Unexpected accidents and incidents can happen in anyone’s life, even within the confines of a rented apartment. Renters insurance, specifically its personal liability coverage, acts as a crucial safety net, protecting you from potentially devastating financial consequences. Understanding this coverage is vital for responsible renters, ensuring peace of mind and financial security.

This comprehensive guide delves into the intricacies of renters insurance personal liability coverage, exploring its core functions, coverage limits, exclusions, the claims process, and the crucial role it plays in safeguarding your financial well-being. We’ll examine real-world scenarios to illustrate the importance of adequate coverage and help you make informed decisions to protect yourself and your belongings.

What is Renters Insurance Personal Liability Coverage?

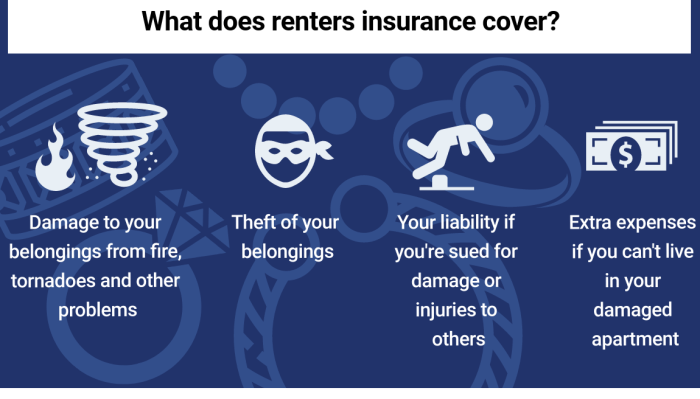

Renters insurance personal liability coverage is a crucial component of a comprehensive renters insurance policy. It protects you from financial losses resulting from accidents or injuries that occur on your property or because of your actions, even if they happen outside your rented space. Essentially, it safeguards you against lawsuits stemming from your responsibility for someone else’s harm or property damage.

Renters insurance personal liability coverage protects against a wide range of situations. It covers bodily injury or property damage caused by you, a member of your household, or even your pet. This protection extends beyond your apartment or house to other locations, such as a friend’s home or a public space. The policy will help cover legal fees and any settlements or judgments awarded against you.

Situations Covered by Personal Liability Coverage

This coverage is beneficial in numerous scenarios. For example, imagine your dog bites a visitor to your apartment. Personal liability coverage would help pay for the victim’s medical bills and any legal costs associated with the incident. Or, perhaps you accidentally damage your neighbor’s property while moving furniture. Again, this coverage would assist in covering the repair or replacement costs. Another scenario might involve a guest tripping and injuring themselves inside your apartment due to a hazard you overlooked. Personal liability coverage would help cover the resulting medical expenses and potential legal claims. Finally, even if you are responsible for an accident while away from your home, such as damaging someone’s car in a parking lot, this coverage could offer protection.

Comparison of Renters Insurance with and Without Personal Liability Coverage

The following table illustrates the key differences between renters insurance policies with and without personal liability coverage:

| Coverage Feature | With Liability Coverage | Without Liability Coverage | Explanation of Difference |

|---|---|---|---|

| Liability Protection | Provides coverage for bodily injury or property damage caused by you or members of your household. | No coverage for injuries or damages caused by you or members of your household. | With liability coverage, you are financially protected against lawsuits resulting from accidents. Without it, you would be personally responsible for all costs. |

| Legal Defense Costs | Covers legal fees associated with defending against liability claims. | No coverage for legal fees. | This significantly reduces the financial burden if you are sued. Without it, you would have to pay all legal expenses yourself. |

| Medical Payments to Others | Covers medical expenses for others injured on your property or as a result of your actions, regardless of fault. | No coverage for medical expenses of others injured due to your actions. | This offers additional protection by covering medical bills even if you aren’t legally at fault. Without this, you would be solely responsible. |

| Settlement or Judgment Costs | Covers the cost of settling or paying a judgment in a liability lawsuit. | You are personally responsible for all settlement or judgment costs. | This can prevent financial ruin in the event of a significant lawsuit. Without this, a single lawsuit could have devastating financial consequences. |

Coverage Limits and Deductibles

Renters insurance personal liability coverage limits and deductibles are crucial aspects to understand when securing your financial protection. These two factors significantly influence how much your insurance company will pay out in the event of a covered claim. Choosing appropriate limits and deductibles involves balancing the level of protection you need with the cost of your premiums.

Liability coverage limits define the maximum amount your insurance company will pay for covered claims arising from bodily injury or property damage caused by you or members of your household. Deductibles, on the other hand, represent the amount you are responsible for paying out-of-pocket before your insurance coverage kicks in. Understanding the interplay between these two elements is vital for making an informed decision.

Liability Coverage Limits

Typical liability coverage limits for renters insurance range from $100,000 to $300,000, though higher limits are sometimes available for an additional premium. The amount of coverage you choose should reflect your potential exposure to liability. For instance, someone who frequently hosts large gatherings might consider a higher limit than someone who lives a more secluded life. Choosing a higher limit provides greater financial protection in the event of a significant accident or incident.

Deductibles and Their Impact on Personal Liability Claims

The deductible you choose directly impacts how much you will pay out-of-pocket after a liability claim. A higher deductible typically results in lower premiums, while a lower deductible means higher premiums. The deductible amount is subtracted from the total claim payout. For example, if you have a $500 deductible and a liability claim of $10,000, you would be responsible for paying the first $500, and your insurance company would cover the remaining $9,500.

Illustrative Scenarios with Varying Coverage Limits

Consider these scenarios:

Scenario 1: A guest trips and falls at your apartment, suffering a broken leg requiring $20,000 in medical expenses. With $100,000 liability coverage, your insurance would cover the full amount. However, with only $50,000 coverage, you could be personally liable for the remaining $10,000.

Scenario 2: Your dog bites a neighbor’s child, resulting in $50,000 in medical bills and $20,000 in legal fees. $100,000 coverage would leave you with a significant out-of-pocket expense, whereas $300,000 coverage would fully cover the incident.

High Deductible vs. Low Deductible: A Hypothetical Scenario

Imagine a scenario where a guest is injured in your apartment and incurs $15,000 in medical expenses.

Scenario A: You have a $1,000 deductible and $200,000 liability coverage. Your out-of-pocket cost would be $1,000, and your insurer would pay $14,000.

Scenario B: You have a $5,000 deductible and $200,000 liability coverage. Your out-of-pocket cost would be $5,000, and your insurer would pay $10,000. This illustrates how a higher deductible reduces your premium but increases your personal financial responsibility in the event of a claim.

Exclusions and Limitations

Renters insurance personal liability coverage, while valuable, doesn’t extend to every conceivable scenario. Understanding the exclusions and limitations is crucial to avoid disappointment in the event of a claim. This section clarifies what situations are typically not covered, helping you assess the true scope of your protection.

It’s important to remember that specific exclusions can vary depending on your policy and insurer. Always review your policy documents carefully to understand your exact coverage. This information provides general guidance on common exclusions; it is not a substitute for reviewing your specific policy.

Intentional Acts

Personal liability coverage generally does not protect you from the consequences of intentional acts. This means that if you deliberately cause harm or damage to someone or their property, your insurance likely won’t cover the resulting costs. For example, if you intentionally vandalize your neighbor’s car, your renters insurance won’t pay for the repairs. Similarly, assault and battery are typically excluded.

Business Activities

Most renters insurance policies exclude liability arising from business activities conducted from your rented premises. If you operate a home-based business, you’ll need separate business liability insurance to cover potential risks associated with your work. This exclusion applies even if the business operates on a small scale. For instance, if you run a small online store from your apartment and a customer is injured due to a product defect, your renters insurance will not cover the liability.

Damage to Your Own Property

Renters insurance personal liability coverage protects others from harm caused by you; it doesn’t cover damage to your own belongings. Damage to your personal property is typically covered under the personal property section of your renters insurance policy, but this is a separate coverage with its own limits and exclusions. For example, if you accidentally damage your neighbor’s property, your liability coverage may apply, but if you damage your own television, your personal property coverage would be relevant.

Specific Excluded Perils

- Nuclear hazard

- War or acts of terrorism

- Damage caused by mold (unless resulting from a covered event like a burst pipe)

- Damage caused by neglect or failure to maintain your property

- Damage caused by wear and tear

These are examples of events or circumstances that are often explicitly excluded from renters insurance personal liability coverage. The specific wording in your policy will determine the exact exclusions that apply.

Pre-existing Conditions

Damage or injury that existed before your policy started is usually not covered. For example, if you have a pre-existing crack in your floor and someone trips on it, the damage would likely not be covered under your personal liability insurance. This is a common exclusion across many types of insurance.

Filing a Claim Under Personal Liability Coverage

Filing a renters insurance personal liability claim can seem daunting, but understanding the process can make it significantly less stressful. This section Artikels the steps involved, the necessary documentation, and what to expect during the claim process. Remember, prompt reporting is crucial to a smooth and efficient claim resolution.

The Claim Filing Process

The process generally begins immediately after an incident resulting in a potential liability claim. Your prompt action will expedite the process and facilitate a better outcome. First, you’ll contact your insurance provider, usually through a phone call or online portal. They will guide you through the necessary steps, providing a claim number and assigning a claims adjuster. The adjuster will then investigate the incident, gather information from all involved parties, and assess the validity and extent of the claim. Following the investigation, the insurer will determine coverage and potentially issue a settlement.

Required Documentation and Information

Providing comprehensive and accurate information is vital for a successful claim. This typically includes your policy information (policy number, effective dates), a detailed account of the incident (date, time, location, and circumstances), names and contact information of all parties involved, any witness statements, and copies of any relevant police reports or medical records. Photos or videos of the incident, damages, and injuries are highly beneficial. Remember to maintain meticulous records of all communications and documentation throughout the process.

Step-by-Step Claim Filing Guide

- Report the Incident: Immediately contact your insurance provider to report the incident and obtain a claim number.

- Gather Information: Collect all relevant documentation, including police reports, medical records, witness statements, and photographic evidence.

- Complete Claim Forms: Your insurer will provide the necessary claim forms to complete accurately and thoroughly.

- Cooperate with the Adjuster: Fully cooperate with your assigned claims adjuster by providing all requested information and attending any necessary meetings or inspections.

- Review the Settlement Offer: Once the investigation is complete, review the settlement offer carefully and negotiate if necessary.

- Sign and Submit Documents: Once you’ve agreed on a settlement, sign and return all required documents to finalize the claim.

Claim Process Flowchart

Imagine a flowchart with six boxes connected by arrows.

Box 1: Incident Occurs (e.g., a guest slips and falls in your apartment).

Arrow points to Box 2: Report Incident to Insurer.

Arrow points to Box 3: Insurer Assigns Adjuster and Claim Number.

Arrow points to Box 4: Investigation and Information Gathering.

Arrow points to Box 5: Insurer Determines Coverage and Settlement.

Arrow points to Box 6: Claim Resolution (Settlement Paid or Denied).

This visual representation simplifies the claim process, highlighting the sequential steps from the initial incident to the final resolution. Each box could also include sub-steps, but this basic Artikel gives a clear overview.

Cost and Factors Affecting Premiums

The cost of renters insurance, including personal liability coverage, isn’t uniform. Several factors influence the premium you’ll pay, ultimately determining the overall cost of your protection. Understanding these factors can help you make informed decisions and potentially secure more affordable coverage.

Several key elements contribute to the final premium calculation. These range from your location and the value of your belongings to your claims history and the level of liability coverage you select. The interplay of these factors creates a unique premium for each individual policy.

Factors Influencing Renters Insurance Premiums

The price of your renters insurance policy is influenced by a variety of factors. Insurance companies use a complex algorithm to assess risk, and this assessment directly impacts the cost. Higher-risk profiles typically lead to higher premiums.

- Location: Renters in areas with high crime rates or a history of natural disasters (like hurricanes or wildfires) will generally pay more. For example, a policy in a hurricane-prone coastal city will cost significantly more than a similar policy in a low-risk inland area. This is due to the increased likelihood of claims in high-risk locations.

- Coverage Amount: The higher the coverage amount you choose for your personal belongings and liability, the higher your premium will be. Choosing a higher liability limit, for instance, from $100,000 to $300,000, will increase your premium, but provides significantly more protection in case of a lawsuit.

- Deductible: Your deductible—the amount you pay out-of-pocket before your insurance coverage kicks in—directly impacts your premium. A higher deductible typically results in a lower premium, as you’re accepting more financial responsibility upfront. Conversely, a lower deductible leads to a higher premium but reduces your out-of-pocket expenses in the event of a claim.

- Credit Score: In many states, insurers consider your credit score when determining your premium. A higher credit score often correlates with a lower premium, as it’s seen as an indicator of responsible financial behavior. A lower credit score may lead to a higher premium.

- Claims History: Your past claims history significantly influences your premium. Filing multiple claims in the past may increase your premium, reflecting the increased risk you present to the insurer. Conversely, a clean claims history usually results in lower premiums.

- Type of Building: The type of building you live in can also affect your premium. For instance, apartment buildings with robust security features might lead to lower premiums compared to older buildings with less security.

Comparing Liability Coverage Costs

The cost of liability coverage varies significantly depending on the coverage limit selected. A policy with a $100,000 liability limit will generally be cheaper than a policy with a $300,000 or $500,000 limit. The difference in cost is usually not proportional to the increase in coverage; the jump from $100,000 to $300,000 might be a smaller increase than the jump from $300,000 to $500,000, reflecting the diminishing marginal return of increased liability coverage.

For example, a hypothetical policy with $100,000 liability coverage might cost $15 per month, while a policy with $300,000 liability coverage might cost $20 per month. The increased cost reflects the higher risk the insurer assumes with the greater liability limit. It’s important to weigh the cost against the potential financial consequences of a significant liability claim.

Impact of Risk Factors on Liability Coverage Cost

Risk factors directly influence the cost of personal liability coverage. Factors such as owning certain breeds of dogs (known for aggression), having a swimming pool, or engaging in high-risk activities (e.g., owning firearms) can all lead to higher premiums. Insurers assess these factors because they increase the likelihood of a liability claim. For example, owning a pit bull might increase your premium more than owning a golden retriever due to perceived higher liability risks associated with the pit bull breed. Similarly, having an unsecured swimming pool significantly increases the risk of accidents and subsequent liability claims.

The Importance of Adequate Coverage

Choosing the right amount of personal liability coverage on your renters insurance isn’t just about ticking a box; it’s about protecting your financial future. Insufficient coverage can leave you vulnerable to devastating financial consequences, far exceeding the cost of a slightly higher premium. Understanding the potential risks and selecting appropriate coverage is crucial for peace of mind.

The potential financial consequences of inadequate personal liability coverage can be severe and long-lasting. A single incident, such as an accident causing injury or property damage, could result in legal fees, medical expenses, and property repair costs far surpassing your policy’s limits. This could lead to significant personal debt, impacting your ability to meet financial obligations and potentially leading to bankruptcy.

Financial Losses from Insufficient Coverage

Consider these scenarios: Imagine a guest slips and falls in your apartment, suffering a serious injury requiring extensive medical treatment and rehabilitation. Or perhaps a fire starts in your apartment, damaging not only your belongings but also those of your neighbors. Without adequate liability coverage, you could be personally responsible for all associated costs, potentially amounting to hundreds of thousands of dollars. These costs could include medical bills, legal defense fees, lost wages, and property damage settlements. Even a seemingly minor incident could lead to significant expenses if legal action is pursued.

Determining Appropriate Liability Coverage

Determining the appropriate level of liability coverage requires careful consideration of several factors. Your personal assets, lifestyle, and location all play a role. While a standard policy might offer $100,000 in liability coverage, this may be insufficient in many situations. Consider the potential costs associated with a major accident or incident in your area. Consulting with an insurance professional can help you determine the optimal level of coverage based on your individual circumstances and risk profile. Remember, it’s better to have more coverage than you need than to be underinsured and face financial ruin.

Impact on Credit Scores

An uncovered liability incident can have a significant and long-lasting negative impact on your credit score. If you are sued and unable to meet the financial obligations resulting from a judgment against you, this will likely be reported to credit bureaus, severely damaging your creditworthiness. This can make it difficult to secure loans, rent an apartment, or even get a job. The impact on your credit score could affect your financial life for years to come. Adequate insurance coverage acts as a crucial safety net, protecting not only your assets but also your credit rating.

Ending Remarks

Securing adequate renters insurance personal liability coverage is not merely an optional expense; it’s a prudent investment in your financial future. By understanding the nuances of this essential coverage, you can navigate unexpected events with confidence, knowing you have a reliable safety net in place. Remember to review your policy regularly and adjust your coverage limits as needed to reflect your evolving circumstances and possessions. Protecting yourself is the most important step.

FAQs

What constitutes a “covered incident” under personal liability coverage?

Covered incidents typically include bodily injury or property damage caused by you or a member of your household to someone else. Examples include a guest tripping and injuring themselves in your apartment, or accidentally damaging a neighbor’s property.

Can I choose my deductible amount?

Yes, you usually have the option to choose your deductible, which is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums, while lower deductibles mean higher premiums.

What happens if I have a claim that exceeds my coverage limit?

If your claim exceeds your liability coverage limit, you would be personally responsible for the remaining amount. This could lead to significant financial hardship, emphasizing the importance of carrying adequate coverage.

How long does the claims process typically take?

The claims process varies depending on the insurance company and the complexity of the claim. However, it typically involves reporting the incident, providing necessary documentation, and potentially undergoing an investigation. Expect a timeframe of several weeks to several months.