containment and consumer choice, and the MDI plays a central role in implementing and monitoring these changes.

Health Insurance Regulation

The MDI regulates health insurance companies operating within Michigan, ensuring compliance with state and federal laws, including the Affordable Care Act (ACA). This involves reviewing rate filings, ensuring compliance with mandated benefits, and monitoring marketing practices to prevent misleading or deceptive advertising. The MDI also investigates consumer complaints related to health insurance, mediating disputes and taking enforcement actions when necessary. The MDI’s role in health insurance regulation extends to monitoring the solvency of health insurers, ensuring they can meet their obligations to policyholders. The agency actively participates in efforts to improve access to affordable and quality health care.

Life Insurance Oversight

The MDI’s oversight of life insurance policies focuses on protecting consumers and ensuring the financial stability of life insurance companies. This includes reviewing and approving policy forms, monitoring the solvency of life insurers, and investigating complaints related to life insurance sales practices and claims handling. The MDI ensures that life insurance companies adhere to state laws concerning policy disclosures, suitability of products, and fair claims practices. This regulatory framework is designed to safeguard consumers from unfair or deceptive practices and ensure that they receive the benefits they are entitled to under their policies. The MDI also plays a role in educating consumers about life insurance options and assisting them in making informed decisions.

Comparative Regulatory Approaches

While the MDI’s regulatory approach across different insurance types shares common goals—consumer protection and insurer solvency—the specific methods and emphasis vary. Auto insurance, with its unique no-fault system and high volume of claims, requires a different regulatory focus than life insurance, which involves long-term contracts and complex financial calculations. Health insurance regulation involves a complex interplay of state and federal laws, demanding a coordinated approach involving multiple regulatory bodies. The MDI adapts its regulatory strategy to the specific characteristics and risks associated with each insurance type, ensuring a balanced approach that fosters both market stability and consumer protection.

Illustrative Example: A Case Study of MDI Enforcement

This section details a hypothetical scenario illustrating how the Michigan Department of Insurance (MDI) investigates fraudulent insurance claims and the subsequent enforcement actions. Understanding this process helps consumers understand their rights and responsibilities when dealing with insurance matters.

The following case study depicts a fictional scenario but reflects the general investigative procedures and legal processes employed by the MDI.

Fraudulent Auto Insurance Claim Investigation

A claimant, Mr. John Smith, filed a claim with his insurer, “Acme Insurance,” for significant damage to his vehicle following a purported collision. He claimed the accident occurred on a specific date and time, providing a detailed account of the incident and substantial supporting documentation, including photos of the damaged vehicle. However, Acme Insurance suspected fraud due to inconsistencies in Mr. Smith’s statements and the photographic evidence. They referred the case to the MDI for investigation.

MDI Investigative Process

The MDI initiated an investigation by reviewing the claim file provided by Acme Insurance. This included Mr. Smith’s claim form, police reports (if any), repair estimates, photographs of the vehicle damage, and witness statements. Investigators also conducted interviews with Mr. Smith, verifying his account of the accident. They independently investigated the location of the alleged accident, checking for traffic camera footage or witness accounts that might corroborate or contradict Mr. Smith’s story. Furthermore, the MDI reviewed Mr. Smith’s driving record and insurance history to identify any potential patterns of fraudulent behavior. Discrepancies were found between the reported time of the accident and Mr. Smith’s cell phone location data.

Evidence Gathered and Outcome

The MDI’s investigation uncovered several inconsistencies. The photos of the damage did not align with the severity of the accident described by Mr. Smith. Independent analysis of the vehicle damage suggested the damage was not consistent with the type of accident described. Furthermore, the cell phone location data indicated Mr. Smith was in a different location than he claimed at the time of the alleged accident. This evidence strongly suggested Mr. Smith had fabricated the accident to obtain an insurance payout. Based on this evidence, the MDI determined Mr. Smith had committed insurance fraud. The MDI imposed a significant fine on Mr. Smith and referred the case to the appropriate prosecuting authorities for potential criminal charges. Acme Insurance was reimbursed for the costs of the investigation.

Filing a Complaint with the MDI

To file a complaint against an insurance company with the MDI, consumers must submit a written complaint outlining the issue. This should include the name and contact information of the complainant, the name of the insurance company, the policy number (if applicable), a detailed description of the complaint, and any supporting documentation, such as correspondence with the insurance company or relevant policy documents. The MDI will acknowledge receipt of the complaint and begin an investigation, which typically involves contacting the insurance company and reviewing the relevant documentation. The timeline for resolving a complaint varies depending on the complexity of the issue, but the MDI strives to resolve complaints efficiently and fairly.

Final Summary

The Michigan Department of Insurance stands as a crucial guardian of consumer rights and market stability within the state’s insurance landscape. Through its comprehensive regulatory framework, robust consumer protection measures, and rigorous financial oversight, the MDI strives to maintain a fair and transparent insurance market. By understanding the MDI’s role and utilizing the resources it provides, Michigan residents and industry professionals alike can navigate the complexities of insurance with greater confidence and security. This comprehensive overview has highlighted the MDI’s multifaceted responsibilities, providing a clearer understanding of its crucial role in Michigan’s economic ecosystem.

FAQs

What types of insurance are NOT regulated by the MDI?

The MDI primarily regulates insurance lines offered by licensed insurers. It generally does not regulate self-insurance programs or certain types of surety bonds.

How long does it take to get a response to a complaint filed with the MDI?

Response times vary depending on the complexity of the complaint. The MDI aims to resolve complaints efficiently, but some may require more investigation than others.

Can I file a complaint anonymously with the MDI?

While anonymity is not guaranteed, the MDI will treat all complaints confidentially and protect the identity of the complainant to the extent possible.

What happens if an insurance company goes bankrupt?

The MDI works to ensure policyholders are protected through the state’s guaranty association, which provides a safety net for certain claims.

Where can I find information about insurance rates in Michigan?

The MDI website provides resources and data related to insurance rates, though specific rates depend on numerous factors and are not always publicly available.

На данном ресурсе посетители можете ознакомиться с важной информацией о лечении депрессии у пожилых людей. Здесь собраны рекомендации и обзоры методов борьбы с этим состоянием.

http://livespark.co.uk/2017/01/25/a-day-alone-at-the-sea/