Finding the right car insurance can feel overwhelming, but it doesn’t have to be a time-consuming ordeal. The demand for quick car insurance quotes reflects a modern need for speed and efficiency. This guide explores the user experience behind obtaining these quotes, analyzing the factors influencing speed and clarity, and offering insights into optimizing the entire process for both providers and consumers.

We’ll delve into the various reasons people seek immediate quotes, examine the competitive landscape of major insurance providers, and discuss website optimization strategies to ensure a seamless and efficient quote generation process. From minimizing form fields to crafting clear and concise quote presentations, we’ll cover all the essential aspects of providing a superior user experience.

User Search Intent

Understanding why a user searches for “quick car insurance quote” is crucial for optimizing the online experience and providing relevant information. The search term itself reveals a strong emphasis on speed and efficiency, but the underlying reasons can be diverse and reflect varying needs and priorities. This analysis explores the different user intents and their associated characteristics.

Reasons for Searching “Quick Car Insurance Quote”

Users searching for a “quick car insurance quote” are motivated by a range of factors, each influencing their urgency and expectations. These factors can be broadly categorized, leading to different user journeys and information needs.

User Needs and Expectations

The urgency implied by “quick” significantly impacts the user experience. A user needing insurance immediately, perhaps due to a recent car purchase or accident, will have different priorities than someone casually comparing options. Understanding these nuances is key to providing a tailored and effective service.

Urgency Implied by “Quick”

The term “quick” signifies a high level of urgency. This urgency can stem from various circumstances, such as an impending deadline, a time-sensitive need, or a desire for immediate action. The level of urgency directly correlates with the user’s willingness to compromise on factors like price or coverage detail for speed. For instance, someone who just bought a car and needs to register it quickly will prioritize speed over extensive price comparison. Conversely, someone planning ahead might be more willing to invest time in finding the best deal.

Comparison of User Search Intents and Priorities

The following table summarizes the different user search intents and their associated priorities. It highlights the variations in urgency, price sensitivity, and information needs across different user groups.

| Intent | Urgency Level | Price Sensitivity | Information Needs |

|---|---|---|---|

| Immediate coverage needed (e.g., after accident) | High | Low (willing to pay more for speed) | Basic coverage options, immediate quote, quick purchase process |

| New car purchase, requires insurance for registration | High | Medium (balance between speed and cost) | Minimum required coverage, competitive pricing, quick quote and policy issuance |

| Comparing insurance options before renewing policy | Medium | High (focus on finding the best deal) | Detailed coverage comparisons, price breakdowns, policy features |

| General research and price exploration | Low | High (prioritizes cost savings) | Broad range of options, detailed coverage information, customer reviews |

Competitor Analysis

This section compares the speed and features of obtaining car insurance quotes from three major providers: Geico, Progressive, and State Farm. The analysis focuses on the user experience, specifically the speed of quote generation and the features offered during the process. This information is based on recent website visits and publicly available information.

Quote Acquisition Speed and User Experience

Obtaining a car insurance quote online should be a quick and straightforward process. However, the actual experience can vary significantly depending on the insurer’s website design and functionality. We examined the quote acquisition process on the websites of Geico, Progressive, and State Farm, focusing on factors such as ease of navigation, clarity of instructions, and the time required to complete the process.

Comparison of Key Features and Quote Generation Speed

The following table summarizes our findings regarding the speed of quote generation and the features offered by each provider. It’s important to note that quote times can vary based on individual circumstances and the complexity of the requested coverage.

| Provider | Quote Time (Average) | Features Offered | User Friendliness |

|---|---|---|---|

| Geico | 2-3 minutes | Comprehensive coverage options, multiple discounts, instant quote results, ability to compare multiple vehicles | Highly intuitive and user-friendly interface; clear and concise instructions. |

| Progressive | 3-5 minutes | Name Your Price® tool, comparison of multiple quotes, various coverage options, detailed policy explanations | Generally user-friendly, although some users might find the Name Your Price® tool slightly overwhelming. |

| State Farm | 4-6 minutes | Wide range of coverage options, personalized recommendations, strong customer support integration, multiple payment options | Clear navigation, but the quote process might feel slightly more lengthy compared to competitors. |

Website Optimization for Speed

A fast-loading website is crucial for a positive user experience when obtaining a car insurance quote. Slow loading times lead to frustrated users who may abandon the process before completion. Optimizing your website for speed directly impacts conversion rates and ultimately, your business success. This section will explore key aspects of website optimization to ensure a quick and efficient quote generation process.

Website design elements significantly influence quote generation speed. Large images, excessive use of JavaScript, and poorly optimized CSS can all contribute to slower loading times. Furthermore, the server’s processing power and database efficiency directly affect how quickly the quote calculation engine responds. Inefficient code, particularly within the quote generation script, can also cause significant delays.

Website Loading Time Optimization Best Practices

Optimizing website loading times involves a multifaceted approach. First, compressing images without sacrificing visual quality is essential. Tools and techniques exist to reduce file sizes significantly, such as using lossy compression for JPEGs and lossless compression for PNGs. Second, minimizing HTTP requests is key. This can be achieved by combining CSS and JavaScript files, using a content delivery network (CDN) to distribute assets geographically, and leveraging browser caching effectively. Third, utilizing efficient code practices, such as minimizing the use of unnecessary plugins or scripts, is crucial. Fourth, implementing proper server-side caching can dramatically reduce the load on the server, especially for frequently accessed pages. Finally, regular testing and monitoring of website speed using tools like Google PageSpeed Insights provides valuable data for ongoing optimization.

Minimizing Form Fields Without Sacrificing Essential Information

Balancing the need for accurate quote calculations with a streamlined user experience requires careful consideration of form fields. Unnecessary fields should be removed to reduce the time required to complete the form. For example, fields like “favorite color” or “number of pets” are irrelevant to car insurance quotes. Essential information, however, such as vehicle details (year, make, model), driver information (age, driving history), and address are necessary for an accurate quote. Prioritizing essential information ensures a quick and efficient quote generation without compromising data integrity.

Quote Request Form Structure for Optimal Speed and User Experience

A well-structured quote request form is crucial for a positive user experience. The following HTML example demonstrates a simplified, yet effective, structure:

This example uses only essential fields, employs clear labels, and utilizes input types appropriate for each data type. Furthermore, the `required` attribute ensures all necessary information is provided. This simple structure minimizes loading time and provides a user-friendly experience. Advanced features, such as auto-completion and real-time validation, can be added for further enhancement, but should be implemented carefully to avoid slowing down the form.

Quote Presentation and Clarity

A clear and concise quote presentation is crucial for converting potential customers. Users need to quickly understand the cost and coverage offered to make an informed decision. Ambiguity leads to abandonment, so prioritizing readability and ease of understanding is paramount.

The key information presented must be easily digestible, avoiding jargon and technical terms. A well-structured quote fosters trust and encourages users to proceed with the purchase. Visual elements play a vital role in improving comprehension and making the quote more engaging.

Key Information in a Quick Car Insurance Quote

A quick car insurance quote should prominently display the most important details to the user. This information needs to be presented in a logical order for easy comprehension.

- Total Premium: This is the most important piece of information – the overall cost of the insurance policy. It should be clearly highlighted, perhaps in a larger font size or a different color.

- Coverage Details: Briefly Artikel the type of coverage included (e.g., liability, collision, comprehensive). Avoid overwhelming the user with granular details at this stage; a summary is sufficient.

- Deductible: Clearly state the deductible amount for each type of coverage. This is crucial for the user to understand their out-of-pocket expenses in case of an accident.

- Policy Period: Specify the duration of the insurance policy (e.g., 6 months, 1 year).

- Payment Options: Briefly mention available payment options (e.g., monthly installments, annual payment).

Sample Quote Presentation

The following example demonstrates a simple and effective way to present a car insurance quote. Note that this is a simplified representation and actual quotes may include more details.

<div style="width: 500px; border: 1px solid #ccc; padding: 20px; font-family: sans-serif;">

<h3>Your Quick Car Insurance Quote</h3>

<p><strong>Total Premium:</strong> $500 per year</p>

<p><strong>Coverage:</strong> Liability, Collision, Comprehensive</p>

<p><strong>Deductible:</strong> $500 (Collision), $250 (Comprehensive)</p>

<p><strong>Policy Period:</strong> 1 year</p>

<p><strong>Payment Options:</strong> Annual, Monthly installments</p>

<button>Get Full Details & Proceed</button>

</div>

Use of Visual Elements

Visual elements significantly enhance the clarity and appeal of the quote. Strategic use of color, spacing, and formatting can improve readability and user experience.

- Color Coding: Use contrasting colors to highlight key information like the total premium. For example, a bold green for the price could subtly convey a sense of value.

- Clear Typography: Choose a legible font and appropriate font sizes. Ensure sufficient spacing between lines and paragraphs to prevent overcrowding.

- Progress Bars: If the quote process involves multiple steps, a progress bar can provide a sense of completion and reassure the user.

- Charts and Graphs (Optional): For more detailed quotes, simple charts can visually represent coverage breakdowns or payment schedules. However, avoid overly complex visuals that could distract from the core information.

Post-Quote Experience

The post-quote experience is crucial for converting a potential customer into a policyholder. A seamless and positive experience at this stage can significantly impact customer satisfaction and ultimately, your bottom line. It’s about making the process of purchasing the policy as easy and straightforward as possible, building trust, and leaving the customer feeling confident in their decision.

A smooth post-quote experience begins immediately after the user receives their quote. The quote presentation should be clear, concise, and easily digestible. Users should be able to readily understand the coverage details, price breakdown, and any additional options available. From there, the process of purchasing the policy needs to be intuitive and frictionless.

Facilitating Easy Policy Purchase

The goal is to minimize the number of steps between quote generation and policy purchase. Ideally, the purchase process should be integrated directly into the quote presentation page. This could involve a simple, clearly labeled “Buy Now” button or a similar strong call to action. The user should be able to proceed to checkout with minimal clicks, providing necessary information such as payment details securely and efficiently. A progress bar indicating the stages of the purchase process can also enhance the user experience, offering transparency and reassurance. Consider offering multiple payment options, such as credit cards, debit cards, and possibly even payment installments to cater to diverse customer preferences. This streamlined process reduces the likelihood of cart abandonment and improves conversion rates.

Effective Calls to Action

Effective calls to action (CTAs) are critical for driving policy purchases. Instead of generic buttons, consider using action-oriented and benefit-driven CTAs. For example, instead of “Buy Now,” try “Get Protected Today,” “Secure Your Rate,” or “Start Saving Now.” These options emphasize the immediate benefits of purchasing the policy and encourage immediate action. The CTA should be visually prominent, using contrasting colors and clear, concise language. Placement is also key; ensure the CTA is easily visible and readily accessible within the quote presentation. A/B testing different CTAs can help determine which performs best. For example, comparing “Get a Quote” against “Get Protected Today” can show which resonates better with your target audience.

Best Practices for Follow-Up Communication

Following up with users after they receive a quote is a vital part of the post-quote experience. This shouldn’t be intrusive but should offer additional support and answer any lingering questions. A timely email confirmation summarizing the quote details is essential. This email should reiterate the key benefits of the policy and include a direct link to the purchase page. If the user doesn’t purchase immediately, consider sending a follow-up email a few days later, offering further assistance or addressing any potential concerns they may have. Avoid excessive or aggressive follow-up; a single, well-crafted email is usually sufficient. Personalization can also enhance the effectiveness of follow-up communication. For example, addressing the user by name and referencing specific aspects of their quote demonstrates attention to detail and strengthens the customer relationship. If a user requests a call back, ensure a timely response, demonstrating responsiveness and customer care.

Illustrative Example

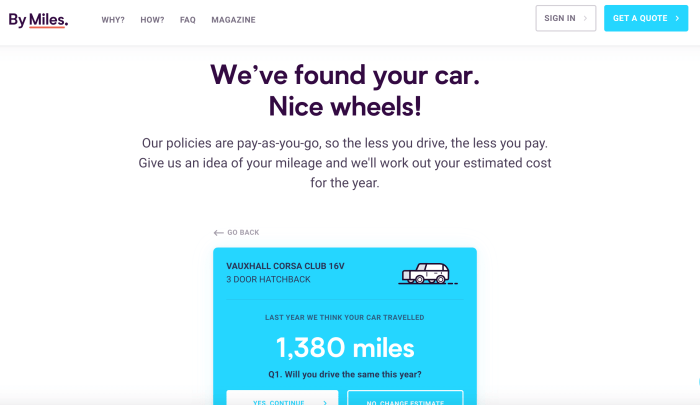

This section provides a visual walkthrough of the process of obtaining a quick car insurance quote on our website, highlighting key navigational elements and user interactions. The aim is to illustrate the simplicity and efficiency of our quote generation system.

The process begins with a user arriving at our homepage. Imagine a clean, uncluttered design, with a prominent search bar and a large, clear button labeled “Get a Quote Now.” This button is visually distinct, perhaps using a contrasting color, to immediately draw the user’s attention.

Homepage and Initial Search

The homepage features a simple, intuitive search bar where users can input basic information like their zip code. Upon entering the zip code and clicking “Get a Quote,” the user is seamlessly transitioned to the next stage – the quote form. This transition is smooth and fast, avoiding any jarring page reloads. The background remains consistent, providing a sense of continuity.

Quote Form Completion

The quote form is designed with clear, concise labels above each input field. Imagine a clean, white background with well-spaced fields for essential information such as vehicle details (year, make, model), driver information (age, driving history), and coverage preferences. A progress bar at the top of the form visually indicates the user’s progress through the various sections. Each field is clearly labelled and provides helpful hints or examples where needed, ensuring a straightforward user experience. Error messages, if any, appear directly below the relevant field, guiding the user towards correction.

Quote Display

Upon completion of the form and submission, the user is presented with a clear and concise quote summary. Imagine a neatly organized table displaying the selected coverage options, their respective premiums, and the total cost. The design prioritizes readability and avoids overwhelming the user with unnecessary information. A prominent call-to-action button, such as “Purchase Now” or “View Details,” is displayed clearly, enabling the user to proceed to the next step in the process. The quote also clearly displays any applicable discounts. The overall aesthetic is professional and reassuring.

Post-Quote Experience

After viewing the quote, the user is given options to either proceed with the purchase or save the quote for later review. Clear navigation options are available to allow the user to easily return to the homepage or explore other aspects of the website. The user experience is designed to be seamless and straightforward throughout the entire process. This includes providing multiple contact options (phone, email, live chat) should the user require further assistance.

Final Summary

Securing a quick car insurance quote shouldn’t compromise clarity or accuracy. By understanding user needs, optimizing website design, and prioritizing a user-friendly experience, insurance providers can effectively meet the demand for speed without sacrificing essential information. This guide provides a framework for achieving this balance, ultimately benefiting both the provider and the consumer seeking swift and reliable car insurance coverage.

FAQ Overview

What information is typically needed for a quick car insurance quote?

Generally, you’ll need your driver’s license information, vehicle details (make, model, year), address, and driving history.

Are quick car insurance quotes binding?

No, quick online quotes are typically not binding. They provide an estimate; the final price may vary after a full application review.

Can I compare multiple quotes simultaneously?

Yes, many websites allow you to compare quotes from multiple providers side-by-side, facilitating a more informed decision.

What if I have a poor driving record? Will I still get a quote?

You can still obtain a quote, though the rates might be higher. Be prepared to provide accurate information about any accidents or violations.