Navigating the world of car insurance can feel like deciphering a complex code. With countless providers offering a bewildering array of coverage options and prices, finding the best value can seem daunting. This guide unravels the intricacies of price comparing car insurance, empowering you to make informed decisions and secure the optimal policy for your needs and budget. We’ll explore consumer behavior, key features to consider, effective comparison methods, and strategies for securing the best possible rates.

From understanding the influence of personal factors like age and driving history to leveraging online tools and negotiating premiums, we’ll equip you with the knowledge and techniques to confidently navigate the car insurance landscape. We’ll also delve into the often-overlooked aspects, such as hidden fees and the benefits of bundling policies, ensuring you’re fully prepared to make a smart choice.

Understanding Consumer Behavior in Car Insurance Price Comparisons

The process of choosing car insurance often involves a complex interplay of factors beyond simply finding the cheapest option. Consumers navigate a multifaceted decision-making journey influenced by various personal, financial, and technological elements. Understanding this behavior is crucial for insurers to effectively target their marketing and product offerings.

Consumers typically begin their car insurance search with an initial online search, often using comparison websites. This initial phase is driven by a need for quick price comparisons and a broad overview of available options. The subsequent stages involve deeper dives into specific insurer offerings, reviews, and policy details. This often involves cross-referencing information from multiple sources before making a final decision.

Factors Influencing Car Insurance Choice Beyond Price

Price is undoubtedly a significant factor, but it rarely stands alone. Three key elements often outweigh the purely financial aspect: trustworthiness and reputation of the insurer, the level of customer service provided, and the comprehensiveness of the coverage offered.

Consumers prioritize insurers with a strong reputation for fair claims handling and financial stability. Negative reviews or incidents of poor customer service can significantly impact a potential customer’s decision, regardless of price differences. Similarly, the extent and quality of coverage offered – including optional add-ons – plays a vital role. A consumer might choose a slightly more expensive policy if it offers more comprehensive protection, such as roadside assistance or higher liability limits.

The Role of Online Resources in Price Comparisons

The internet has revolutionized the car insurance comparison process. Online comparison websites aggregate quotes from multiple insurers, allowing consumers to easily compare prices and coverage options side-by-side. These platforms provide a crucial starting point for many consumers, offering a convenient and efficient way to narrow down their choices. Furthermore, online reviews and forums provide valuable social proof, influencing consumer perceptions of different insurers and their services. Access to policy details, FAQs, and online customer support further enhances the online experience, allowing for informed decision-making.

Hypothetical User Journey for Car Insurance Research

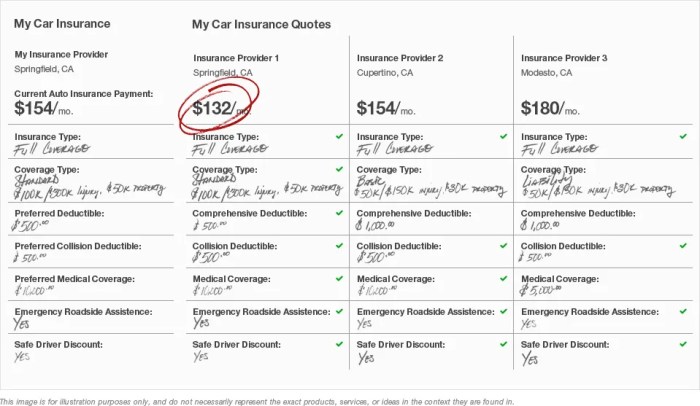

Imagine Sarah, a new driver, needing car insurance. Her journey might start with a Google search for “cheap car insurance.” She lands on a comparison website, inputs her details (age, car details, driving history), and receives several quotes. She then visits the websites of the top three insurers, comparing their policy details, customer reviews on independent review sites, and checking their financial ratings with a reputable agency. She might contact one or two insurers directly with specific questions about coverage before finally selecting a policy that best balances price, coverage, and reputation. This process highlights the multi-stage nature of the decision-making process, showing that price is only one piece of a larger puzzle.

Key Features and Benefits Considered During Price Comparisons

Choosing car insurance involves a careful balancing act between cost and coverage. Consumers often prioritize price, but the level of protection offered is equally, if not more, crucial. Understanding the interplay between these factors is key to making an informed decision.

The decision-making process is complex, influenced by individual risk tolerance, financial capacity, and perceived value of different features. While a lower premium is undeniably attractive, sacrificing essential coverage for a few dollars saved can have significant financial repercussions in the event of an accident. This section will explore the key features and benefits consumers consider when comparing car insurance prices, highlighting the trade-offs involved.

Coverage Options Versus Price

The relationship between coverage options and price is directly proportional. More comprehensive coverage, such as collision and comprehensive, typically results in higher premiums. Liability coverage, which protects against claims from others involved in an accident you caused, is usually mandatory and forms the base of most policies. However, the limits of liability coverage (e.g., $100,000/$300,000) significantly influence the price. Higher limits offer greater protection but come at a higher cost. Conversely, choosing lower coverage limits, while saving money upfront, exposes the policyholder to greater financial risk in the event of a serious accident. For instance, someone with a high-value vehicle might opt for higher collision and comprehensive coverage to ensure adequate repair or replacement, accepting a higher premium in return. Conversely, someone with an older, less valuable vehicle might choose lower coverage limits, prioritizing affordability over extensive protection.

Impact of Deductibles on Overall Cost

Deductibles represent the amount a policyholder pays out-of-pocket before insurance coverage kicks in. Higher deductibles directly translate to lower premiums. This is because the insurance company’s financial liability is reduced. A $500 deductible, for example, means the policyholder will pay the first $500 of any claim, while the insurer covers the rest. Choosing a higher deductible, say $1000 or $2000, will significantly lower the premium but increases the out-of-pocket expense in case of a claim. The optimal deductible amount depends on the individual’s risk tolerance and financial situation. Someone with a higher savings capacity might opt for a higher deductible to save on premiums, while someone with limited savings might prefer a lower deductible for greater financial protection.

Influence of Additional Features

Beyond basic coverage and deductibles, several additional features influence consumer choices. These add-ons offer enhanced protection and convenience but often come at an extra cost. The decision of whether or not to include them depends on individual needs and priorities.

| Feature | Description | Impact on Price | Consumer Value |

|---|---|---|---|

| Roadside Assistance | Provides services like towing, flat tire changes, and jump starts. | Slightly increases premium. | High value for drivers who frequently travel or live in remote areas. |

| Accident Forgiveness | Protects against premium increases after an at-fault accident. | Moderately increases premium. | High value for drivers concerned about maintaining a good driving record and low premiums. |

| Rental Car Reimbursement | Covers the cost of a rental car while your vehicle is being repaired after an accident. | Moderately increases premium. | High value for drivers who rely on their vehicle for daily commuting or work. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re involved in an accident with an uninsured or underinsured driver. | Moderately increases premium. | High value, especially in areas with high rates of uninsured drivers. |

Visualizing Price Comparison Data

Understanding how to visualize car insurance price comparisons is crucial for making informed decisions. Effective visualizations can quickly highlight key differences between policies and insurers, simplifying the often complex process of choosing the right coverage. Clear visual representations allow consumers to easily compare price points, coverage details, and overall value.

Effective visualization methods for car insurance price comparisons can significantly improve consumer understanding and decision-making. By presenting data in a clear and concise manner, consumers can readily identify the best options based on their individual needs and budgets.

Price Range Visualization for a Standardized Profile

This visualization uses a bar chart to represent the price range of different insurers for a standardized driver profile (e.g., 30-year-old male, clean driving record, driving a mid-size sedan in a specific zip code). The horizontal axis (x-axis) lists the names of different insurance companies (e.g., Company A, Company B, Company C, etc.). The vertical axis (y-axis) represents the annual premium cost, measured in dollars. Each insurance company is represented by a bar, with the height of the bar corresponding to its quoted annual premium. Data points would include the specific premium cost for each insurer. For example, Company A might have a bar reaching $1200, Company B at $1000, and Company C at $1500, clearly showing the range of prices. The chart title would be “Annual Premiums for Standardized Driver Profile”.

Comparison of Two Policies with Different Coverage Levels

A table is an effective way to compare two insurance policies with varying coverage levels and prices. The table would have two columns, one for each policy (e.g., Policy X and Policy Y). The rows would list key features, including coverage limits for liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments. Another row would specify the annual premium for each policy. For example, Policy X might offer higher liability coverage ($100,000/$300,000) but cost $1300 annually, while Policy Y might have lower liability coverage ($50,000/$100,000) at a cost of $1000 annually. The table would clearly show the trade-off between coverage levels and cost, enabling consumers to assess the value proposition of each policy. The table title would be “Comparison of Policy X and Policy Y”.

Strategies for Finding the Best Value

Finding the best car insurance value isn’t just about the lowest initial quote; it’s about securing comprehensive coverage at a price that aligns with your budget and risk profile. This involves proactive strategies, careful scrutiny of policy details, and an understanding of how different insurers operate.

Negotiating Lower Premiums

Successfully negotiating lower premiums often hinges on demonstrating your responsible driving history and commitment to risk mitigation. Insurers appreciate evidence of safe driving, such as a clean driving record, completion of defensive driving courses, and the installation of telematics devices that monitor driving habits. Presenting these factors during your initial quote request or during a renewal discussion can significantly impact your premium. Furthermore, comparing quotes from multiple insurers and highlighting a competitor’s lower offer can often incentivize your current insurer to match or better the price. Remember to be polite but firm in your negotiations, emphasizing your loyalty if applicable.

Careful Review of Policy Details

Reading the fine print is crucial. Don’t just focus on the premium; understand the coverage limits, deductibles, exclusions, and any additional fees. A lower premium with significantly restricted coverage might ultimately prove more expensive in the event of an accident. Pay close attention to the definitions of covered events and what constitutes a claim. Understanding the claims process, including how to report an incident and what documentation is required, is also essential. This proactive approach minimizes unexpected surprises and ensures you are adequately protected.

Avoiding Hidden Fees and Unexpected Costs

Hidden fees can significantly inflate your overall insurance cost. Common hidden fees include administrative charges, policy processing fees, and even charges for specific add-ons that might not be clearly Artikeld in the initial quote. Always ask for a complete breakdown of all fees and charges associated with the policy. Scrutinize the policy document for any clauses that might lead to unexpected expenses, such as fees for specific types of claims or penalties for late payments. Comparing quotes from different insurers with transparent fee structures is essential to avoid these hidden costs.

Benefits of Bundling Insurance Policies

Bundling your home and auto insurance policies with the same insurer often results in significant discounts. Insurers frequently offer bundled packages at a lower overall cost than purchasing each policy separately. This is because the insurer reduces administrative costs by managing both policies under one account. The exact discount varies by insurer and the specific policies being bundled, but the savings can be substantial, potentially amounting to hundreds of dollars annually. It’s worth exploring this option to see if it fits your needs and budget.

Summary

Ultimately, price comparing car insurance is a journey of informed decision-making. By understanding your individual needs, leveraging available resources effectively, and negotiating strategically, you can secure comprehensive coverage at a price that aligns with your budget. Remember, the cheapest policy isn’t always the best; finding the right balance between price and coverage is key to achieving peace of mind on the road. This guide provides the tools; now it’s time to take control of your car insurance costs.

Frequently Asked Questions

What is the best time of year to buy car insurance?

While there’s no single “best” time, shopping around closer to your renewal date allows for direct comparison with your current policy. Some insurers may offer discounts during specific promotional periods.

Can I compare car insurance without providing my personal information?

Many comparison websites offer initial estimates without requiring full personal details. However, to obtain accurate quotes, you’ll eventually need to provide some information.

How often should I compare car insurance rates?

It’s advisable to compare rates at least annually, or even more frequently if your circumstances change significantly (e.g., new car, change in address, driving record improvement).

What if I have a poor driving record?

Insurers will consider your driving history. While rates may be higher, comparing quotes from different insurers is crucial, as they may weigh factors differently. Some may specialize in high-risk drivers.