Navigating the world of auto insurance can feel like driving through a dense fog. Understanding your options, especially with a major provider like State Farm, is crucial for securing the right coverage at the best price. This guide delves into the intricacies of obtaining a State Farm auto insurance quote, comparing it to competitors, and exploring ways to optimize your policy for maximum value and peace of mind. We’ll unpack the factors influencing your quote, highlight available coverage options, and even offer tips for improving your overall experience.

From understanding the nuances of liability and collision coverage to exploring the potential cost savings of bundling your insurance, we aim to equip you with the knowledge to make informed decisions about your auto insurance needs. We’ll also analyze State Farm’s online quote process, comparing its user-friendliness and efficiency to other leading providers, offering insights to help you secure the best possible deal.

Understanding State Farm Auto Insurance Quotes

Obtaining an accurate auto insurance quote from State Farm involves understanding the various factors that influence the final price and the coverage options available. This information will empower you to make informed decisions about your insurance needs and potentially save money.

Factors Influencing State Farm Auto Insurance Quotes

Several key factors determine the cost of your State Farm auto insurance quote. These factors are carefully assessed to create a personalized premium reflecting your individual risk profile. Understanding these elements can help you anticipate the cost and potentially lower your premiums.

- Driving History: Your driving record, including accidents, tickets, and DUI convictions, significantly impacts your quote. A clean driving record generally results in lower premiums.

- Vehicle Information: The make, model, year, and safety features of your vehicle influence the cost of insurance. Newer cars with advanced safety features often have lower premiums than older vehicles.

- Location: Your address influences your premium due to varying accident rates and theft risks in different areas. Higher-risk areas generally have higher premiums.

- Coverage Choices: The type and amount of coverage you select directly affect your premium. More comprehensive coverage typically costs more.

- Age and Gender: Statistically, certain age and gender demographics are associated with higher or lower risk profiles, influencing premium calculations.

- Credit Score: In many states, your credit score is a factor in determining your insurance rates. A higher credit score often correlates with lower premiums.

State Farm Auto Insurance Coverage Options

State Farm offers a range of coverage options to protect you and your vehicle. Choosing the right coverage depends on your individual needs and risk tolerance. Understanding these options is crucial for obtaining adequate protection.

- Liability Coverage: This covers bodily injury and property damage to others if you cause an accident. It’s usually required by law.

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, or weather damage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver.

- Medical Payments Coverage (Med-Pay): This covers medical expenses for you and your passengers, regardless of fault.

- Personal Injury Protection (PIP): This covers medical expenses and lost wages for you and your passengers, regardless of fault. Availability varies by state.

Obtaining a State Farm Auto Insurance Quote Online

Getting a State Farm auto insurance quote online is a straightforward process. Follow these steps to receive a personalized quote tailored to your specific needs.

- Visit the State Farm Website: Go to the official State Farm website.

- Navigate to the Auto Insurance Section: Look for the section dedicated to auto insurance quotes.

- Enter Your Information: Provide the necessary information about yourself, your vehicle, and your driving history.

- Review Your Quote: Carefully review the quote, ensuring all information is accurate.

- Compare Coverage Options: Explore different coverage levels to find the best balance of protection and cost.

- Get a Personalized Quote: Once you’ve selected your preferred coverage, receive your personalized quote.

Common State Farm Auto Insurance Discounts

State Farm offers a variety of discounts to help lower your premiums. Taking advantage of these discounts can significantly reduce your overall insurance cost.

- Good Driver Discount: This is awarded to drivers with a clean driving record.

- Bundling Discount: Combining auto and home insurance often results in a significant discount.

- Safe Driver Discount: This discount might be available if you use a telematics device to track your driving habits.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can qualify you for a discount.

- Vehicle Safety Features Discount: Cars equipped with certain safety features may qualify for a discount.

Comparing State Farm Auto Insurance Quotes with Competitors

Choosing the right auto insurance provider involves careful consideration of price, coverage, and additional features. While State Farm is a well-established and popular choice, comparing its offerings to those of competitors is crucial for making an informed decision. This section analyzes State Farm’s auto insurance quotes against three major competitors, highlighting key differences and helping you determine the best fit for your needs.

State Farm Auto Insurance Quote Comparison

The following table compares State Farm’s average premiums with those of three other major auto insurance providers: Geico, Progressive, and Allstate. Note that average premiums can vary significantly based on location, driving history, vehicle type, and coverage choices. The data presented here represents a generalized comparison and should not be taken as a definitive quote for any individual.

| Company Name | Average Premium (Annual) | Coverage Details | Notable Features |

|---|---|---|---|

| State Farm | $1200 (Estimated) | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist (options vary) | 24/7 roadside assistance, accident forgiveness programs, discounts for bundling policies |

| Geico | $1100 (Estimated) | Similar coverage options to State Farm | Strong online presence, easy quote process, potentially lower premiums for good drivers |

| Progressive | $1150 (Estimated) | Similar coverage options to State Farm | Name Your Price® Tool, robust online management tools, various discounts |

| Allstate | $1300 (Estimated) | Similar coverage options to State Farm | Strong reputation, various bundled discounts, 24/7 claims service |

Advantages and Disadvantages of Choosing State Farm

State Farm’s advantages include its extensive agent network, providing personalized service and local support. Their reputation for customer service and claims handling is also a significant draw. However, State Farm’s premiums might be higher than some competitors, particularly for drivers with excellent driving records who qualify for significant discounts elsewhere. The availability of specific discounts and features can also vary by location.

Impact of Driver Profiles on Quotes

Young drivers typically face higher premiums across all insurance companies due to their statistically higher accident rates. However, some companies may offer discounts for good grades or completing driver’s education courses. Senior drivers, on the other hand, might benefit from lower premiums due to their generally lower accident rates, although specific discounts and policies can vary widely depending on age and driving history. For example, a young driver with a clean record might find a more competitive rate with Geico or Progressive, while a senior driver might prefer State Farm’s personalized service and established reputation. These are estimations, and individual quotes will vary based on specific circumstances.

Analyzing State Farm’s Quote Process and Customer Experience

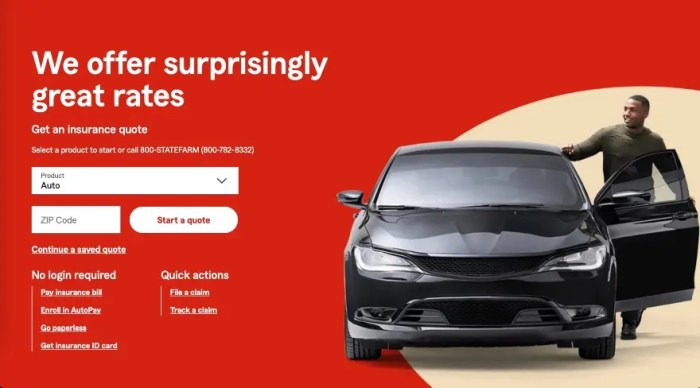

Obtaining an auto insurance quote is a crucial step for potential customers, and the ease and efficiency of this process significantly impact their overall perception of an insurance provider. State Farm, being a major player in the industry, offers various avenues for obtaining quotes, primarily through their website, mobile app, and phone calls. This analysis focuses on the website experience, evaluating its user interface and identifying potential areas for improvement.

State Farm’s website offers a relatively straightforward quote process. Users are generally guided through a series of questions regarding their vehicle, driving history, and desired coverage. The interface is generally clean and uncluttered, using a predominantly text-based approach with minimal use of distracting visuals. Information is presented in a clear and concise manner, although the sheer number of questions can sometimes feel overwhelming. The process culminates in a final quote display, including a breakdown of coverage options and their respective costs. While the overall experience is functional, certain aspects could be significantly enhanced.

State Farm Website Quote Process User Interface Evaluation

The website’s user interface is functional but lacks a modern, intuitive design. The layout feels somewhat dated compared to competitors who utilize more visually appealing and interactive elements. For example, a progress bar indicating the user’s progress through the quote process would significantly improve the user experience. Furthermore, the use of dropdown menus for selecting options, while functional, can be slow and cumbersome. A more streamlined approach, perhaps using radio buttons or checkboxes for simpler choices, could expedite the process. The font size and style could also benefit from modernization to enhance readability. The current design prioritizes information density over user-friendliness. A more visual approach, incorporating infographics or interactive charts, could help customers better understand the various coverage options and their associated costs.

Areas for Improvement in State Farm’s Quote Process

Several improvements could enhance the State Farm quote process. First, the sheer number of questions can feel overwhelming to users. A more intelligent system that dynamically adjusts the questions based on user responses could streamline the process, reducing the perceived complexity. For instance, if a user indicates they have a clean driving record, questions related to accidents or traffic violations could be omitted. Second, incorporating real-time feedback and visual aids would significantly improve the experience. For example, dynamically updating the total cost as users select different coverage options provides immediate clarity. Third, improving the mobile responsiveness of the website is crucial. The current mobile experience is functional but lacks the optimized design of many competitor websites. A more responsive design would ensure a consistent and seamless experience across all devices. Finally, integrating a chatbot or virtual assistant could provide immediate support and answer frequently asked questions, thereby reducing the need for phone calls.

Hypothetical Improved Quote Process Flow Chart

A redesigned quote process could utilize a more visually engaging and interactive flow. The process would begin with a simplified initial screen requesting basic information (vehicle year, make, model, zip code). This initial information would then feed into a dynamic questionnaire that adapts based on user responses. A progress bar would visually represent the user’s progress. Each question would be accompanied by clear and concise explanations and visual aids (such as short videos or illustrations) to explain complex terms. As users make selections, the total cost would update in real-time. Once the questionnaire is complete, a clear and comprehensive quote summary would be presented, along with the option to purchase or request a callback from an agent. This revised flow aims for a smoother, more intuitive, and user-friendly experience.

Illustrating State Farm’s Auto Insurance Coverage

Understanding the different types of coverage offered by State Farm is crucial for choosing the right policy to protect yourself and your vehicle. This section will illustrate two key coverage types: comprehensive and liability. These are common components of many auto insurance policies, but the specific details and limits can vary depending on your individual policy and state regulations.

Comprehensive Coverage: Protection Beyond Accidents

Comprehensive coverage protects your vehicle against damage from events other than collisions. This broad protection extends to a range of scenarios, ensuring you’re covered for unforeseen circumstances. Imagine your car is damaged by a falling tree during a storm, or vandalized while parked on the street. Comprehensive coverage would typically step in to cover the repair or replacement costs, minus your deductible. Similarly, if a hailstorm causes significant damage to your vehicle’s paint and body, this coverage would help pay for repairs. The claims process generally involves filing a report with State Farm, providing documentation of the incident (police report if applicable, photos of the damage), and then getting your vehicle assessed by a State Farm-approved repair shop. The insurer will then determine the cost of repairs and reimburse you, after deducting your deductible. The level of protection offered varies based on your policy limits and the extent of the damage.

Liability Coverage: Protecting Others in Case of an Accident

Liability coverage is a crucial aspect of auto insurance, protecting you financially if you cause an accident that results in injuries or property damage to others. This coverage doesn’t repair your own vehicle; it covers the costs associated with the other party’s losses. For example, if you rear-end another car causing damage and injury to the other driver, your liability coverage would pay for their medical bills, vehicle repairs, and potentially lost wages. The amount of coverage you carry directly impacts the level of protection. If the damages exceed your liability limits, you would be personally responsible for the remaining costs. The claims process for liability typically involves reporting the accident to State Farm, cooperating with their investigation, and providing any necessary documentation. State Farm will then work to settle claims with the other party, either through direct payment or negotiation. It’s important to note that liability coverage is mandated in most states, and having sufficient coverage is crucial to avoid significant financial burdens in the event of an at-fault accident. A real-life example would be a scenario where a driver, insured with State Farm, runs a red light and causes a multi-vehicle collision. Their liability coverage would be responsible for the medical bills, vehicle repairs, and other related expenses for the other drivers and passengers involved.

Exploring Bundling Options and Additional Services

Bundling your State Farm auto insurance with other insurance products, and adding supplemental services, can significantly impact your overall cost and coverage. Smart consumers often find that combining policies and adding appropriate add-ons results in considerable savings and enhanced protection. This section details the benefits and costs associated with these options.

Bundling your auto insurance with other State Farm policies, such as homeowners or renters insurance, frequently leads to discounts. These discounts vary depending on the specific policies bundled and your location, but they often represent a substantial percentage reduction in your total premium. The savings are a direct result of State Farm’s streamlined administrative processes and reduced risk assessment for multiple policies held by a single customer. For example, a homeowner bundling their home and auto insurance might see a 10-15% discount, potentially saving hundreds of dollars annually.

State Farm Bundling Options and Associated Discounts

The exact discount offered for bundling State Farm insurance policies varies based on location, coverage levels, and the specific policies combined. However, the general principle remains consistent: bundling typically translates to lower premiums. Contact your local State Farm agent for a personalized quote reflecting potential discounts in your specific situation. They can provide a detailed breakdown of the savings achievable by combining your auto insurance with other State Farm products, such as homeowners, renters, or life insurance.

Available Add-on Services and Their Value

State Farm offers a range of add-on services designed to enhance your auto insurance coverage and provide additional peace of mind. While these services incur extra costs, they often offer significant value in terms of convenience and protection against unexpected events.

- Roadside Assistance: This service typically covers towing, flat tire changes, jump starts, and lockout assistance. The cost varies depending on the level of coverage chosen, but the convenience and potential cost savings in emergency situations make it a worthwhile investment for many drivers. For instance, a single towing service can cost several hundred dollars, making the annual cost of roadside assistance a relatively small price to pay for avoiding such expenses.

- Rental Car Reimbursement: If your vehicle is damaged and needs repair, this coverage helps offset the cost of a rental car while your vehicle is being fixed. The daily reimbursement amount and maximum coverage period are defined in your policy. The value proposition lies in maintaining mobility and avoiding the inconvenience of being without a vehicle during repairs.

- Accident Forgiveness: Some State Farm policies offer accident forgiveness, meaning that a single at-fault accident may not result in a premium increase. The cost of this add-on varies, but the potential savings in the event of an accident can be significant, especially for drivers with clean driving records who value the protection against unexpected premium hikes.

- New Car Replacement: This coverage option replaces a totaled new car with a new car of the same make and model, regardless of depreciation. While significantly more expensive than standard collision coverage, it provides significant peace of mind for those who have recently purchased a new vehicle. The cost-benefit analysis should consider the value of the new car and the potential financial impact of a total loss without this coverage.

Impact of Bundling and Add-on Services on Overall Cost

The effect of bundling and add-on services on your overall auto insurance quote is multifaceted. While add-ons increase the premium, bundling often provides offsetting discounts. The net effect depends on the specific combination of policies and services chosen. For example, bundling home and auto insurance might yield a 15% discount, while adding roadside assistance might add $10 per month. In this scenario, the net impact on the total premium would depend on whether the bundling discount outweighs the cost of the add-on service. It’s crucial to obtain a personalized quote from State Farm to determine the precise impact on your individual circumstances.

Closure

Securing affordable and comprehensive auto insurance is a vital step in responsible vehicle ownership. By understanding the factors influencing your State Farm auto insurance quote, comparing options with competitors, and leveraging available discounts and bundling opportunities, you can significantly improve your chances of finding the perfect policy. Remember to thoroughly review your coverage options and consider your individual needs and driving habits when making your final decision. Driving with confidence starts with knowing you’re properly protected.

Quick FAQs

What factors influence my State Farm auto insurance quote?

Your driving record, age, location, vehicle type, coverage choices, and credit score all impact your quote.

Can I get a State Farm auto insurance quote without providing my personal information?

No, you’ll need to provide some basic information to receive a personalized quote. The level of detail required varies depending on the quote tool used.

What happens if I have an accident after getting a quote but before purchasing the policy?

A quote is not a binding agreement. Any accidents occurring before policy activation will not be covered.

How often can I get a State Farm auto insurance quote?

You can obtain a quote as often as you need, although frequent requests might be flagged by the system.

Does State Farm offer discounts for safe driving?

Yes, many insurers, including State Farm, offer discounts for good driving records and completion of defensive driving courses.