Bringing a new puppy home is an exciting time, filled with boundless joy and the promise of unconditional love. However, responsible pet ownership also involves considering the unexpected – veterinary emergencies and illnesses. Understanding puppy insurance prices is crucial to ensuring your furry friend receives the best possible care without placing undue financial strain on your household. This guide delves into the intricacies of puppy insurance costs, helping you navigate the complexities of coverage options and make informed decisions.

From breed-specific predispositions to the nuances of policy terms, we’ll explore the key factors influencing premiums and provide practical strategies for securing affordable yet comprehensive coverage. We’ll compare different insurance providers, analyze various coverage types, and offer insights into finding the best value for your money. Ultimately, our goal is to empower you with the knowledge needed to protect your beloved companion’s health and well-being.

Factors Influencing Puppy Insurance Costs

Securing pet insurance for your new puppy is a significant decision, and understanding the factors that influence the cost is crucial for budgeting effectively. Several key elements determine your monthly premium, and comparing different providers is essential to find the best value for your needs.

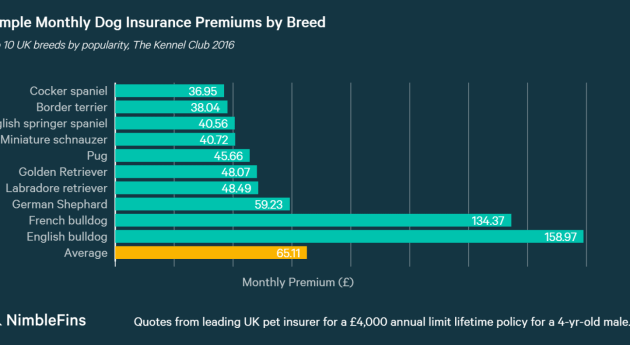

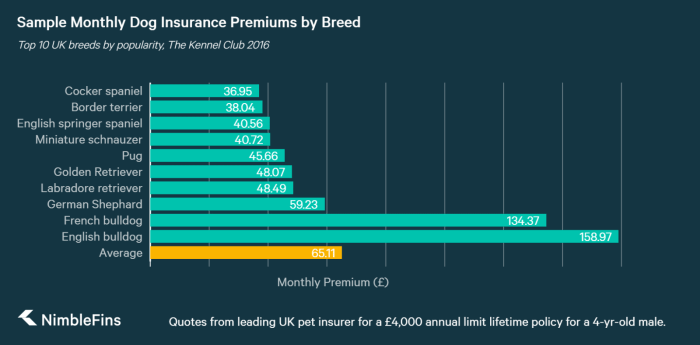

Breed

A puppy’s breed significantly impacts insurance premiums. Certain breeds are predisposed to specific health conditions, leading to higher expected veterinary costs. For example, breeds prone to hip dysplasia (like German Shepherds) or eye problems (like Poodles) will generally command higher premiums than breeds with a history of robust health. Insurers use actuarial data and breed-specific health statistics to assess risk and set premiums accordingly. Breeds with a documented history of expensive health issues will naturally result in higher insurance costs.

Age

The age of your puppy is another critical factor. Puppies are generally considered healthier and less prone to serious illnesses than older dogs. Therefore, premiums are typically lower for younger puppies. As your puppy ages, the risk of developing health problems increases, and consequently, so do your insurance premiums. Many insurers offer discounts for enrolling puppies at a young age, incentivizing early coverage.

Location

Your geographic location plays a role in determining insurance costs. Areas with higher veterinary costs tend to have higher insurance premiums. This is because the insurer needs to cover the expected expenses of veterinary care within that region. Similarly, areas with a higher prevalence of certain diseases may also see increased premiums.

Pre-existing Conditions

Pre-existing conditions are a significant factor impacting insurance coverage. Most insurers will not cover conditions that existed before the policy’s effective date. This means any health problems your puppy had before you purchased the insurance will likely be excluded from coverage. Therefore, it’s crucial to enroll your puppy in insurance as early as possible to maximize coverage and minimize exclusions.

Comparison of Pricing Structures and Coverage

Different insurance providers offer varying pricing structures and coverage levels. Some may offer comprehensive coverage encompassing a wide range of illnesses and accidents, while others might focus on specific areas. Policies with higher premiums generally offer broader coverage, including options like accident-only coverage, comprehensive coverage, and wellness plans. It’s vital to compare policies from multiple providers, carefully examining the details of their coverage, deductibles, and reimbursement percentages. For instance, one insurer might offer a lower monthly premium but a high deductible, while another might have a higher monthly premium but a lower deductible. Choosing the best policy depends on your individual financial situation and risk tolerance.

Impact of Deductible and Reimbursement Levels

The deductible and reimbursement percentage significantly influence the overall cost of your pet insurance. The deductible is the amount you pay out-of-pocket before the insurance coverage kicks in. A higher deductible generally leads to lower monthly premiums, but you’ll pay more upfront if your puppy requires veterinary care. The reimbursement percentage represents the proportion of veterinary bills the insurer will cover after you meet your deductible. A higher reimbursement percentage (e.g., 90%) means the insurer covers a larger share of the costs, resulting in lower out-of-pocket expenses but typically higher premiums.

Example Premiums

| Breed | Age | Average Monthly Premium | Key Coverage Details |

|---|---|---|---|

| Golden Retriever | 8 Weeks | $50 | Accident & Illness, $500 deductible, 80% reimbursement |

| French Bulldog | 8 Weeks | $65 | Accident & Illness, $250 deductible, 90% reimbursement |

| German Shepherd | 8 Weeks | $75 | Accident & Illness, $500 deductible, 70% reimbursement |

| Labrador Retriever | 1 Year | $60 | Accident & Illness, $500 deductible, 80% reimbursement |

Types of Puppy Insurance Coverage

Choosing the right puppy insurance involves understanding the different coverage levels available. Pet insurance policies typically fall into three main categories: accident-only, accident and illness, and comprehensive. Each offers a varying degree of protection and, consequently, comes with a different price tag. The best option for your puppy will depend on your budget and your risk tolerance.

Accident-Only Coverage

Accident-only plans cover veterinary costs associated with accidents your puppy might experience, such as broken bones, lacerations, or ingestion of foreign objects. These plans are generally the most affordable option, but they offer the least comprehensive protection. They will not cover illnesses, pre-existing conditions, or routine checkups.

- Policy Inclusions: Emergency veterinary care for accidents, diagnostic testing related to accidents, surgery resulting from accidents, hospitalization due to accidents.

- Policy Exclusions: Illnesses, pre-existing conditions, routine vaccinations, preventative care (e.g., flea and tick prevention), dental issues (unless directly caused by an accident), hereditary conditions.

Accident and Illness Coverage

This type of coverage expands upon accident-only plans by including illnesses in addition to accidents. This means your pet is protected against a wider range of health issues, offering greater peace of mind. While more expensive than accident-only plans, the increased protection can be worth the higher premiums, particularly for puppies who are more susceptible to illnesses.

- Policy Inclusions: All inclusions of accident-only plans, plus treatment for illnesses such as infections, allergies, and certain hereditary conditions (depending on the policy). Diagnostic testing for illnesses, medication, and hospitalization related to illness.

- Policy Exclusions: Pre-existing conditions, routine preventative care (e.g., vaccinations, dental cleanings), some hereditary conditions (depending on the policy), certain breed-specific conditions (e.g., hip dysplasia in certain breeds may have limitations on coverage).

Comprehensive Coverage

Comprehensive plans offer the most extensive protection, covering accidents, illnesses, and often including additional benefits like routine preventative care. These policies typically provide the highest level of protection but also come with the highest premiums. While the initial cost is higher, the long-term financial benefits could outweigh the expense, particularly for high-risk breeds or puppies with a history of health problems.

- Policy Inclusions: All inclusions of accident and illness plans, plus routine preventative care (e.g., vaccinations, dental cleanings), wellness exams, and potentially additional benefits such as alternative therapies (depending on the policy).

- Policy Exclusions: Pre-existing conditions, some hereditary conditions (depending on the policy), certain breed-specific conditions (depending on the policy), and exclusions might apply to specific treatments or procedures.

Finding Affordable Puppy Insurance

Securing comprehensive insurance for your new puppy doesn’t have to break the bank. Several strategies can help you find cost-effective plans without compromising essential coverage for your furry friend. Careful comparison shopping and understanding your options are key to finding the right balance between affordability and protection.

Finding affordable puppy insurance involves a strategic approach. This includes comparing quotes from multiple insurers, understanding the nuances of different coverage options, and considering the potential benefits of bundled plans. By adopting a proactive and informed approach, you can secure a plan that suits your budget and your puppy’s needs.

Comparing Quotes from Multiple Insurers

Obtaining quotes from several pet insurance providers is crucial for identifying the most competitive pricing. Different companies offer varying levels of coverage and pricing structures, so comparing apples to apples is essential. Websites that allow you to input your puppy’s breed, age, and location will often generate a list of potential plans and their associated premiums. Pay close attention to the details of each quote, focusing on the annual premium, deductible, reimbursement percentage, and any exclusions. For instance, one insurer might offer a lower annual premium but a higher deductible, while another might offer a higher premium with a lower deductible and better reimbursement. Careful comparison will reveal which insurer offers the best value for your specific needs and budget.

Benefits of Bundled Pet Insurance and Wellness Plans

Some pet insurance providers offer bundled packages that combine accident and illness coverage with wellness plans. These bundled plans often provide discounts compared to purchasing each coverage separately. Wellness plans typically cover routine care such as vaccinations, preventative medications, and annual check-ups. While the initial premium might be higher than a basic accident and illness plan, the bundled approach can prove more cost-effective in the long run by reducing out-of-pocket expenses for routine care. For example, a bundled plan might include coverage for vaccinations, saving you several hundred dollars annually compared to paying for these services individually. However, carefully review the specifics of the wellness plan to ensure it aligns with your puppy’s anticipated healthcare needs.

A Step-by-Step Guide to Shopping for Pet Insurance

Effectively shopping for pet insurance involves a systematic approach. Following these steps will help you find a plan that meets your needs and budget:

- Determine Your Budget: Establish a realistic monthly or annual budget for pet insurance before you start comparing plans. This will help you narrow your search and avoid unexpected financial strain.

- Identify Your Needs: Consider the level of coverage you require. Do you need comprehensive coverage for accidents and illnesses, or would a more basic plan suffice? Think about your puppy’s breed and any predispositions to specific health problems.

- Gather Quotes: Request quotes from at least three different pet insurance providers. Use online comparison tools or contact insurers directly.

- Compare Coverage Details: Carefully review each quote, paying close attention to the annual premium, deductible, reimbursement percentage, and any exclusions or limitations.

- Read the Fine Print: Thoroughly read the policy documents before making a decision. Understand the terms and conditions, including waiting periods and claim procedures.

- Choose a Plan: Select the plan that best balances your budget and your puppy’s needs. Consider factors such as the likelihood of needing extensive veterinary care in the future.

Understanding Policy Terms and Conditions

Purchasing puppy insurance offers valuable protection, but a thorough understanding of the policy’s terms and conditions is crucial to ensure you receive the coverage you expect. Failing to review these details carefully can lead to unexpected costs and claim denials. This section will clarify key policy aspects to help you make informed decisions.

Policy terms and conditions are the legal agreement between you and the insurance provider. They Artikel the specifics of your coverage, including what is and isn’t covered, the procedures for filing a claim, and any limitations on benefits. Careful review is essential to avoid disappointment later.

Waiting Periods

Waiting periods are the timeframe after policy activation before coverage begins for specific conditions. For example, there might be a waiting period of 14 days for illness and 24 hours for accidents. These periods are designed to prevent people from purchasing insurance just before a known issue arises. Understanding the waiting periods for different types of conditions is essential for accurately assessing the policy’s value. A policy with shorter waiting periods generally offers better protection.

Exclusions

Insurance policies typically exclude certain conditions or treatments from coverage. Common exclusions might include pre-existing conditions (illnesses or injuries present before the policy starts), certain breeds predisposed to specific health issues, or elective procedures (such as spaying/neutering unless explicitly stated otherwise). Carefully reviewing the list of exclusions is critical to understanding the limitations of your coverage. For instance, a policy excluding hip dysplasia would not cover treatment costs related to that condition.

Claim Processes

The claim process Artikels the steps you must take to submit a claim for reimbursement. This usually involves providing documentation such as veterinary bills, diagnostic reports, and possibly a completed claim form. Understanding the required documentation and the process timeline is important for timely reimbursement. A complex or lengthy claim process could delay reimbursement, impacting your ability to cover veterinary expenses. Policies often have detailed instructions on submitting claims, including deadlines and required forms.

Examples of Policy Terms Impacting Claims

Let’s consider a hypothetical scenario. Imagine your puppy develops hip dysplasia after the waiting period. However, the policy excludes pre-existing conditions, and a vet examination before the policy began noted a slight hip abnormality. The insurer could deny the claim, citing the pre-existing condition exclusion. Conversely, if your puppy injures its leg in an accident, and the policy includes accident coverage without a waiting period, the claim would likely be approved, provided all other policy conditions are met.

Interpreting Key Sections of a Sample Policy Document

A typical policy document will include sections detailing the covered perils (accidents and illnesses), exclusions, waiting periods, claim procedures, and policy limits (maximum payout amounts). It might also contain information on premium payments, policy cancellation, and dispute resolution processes. Each section should be read carefully, paying attention to the specific wording and any limitations on coverage. For example, a section on “covered illnesses” may list specific conditions or specify that only illnesses diagnosed by a licensed veterinarian are covered. A detailed review of these sections is vital to ensuring the policy aligns with your needs and expectations.

Illustrative Examples of Puppy Insurance Costs

Understanding the cost of puppy insurance can be complex, as premiums vary significantly based on several factors. These factors include breed, age, location, coverage level, and the specific insurer. The following examples illustrate the potential annual costs for different breeds and coverage levels. Remember that these are estimates, and actual costs may vary. It’s crucial to obtain quotes from multiple insurers for the most accurate pricing.

Puppy Insurance Cost Scenarios

The following table provides three illustrative examples of annual puppy insurance costs, showcasing the differences based on breed size and coverage level. These are hypothetical examples for illustrative purposes only and do not reflect any specific insurer’s pricing. Always contact insurance providers directly for accurate quotes.

| Breed | Age | Annual Premium | Coverage Details |

|---|---|---|---|

| Chihuahua | 8 weeks | $300 | Accident & Illness coverage, $250 deductible, 80% reimbursement |

| Beagle | 12 weeks | $450 | Accident & Illness coverage, $500 deductible, 70% reimbursement |

| Great Dane | 16 weeks | $700 | Accident & Illness coverage, $1000 deductible, 60% reimbursement |

Final Summary

Securing adequate puppy insurance is an investment in your pet’s health and your peace of mind. By carefully considering the factors influencing prices, comparing different providers and coverage options, and understanding policy terms, you can find a plan that aligns with your budget and your puppy’s needs. Remember, proactive planning can significantly mitigate the financial burden of unexpected veterinary expenses, allowing you to focus on providing the best possible care for your furry friend throughout their life. Choosing the right insurance is a key step in responsible pet ownership, ensuring a healthier and happier future for both you and your beloved companion.

FAQ Explained

What is a waiting period in puppy insurance?

A waiting period is the time after you purchase a policy before coverage begins for certain conditions (e.g., illnesses). This period typically varies by condition and insurer.

Can I get insurance for a puppy with pre-existing conditions?

Generally, pre-existing conditions are not covered by pet insurance. It’s crucial to obtain coverage before your puppy develops any health issues.

How do I file a claim with my pet insurance provider?

The claims process varies by insurer, but typically involves submitting veterinary bills and a claim form. Check your policy documents for specific instructions.

What factors influence the deductible amount?

Deductibles are often influenced by the level of coverage you choose and the type of policy (annual or per-incident). Higher coverage typically means a higher deductible.

Does my puppy’s breed affect insurance costs?

Yes, certain breeds are predisposed to specific health problems, leading to higher premiums. Larger breeds often have higher costs than smaller breeds.